Imagine a world where headline inflation is reported at 5% and the stock market rallies. That's exactly what happened last week. I received several questions from advisors and clients asking how that can happen.

The simple answer is "the market already expected this." We are comparing prices and economic activity to a year ago when a handful of southern states had started to reopen, but the vast majority were still under severe restrictions. We are now nearly fully reopened and prices today are being compared to those low prices. We also have seen a disruption of the supply chain and big jumps in commodity prices which have been showing up in the inflation data.

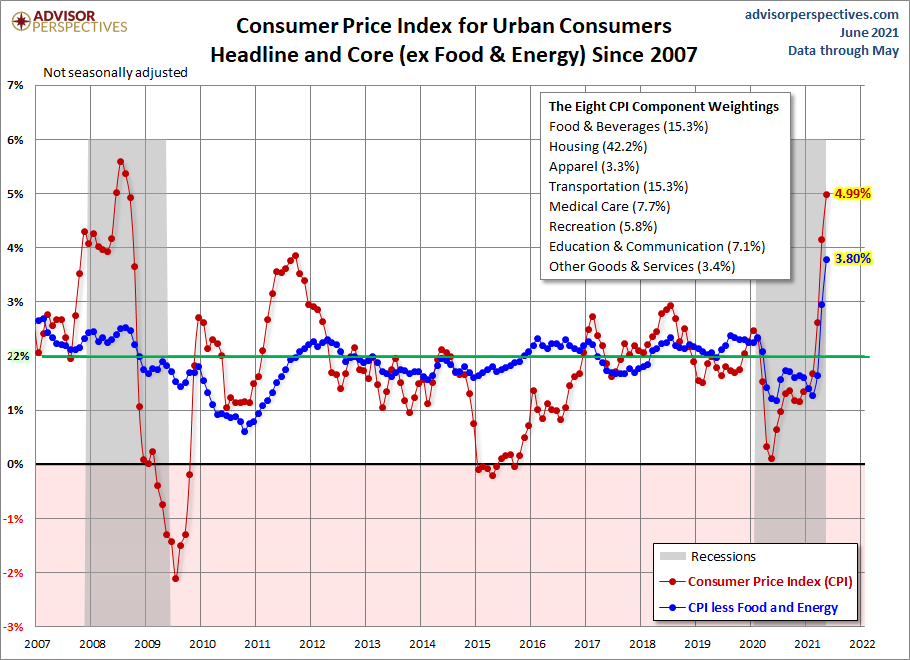

Here's a chart from Advisor Perspectives showing the CPI numbers since 2000. It also shows the breakdown of the CPI components.

What is interesting is how the biggest component (Housing/Shelter) does not even show any sort of inflation.

