"Don't fight the Fed" - Marty Zweig

Marty Zweig was a famous investment advisor and stock trader for his disciplined approach. This approach helped him warn clients about both the 1987 crash as well as the bursting of the tech bubble. His book, "Winning on Wall Street" contained a list of rules he'd originally created in 1990. The rule above was #6 on the list. "The trend is your friend. Don't fight the tape" is #1.

At least for the first week of 2022, stock market participants grew concerned about the prospects of a year where we are fighting the Fed, which could lead to bulls having to fight a negative 'tape' (trend). More on that later.

Last week was a busy week with lots of things to 'muse' about. I'll try to include plenty of charts to tell the story.

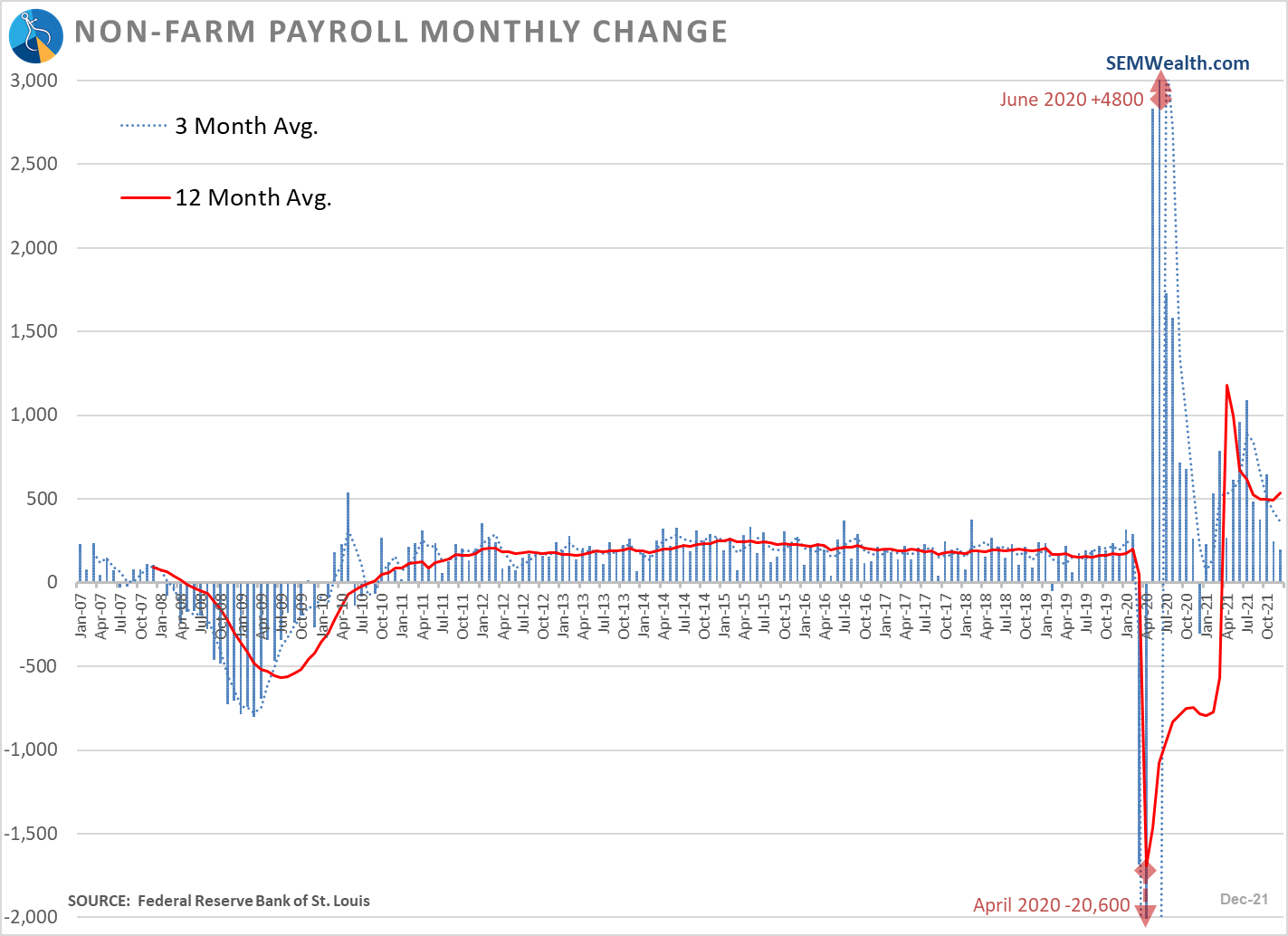

Job market continues to disappoint

The December Payrolls report again came in below expectations. It should be noted prior months were revised higher, but regardless it is clear the latest COVID surge is still playing an impact on the number of new jobs.

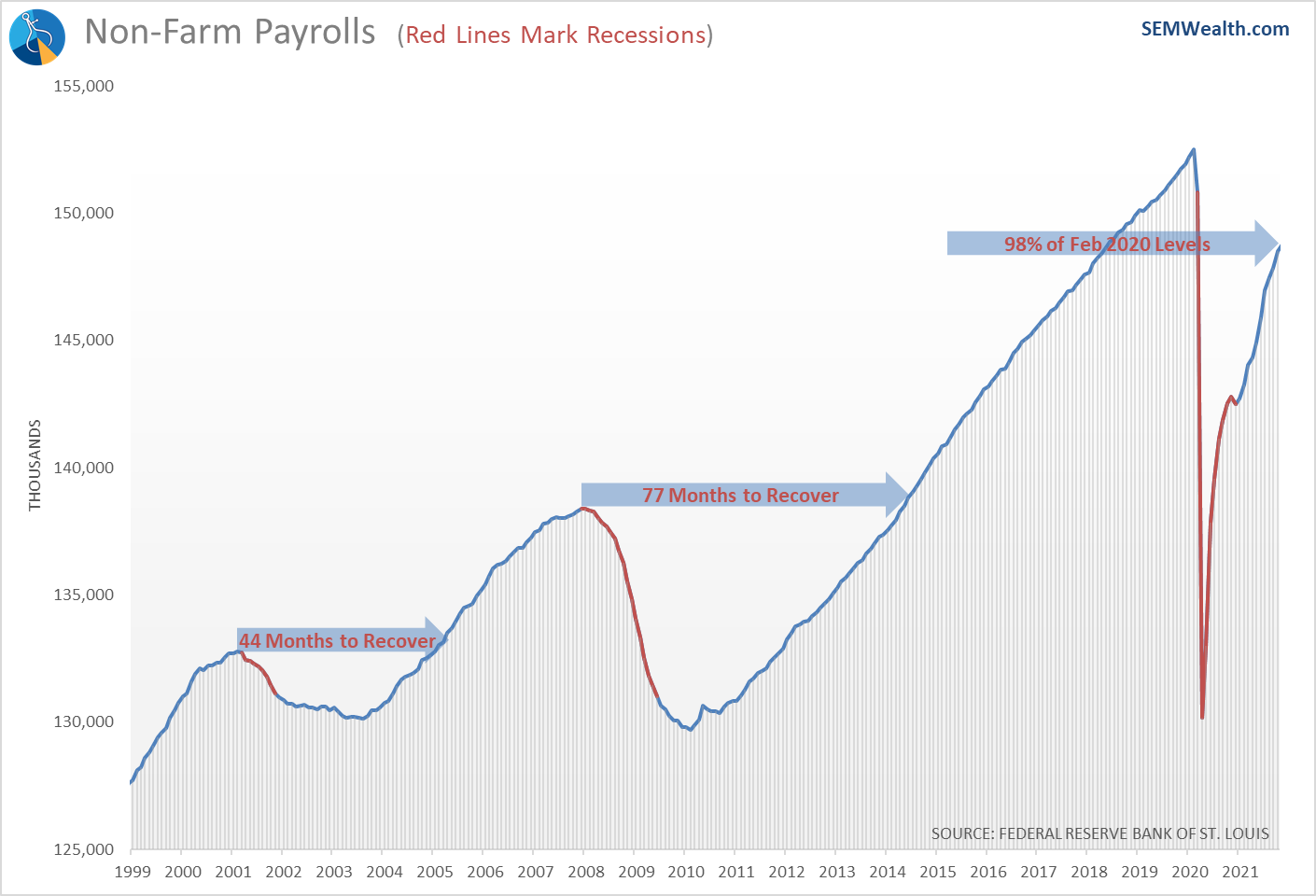

I think this chart is important for perspective. It shows we are still running at 98% of the prior peak, but it also is a reminder of how long it took to fully recover the jobs lost during the past two recessions. Recessions change the structure of the economy, sometimes for the good, sometimes for the worse.

