We're used to things being resolved in short order. I'd like to say that's a function of today's always-connected world where we can find pretty much anything we want on demand. A study of history and human behavior tells us its not the technology that makes us impatient, but instead our natural human biases. I often use the example from the Bible where the Israelites after being freed from 400 years of slavery took a little over a month before complaining about their current situation. Since the beginning of time humans have been incredibly impatient beings.

SEM was founded with this understanding. Our "behavioral" approach is designed to not only remove our own personal emotions as investment managers, but also to help our clients and advisors overcome whatever biases could impair their ability to make wise decisions. This approach becomes especially valuable during a bear market.

Back in June I put out a video and blog entry with tips to handle a bear market. I continue to point to this as the single best source of how to handle what lies ahead.

One thing I pointed out in the video is the fact a true bear market is not based on a set percentage loss, but rather encompasses both the magnitude of losses as well as the duration of those losses. Internally we have a measure called the "ulcer" index used when developing trading systems and determining the allocations to each system inside our various investment models. It was developed because a fast 20% drop followed by a full recovery doesn't generate the same emotions as a TRUE bear market.

When I say a TRUE bear market I'm talking about one that happens concurrently with an economic slowdown/recession. These take on average 18-24 months and see losses of 35-50%. During a TRUE bear market, our natural human biases take over and make us believe things will always be "bad", which causes us to often make poor decisions.

Since June I've continued to highlight the tough road ahead for those hoping the worst is over. I often say, "hope is not a strategy". Instead "hope for the best, plan for the worst," is a much better strategy, especially for those who are already relying on their investments for living expenses or those who will need to start relying on their investments in the next 10 years. Why 10 years? Because a TRUE bear market can often take 7-10 years just to get back to breakeven. If you take money out of your account during the bear market you risk never recovering your losses.

I'm not going to rehash all of the problems facing those HOPING for a fast recovery. Last week I listed 5 bullet points to consider:

- Inflation will continue to be a problem well into next spring.

- The Fed has said fighting inflation is their primary focus.

- The Fed has BARELY begun fighting inflation.

- Earnings are going to be much lower than expected this year (and possibly next).

- Stocks are over valued.

The post also included charts illustrating how many huge rallies we saw during the last two TRUE bear markets before the ultimate bottom was in. It also included links to the articles diving into inflation, the Fed's current strategies, the economic environment, and the valuation of stocks.

The most important thing to understand is bear markets are a process, not an event. We will see many times where it appears the worst is over, which will be followed by more bad news/reality, which leads to fresh new lows. We won't know until the benefit of hindsight when the bear market actually ended. What we do know is past bear markets have ended when most people despised the idea of owning stocks. Opportunities are created during bear markets and our data-driven, quantitative trading systems are designed to take advantage of them.

Right now they are as close to defensive as possible. They will continue to seek ways to take advantage of these opportunities. They will not always be right, but they have been the reason SEM has been able to provide a smooth road to lifelong investing for over 30 years. We hope for the best and plan for the worst. We trust the process. We don't let our emotions determine our decisions.

