Tariffs and Trade Wars are dominating the headlines. Stock market participants are worried and the market indices have been falling every time one of the sides announces a new tariff or other restrictions on trade. Whenever markets start falling emotions begin to take over. The logic is “stocks dropped because of tariffs, therefore tariffs are bad.” This type of short-term thinking is what has gotten the US into the economic mess we see ourselves in today. (For more read ‘A necessary war‘).

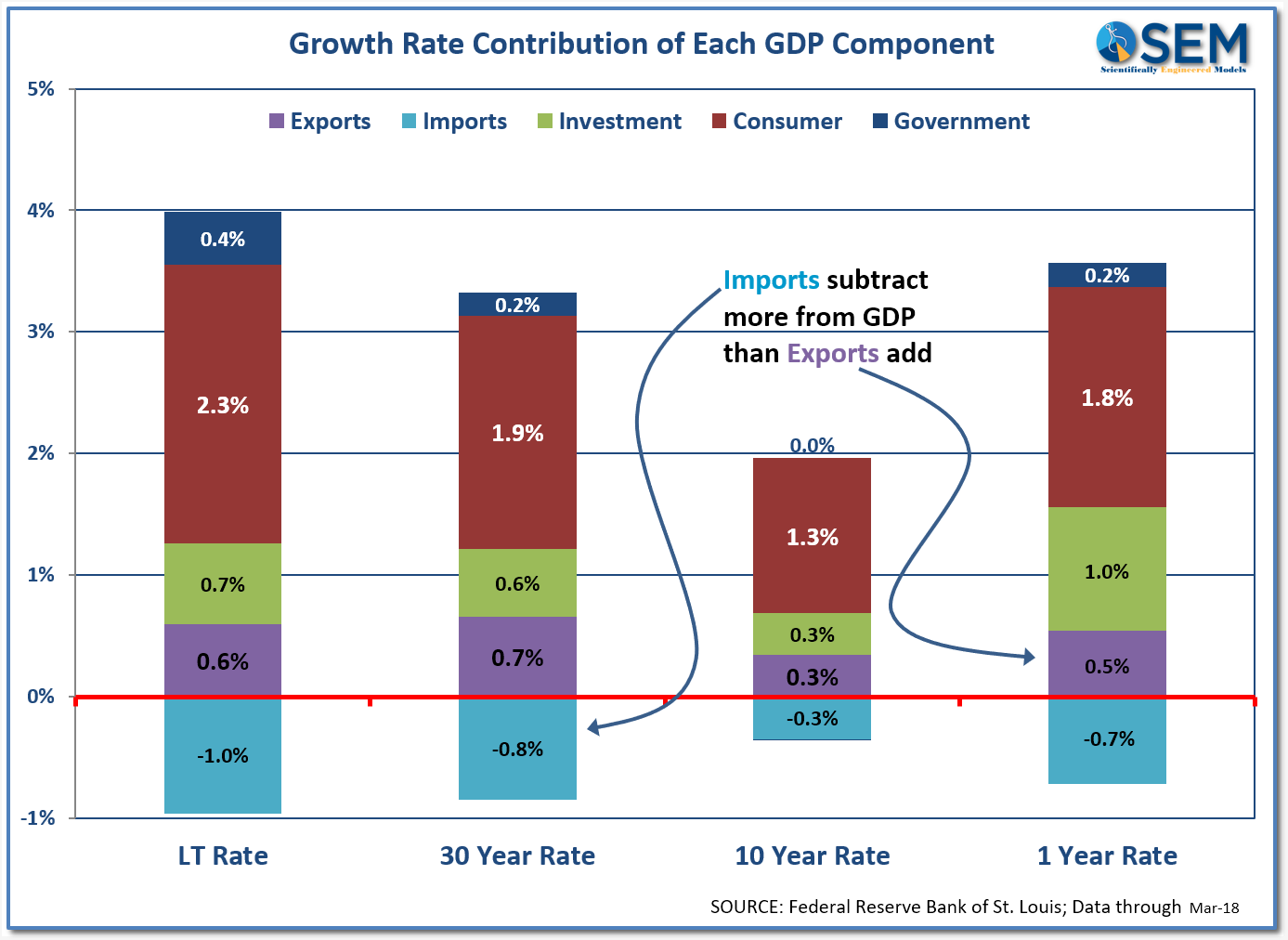

The best way to overcome emotional reactions is to look at the DATA. We keep hearing from experts how a widespread Trade War would damage the economy. Over the short-term that may be true as our economy adjusts, but all of the foreign things we buy SUBTRACTS from GDP growth. Historically those subtractions have exceeded the total amount other countries buy from us. Over the last year that has subtracted 0.2% from GDP growth. The long-term average is a subtraction of 0.4%.

Granted, it will take some time to adjust to actual “fair trade” (where both sides win). We will see some inflation in the US which will slow consumer spending over the short-term. However, we’ve exported inflation for the past 30 years. What I mean by that is we saw inflation cut in half starting in the 1990s as we imported more and more cheap foreign goods (when I took my first economics class in the early 1990s long-term inflation was expected to by 7%). That came at the expense of American jobs, which has hurt the long-term potential growth of our economy (back in the early 1990s potential GDP growth was 4%. It is now down around 2%). Having higher inflation over the short-term may not be so bad if it means higher long-term potential GDP growth.

(As a side note, it is refreshing to see investment contribute 1% to GDP growth in the past year. This is something else we need to see if we ever hope to grow above 3% for the long-term.)

Just because the data shows we need trade reform will not prevent the market from falling. Humans control the direction of the market and humans are emotional. At SEM we plan on doing what we always do — let our data based systems tell us when the markets are getting risky and use that data to pull money out of the market. We’ve learned during our 26 year history it is always better to err on the side of caution so you have money available to take advantage of disconnects as the market and economy goes through a reset. More importantly, using these systems prevents SEM and our clients from reacting emotionally when the headlines and market losses cause nearly everyone else to react in ways that could be detrimental to their long-term success.