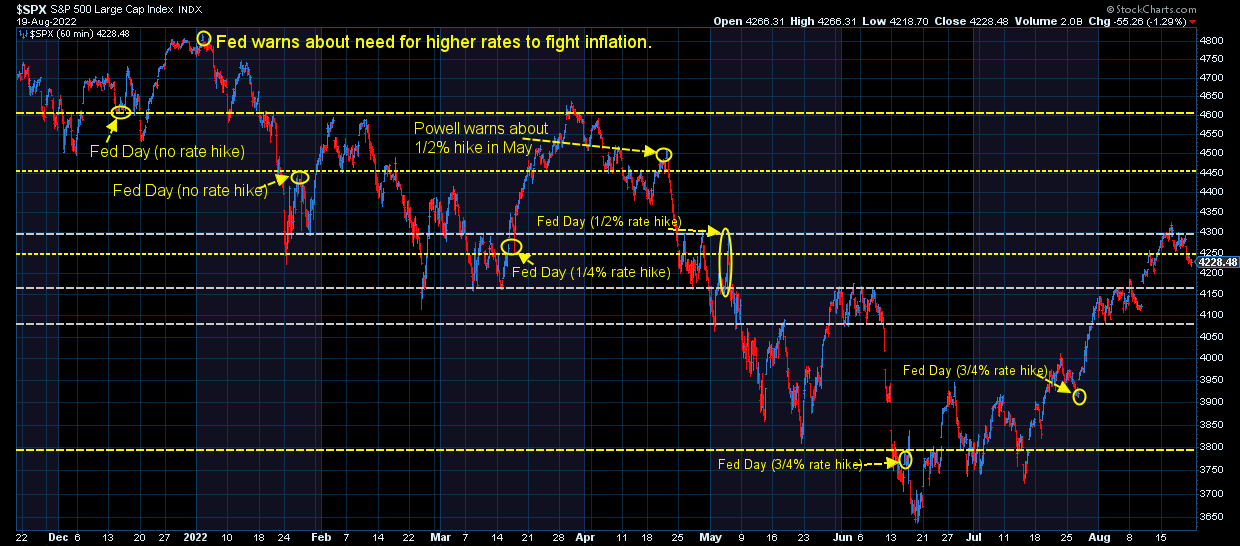

The Federal Reserve has been going out of their way to tell the stock and bond market that they will be focusing solely on taming inflation and won't be looking to stimulate the economy unless inflation is under control. Too much money floating around the system led to too much speculation, which led to too much inflation. Since mid-July, the stock market has ignored their warnings and has staged an impressive rally, which has recovered a little over half of the losses this year. It's as if the market believes the Fed is bluffing and won't follow through with their plans.

