On Thursday Facebook stock suffered the largest single day loss of market value in history. At one point the stock was down 24%. It recovered to close down 19%. $119 Billion of market capitalization was lost. The reason behind the drop was a combination of the company reporting quarterly earnings below expectations as well as warning the 2nd half of the year may not be as great as previously hoped. There are 5 key lessons we all can learn from this historic drop.

1.) Risk of high valuations

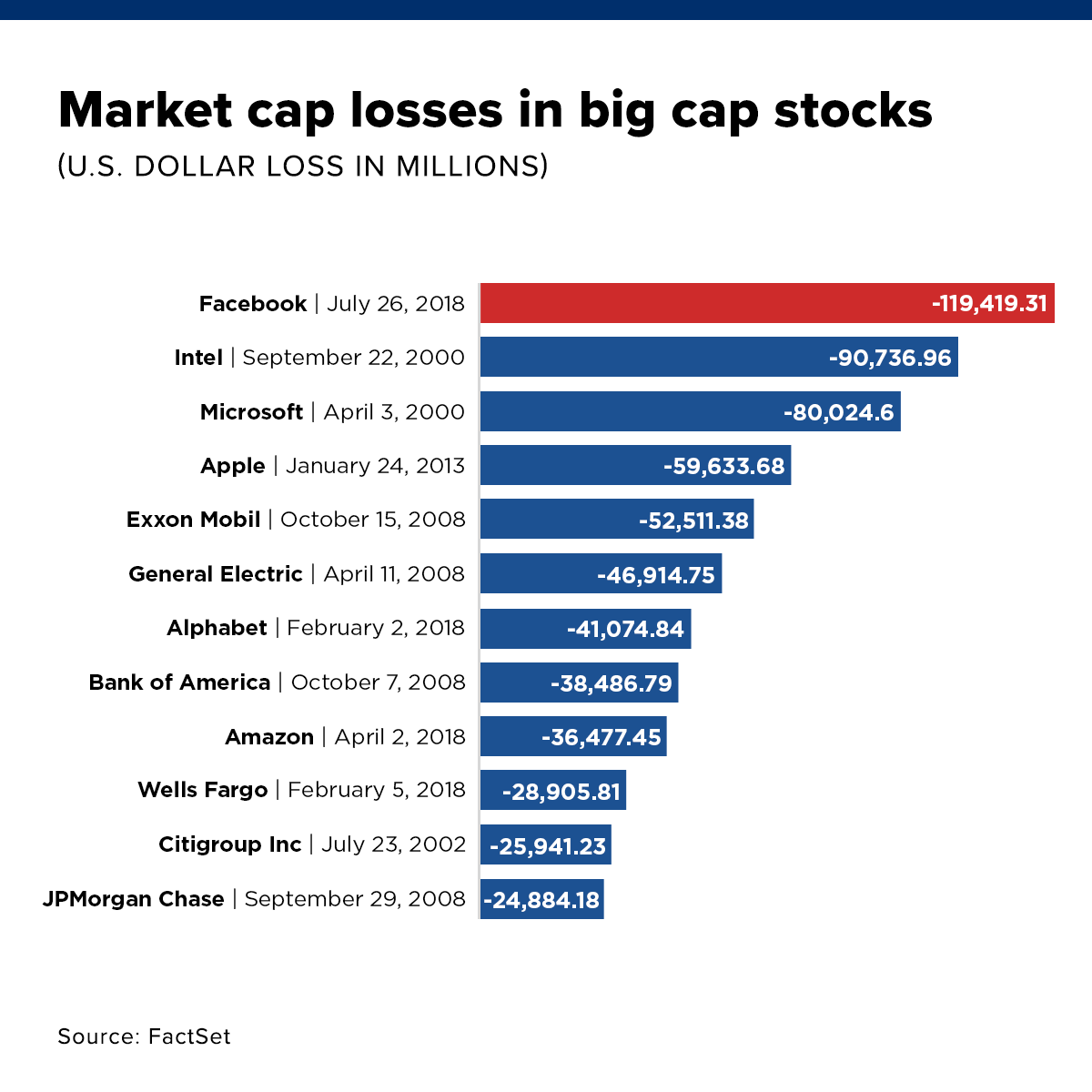

Going into the day, Facebook had a Price/Earnings (P/E) ratio of 36. After the drop it still had a P/E of 29. To put that in perspective, the S&P 500’s average P/E is 15, and it is currently at 24. CNBC posted this chart yesterday highlighting the largest losses in market capitalization in history. As I looked through the dates I saw one common theme — nearly all of them occurred inside a bear market. Bear markets always start with valuations well above the long-term average. Apple’s loss in 2013 was the outlier. We will not know until we have the benefit of hindsight whether or not the 2018 losses of Alphabet (Google), Amazon, Wells Fargo, & Facebook were part of the next bear market. Remember, the S&P 500 peaked for the year in January.

2.) Sensitivity of growth rates

Before the earnings disaster, Facebook was expected to grow earnings this year by a whopping 41%. I began my career in the 1990s and remember vividly what happens when a high growth company warns their growth may be slightly lower than previously expected (notice Microsoft & Intel on the chart above). In the whole scheme of things, even a 35% growth rate would be far better than most S&P 500 companies could dream of, but the slightest drop in this number can bring huge losses in market value, which brings us to lesson #3.

