For our final BRI objections blog, we're going to discuss management styles. Some of the content in this blog might sound similar to some of what we discussed last month, but we believe that it's important to emphasize the options people have with our Cornerstone Portfolios. The subject for today can also tie into the issue with performance (see our blog on BRI performance here). An objection we've received from many people with it comes to Biblically Responsible Investing is having to have a passive approach to investing instead of different options based on your investing goals and time horizon.

I have some good news for you, our approach at SEM is not like most firms! And regardless of if you are invested in our regular models or Cornerstone models, you'll receive a customized portfolio based on your investing needs because of our 3 different management styles. The management styles that SEM uses are Tactical, Dynamic, and Strategic styles. In this blog, I'll break down the different styles and how they'd work for Biblically Responsible Investing. In May, we've also been posting brief videos each Friday about our management styles. Here are the videos discussing each of the management styles (this goes for both our regular and BRI models).

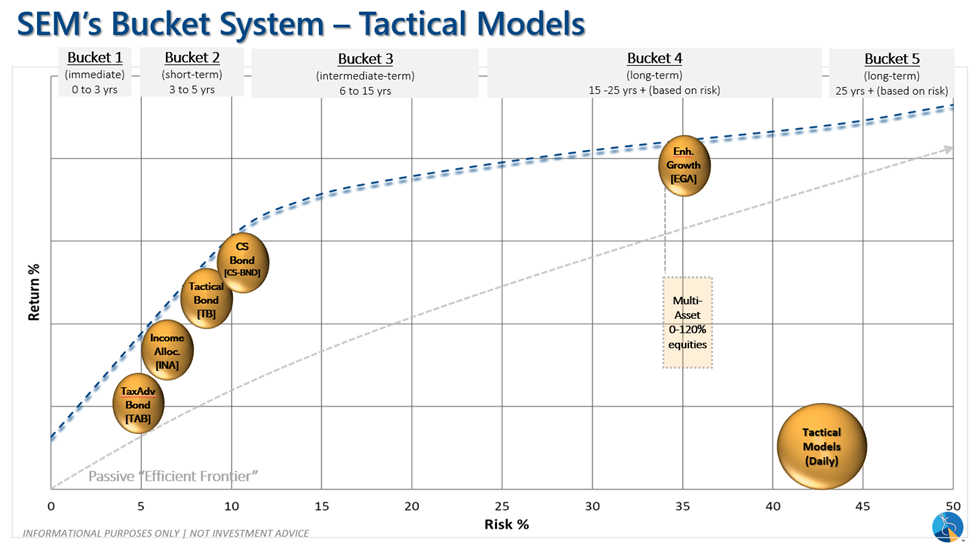

Tactical Models

Here is our bubble chart showing the Tactical Models that we offer. For BRI, we offer Cornerstone-Bond. Cornerstone-Bond utilizes the same trading strategies as our popular Tactical Bond model. Our Tactical programs are monitored daily. They study the trends in the market with a primary focus on moving to lower risk asset classes when risks are high. Due to their focus on risk management, tactical programs will not participate as much in rising markets. Cornerstone-Bond is a good option for people who don't like to take big risks and/or have a shorter time horizon (when they need the money). While you won't receive as large of a return as our other management styles when the markets are up with Cornerstone-Bond, you also won't lose as much money when the markets are down.