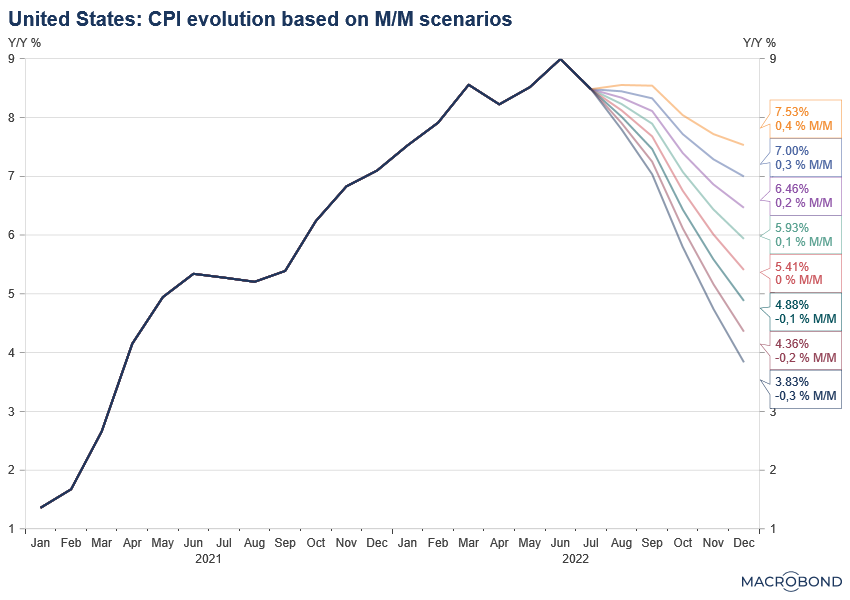

Based on the data, market history, and my 25+ years of experience I think this is a dangerous bet. Inflation may have peaked, but that doesn't mean the Fed will not be dealing with uncomfortably high inflation for quite some time. This chart from MacroBond is something anyone betting on an easy Fed needs to understand.

If inflation is flat the rest of the year, we'd still be at a 5.4% annual inflation rate. Even if it drops by 0.3% every single month we'd be barely below 4%.

I'm not going to go into the details because I did that last week, but it is going to be VERY difficult to get inflation back to 'normal' in the next 12 months. In case you missed it or need a refresher, you can check it out below:

The key takeaway is this – barring a severe recession that causes inflationary pressures to ease, the Fed will not be on the side of the markets. They want to see the economy SLOW, which is not good for those paying above average valuations for stocks.