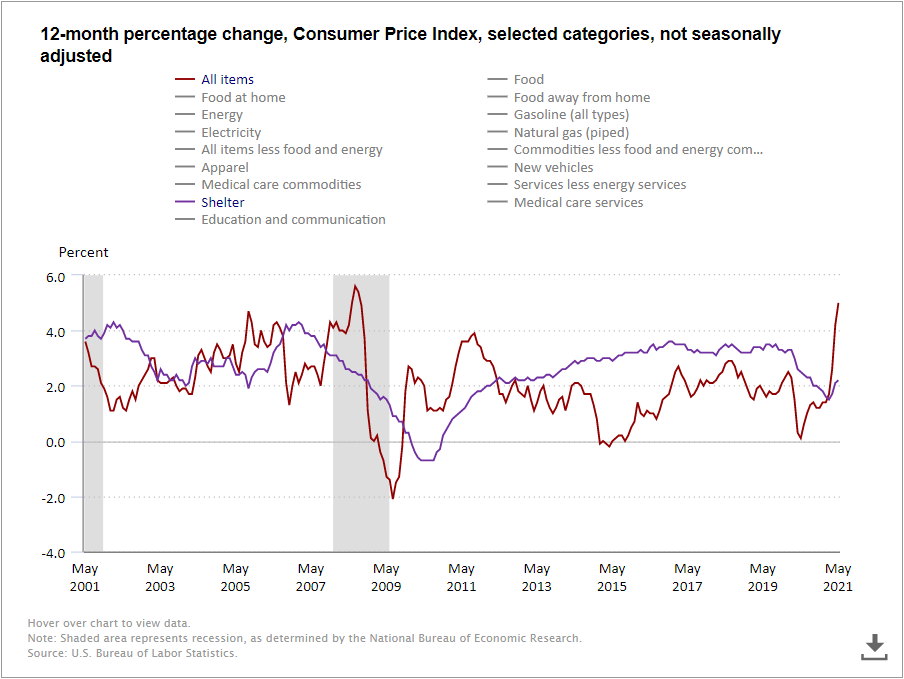

I don't know a single person who hasn't witnessed a significant increase in shelter costs in their hometown. Whether it is the prices of houses or the cost of rent, our country has seen shelter costs rise at significant levels the past 15 months. The problem is CPI uses "owner's equivalent rent" to measure shelter costs, rather than a rental or housing price index.

Owner's equivalent rent is essentially the researchers at BLS surveying home owners and asking, "if you were to rent your house today, what would you charge." Unless you were actively looking to rent your house, chances are you would have no idea what the market was in your area. We would then use heuristics (mental shortcuts) to come up with the price. Most of the time it would be whatever your mortgage payment is, plus a little extra to cover your time and other expenses. Therefore, the shelter costs in CPI track mortgage rates, rather than the actual costs.

Investors believe the big jump in inflation (even without the huge shelter cost increases) is temporary, which means the Fed will not have to start pulling back their stimulus or raising interest rates. This has created an underlying bid to stocks which allows them to bounce back after every small sell-off. Whenever somebody is overly optimistic (or pessimistic) I like to challenge them with some "what if" questions. In this case I say, "what if we find inflation is significantly higher a few months down the road and the Fed is too late to start pulling it back?" Worse, "what if inflation hurts economic growth?"

I have my opinions, but what is important to understand is those opinions do not influence any investment decisions or recommendations we make at SEM. Our models are designed to adjust to whatever environment we are in. For what it's worth, I think we will see stubbornly higher hidden inflation which when combined with the lack of new stimulus checks, our massive debt load, and the significant amount of money necessary to support the growing retiree population will lead to a possible deflationary period in 2023 and beyond (due to much slower economic growth).

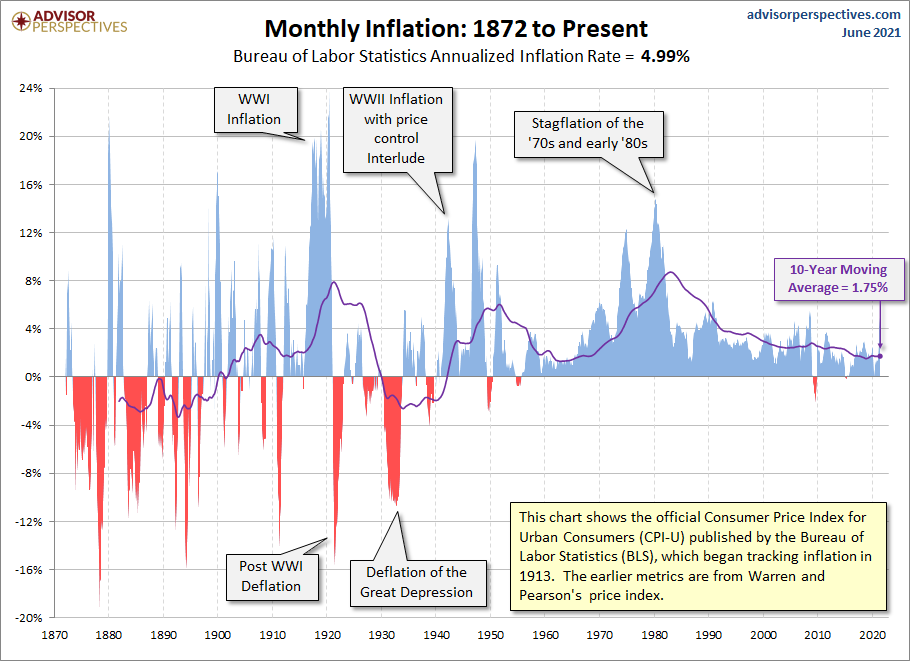

Whenever I bring up the prospect of deflation, most people look at me like I'm crazy. This chart from Advisor Perspectives helps frame the big picture story of inflation.

When framed this way, the big spike in inflation is barely noticeable. I could be right or wrong, but it doesn't matter when it comes to how we are investing. All decisions are based on the data coming out of the market, which given the huge unknowns out there is a very comfortable position to be in.