Trade War, Recession, & Interest Rates

The 3rd Quarter brought some large fluctuations in both the stock and bond markets. By far the most often discussed topics in client and advisor meetings this quarter centered around the on-going Trade War, the impact of interest rate adjustments by the Federal Reserve (as well as the yield curve inversion), and the increasing chances of a recession.

These are all topics that could take up multiple pages by themselves. In the interest of space, this quarter we’re providing a “Reader’s Digest” version of some articles we posted on our blog. At the end of each article is the location of the full article if you’d like to read a more detailed discussion.

Our investment models have all been “cautious” for most of the year due to the impact these items are having on stock and bond prices. As we said last quarter, everything at SEM is working according to plan. History tells us it is better to wait for volatility to calm down before being heavily invested.

Trading the Trade War

Nothing has moved the market more in the last two years than news surrounding the Trade War with China. Many times the news starts with a post on Twitter from President Trump. We’ve written about both the need for a long-term adjustment to trade policies and the impact making those adjustments can have on the economy over the short-term.

In fairness, the President’s strategy cannot be judged by short-term movements in the markets or the economy. It will be several years before we can measure the success of his policies. For now, this is an illustration of the cycle we’ve seen the last 18 months in the stock market. This is likely to continue for a while.

For more on the Trade War, go to: TinyURL.com/TrumpTradeWar

Preparing for Recession

This summer Google Trends reported a spike in the number of searches for “recession”. As SEM Client Portfolio Manager, Cody Hybiak pointed out, after 12 years of economic growth a recession is inevitable. With summer ending and ushering in the fall months, people around the country are either preparing for the cold, dreary months of winter or for those in Arizona or Florida, celebrating the end to a brutally hot summer.

Unlike the change in seasons, we do not have a date for when the recession will begin. This means we need to prepare now for what could be a difficult time ahead.

For tips on how you can prepare, go to: TinyURL.com/RecessionPrep

What’s Happening With Interest Rates?

Two things have happened this summer with interest rates. First, the Federal Reserve cut short-term interest rates for the first time since 2008. The belief is this will help fight a slowing economy and prevent a recession. Investors seem to forget how horrible the Federal Reserve has been at preventing recessions. Our economy is a $21 Trillion machine that cannot be turned just by a simple drop in interest rates. If businesses weren’t investing in long-term projects when short-term interest rates were at 2.25%, do we really think a cut to 1.75% will spark a rush to invest in new projects, especially when most businesses cite “trade uncertainty” as reasons they are not optimistic on the near-term future of the economy?

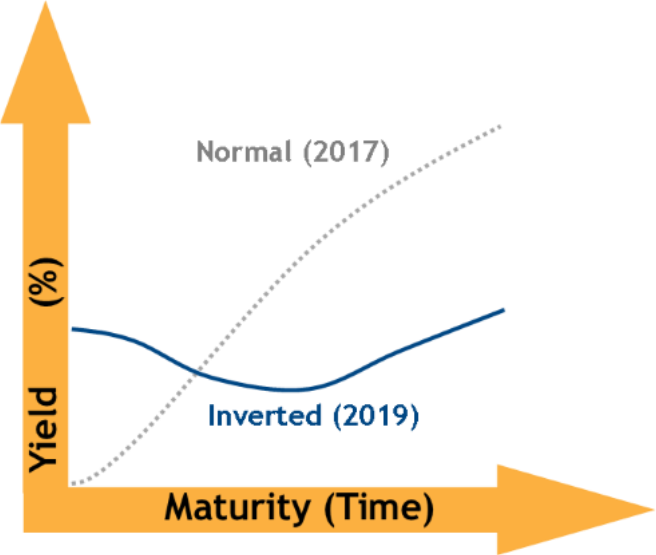

The more interesting event in terms of interest rates was the “inversion” of the yield curve. Normally short-term interest rates are lower than long-term rates. This is because there is more uncertainty and thus more risk the longer somebody is wanting to borrow money. When the yield curve inverts, it is cause for concern. You may have seen this called the “recession indicator” due to the fact nearly every time the yield curve inverted a recession followed. It really turns into a chicken/egg type indicator in our opinion. Does the inverted yield curve cause a recession or do fears of recession cause the yield curve to invert?

To us it doesn’t matter. We simply follow the data and make adjustments accordingly. That said the DATA, especially in the bond market is saying we need to be especially cautious at this point in time. The Fed may temporarily postpone a recession, but history tells us when the economy heads towards a recession very little can stop it from happening.

To learn more, go to: TinyURL.com/FedCuts -AND- TinyURL.com/InvertedYields

News & Notes:

2019 Year-End Tax Statements—what to watch for early 2020:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, both of our custodians, E*TRADE Advisor Services & TD Ameritrade have had this extended to February 15, 2020.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2019 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2019. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive E*Trade’s and/or TD Ameritrade’s 2019 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from TD Ameritrade to E*Trade, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports early next year on our website,

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.