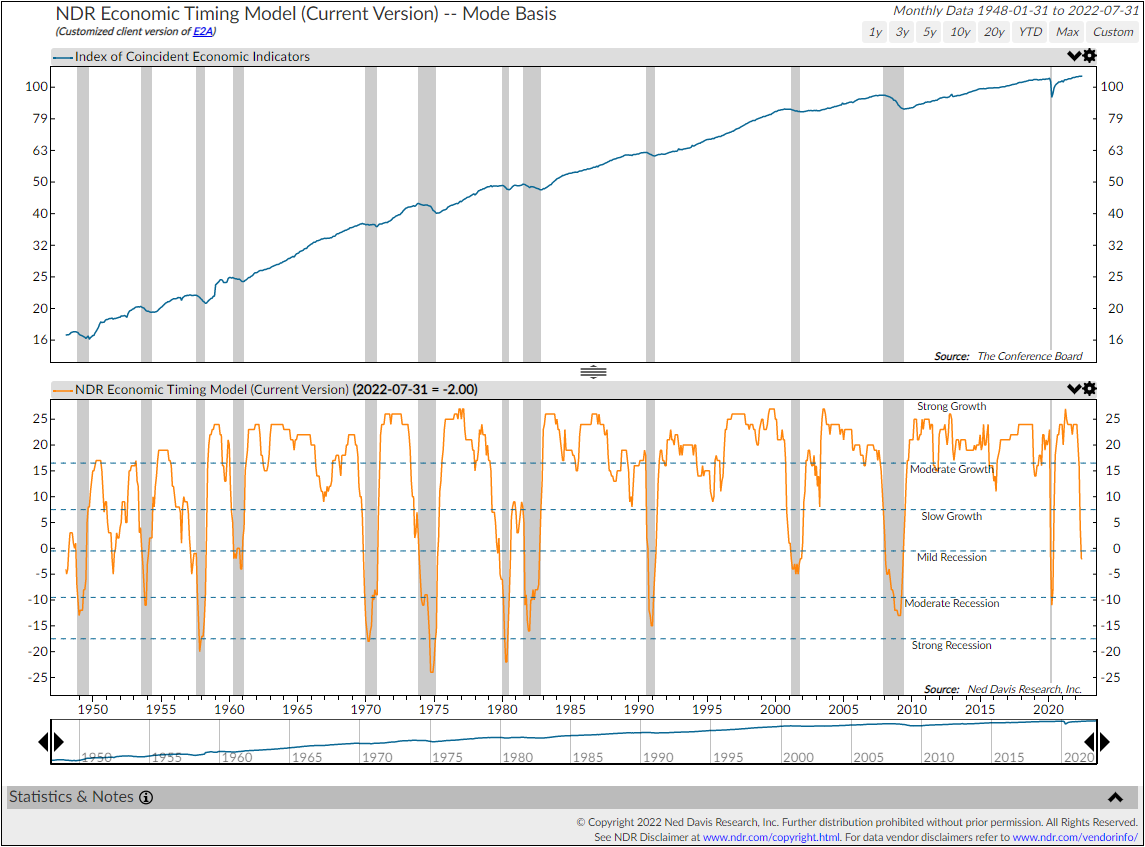

Two weeks ago we looked at the conflicting data inside our economic model. Our model remains "bearish" although the rate of deceleration has slowed over the past month. The market is obviously not pricing in any slowdown.

For what it's worth, Ned Davis's economic model is also calling for at least a mild recession.