Excess being removed

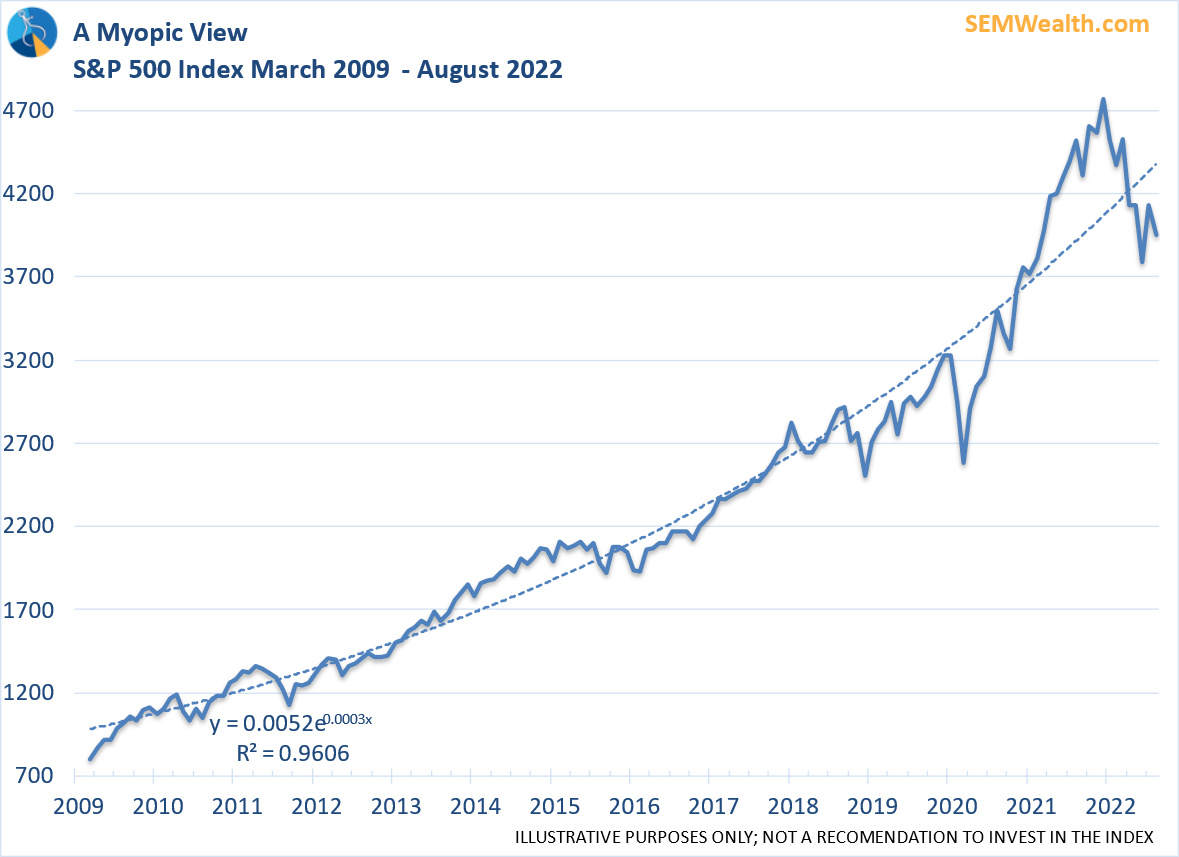

One reason this bear market could be much more painful is most investors either don't remember or have never experienced a TRUE bear market. I show this chart in pretty much every presentation. It shows the S&P 500 since the bottom of the market in 2009. At the time the market bottomed, most people forget that investor sentiment and advisors allocations to stocks were at all-time lows. In other words, pretty much everybody HATED the idea of owning stocks.

Since that time, every dip (with the benefit of hindsight) has been a buying opportunity. I have warned, buying the dip works until it doesn't.

From March 2009 through the beginning of 2022, the annualized return was 15.6%, which was nearly the same as the returns during the tech bubble. If anybody thought this was "normal" they were delusional.