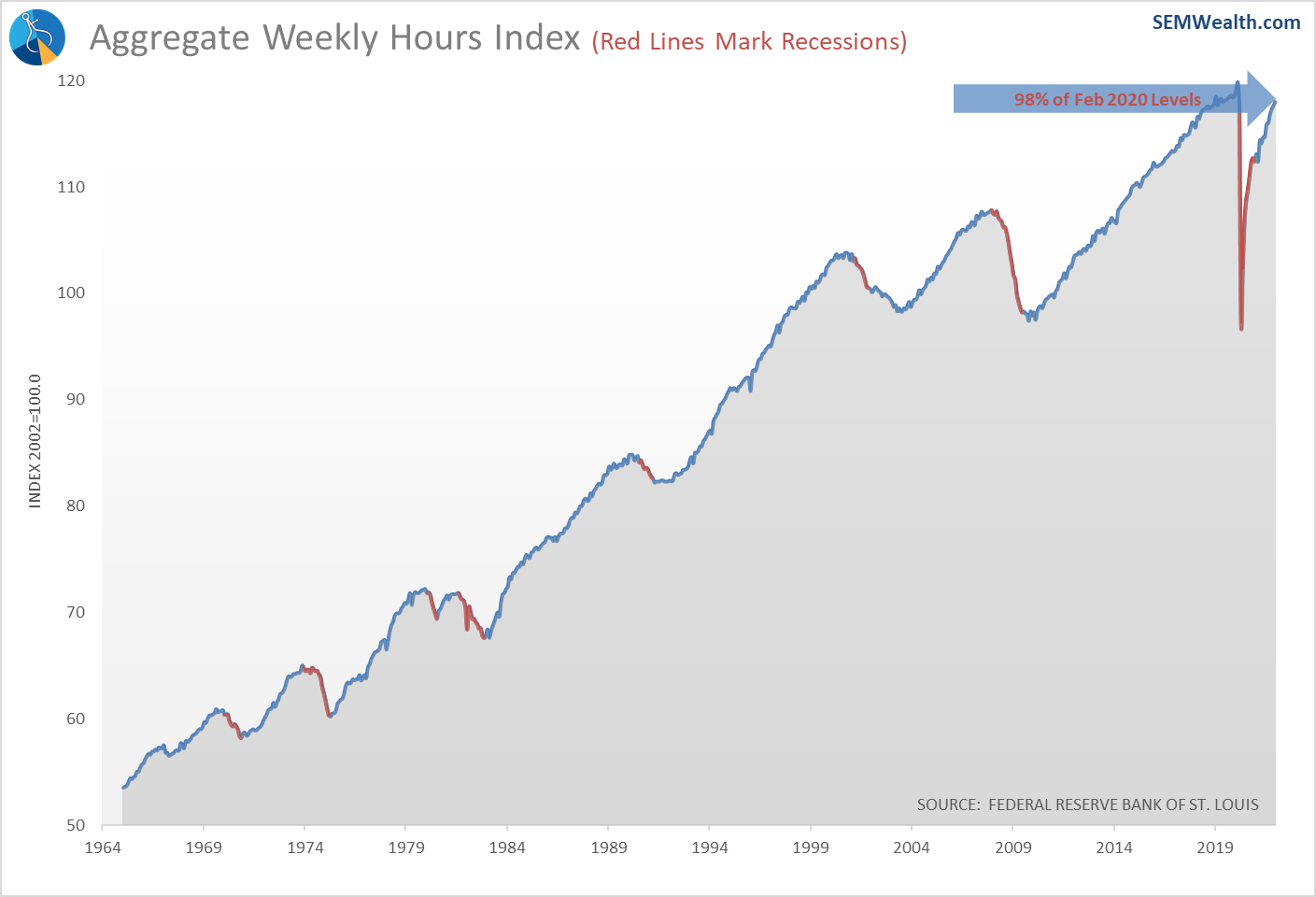

One of the discouraging signs is that the weekly hours worked index is also running at 98% of the prior peak. Employers have been unable to have existing workers pick up the slack, which creates a drag on future economic growth.

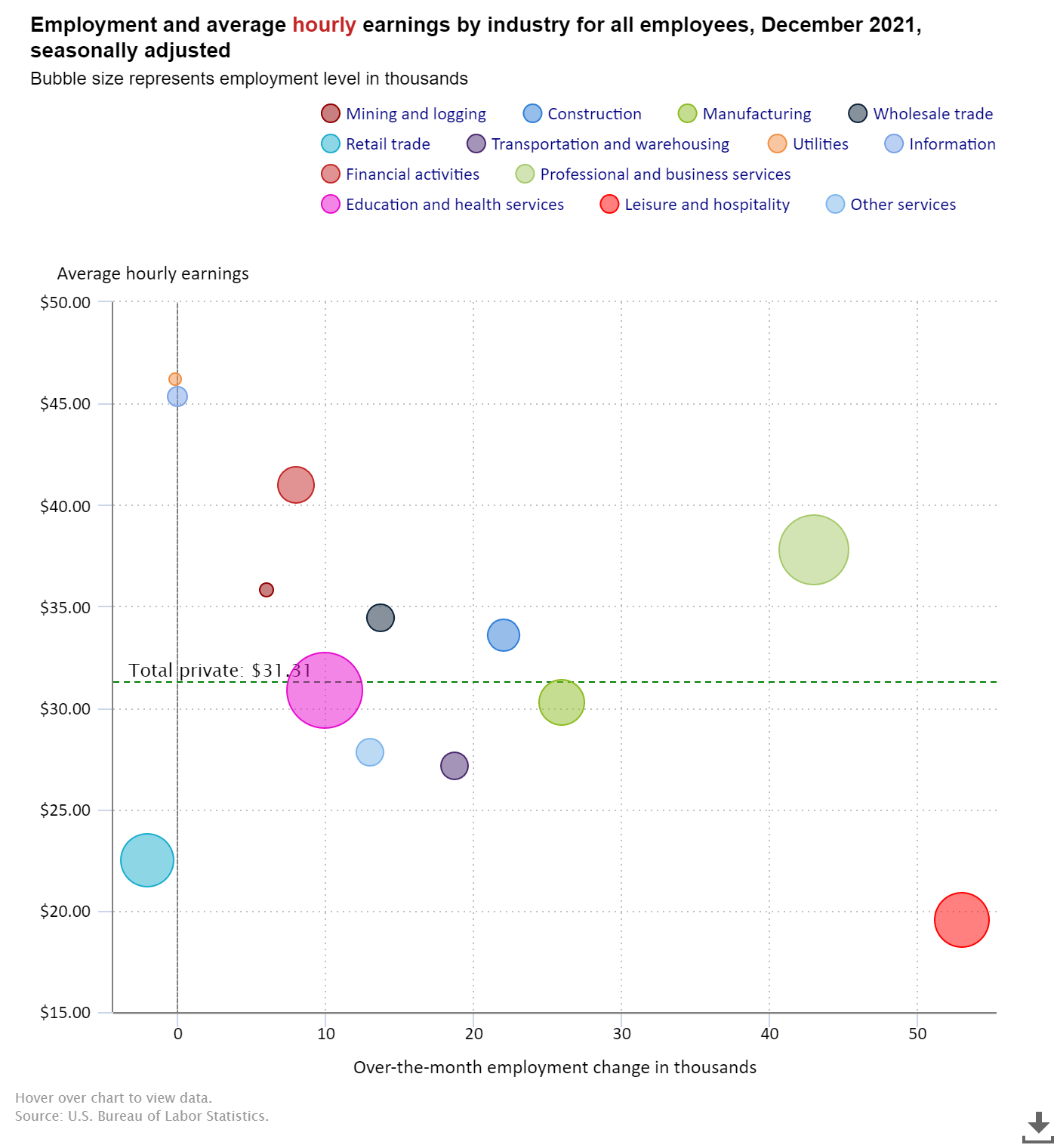

Looking at the industries which added the most jobs it was good and bad news. The good is the manufacturing sector, which pays significantly more than the average wage once again added a significant number of jobs. The bad news is the worst paying industry, leisure and hospitality was again the sector with the highest number of new jobs.

