At least here in Virginia this is the 3rd week of the Coronavirus panic. I had to check the calendar. 3 weeks ago I had just returned from my quarterly trip to our Tucson office. Friday evening they decided to cancel soccer games for just that weekend. Our schools were going to be closed on Monday to "prepare" for a possible 2-3 week closure. Church as moved to online only. By Monday pretty much everything was cancelled for "at least 2-3 weeks".

We created the Traders Blog back in 2008. It became a source of data driven analysis for our advisors and clients. During a crisis there is so much news-flow it's difficult to determine what matters and what doesn't. Our goal is to cut through the noise and provide big picture analysis and be a voice of reason while everyone else panics. There was so many topics that needed addressed, we included a "random musings" section, which was essentially a brain dump of everything on my mind. There simply isn't enough time to write detailed articles on the wide range of misinformation and terrible advice I see out there.

Stay tuned throughout the week as I know there will be several articles posted with deeper research (I have drafts of 6 already in the works -- just need time to finish the research and write the articles. For now, here's some random thoughts in no particular order:

- It's crazy how fast our "normal" can change. Since moving to the east coast 3 years ago I had settled into a nice routine -- wake up at 6, read for 90ish minutes, shower, and head to the office. Plenty of time for projects, calls, and anything else that came up throughout the day. I was usually heading home by 5 or 5:30 for a nice quiet evening.

- Last week my "normal" was waking up at 5, a quick shower, and then to the office by 5:30. I've been locked in my "workspace" rather than the open area where I usually sit with our operations team. It's been a whirlwind. A good day had me heading home by 7 where "relaxation" has been cleaning up my emails from the day and maybe an episode or two of West World (since we are all caught up on Homeland).

- Work/life balance is important, but I don't take our role of managing our clients' hard-earned money lightly. This is my third recessionary bear market and I know this is just a season and we will once again return to "normal". I look forward to the futures market is not the first and last thing I look at on my phone each day.

- The time I've been locked away has been extremely productive and encouraging. I'll have some additional details later this week and probably into the next week, but I'm happy to report that not only are things working the way they should be, but we've found some things to make some of our investment models even stronger coming out of this.

- Speaking of, what else do we need to do to prove to people the value of SEM versus all the other big name managers and firms out there? Our "shorter-term" income buckets have barely lost (or even have made money), our "medium-term" balanced buckets have been solid, and our "longer-term" buckets have also out-performed the other 'strategic' portfolios out there. There's no guessing about when or how our country, economy, and markets will emerge. We've proven ourselves once again.

- The opportunities in the bond markets are huge right now, but the timing will be key (more on that later this week).

- This is not a buying opportunity for stocks......yet. (See Still Overvalued) I'll take a look at expected returns later this week or early next once we have some end of quarter data.

- I see so many examples of "Representativeness" Bias out there (where you try to find a similar situation to navigate the current situation.) This is a HUGE mistake. This is not like any other bear market we've had in our country. It's not like any other illness. It's not like any other recession. What is the same is the human reaction, which is what makes SEM's models so valuable before, during, and after. Last year we explained Representativeness Bias here.

- If the quarantine works, people will say we overreacted. If we see a million deaths, leaders will be blamed for not doing enough. Let's have some grace with our leaders (government, businesses, churches, etc). They've never had to handle anything remotely close to this. The wisest leaders will focus on the DATA and surround themselves with as many experts as possible.