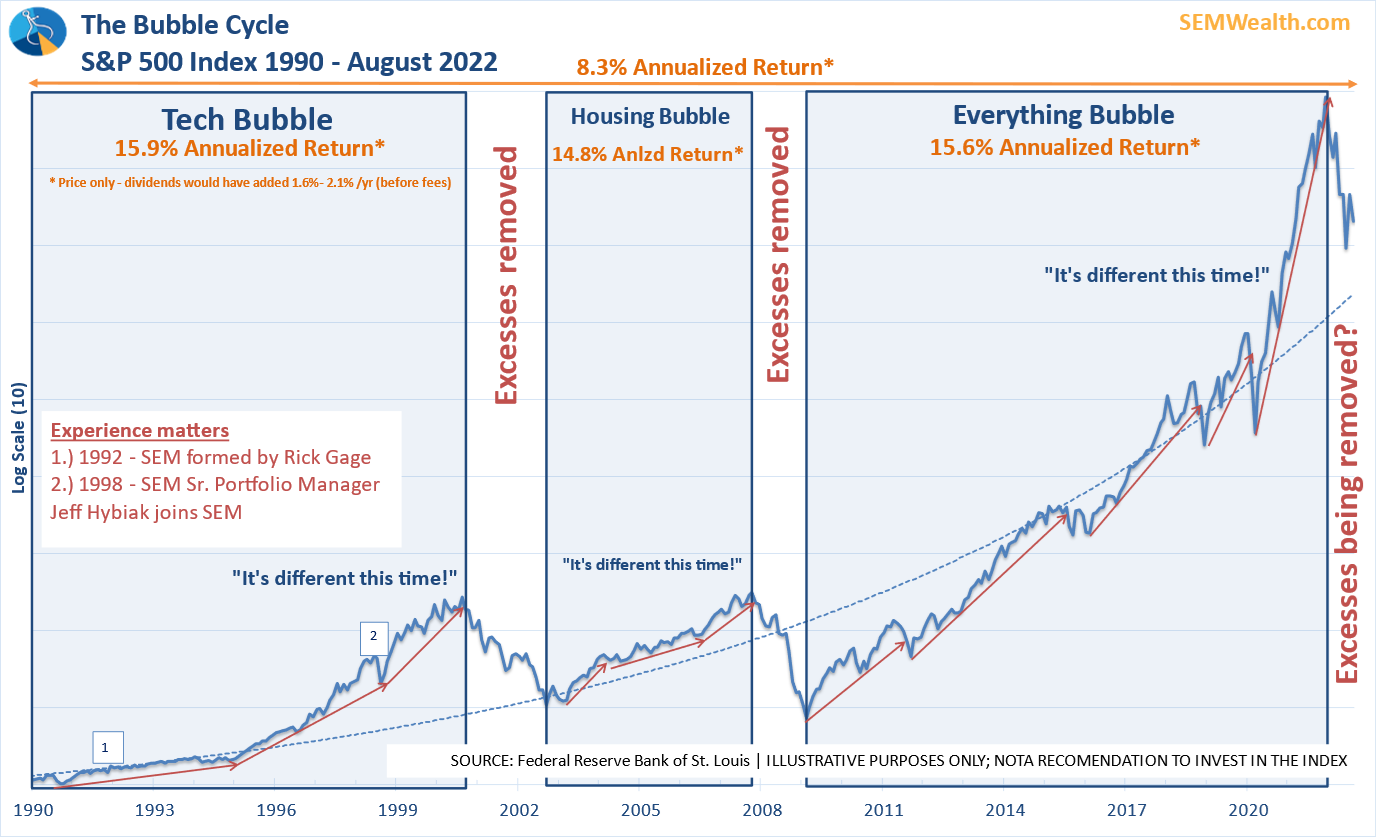

Going back to the 1920s, 1950s, 1970s, 1980s, and even to 1990 (when the tech 'revolution' began), the annualized returns for stocks has been 8-10%. Anytime we enjoyed a prolonged period of time with returns well above this average, the excesses were removed in a very painful fashion.