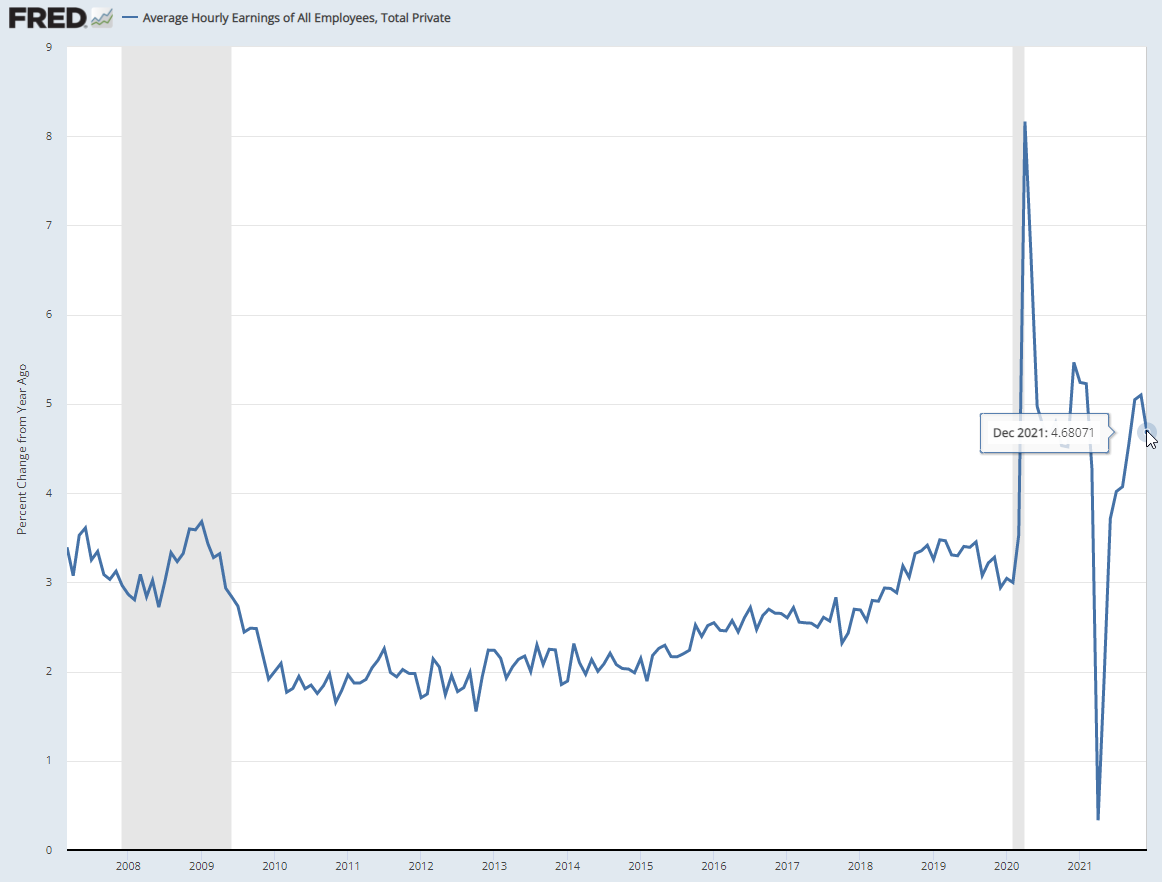

Overall wages increased 4.6% on a year-over-year basis. The expectations were for wage growth to slow to around 4%. The fear is if wages grow too fast, demand for consumer goods as well as commodities used to produce them will continue to be high, which will lead to prolonged inflation. Of course, if the Fed taps the brakes to cool wage growth, they could easily throw the economy back into a recession.