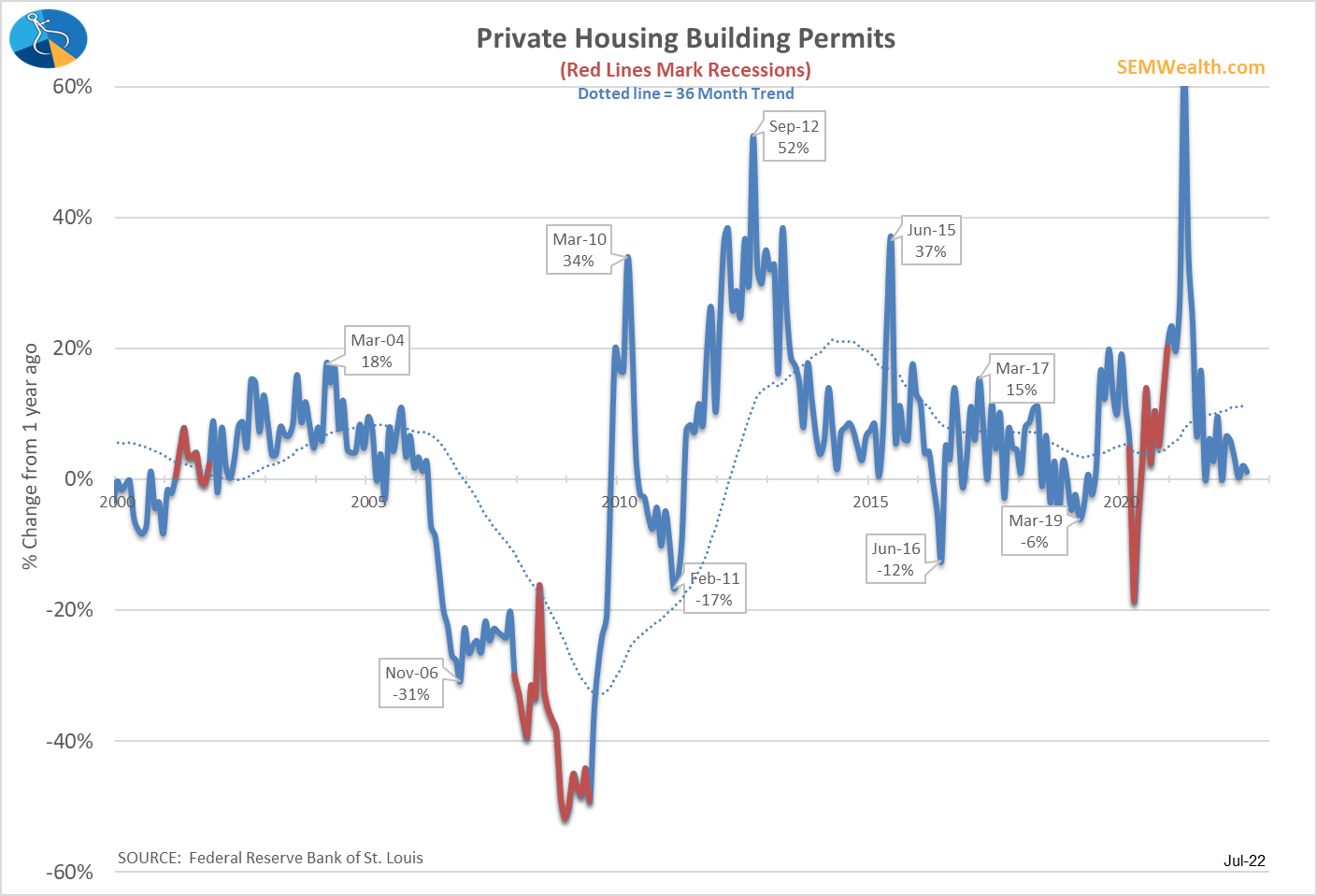

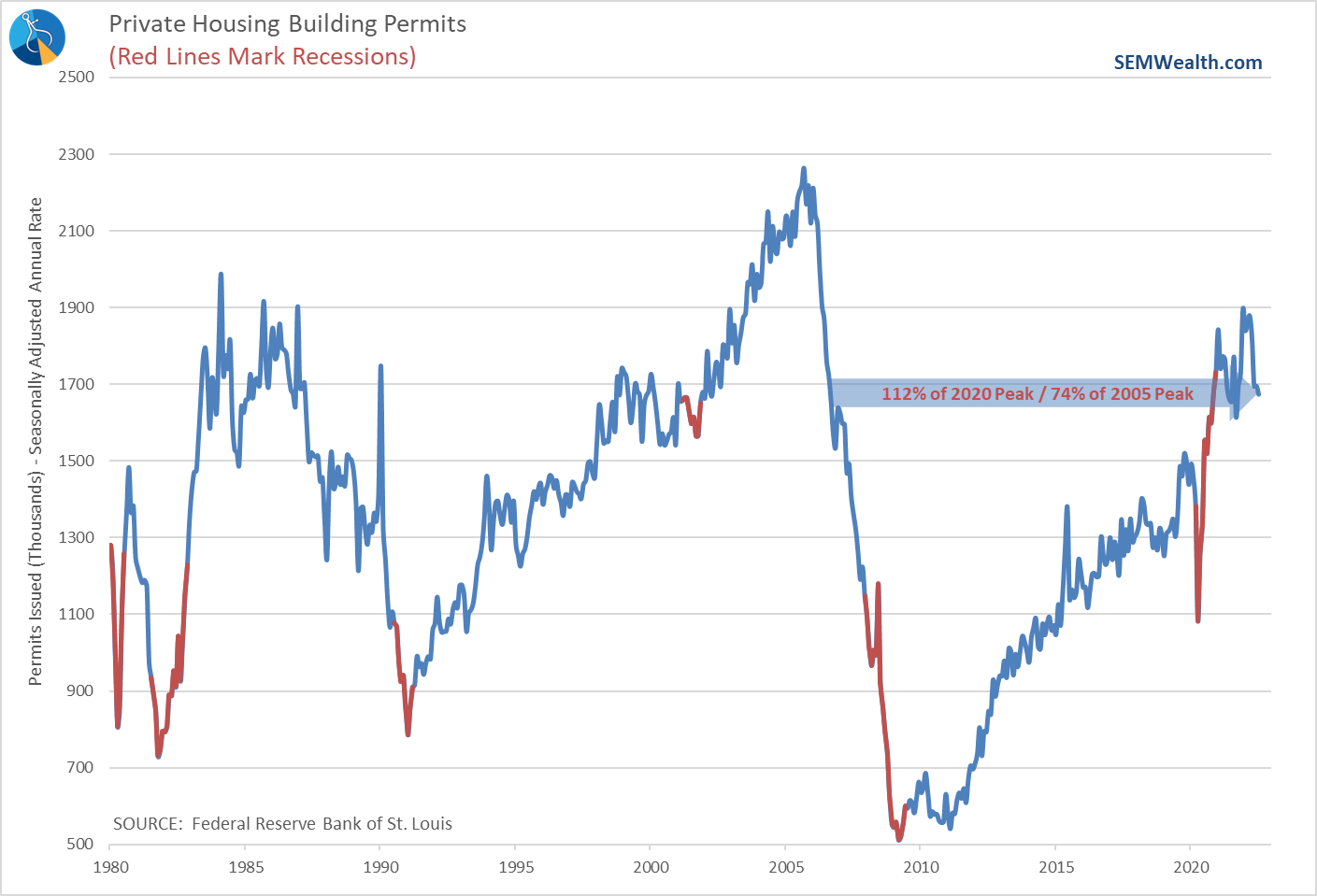

Last week, one of the most reliable predictors of recession – building permits, showed continued slowing in the housing market. The number of permits issued was nearly identical to a year ago.

