Party like it's 1999!

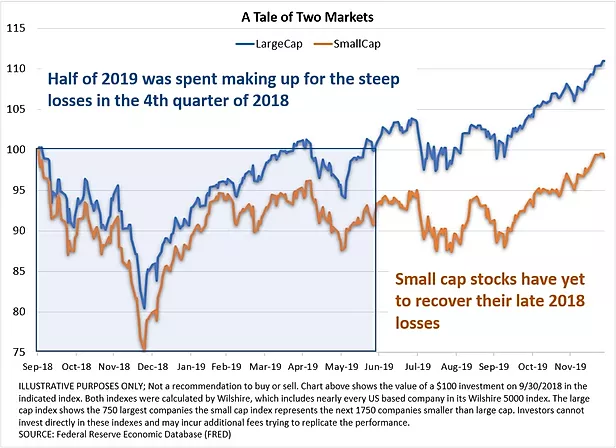

On paper 2019 is going down as the best year for the S&P 500 since 1997. The euphoria and confidence we are seeing at the end of the year feels quite similar to what we experienced at the end of the 1990s. It is also in stark contrast to the mood this time last year after the stock market posted its worst December since the Great Depression. 2019 was not as great as everyone made it out to be. First, nearly half the year was spent making up for the losses from the 4th quarter. It wasn’t until June an investor in the S&P 500 finally was safely back above where they were at in September 2018. Second, only the largest stocks have recovered. Small cap stocks are still below where they were 15 months ago.

Like in 1999, a narrow market like this could be a sign things are not always as great as they seem. When you have just a small group of stocks leading the market, it doesn’t take much to turn the euphoria into a panic.

Your Personal Benchmark

Whenever you see popular stock market averages post the best year in 20 years, it is natural for investors to wonder whether or not they are invested in the right portfolio mix. Based on history, investment fund flows, and market data very few people participate in the gains of the S&P 500 over the long-run. That is actually ok.

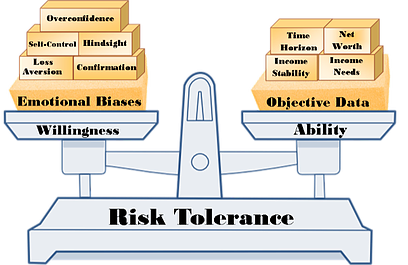

The S&P 500 is not the appropriate benchmark for most investors, especially those working with SEM. Instead, each of our clients should have their own personal benchmark determined by two factors:

1. Your Financial Plan (how much do you need to make to meet your goals?)

2. Your Investment Personality (how much risk can we take without causing you to become uncomfortable?)

For most people, their benchmark is somewhere between 3-6% per year depending on the two factors above. In order to generate higher average returns than that, you would have to be comfortable risking 25- 50% of your investment value. Very few people will tolerate that sort of loss. The good news is, if your portfolio beat your personal benchmark you are ahead of the game!

If you would like SEM to take a look at your current portfolio and compare it to your own personal benchmark go to risk.semwealth.com

The Source of Instability

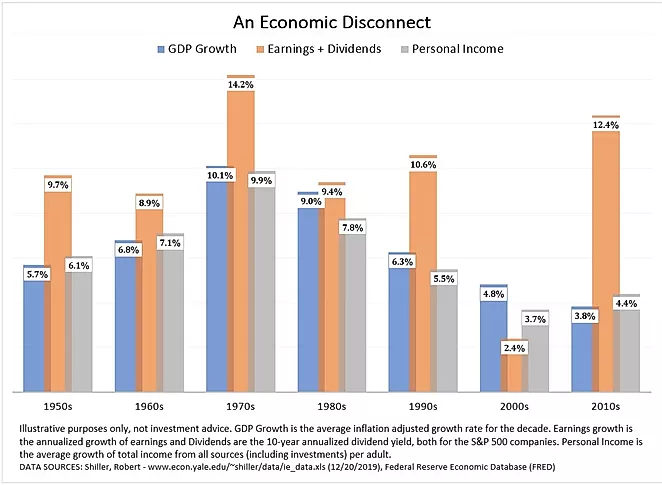

We’ve seen a lot of data about all the great things that happened in the 2010s. Looking at stock market returns, it was the 5th best decade going all the way back to the 1880s. Corporate earnings had their best decade ever. Unfortunately, economic growth was the worst since the 1930s. Income growth was not much better.

This type of disconnect is something that cannot keep up. Over the long-run earnings, economic growth, and personal income should all rise at the same pace. We are already seeing signs of stress in the political environment, which could impact stocks in the next decade. All of the cost cuts and other things corporations did to grow earnings in the 2010s has come at the expense of the average American. History tells us when we have this sort of disconnect the economic and investing environment can become quite unstable.

Successful investors do not spend much time celebrating the past decade, but instead be preparing for the next. That is exactly what we are doing at SEM.

Stay tuned to TradersBlog.SEMWealth.com for more details on this disconnect and how we are positioning our portfolios.

News & Notes:

2019 Year-End Tax Statements—what to watch for early 2020:

For taxable accounts, federal law requires your custodian to mail your IRS Form 1099 to you by January 31. Due to the increasing amount of reclassified mutual fund distributions, both of our custodians, E*TRADE Advisor Services & TD Ameritrade have had this extended to February 15, 2020.

SEM strongly recommends you do not make your tax appointment until after February 15.

The 2019 Consolidated 1099 mailings to you includes cost basis and sales proceeds for investments sold during 2019. This provides essential information needed to complete your Federal Tax Filing Form 1040 Schedule D and Form 8949. Please wait until you receive E*Trade’s and/or TD Ameritrade’s 2019 Consolidated 1099 prior to completing your taxes.

For those clients that consolidated taxable accounts from TD Ameritrade to E*Trade, you will receive forms from both custodians.

SEM will be posting additional information on the tax reports on our website, SEMWealth.com/tax-information

Download / Print version of the newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money. To learn more about ENCORE Portfolios, please contact your financial advisor.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Program Reports for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.