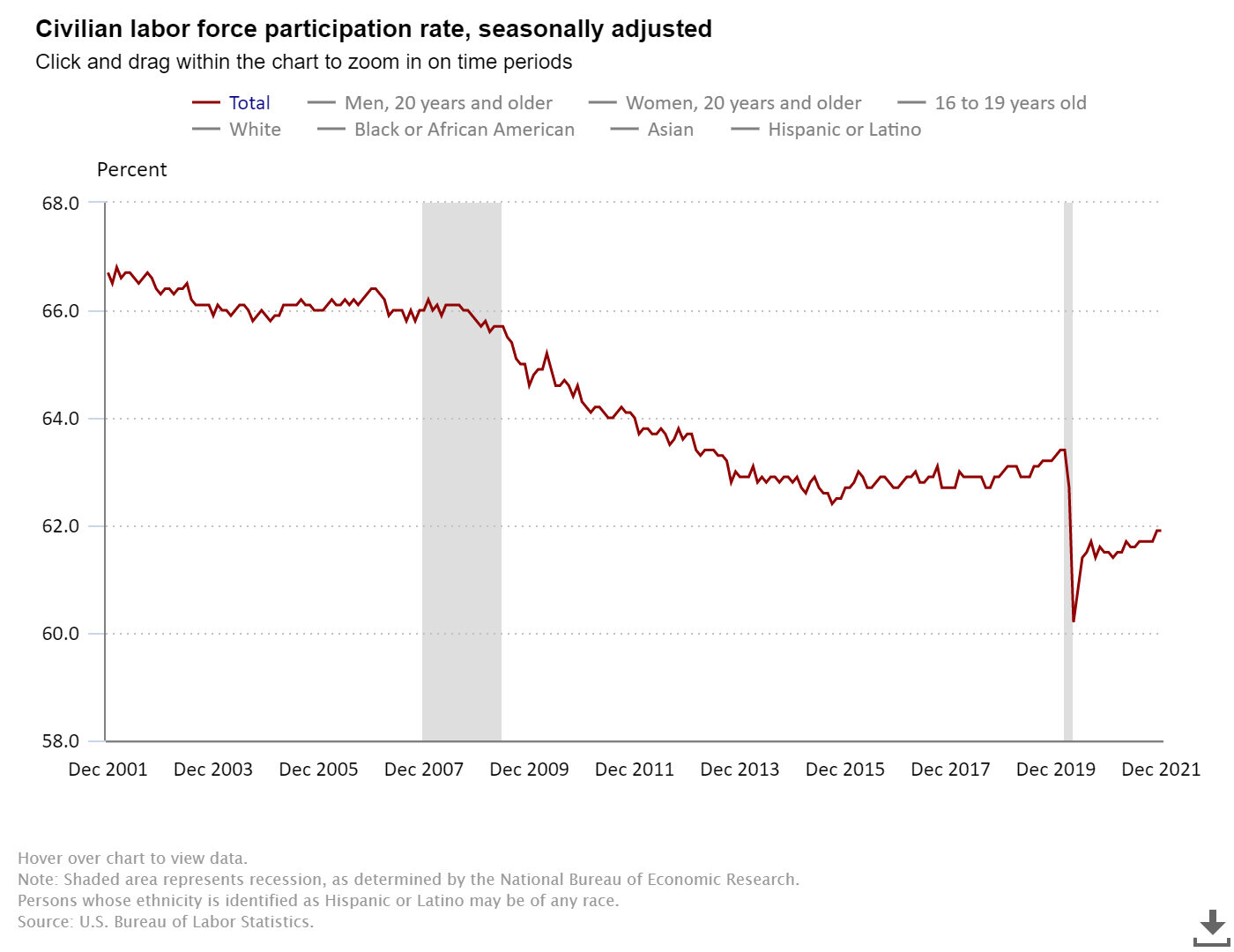

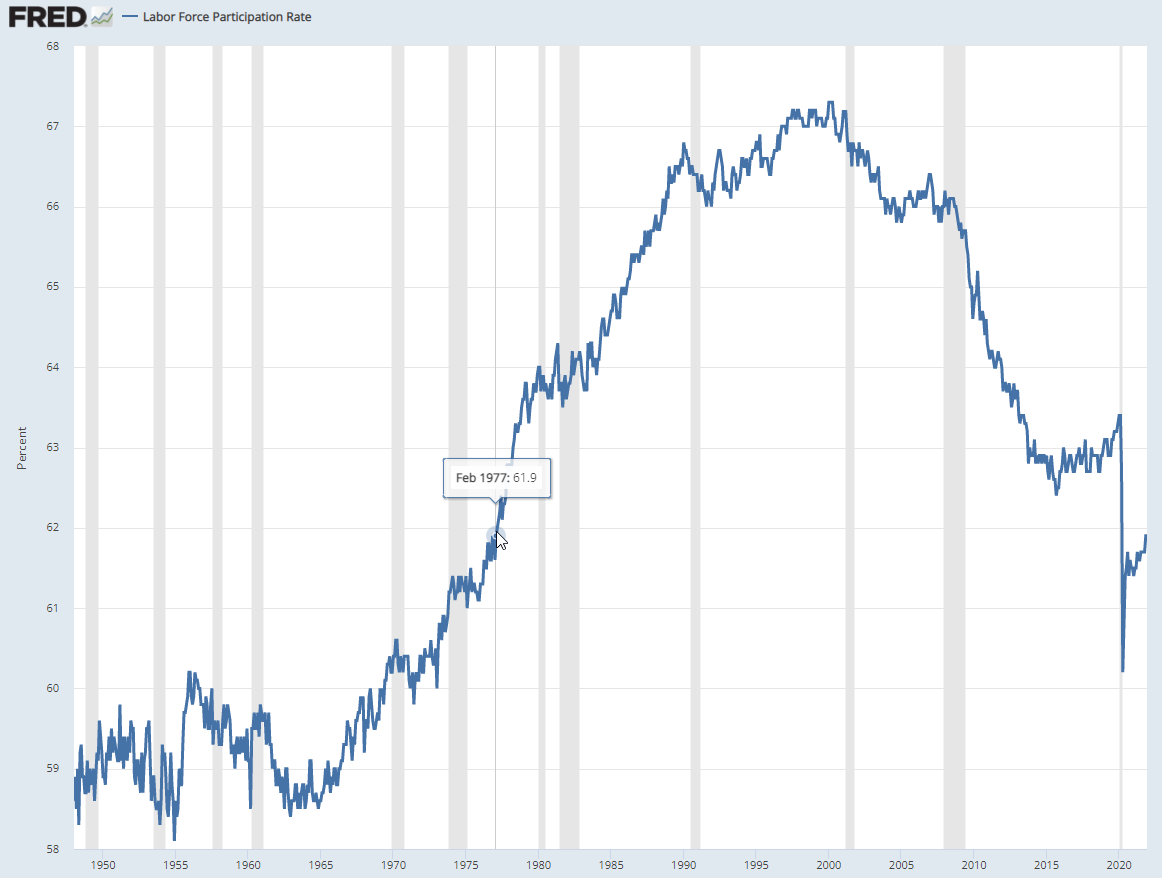

The bigger issue our country is facing is not something new, but rather something that has accelerated during COVID — the number of Americans participating in the labor force is down to late-1970s levels. Our economy thrived as Baby Boomers hit their peak earnings years. It is likely to suffer as those Boomers retire unless we figure out a way to get the younger generations into the workforce. Even if our economy somehow figures that out, those jobs are unlikely to provide the wages, jobs security, or benefits the Boomers enjoyed, which will be a long-term drag on the economy until fixed.

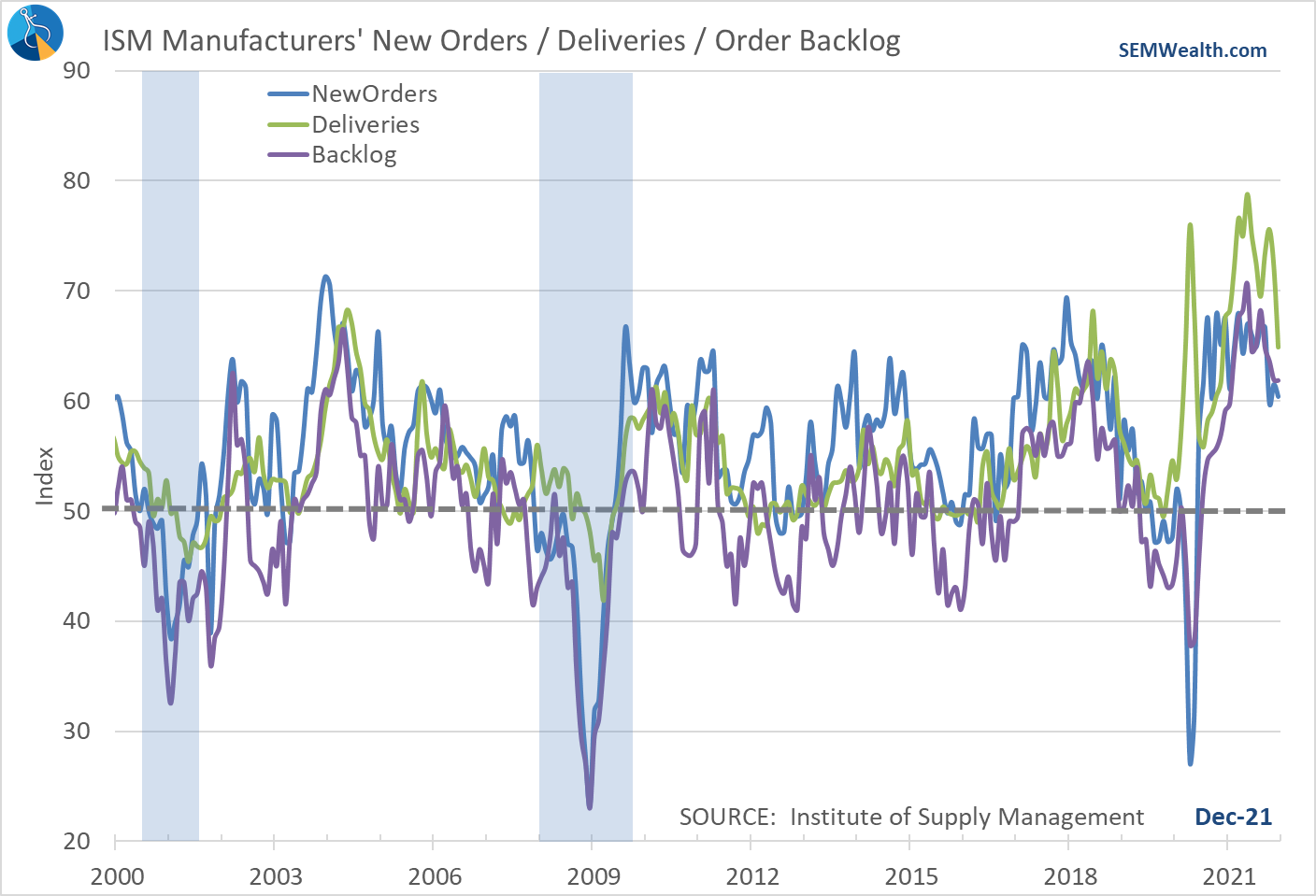

Manufacturing Continues to Slow

After enjoying a strong resurgence thanks in large part to the 3 rounds of stimulus checks, the manufacturing sector has been declining for the past 4 months. It is still indicating "growth", but at a much slower rate than we enjoyed for most of 2021.