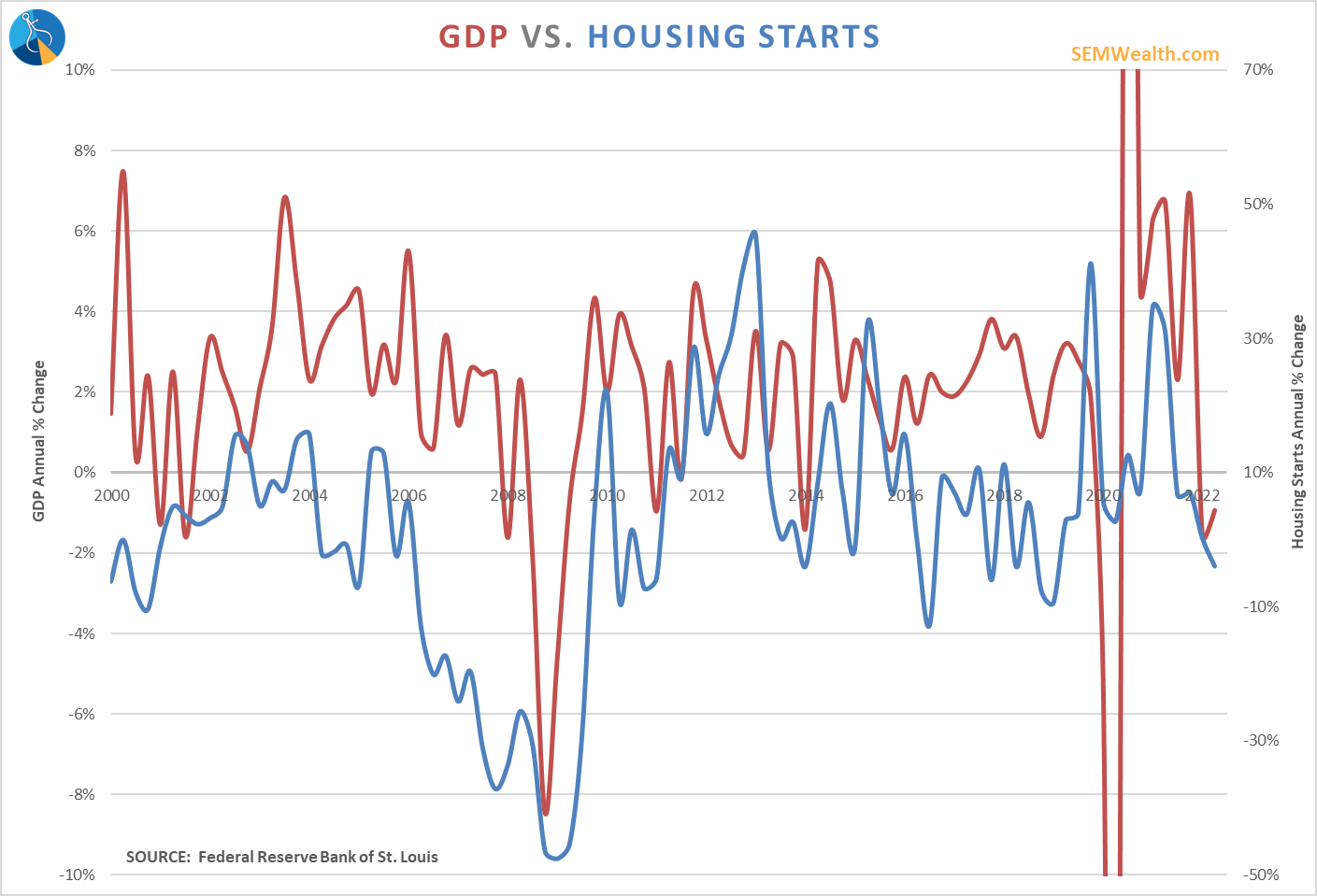

Building permits are a leading indicator to housing starts, which has a fairly strong predictive track record for economic growth. The reason this holds true is fairly simple – consider all of the economic activity that occurs both during construction and after the homeowner moves in. Not only do you see large amounts of money spent on labor, materials, furnishings, and other household goods, as communities develop you have ancillary businesses starting up, which again drives growth.

Other than the pandemic, when the government and Federal Reserve dumped 50% of GDP into the economy in 18 months, Housing Starts tend to lead GDP up and down. Based on housing starts, GDP could be moving quite lower.

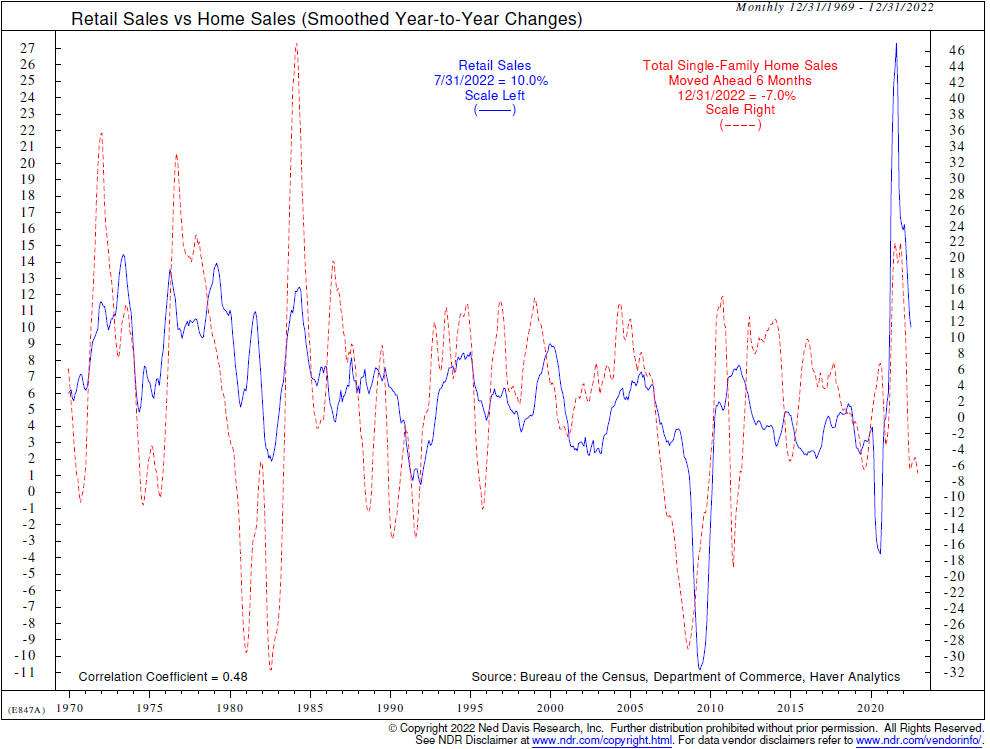

Ned Davis Research posted a chart last week showing the correlation between housing starts and retail sales. According to this, the "surprisingly strong" retail sales data from last week is likely going to be heading lower soon (which is also bad for the economy.)

