The S&P 500 on Tuesday briefly eclipsed its all-time high. This led to all-day coverage on CNBC and Bloomberg of this “great feat”, followed by the financial media picking up on this story. I wouldn’t have earned the nickname “Mr. Sunshine” if I didn’t point out that it did fail to stay above the all-time closing high set on January 26 of this year at 2872.87. This does not mean it won’t surpass it soon, but from a technical perspective the closing levels are far more important than intra-day levels given how much volume occurs near the close of the trading day.

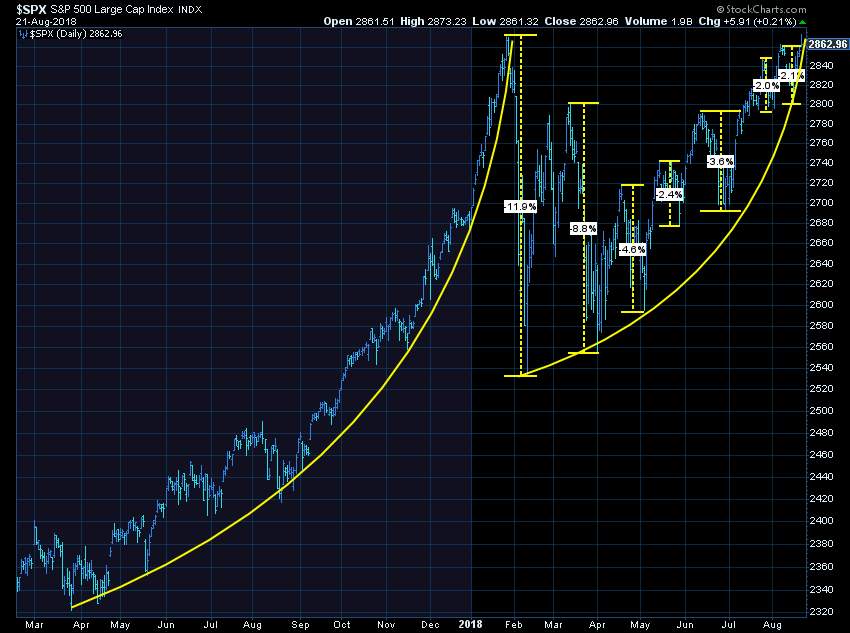

Either way, the recovery has been interesting to watch. After going “parabolic” following the election, gaining enough momentum to gain 7% in the first 26 days of 2018, the drop was a shock to many newly enthusiastic investors who had poured in a record amount of money into mutual funds & ETFs in January. This week’s Chart of the Week shows the action the last 18 months for the market.

Now what? If the market is able to close above the highs and stay above that level for a week or two, we could see a new flood of money into the market. The story will be about how impressive the recovery was and that the “excesses” were wrung out of the market. Wednesday sets the record for the longest running bull market in our history, which will lead to individual investors and advisors alike questioning whether it’s “different this time”. This could lead to another parabolic move higher. On the other hand, if the market cannot close above and stay above the old highs for very long, it could bring back another round of selling from people that know they shouldn’t have this much exposure to stocks in a bull market that is this old and this overvalued. Time will tell.

From our perspective, we could not be much more heavily invested in the markets. Our highest exposure right now is our Enhanced Growth Allocator (EGA) program which was 115% exposed to stocks for the past week, following the 2% drop last week which led to a buy signal in our Volatility System. It did scale back some yesterday as the brief oversold position of that system went back to neutral. It still remains 105% exposed to stocks. The second greatest exposure is in our AmeriGuard-Max, Aggressive, & Growth programs along with our Dynamic Aggressive Growth programs. All are 100% invested in stocks right now. We are also fully invested in high yield bonds in our Tactical Bond & Income Allocator Programs and have max exposure to high yields and dividend growth stocks in our Dynamic Income Allocation program. This should tell us something — from a technical, economic, and momentum perspective over both the short & intermediate-term, the outlook remains strong. However, that can change quickly so it is important to not let your emotions get the best of you and continue with your plan.

Since I promised to keep the Chart of the Week posts to 3-4 paragraphs and because I have a whole lot more to say, I’m going to bring back a popular feature from the early days of the blog………….

Sunshine’s Musings

-

Please do not forget what the Buffett Indicator is saying — if you are a buy and hold investor, you should expect negative returns for the next 10 years.

-

I think we’d all like to invest like Warren Buffett. He’s arguably the greatest investor in history. People forget over his 70 year career he’s been considered “washed up” multiple times. His “buy low, sell high” philosophy is not easy to stick to emotionally. He has a much longer time horizon when he invests and can be patient. He also has “captive” clients at Berkshire Hathaway. Managing money that way as a business would be asking to lose all of your assets every 5-6 years when value investing falls out of favor.

-

This is the longest running bull market in history, but it is also the worst economic recovery in our history. You cannot tell me the market is “efficient” or based on fundamentals.

-

That said, our economic models continue to show acceleration in economic growth. The problem is the tax cuts appear to have only borrowed from next year’s growth and spending, which could lead to a big air pocket next year. At the same time, with the economy heating up, the Fed is likely to continue raising interest rates and do what they always do — spark the next recession after inflating the last recovery too far.

-

I had an advisor call the frustration at the lack of a bear market “fatigue”. He’s seeing it in his clients and having a harder time not giving into their desire to jump into the market. I think we all are feeling this to some degree.

-

Remember, this is by far the most dangerous point in the market cycle for conservative investors. They ALWAYS jump into the market just before the end. It’s in their nature (if you haven’t done so yet, check out our Webinar discussing this.)

-

Earnings growth continues to be strong, but it’s not been supported by strong jumps in revenue. This trend cannot continue.

-

With so much focus on returns people forget the most important variables in their retirement are, how much are you saving & how much are your spending. Don’t believe me? Check out our Free Financial Check-up Tool and I can run some scenarios for you. If you are an advisor, just enter your last name in ( ) after their last name and I’ll send you the report.

-

I realize many of you have gotten out of the habit of checking the blog a few times a week. Why listen to ‘Mr. Sunshine’ when the market just keeps going up? From what I’ve seen our analysis is by far the most balanced of any of the other tactical managers out there. We will point out the good, the bad, and the ugly of the DATA.

-

Instead of going to the website, it may be easier to just follow us on Facebook or LinkedIn. Our Marketing Associate Courtney has taken over those pages and is pushing out quite a bit of content. Some of it you will not find on our websites.

-

I’ve been living on the East Coast for a year now. After living on the West Coast, but following East Coast working hours my body is far happier. I feel more refreshed and productive than ever before.

-

Speaking of — we have quite a few exciting things in the works. We just opened our first account using only e-signatures. If you’re interested, let me know. Next step will be including our questionnaire and recommended portfolio allocations in the account opening process. We also have new Portfolio Allocation portfolios in development and some exciting new things on the trading system front. Stay tuned.

-

We lamented over the cost of a screened porch. After a month in our house, we’ve spent the overwhelming majority of our time on this 16 x 20 piece of the house, including the first couple hours of my workday. This is the very definition of “utility” the economists expect our “rational” brains to be able to measure. If we could have foretasted this utility we would have doubled the square footage of the porch and cut the inside square footage in half.

-

Unfortunately, it’s time to get in the shower and leave my porch office and head to our actual office. Remember as the markets get more volatile the postings will pick up, so check in often…………or just follow us on Social Media.