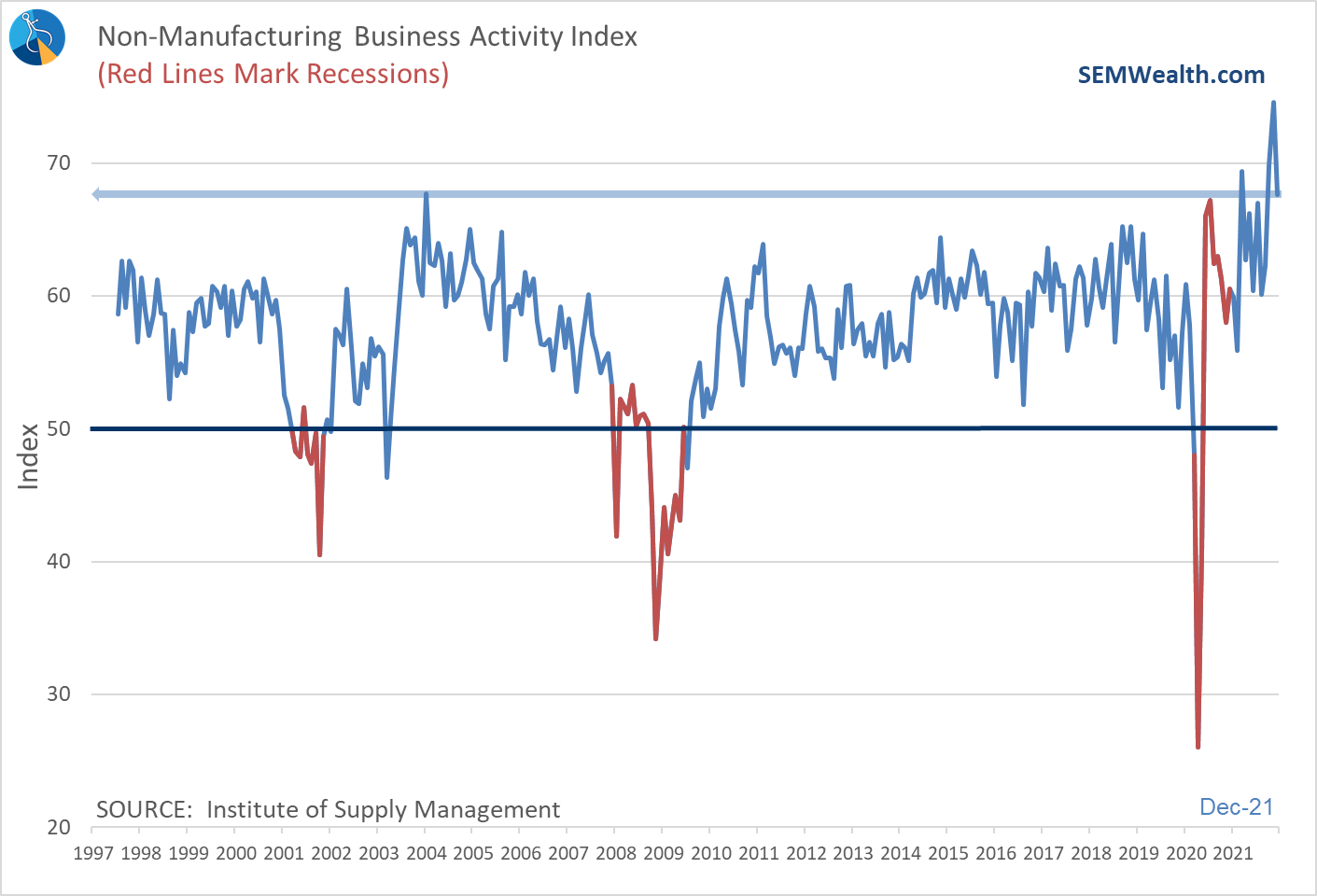

Service Business Slows (Slightly)

The Omicron surge has also taken a bite out of the service sector. Before COVID this was the primary driver of our economy. When the economy shut down, spending shifted to consumer goods (thus the surge in manufacturing and inflation due to the lack of capacity). Service businesses had been thriving the past few months but hit a bump in December. How this indicator performs in the months ahead will be a good indication of how much Omicron is hurting the economy.

Is the Fed making a mistake?

This brings us back to the Fed and the big news from last week. The market sold off hard on Wednesday when the minutes from the Fed's December meeting showed discussions about possibly raising interest rates much sooner than Chair Jerome Powell had indicated during his news conference last month. There were also discussions about an "active" unwinding of their balance sheet versus the current "passive" strategy. They are currently planning on letting maturing bonds simply rollover (passive strategy). An active strategy would have them actually selling current positions.

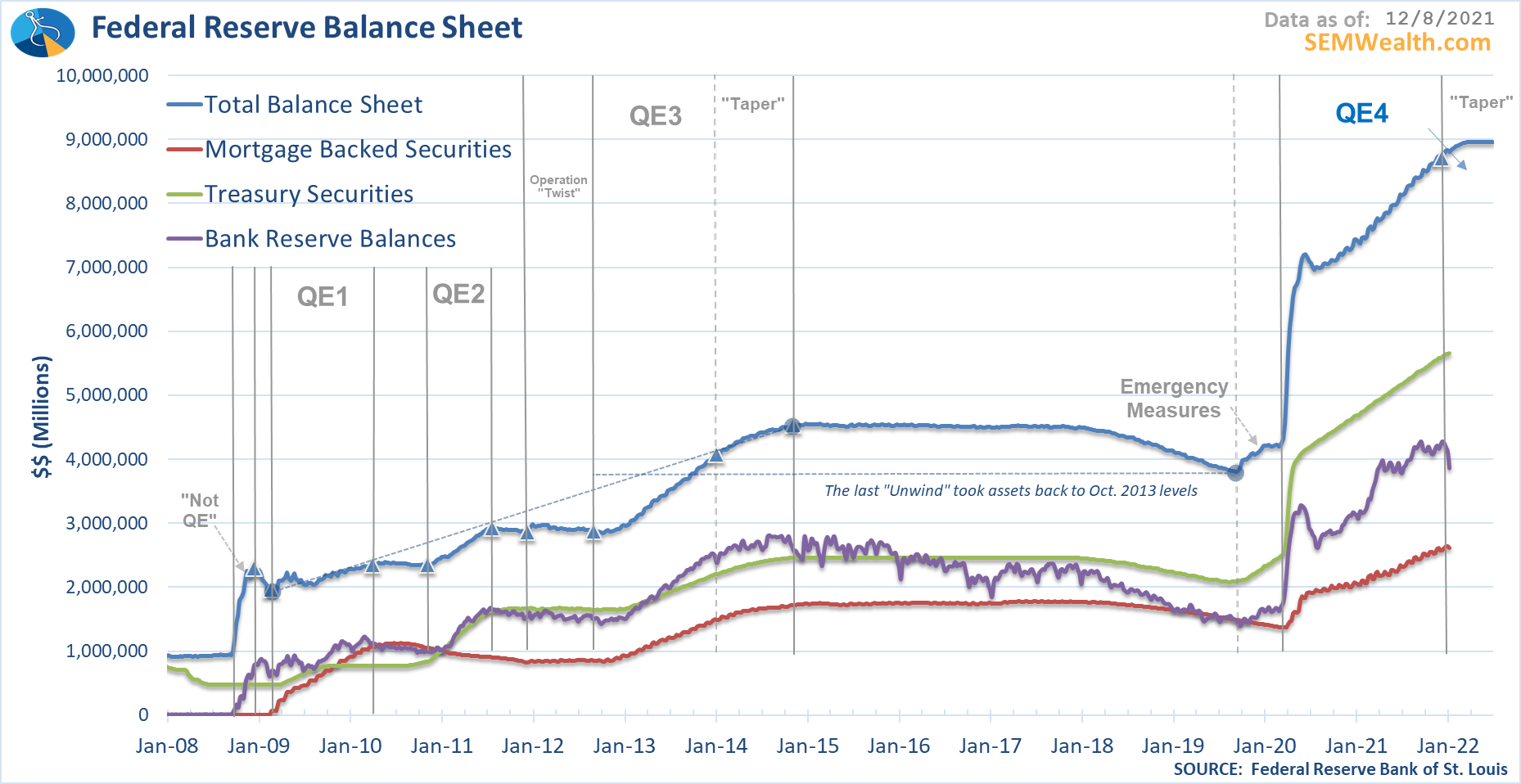

The chart below shows the Fed's Balance Sheet. The dark blue line is the total value of their assets. The proposed "taper" is on the right. One thing that fascinates me is how little of the financial crisis stimulus the Fed was ever able to unwind.