3.) Subjectivity of “value”

Wall Street likes to convince us that there are easy ways to determine the “value” of a stock. As I learned the methods Wall Street uses to determine value, something became quite clear — nearly every input in their formula is subjective (based on somebody’s guess). To calculate the value of a stock, you must know:

-

Last year’s earnings

-

Expected earnings for the current year

-

Short/Intermediate-term growth rate of earnings

-

Long-term (mature) growth rate of earnings

-

Risk Premium for the stock

-

“Discount Rate” (interest rate to calculate for the time-value of money

Looking at the list, the only hard pieces of data are the first & the last variables (although there is no “right” answer to the last one — the CFA materials spent a great deal of time discussing how you would pick a discount rate). What this means is the “value” of a stock comes down to one thing — the current mood of the market, or lesson #4.

4.) Dangers of emotions

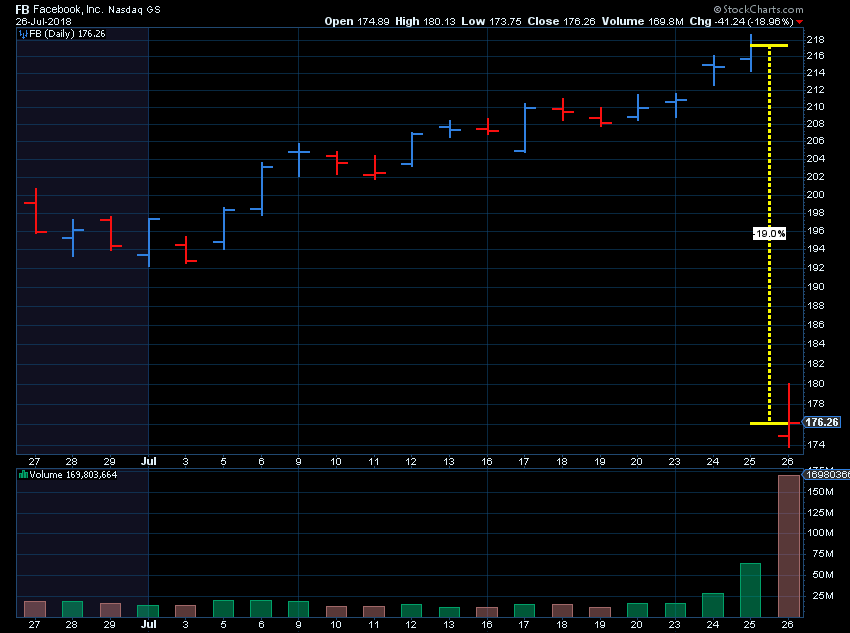

The variables in the “value” of a stock, and thus the “value” of the stock market are all based on how investors/analysts feel. Think about it — if the mood of the market is optimistic, people are more likely going to projected higher earnings, stronger growth rates, and a lower “risk” premium. All of those lead to higher perceived valuations for the market. When stocks fall (or a company reports slightly lower earnings), the mood shifts and huge losses occur. This leads to people that jumped in late in the market cycle to start selling, which then leads to more selling, and more emotions, etc, etc, etc. Think about it — how in one day could Facebook stock do this just because it had a weaker quarter than expected and lowered its growth rate just a bit?

The answer is simple — the rise in Facebook stock was fueled by emotions, which then helped fuel the drop in Facebook stock. This leads to lesson #5

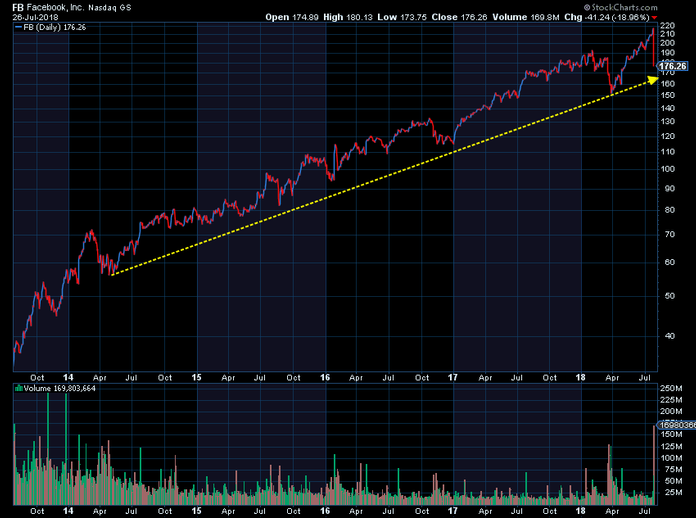

5.) Perspective is key

The chart above looks at the last month for Facebook stock. Zooming out to a longer-term perspective we can see the drop simply returned Facebook stock to a very strong long-term uptrend line.

Notice the drop in April earlier this year? That was when the Cambridge Analytica scandal broke. Even with the near 20% decline, Facebook is still above where it was at in the depths of that fiasco.

This is by no means a recommendation to buy Facebook stock. It is simply a reminder why SEM’s Behavioral Approach to Investing using our Scientifically Engineered Models is critical to long-term success. Our models are designed to take all emotions out of the equation to prevent our clients from falling prey to the inevitable emotional swings the stock market will take.

The stock market overall is at the upper range of its historical valuation levels. The lessons from Facebook should apply to the entire stock market. We do not currently have any indicators saying a bear market has started or is happening soon, but I don’t know of any indicators that reliably can tell us that anyway. However, our models are designed to begin heading to safety as soon as other signs become more clear.