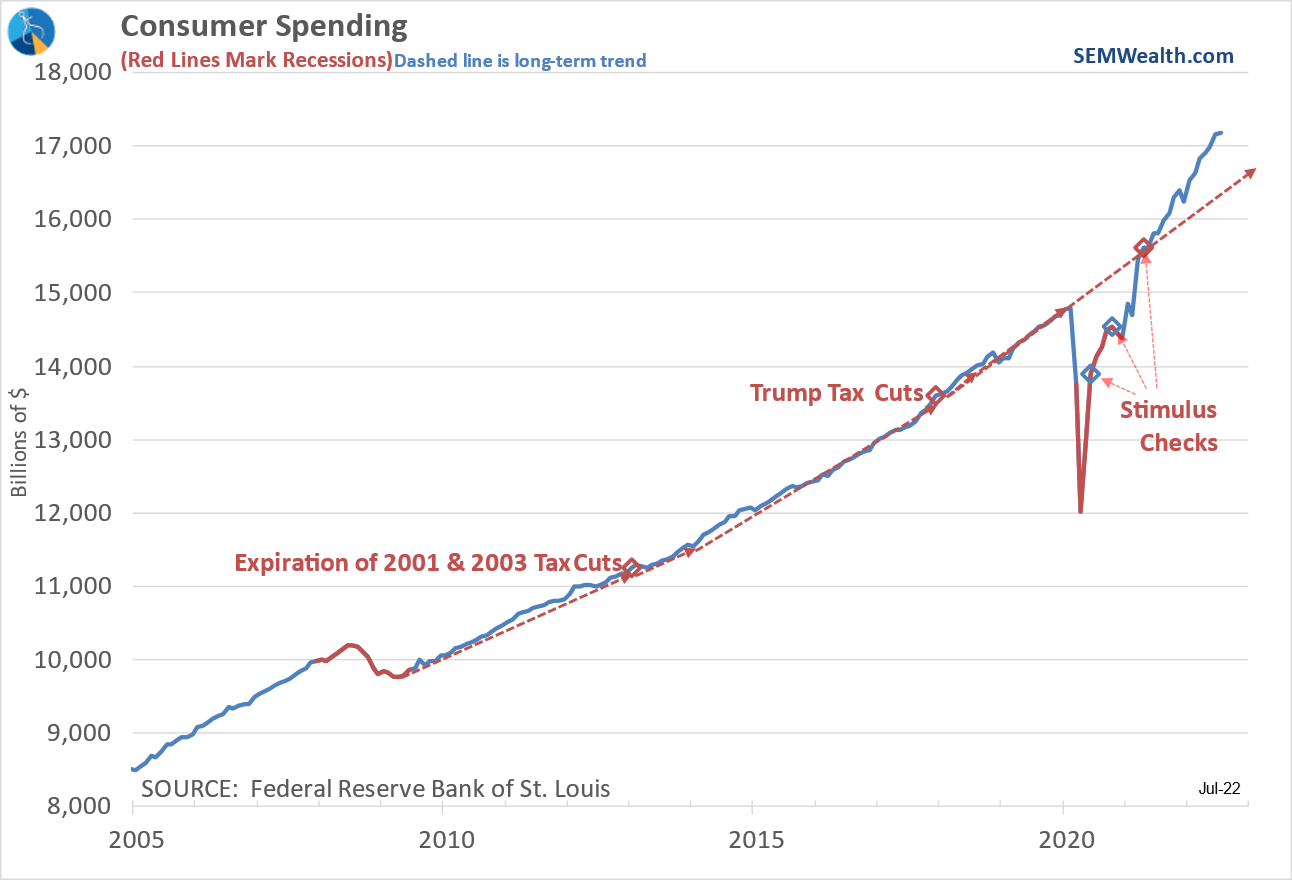

The Fed inflated this bubble in the 2012-2017 period when they made everyone believe they would be there at anytime to save stocks (nicknamed the "Fed put"). They then made it worse by continuing to stimulate the economy even after the third round of stimulus hit in 2021. I'm no PhD, but this chart of consumer spending tells me both the third round of stimulus wasn't necessary and the Fed failing to act in 2022 will go down as one of the biggest economic mistakes in history.

Consumer spending had returned to it's pre-COVID trends just before the last round of stimulus checks hit. That was supposed to be the goal, yet the Fed kept their foot on the gas pedal and now acts shocked that we have so much inflation.

There is no easy way to get out of this mess. The Fed created a bubble and the Fed must burst that bubble to get inflation under control. Please tread carefully.