The reason the Fed was not forced to unwind their positions more quickly after the financial crisis was the fact very little of the money, they created actually entered circulation. They didn't get much help from the fiscal side (Congressional spending), so inflation wasn't an issue. This time the Fed more than doubled their balance sheet in less than a year at the same time Congress dumped more than 25% of the total economic output into the economy via stimulus bills.

Now the Fed is facing something they haven't really had to deal with in 40 years – inflation. Unprecedented policies mean there is no playbook on how to get out of them. My take from reading the minutes is NOBODY on the Federal Reserve Board has any clue how to get out from under their massive balance sheet.

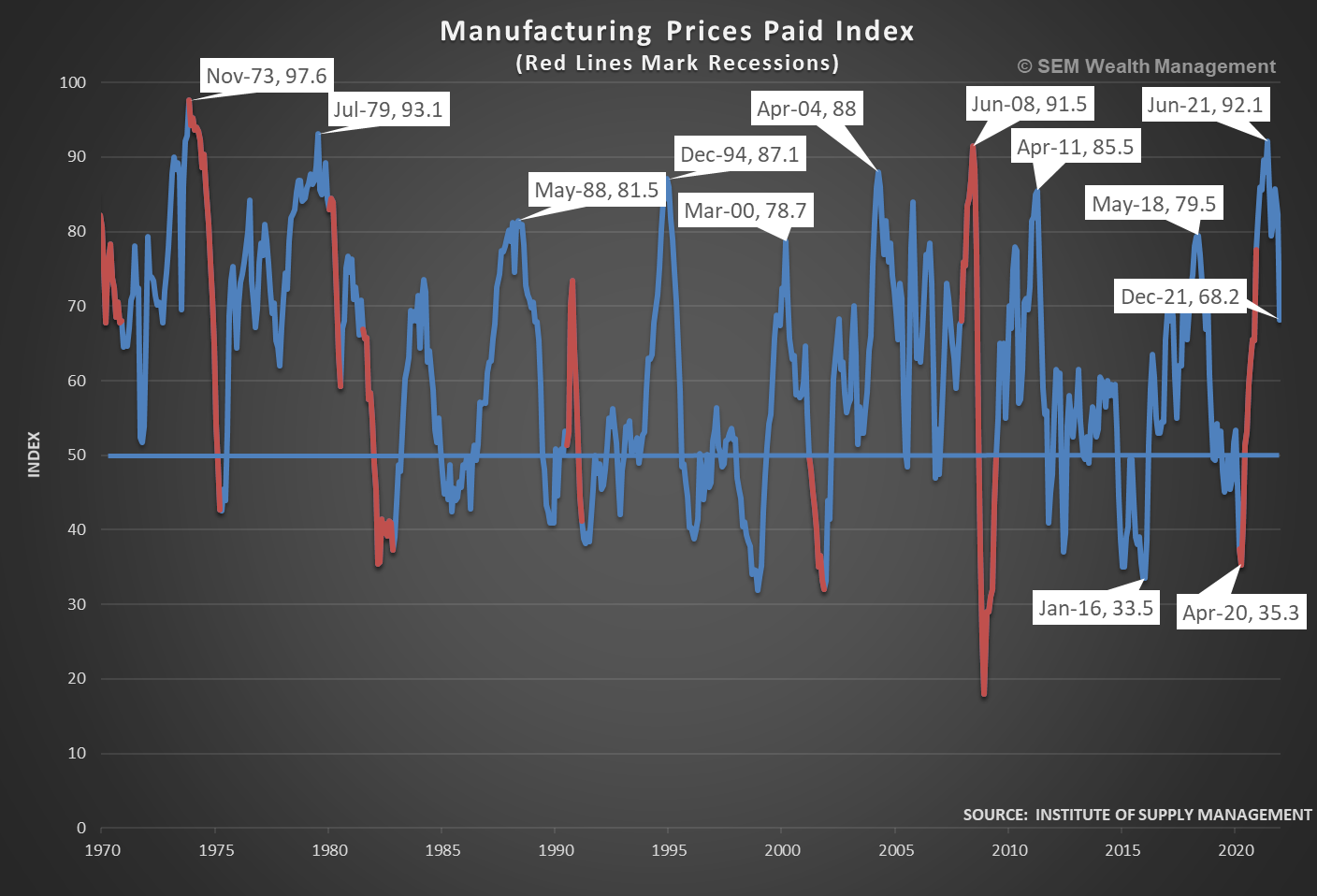

What I think is interesting is until a few months ago the Fed stood by their position that the big spike in inflation was "transitory". I also shared that belief, and the data is still showing that my guess is probably right. Consumer demand has slowed. The supply chain imbalances are starting to resolve themselves. Price increases on the manufacturing side are already starting to slow.

The problem is the fiscal policies may have created an environment that makes it difficult for the Fed's monetary policies to control inflation. They cannot easily tame inflation without throwing water on the speculation in the market. Their tools cannot encourage more people to go to work, which means prices will continue to go higher. Again, unprecedented policies mean no playbook on how to unwind them.

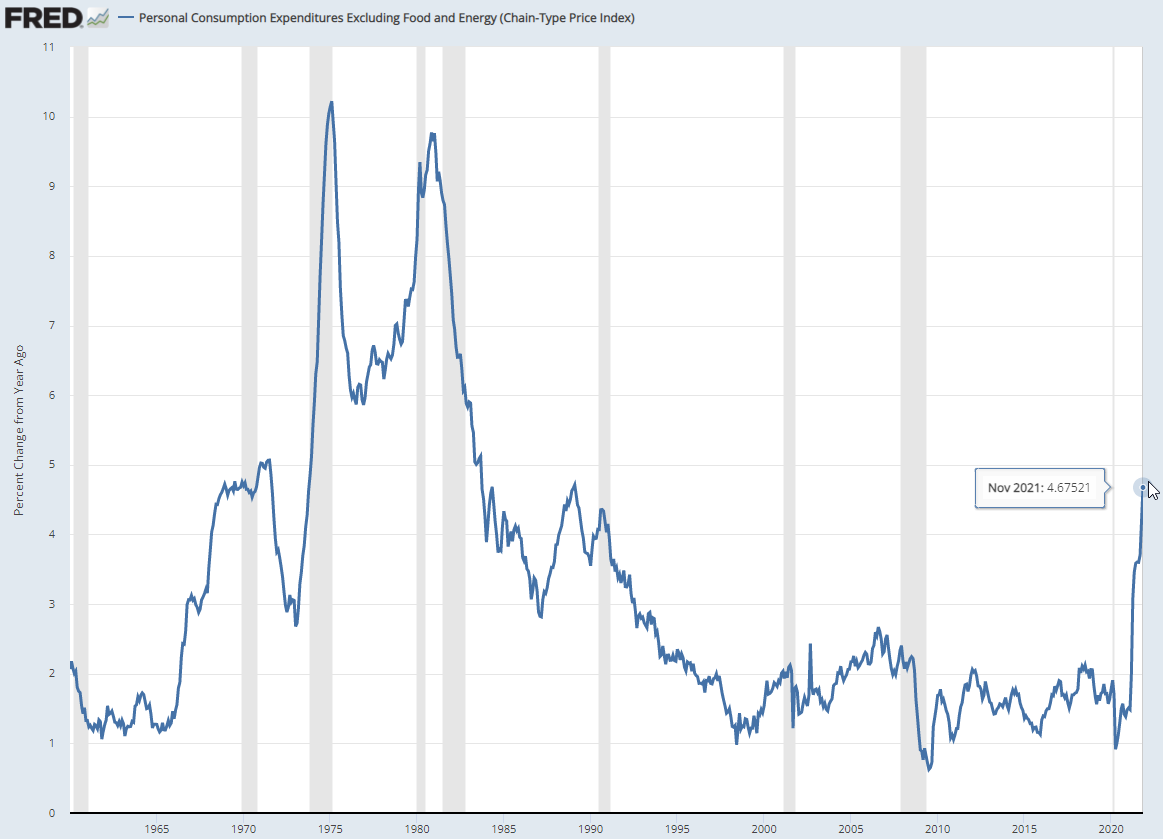

This week the market will be watching the latest CPI reading closely even though the Fed has cited numerous issues with that index and prefers the Core Personal Consumption Expenditures (PCE) index. Here is what that looks like.