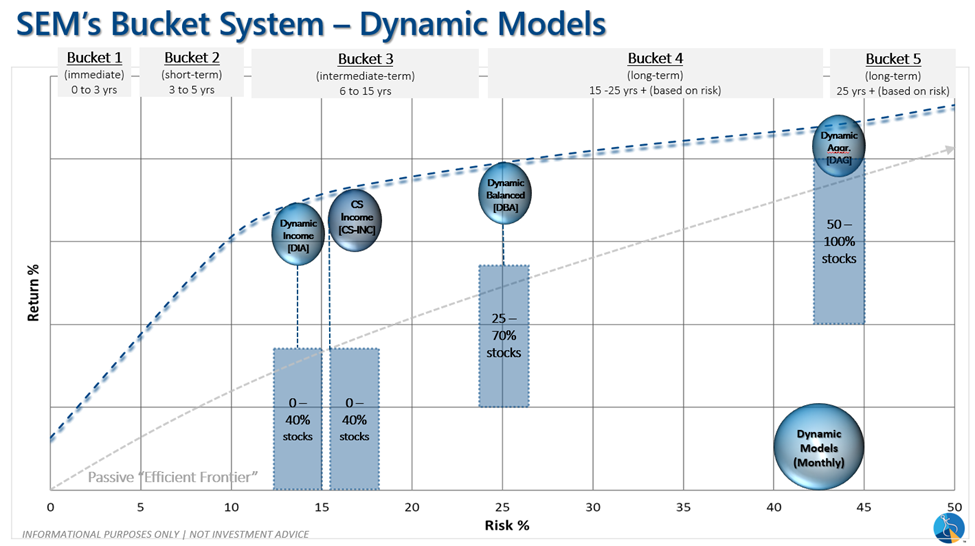

Dynamic Models

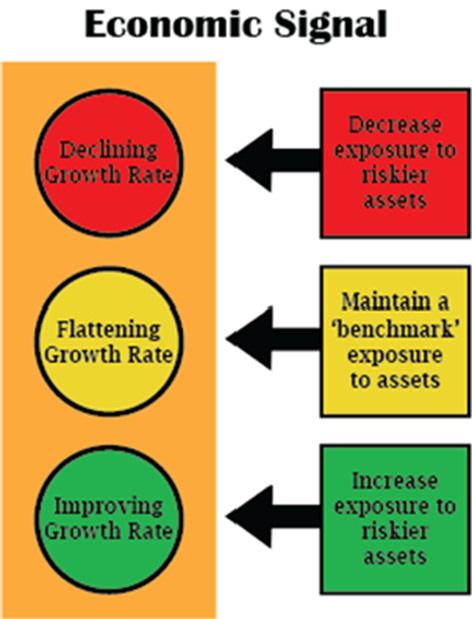

This is our bubble chart showing the Dynamic Models that we offer. For BRI, we offer Cornerstone-Income, which is managed in a similar fashion to our Dynamic income model. Our Dynamic Allocation programs are monitored monthly. These programs start with a core asset allocation and then increase or decrease exposure based on SEM's Economic Models. Compared to Cornerstone-Bond, Cornerstone-Income will have slightly more risk as it will utilize dividend stocks at various times throughout the economic cycle. However, that gives you the potential for more reward if the markets are up. Below you'll see a graphic of our economic signal for when we'll increase or decrease exposure.