Market Chart Update

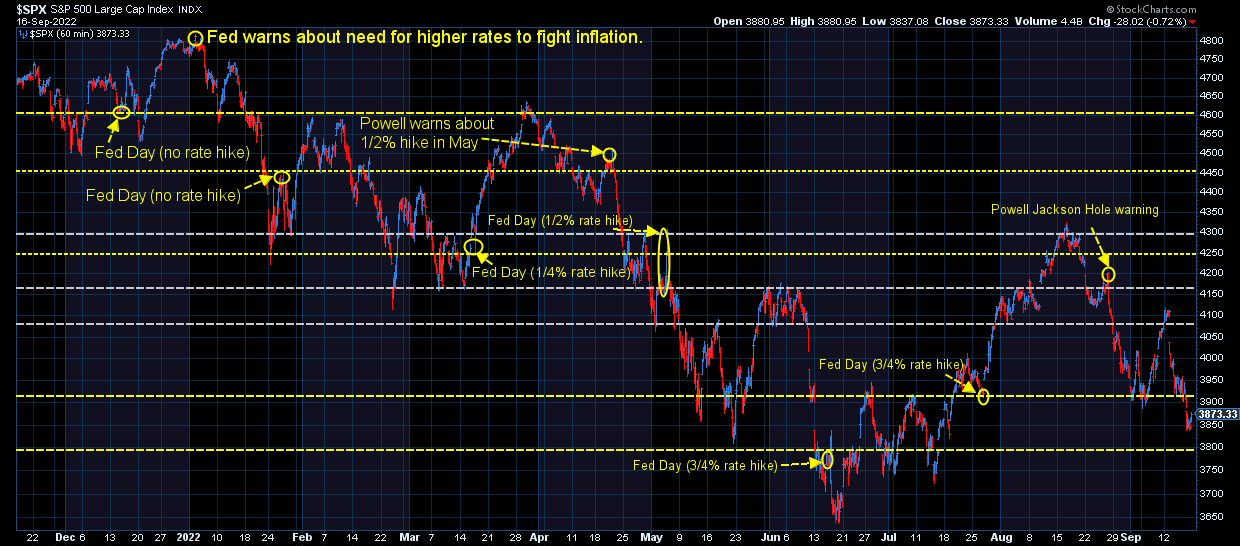

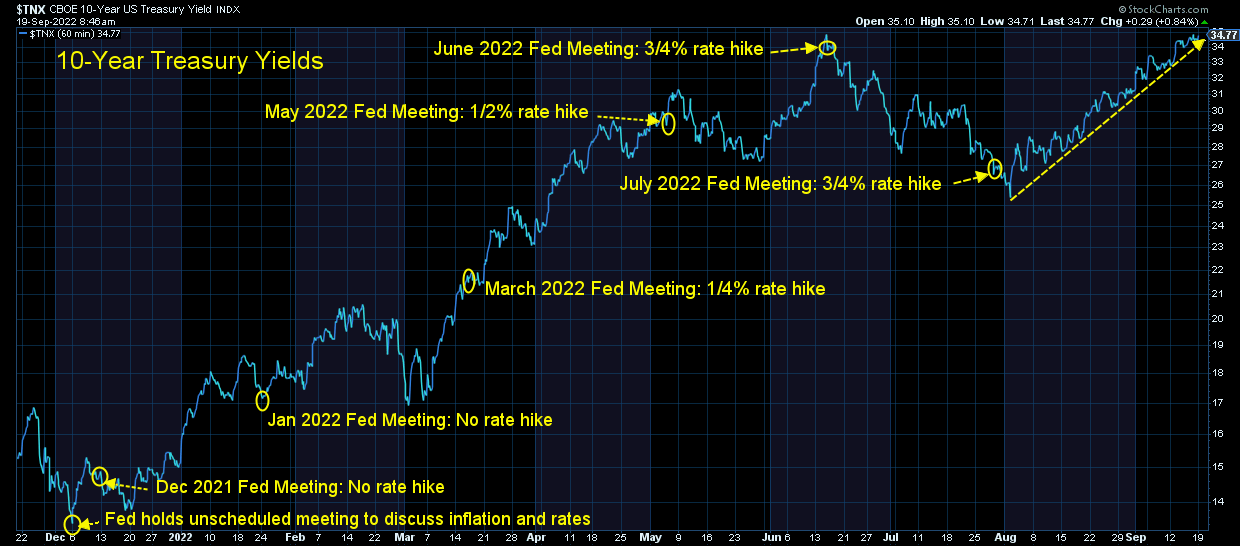

This continues to be my favorite chart to help keep things in perspective. It marks every piece of Fed news since the end of last year.