The chart obviously highlights a key problem the Fed is facing – inflation has spiked at a pace last seen in the 1970s. Their target is to average 2% inflation. The longer this reading remains above 2 or 3, the bigger the problem the Fed is facing.

If the Fed is forced to aggressively unwind, the adage of "Don't fight the Fed" would mean SELLING risky assets such as stocks. That's something very few people remember how to do.

Economy in Transition

My hypothesis during the 4th quarter was that our economy would be facing a marked slowdown heading into the end of the year, with a growing possibility of recession in 2022 or early 2023. The reason was simple – the Fed and Congress dumped nearly 1/2 of our economic output into the economy in 2020 and 2021. That stimulus was at best going to be much smaller in 2022 and at worst going to be non-existent (or pulled back in the case of the Fed.)

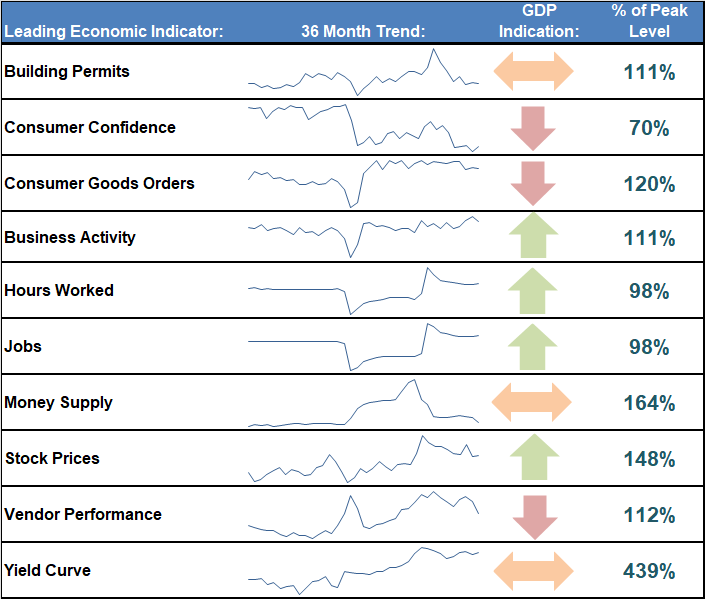

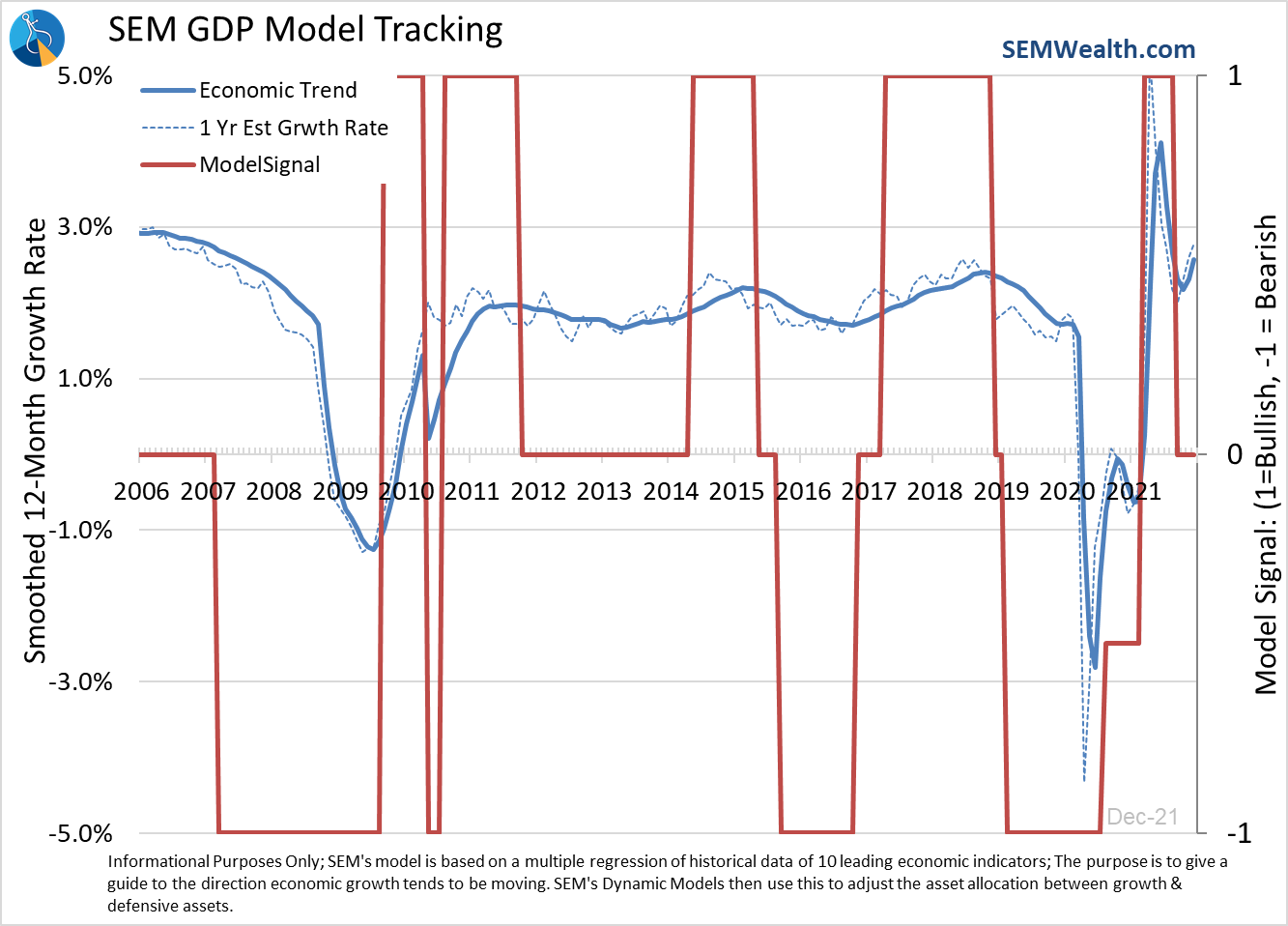

Our economic model began showing signs of a slowdown in October. It continues to be a mixed bag today. Here is our leading indicator dashboard. Long-time readers know Building Permits are one of my favorite leading indicators. It seems inflation and the lack of any new stimulus is now wearing on this indicator. We still have some positives that could turn things around based on what develops out of the Fed and Congress in the months ahead.

Looking at the trends, our model is actually closer to flipping back to "bullish" than moving all the way to "bearish". This is a function of the months being dropped off (remember how bad things still were in January 2021?), although there are mechanisms in place to smooth large fluctuations in the data. An improved employment market and more stable inflationary data could allow our model to flip back to "bullish". Of course, it can just as easily go all the way to "bearish" if a few more indicators turn negative.

The "transition" or "neutral" phase is always the most difficult as it literally can go either way. This is why our Dynamic Models take on more of a cautious "straddling the fence" type positioning during this phase. They aren't designed to make a lot of money during this phase, but rather wait for the trend to be clearer.