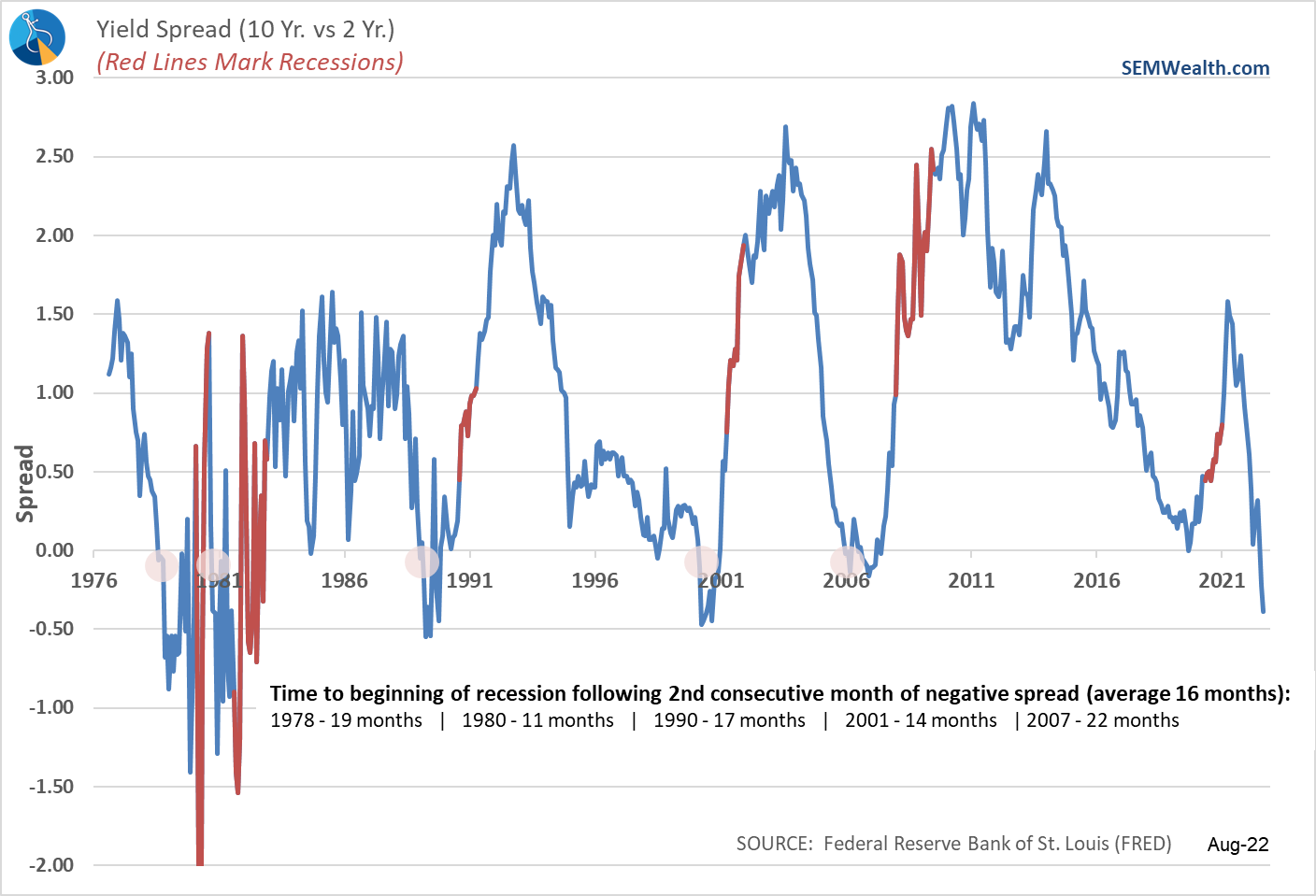

Another very reliable recession predictor is the yield curve, in this case the difference between 10-year and 2-year Treasuries. Normally, interest rates are higher the longer the duration. This is because both the repayment risk and the cost of inflation are higher the longer you wait to be paid back. When the bond market is concerned about the future, they begin charging more for shorter-term bonds. This drives the yields higher for shorter-term bonds because the risks are higher.