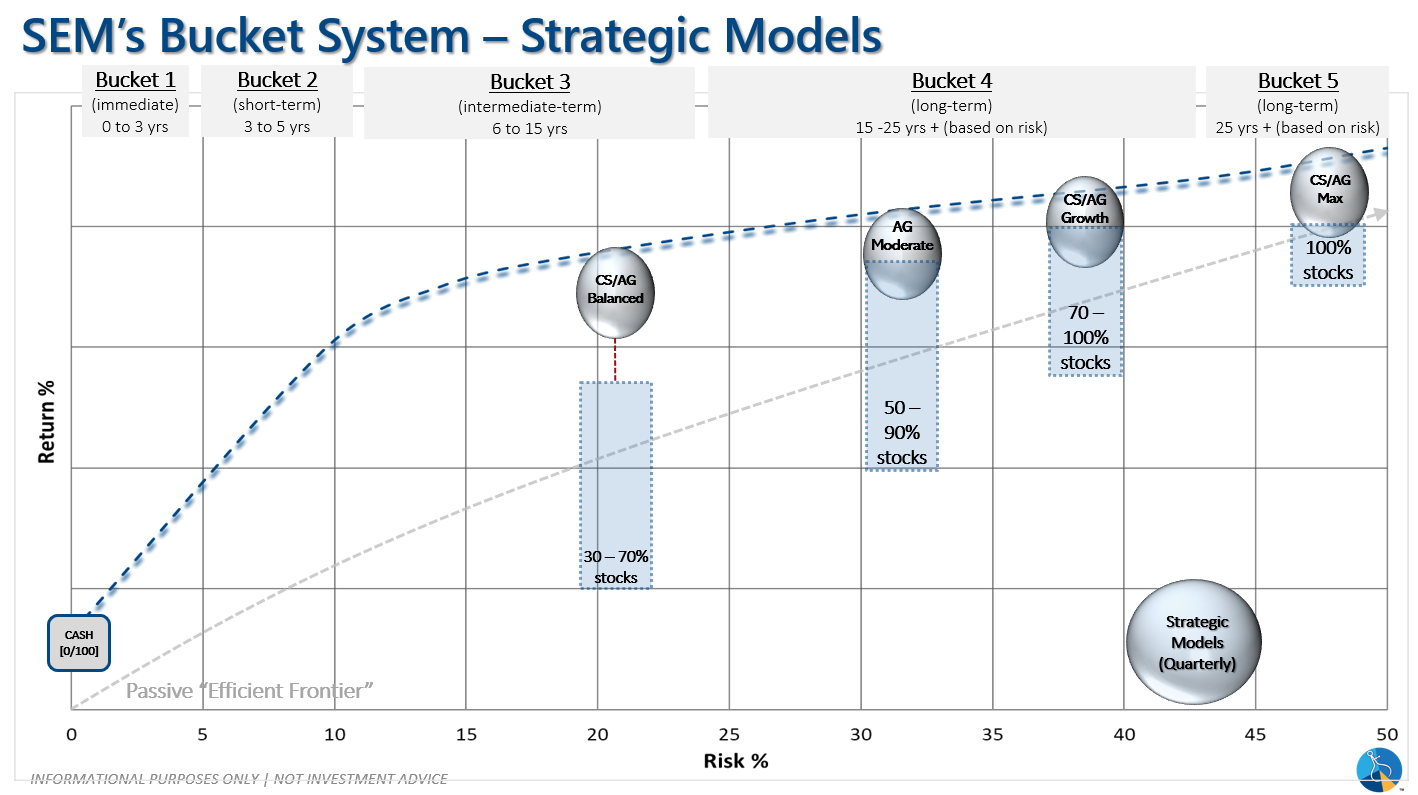

Strategic Models

For our Strategic Models, we have three options for BRI: Cornerstone-Balanced, Cornerstone-Growth, and Cornerstone-Max. These models mirror our AmeriGuard models with the same name. Our Strategic Allocation programs are monitored quarterly. The Cornerstone models seek to allocate to the strongest Biblically Responsible funds. These portfolios have the largest risk; however, if the market is up, they give you the largest reward. Depending on what the market is doing, the percentage invested in stocks will go up or down depending on the model (they range between 30% invested in stocks to 100% invested in stocks).

Just like with our regular models, you can be fully invested in our Cornerstone Portfolios and have a completely customized portfolio by using a mixture of the 3 management styles I discussed above. Here's the final video of the management style series that'll be posted on our social media on May 31st where Jeff discusses more on how the different management styles work within a portfolio.

We really hope this whole BRI objections series has helped you gain a better understanding of what we offer through our Cornerstone Portfolios. We've had a lot of people want to "dabble" in Cornerstone instead of fully committing because of the misunderstanding of not being able to do the same thing with investing as our secular models. If you have any other questions or concerns about our Cornerstone Portfolios, please reach out. Furthermore, if you'd like more information or want to get started with Cornerstone (or commit to fully switching your portfolio to Cornerstone), let us know!

For your convenience, here are all the articles in this series: