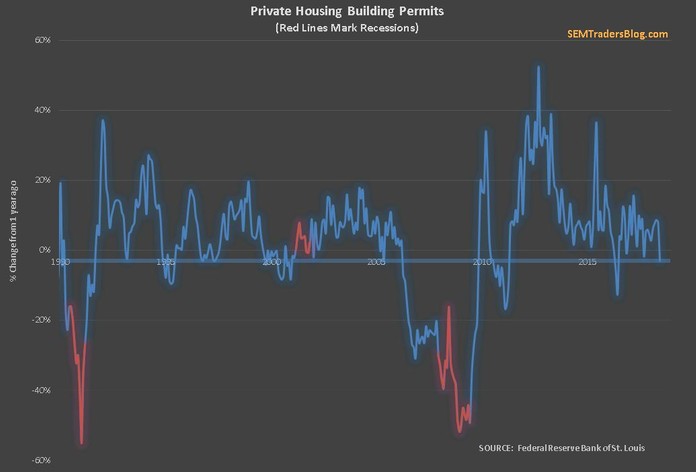

This week my second favorite leading economic indicator was released and it immediately threw cold water on my optimistic outlook. Two weeks ago, I posted our economic model showing a continued bullish uptrend for the next several months. Building Permits and Housing Starts tend to be a very early leading indicator. I guess it’s a “chicken or egg” type relationship, but from my observations, study of history, and experience building houses, housing starts tend to have a big impact on overall economic activity. Building Permits are a leading indicator of Housing Starts (or a leading, leading indicator.)

If you think of all the economic activity that goes on around the building of a new home you can see why it can have such a big impact. In addition to the people working on the home, you have all the materials that must be purchased. If enough homes are going up in an area you have commercial construction following suit and opening of new retail establishments. After buying a new home, homeowners either by necessity or desire end up buying window coverings, new furniture, appliances, landscaping, etc.

[Detour: This is why I’ve always told people a house you are living in should not be considered an investment, but rather your home that gives you “utility” which cannot be measured with economic variables. If you actually kept track of the money you put into the house, including assigning a dollar value to your time, few people would ever “make money” selling their personal residence, not to mention then having to buy a new home at the current prices.]

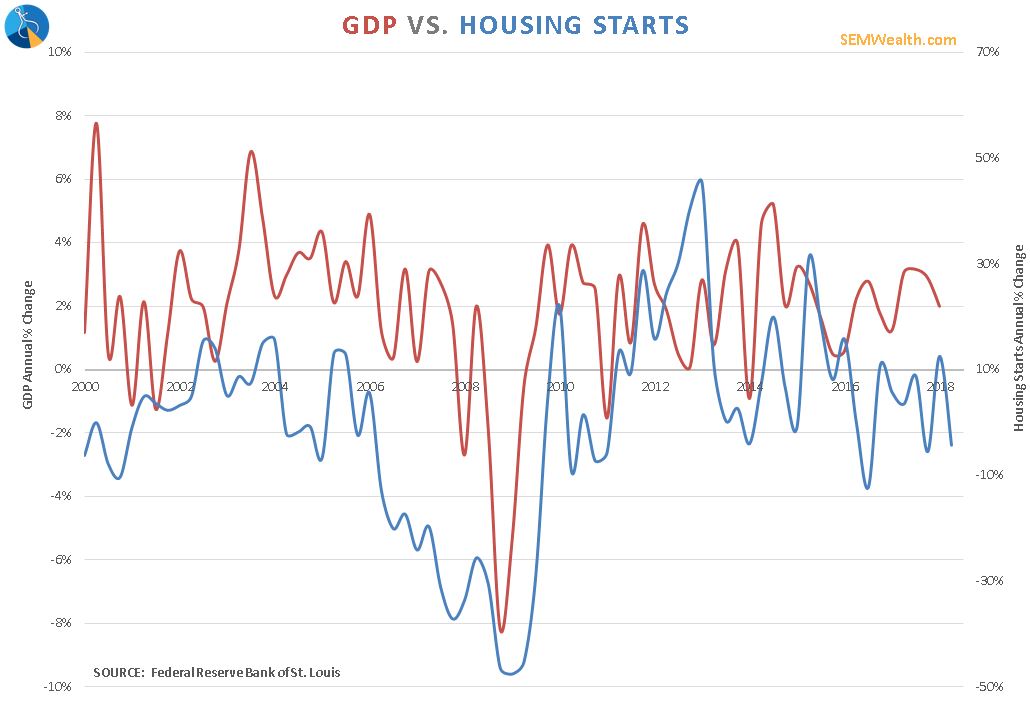

Back to the Chart of the Week. One of my favorite charts shows the relationship between Housing Starts and GDP growth. Both can be volatile, but the general trend of each tends to flow with the other one. Argue all you want about which causes the other, but it is something we should be watching.

Looking at Building Permits (the leading indicator of Housing Starts), we can see both the steep decline that could be a warning for future problems with Housing Starts as well as a reminder that things did get pretty bad in early 2016.

More importantly, even with this drop, our economic model continues to point towards strong economic growth despite the Fed raising interest rates and the on-going trade war. Stay tuned for additional updates on these models.