The bond market tends to look much further ahead than the stock market, so the lead time on this is long. Usually by the time the recession actually starts the bond market is pricing in the end of the recession. You also typically see the Fed lowering short-term rates to help move the yield curve back to "normal".

This chart from shows how noisy this signal can be, but every time the spread was negative for two consecutive months we saw a recession in the next 11 to 22 months. The average is 16 months.

Time will tell if we are in a recession in the next 11 to 22 months. My (educated) opinion continues to be we are facing a market and economy very similar to the 2000-2002 period. I've already gone long, so won't go into all the reasons, but we have to keep this in mind as a distinct possibility.

Remember, the recession during the 2000-2002 bear market was quite mild and short-lived. That didn't prevent a total loss of over 50% that included several big rallies followed by even bigger drops.

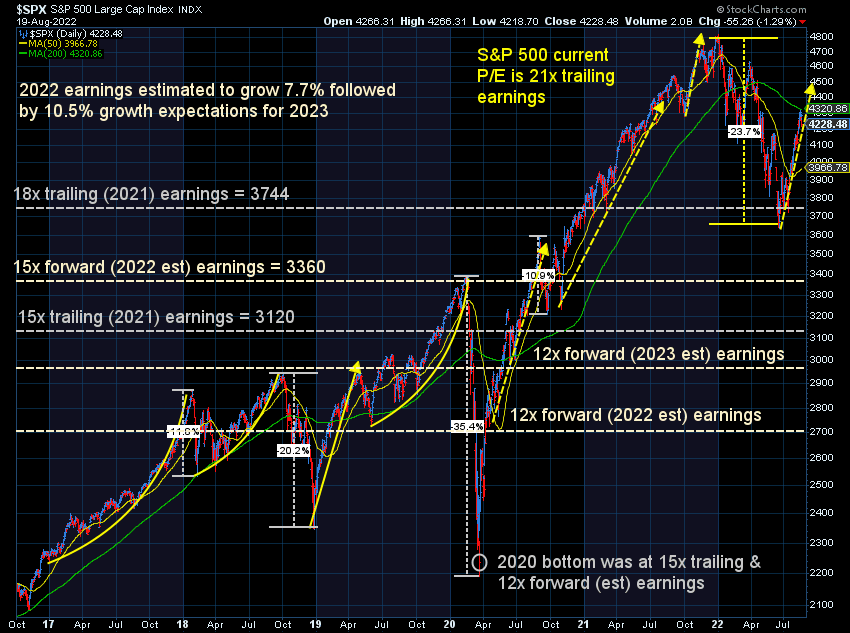

Turning to the stock and bond charts, the S&P 500 found itself bumping into "resistance" at 4300 after breaking through the 4170 level. We are likely to see more activity around both ends of that range. Volume has remained weak, so relatively small orders can drive prices up or down rather quickly.

Probably not coincidently, the market stopped going up right at the 200-day moving average, which is a level many technicians use to determine longer-term market direction. So long as the market is below the 200-day moving average, they believe we are still in a bear market and should act accordingly. Bull or bear, the vertical move higher suggests a need for a large (7-10% or bigger) correction in prices.

The bond market continues to be uncomfortable with the rally as long-term rates have moved higher since the Fed's last meeting.

Somebody is bluffing and it won't be pretty for stocks or those chasing the market higher if the Fed calls them on it.

Finally, last week I mentioned the launch of our TikTok & Instagram channels. The purpose is to provide another resource and a different way to educate. With the 'meme' stocks having a heavy run the last few weeks (before crashing on Friday), we posted this short take on TikTok last Thursday.

@finance_nerd Are you gambling or investing? #reddit #memestocks #bedbathandbeyond #gamestop #gamble #investingtips #financenews #financenerd ♬ News Show - AXS Music

If you're on either platform, you can follow us here (and look for a "Musings Minute video later Monday morning):