1.) "The trend is your friend" – Marty Zweig

11.) "Don't play all the time." - Marty Zweig

When you don't have a clear trend you don't have to participate. This is what our Dynamic Models are doing currently.

Either way the market is overvalued

4.) "If the values don't make sense, don't participate." – Marty Zweig

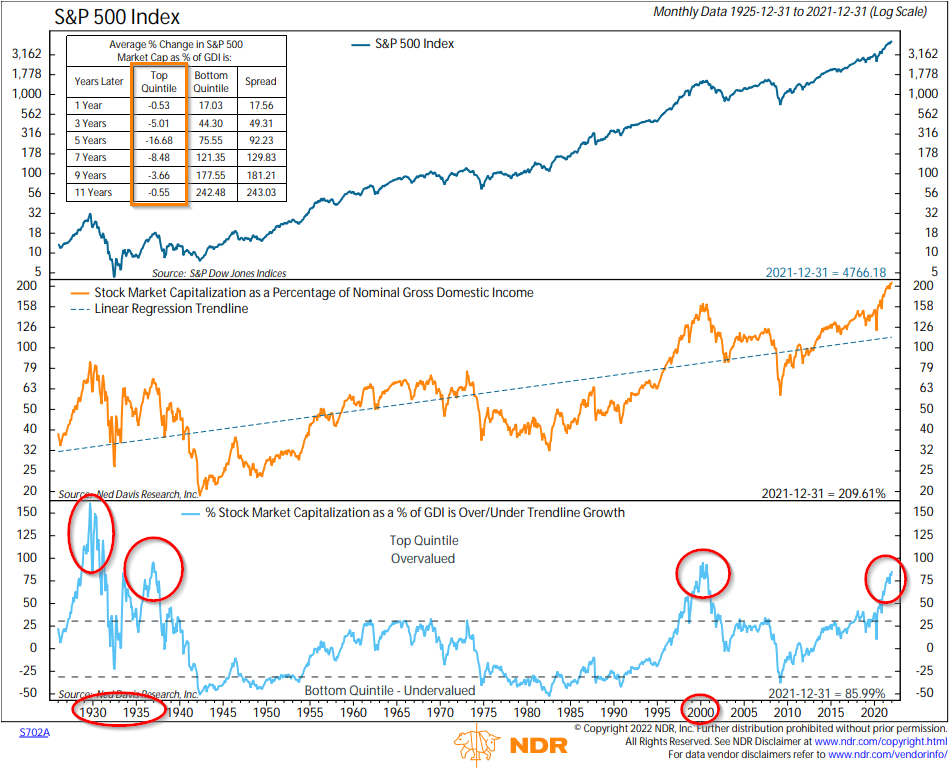

For old guys like me who still hold the firm belief that over the long run the stock market cannot be worth more than the economy (it's mathematically impossible in a capitalistic system), periods like the last three years can be frustrating.

This chart from Ned Davis Research highlights why it is so important to be cautious when valuations are high. This is yet another indicator which shows when valuations are at the current levels, the expected returns for the next decade are likely to be well below average, if not negative!

This indicator measures the value of the stock market versus economic output. I've circled in red the other times we've been in the "overvalued" stage. You don't have to be a market historian to realize that those times led to significant declines for investors.

The orange box shows the returns for stocks over various holding periods. Every period has been negative.

It's Never Different this Time

17.) "Beware New Era thinking, i.e. 'it's different this time.'" – Marty Zweig

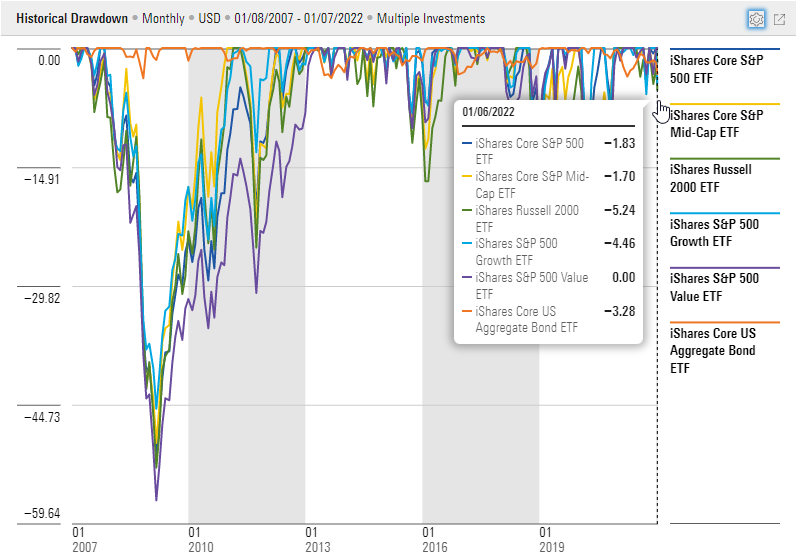

Our brains naturally remember the most recent events and believe those events/actions will continue into the future. Ignoring the quick COVID drop and recovery (because a true bear market is about loss and time), the last time the S&P 500 went through a 20% drop was back in 2011. Since then, it has dropped more than 10% twice, including the COVID drop.

I found it interesting that the three day sell-off led to so many questions about "what is wrong with the market?" Investors and many advisors have been programmed to believe stocks only go up. This chart shows how relatively small the current drop has been (so far).

14.) "If you can't sleep at night, reduce your positions or get out" – Marty Zweig

If you were concerned about last week's sell-off, it's probably time to talk to us about your overall asset allocation and investment objectives.

2.) "Let profits run, take losses quickly." - Marty Zweig

The momentum stocks, namely small cap (Russell 2000) and large cap growth sectors have been hit the hardest. Interestingly enough, large cap value stocks are at a new high. Our AmeriGuard and Cornerstone models had picked up on that rotation and sold small and mid-caps last week to purchase large cap value. They still hold large cap core and blend, so they too went through the losses last week, but not as much as they would have had we not rotated out of those momentum sectors.

The bigger concern is Aggregate Bonds are not helping stem the losses. For 40 years investors have relied on bonds providing a buffer during stock market sell-offs. With the market concerned about inflation and a Fed who once again could simultaneously be late to act and could create another recession with their actions, "safe" bonds have taken a hit.

8.) "Adapt to change" - Marty Zweig

16.) "Don't focus too much on short-term information flows." – Marty Zweig

It's still early in this move to say the trend has shifted, but last week does serve as a warning that things could turn rather quickly. We've also seen 3-5% sell-offs in January every year going back to 2018. In two of the cases (2018 & 2020) it was a sign of further damage to come. In the other two cases it was a "buying opportunity."

Leave your opinions out of it

9.) "Don't let your opinion of what should happen, bias your trading strategy." - Marty Zweig

Over the years the number one thing I've seen derail financial plans is letting opinions influence the overall strategy. At SEM we haven't been around for 30 years because we are good at guessing what happens next. We will continue to do what we've always done – watch the data and make adjustments based on what it is saying. No guessing, no opinions, just data.

15.) "Don't put too much faith in the "experts"" – Marty Zweig

I guess this could include me, but hopefully our history and understanding of the purpose of this blog excludes us from this category. Successful market strategists typically never appear on TV or get quoted in the media because what we do is boring and will not generate clicks or views.

I've always positioned SEM as the contra-Wall Street firm. I didn't want to go to work on Wall Street because I didn't like their focus on how much money you could make and always highlighting returns. This focus leads to investments that are not suitable for most investors. The early days of the blog (back when it was a quarterly and then monthly letter) had one goal in mind – to provide you with data and information to help keep your focus on what really matters in the market and to investors.

I don't know what 2022 will look like, but history and statistics tell us we are due for a really tough year. If you have friends or colleagues who may be prone to focusing too much on the "experts" or short-term movements, I'd encourage you to share this blog with them. Up or down, we'll be here providing a calm look at what is happening and generating ideas on things we should be considering.

[Click here to view the full list of Marty Zweig's rules for investing.]