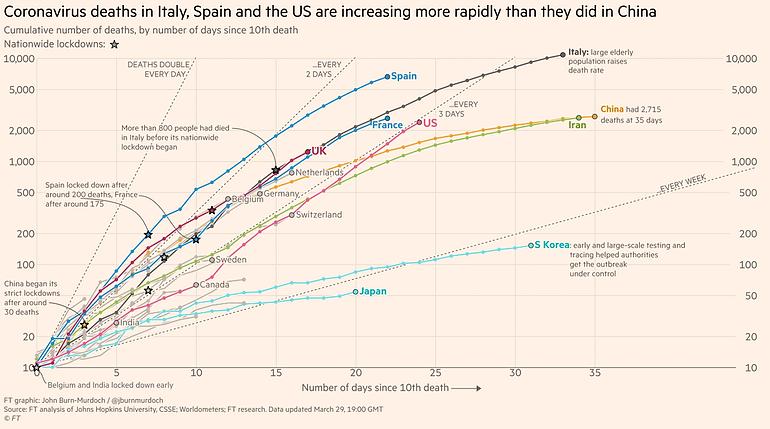

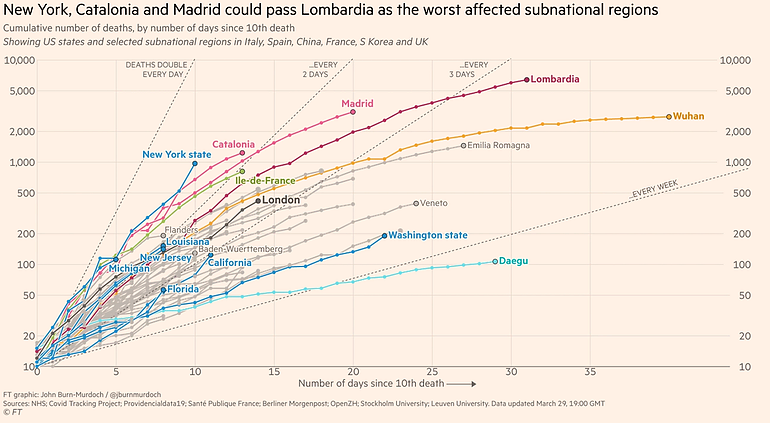

- Early on, one of the smartest people I've known, a biochemist I went to high school with said the key metric to watch is the number of deaths from Coronavirus. The reason is testing is not widely available and there are plenty of people that have had it that didn't even know it. Everyone who has died has been tested. Over the weekend I finally found some reliable data that is updated each day (https://www.ft.com/coronavirus-latest). This will be the first stop for me every morning.

- This is not the flu. This is not like auto accidents. Yes, both of those kill more people, but the issue is your local hospital system could not handle 200 critical flu patients all in one day. It could not handle 100 patients in a severe car accident. That is the issue. The number of deaths is doubling every 3 days.

- So far the trend is not good, especially in New York and other parts of the northeast. It's been a little over a week since they really started shutting things down there. This means it could get really bad over the next week or two, but hopefully then we'll see a turn in that region.

- Subjectively I would be looking to sell any rallies and wouldn't buy stocks until our death curve starts to flatten.

- I'm an introvert and relish time relaxing at home (it's why Brandi and I wanted to live in a rural county of 22,000 with a home backing up to the woods and state-protected wetlands.) Even I'm missing our freedom. I'd love to be at the beach or Busch Gardens or downtown Richmond this weekend, but the only way to beat this virus and not overwhelm our public health system is to stay away from other people as much as possible. Again, those charts above illustrate why it's so important.

- The question has already been raised about whether the economic cost is worth saving lives. This is a slippery slope and not one I care to address. I will say that if we case so much about such radical steps to save people from a virus that mostly kills people over 50, why would we not also care about the fact there will be over 600,000 babies killed in abortions in our country this year? I don't like how politically some lives are more valuable than others.

- Speaking of abortion, one of the primary reasons I'm so excited about our Cornerstone Models is the impact we can make with our investments in ending abortions in our country. Why not use this crisis to highlight how you can make a real difference in our country?

- There are going to be big rallies and signs of hope, but past shocks like this have always taken 18-24 months to run their course (see No Quick Fixes). It's certainly not too late to right size your portfolios (or your clients) to match their true risk tolerance.

- The stimulus was welcome and needed, but based on the people I've talked to, it's not going to work as well as people are expecting. It's going to take too long to get in some people's hands, those who need it the most may not get as much as they need, others who don't need it are going to receive stimulus checks, and once again small businesses are going to be hurt the most.

- Mortgage bankers couldn't handle the rush of refinancing activity BEFORE the country shutdown. Commercial loan departments are SIGNIFICANTLY smaller and Small Business Loans in normal conditions are a slow and painful process. Even with the loans, the amount and structure will not be enough to save many small businesses.

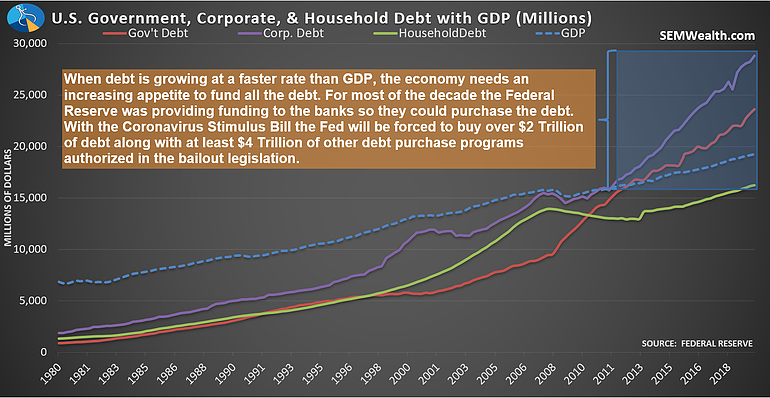

- For the entirety of the expansion, I lamented the lack of fiscal responsibility of federal, state and local governments as well as businesses. They added debt at unacceptable rates during an economic expansion. My question was, "what happens if we have another crisis?" We're about to find out. Now we are in a situation where the Federal Reserve is pretty much the only entity out there willing to finance the debt. They can't and won't be able to finance everything.

- Even if the Fed were able to finance everything, there are ALWAYS unintended consequences. It sounds like we are already seeing this just a couple of weeks into their emergency measures. Turns out the hedges mortgage banks put into place to protect themselves from big moves in interest rates and prices were blown up by the Fed's actions. In addition, postponing payments is also causing mortgage-backed securities to run into significant pricing pressure --- investors bought those securities expecting specific payments in specific intervals. The shorter-term securities are supposed to be the lowest risk. Now the question is who provides the cash flow for those missed payments?