I also noticed a pattern a few weeks ago which showed a similar move up from mid-March to early-April as we enjoyed from mid-July to early August. The orange boxes are identical sizes.

If this plays, out we could see a much larger decline ahead.

Here's a reminder of how our diversified approach which utilizes multiple investment management styles has benefited our clients over the past year.

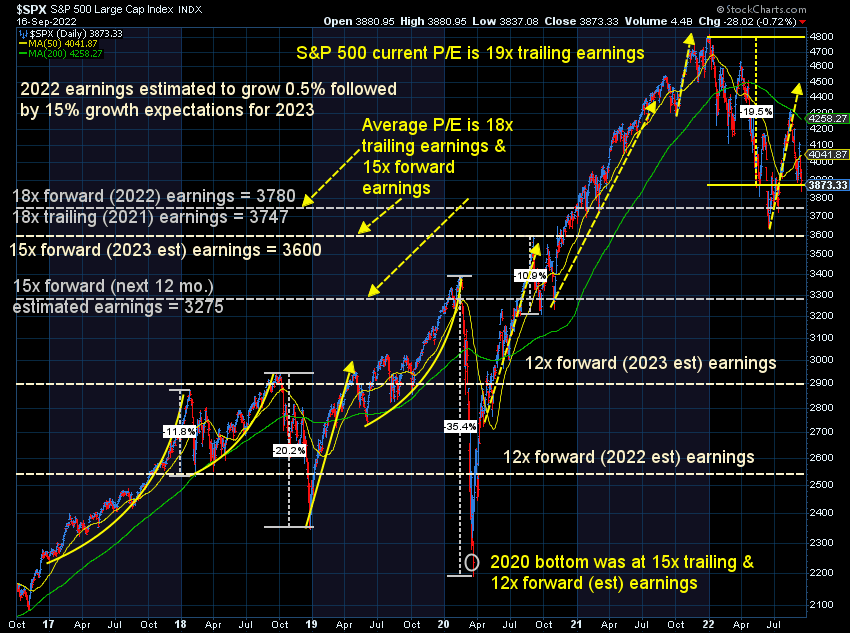

This chart I think illustrates the biggest problem for those arguing stocks are undervalued. IF we believe earnings estimates are correct, we are 7-16% above far value (based on historic averages). The problem is, while earnings estimates have dropped from a 10% growth expectation to start the year down to flat for 2022. However, the market still expects earnings to jump by 15% in 2023. This morning Goldman Sachs reduced their 2023 GDP growth estimate down to 1.1%. I'm not sure how corporations can grow earnings by 15% if the economy only grows 1%.

I continue to say I won't be excited about stocks until we get down to the 3000 level for the S&P. That would put us somewhere around 12x forward earnings, which is when we've seen the best bear market bottoms historically. That's 22% lower from here and would put the total bear market loss at 37%. If that happens by next spring that would be in the range of what we should expect during a TRUE bear market.

Turning to bonds, we can see how little faith bond investors have in the Fed's ability to control inflation. It appeared the Fed was finally getting serious in June when they hiked rates by 0.75%, but following the July meeting their language and actions have convinced bond market participants inflation could be running hotter and longer than any of us would like.

This is not only bad for bonds, but terrible for stocks.

Again, please tread carefully. A bear market is a process, not an event. We've never experienced stimulus the size we witnessed in 2020 and 2021, which means we've never had to get out of the inflation and financial disconnects this created.

Short-term, remember markets don't go straight down or straight up. With such a big drop last week, the market is due for a bounce, but I have a hard time seeing any fundamental improvements which offset the things driving the market lower – inflation will remain too high (even if the level drops), the Fed needs to tighten far longer and harder than the economy can stand, the economy is on the verge of recession, and stocks are still overvalued.

What'd you miss on Social Media

We realize many people have a shorter attention span or simply want some quick takes on a wide array of topics, which is why we've started posting more content to Instagram and TikTok. Here's one example:

@finance_nerd Why does anyone trust Wall Street #fedex #fdx #earnings #economy #investing #financialliteracy ♬ Breaking News - Breaking News

Make sure you are following our channels for the latest quick takes.