- Cody sent the gif above to us in the Virginia office (and Dustin formatted it so we could embed it in the blog). You can play with the background with different ticker symbols (click here). Apparently the people at the Institute for Memetic Research has more cynical views than I do (click here for their website, which includes some fun Fed related games). Pretty dang close to their actions the past few weeks.

- Timing is everything. At one point we had 6 school-aged children. I'm not sure how we would have handled them not having school for the rest of the year. It's hard enough having 13-year old twins out of school. They got off easy the last two weeks, but we spent the weekend working out a more structured day for them. They aren't too happy about that. To you parents out there, my prayers are with you!

- The other interesting thing people are learning is about spending nearly every minute with their spouse. Brandi and I have worked together for nearly 19 years, including working from home at times. Having a schedule and routine is important. Making sure you have a separate space for work so everybody in the house knows when you're in "work mode", including the kids. This is also a great time to teach your kids (and spouse) about what you do all day. Another key is being able to turn on and off a switch between "co-worker" and "spouse". Respect, communications, and a sense of humor all go a long way.

- There are hundreds of billions of dollars in "strategic" funds, which are set to re-balance. Bonds are up, stocks are down. This means a lot of money will be buying stocks and selling bonds this week. Keep that in mind when you see big market moves.

- Today is the 39th anniversary of the shooting of President Reagan. I remember this because it happened on my 7th birthday. While thankfully he survived, that day is always clear in my mind. The fear and concern from my parents was more of a concern to me. I couldn't understand what happened, but it was scary to see my parents scared. Our oldest two children were old enough to remember 9/11. It's something they'll never forget, but didn't understand at the time. If you have kids keep that in mind.

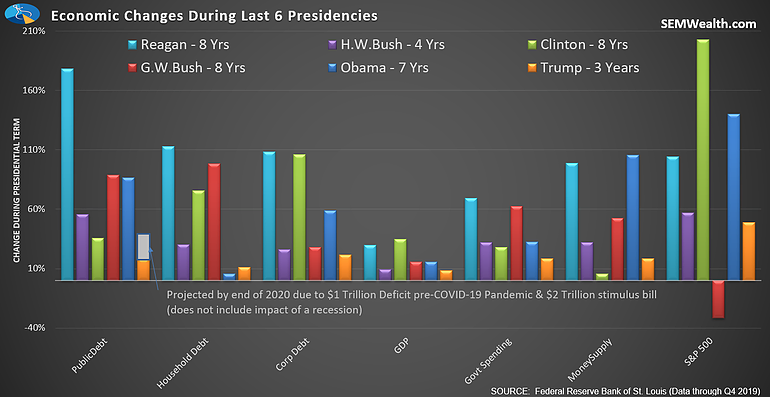

- One thing I've often done on this day is look back at the legacy of Ronald Reagan. While I applaud many of his policies, the data shows he added more debt than any of the other 5 presidents (on a percentage basis). The idea that debt is good was born in the Reagan years and is one reason we are in the dire economic situation we are facing today. George W. Bush and Obama both had their crisis to justify the runaway increase in debt. Will we see Trump's meet those same insane growth levels? For the sake of our future generations I hope not.

- My kids know me well. I'm a chocolate junky and with few options for birthday presents, this is what Corryn and Toby gave me for my birthday.

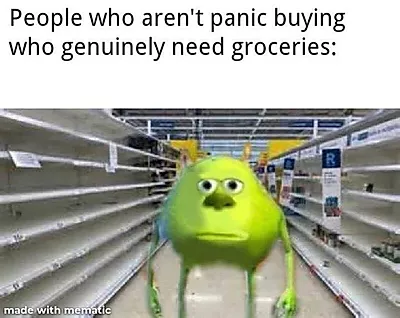

- Speaking of shopping. 4 weeks ago we took the CDC recommendations to stock up on non-perishable foods, paper products, cleaning supplies, medicines, etc seriously. We already had our "hurricane" kits ready (7 days of supplies), but they were recommending a month. What we didn't do was stock-up on meat, dairy products, etc. Working the hours we've been working, we've had no success in finding any of them. We resorted to bratwurst spaghetti the other night. Thankfully when Corryn and Toby went to the store yesterday they got there right after the perishables were re-stocked. We didn't want to be "those people", but we now have a month's worth of meat (which means we shouldn't have to leave the house/office for a while.

- I'm seeing too many people trying to tie the COVID-19 pandemic to God or end times events. Many have tied it to the plagues in Egypt. I point out that God made it very clear those plagues were from Him and they had a specific purpose. Since God has not made this clear, we know this is yet another attack from Satan. "The whole world lies in the power of the evil one...." (1 John 5:19).

- The best advice I have for anybody blowing this pandemic out of proportion -- Jesus was clear in Matthew 24:44 -- "be ready". Those who know me know this drives everything we do. Plan for the worst, hope for the best. That's exactly what we're doing.