9/13/22 - Check out the short video update at the bottom of the page.

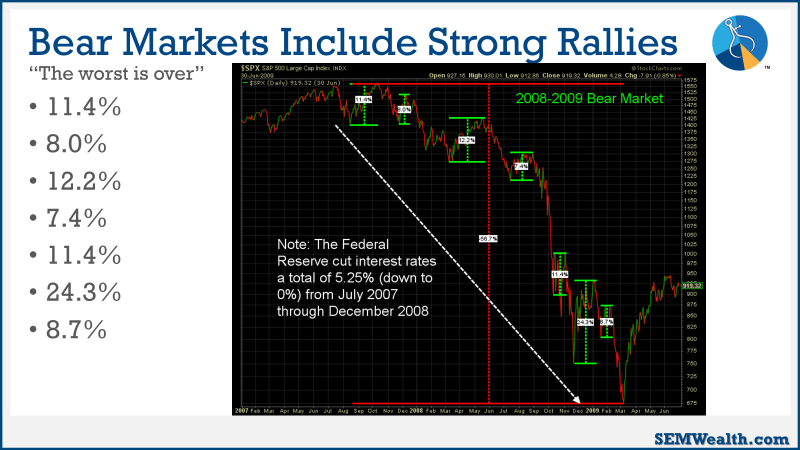

The biggest rallies almost always occur inside a bear market. It's human nature. After large drops our brains instantly begin to think things will only get worse. Losses generate twice the emotional response as gains. When we are feeling excessive amounts of pain, the slightest positive change can look like the end of the bear market, which causes "FOMO" (Fear of Missing Out) to kick in. This can lead to significant rallies without any true underlying support.

I warned about all of this in June when I issued our "Bear Market Tips". I specifically said we need to look at past bear markets as a reminder we will see very strong rallies.

Each rally was accompanied by the belief the "worst was over". Just as I said during the rally from mid-July to mid-August, we must understand nothing has fundamentally changed for the better.

- Inflation will continue to be a problem well into next spring.

- The Fed has said fighting inflation is their primary focus.

- The Fed has BARELY begun fighting inflation.

- Earnings are going to be much lower than expected this year (and possibly next).

- Stocks are over valued.

Just because the market goes up we should not believe the worst is over. We've gone over this exhaustively the last four weeks. Check out our last four entries for the data behind the above statements.

Data is key, which is why we exclusively follow a quantitative approach when making our investment decisions. It removes emotions and prevents us from being sucked into the euphoria (and eventual despair) of a bear market.

There was literally nothing substantial that changed last week other than more people bought stocks than sold, which caused a huge rally. I won't waste any of our time looking at the minutia. The data says we are in a bear market and we will act accordingly.

Market Charts

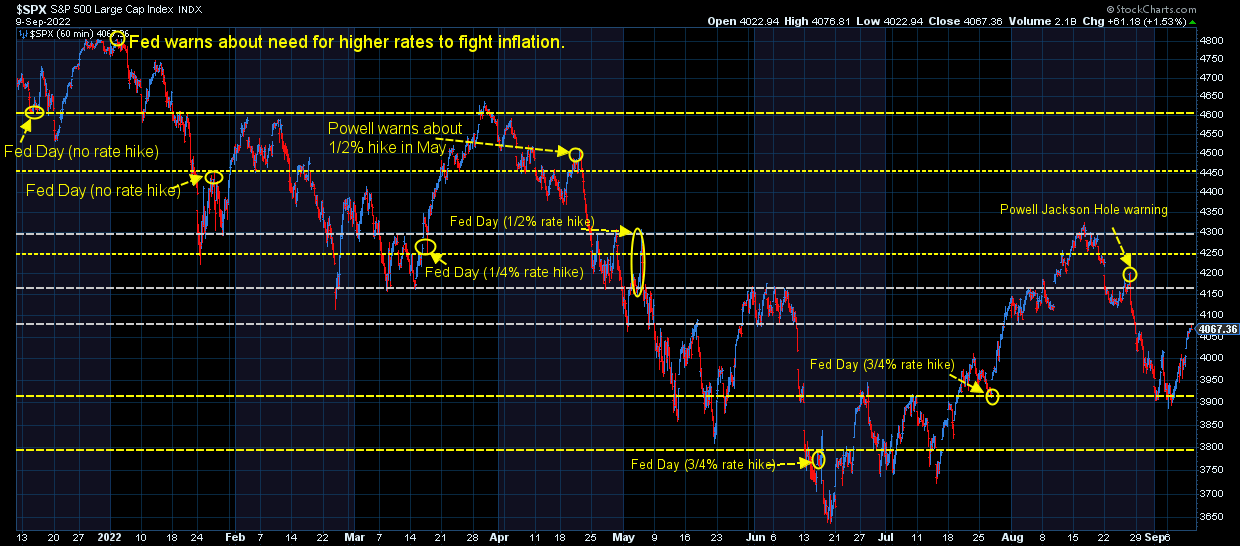

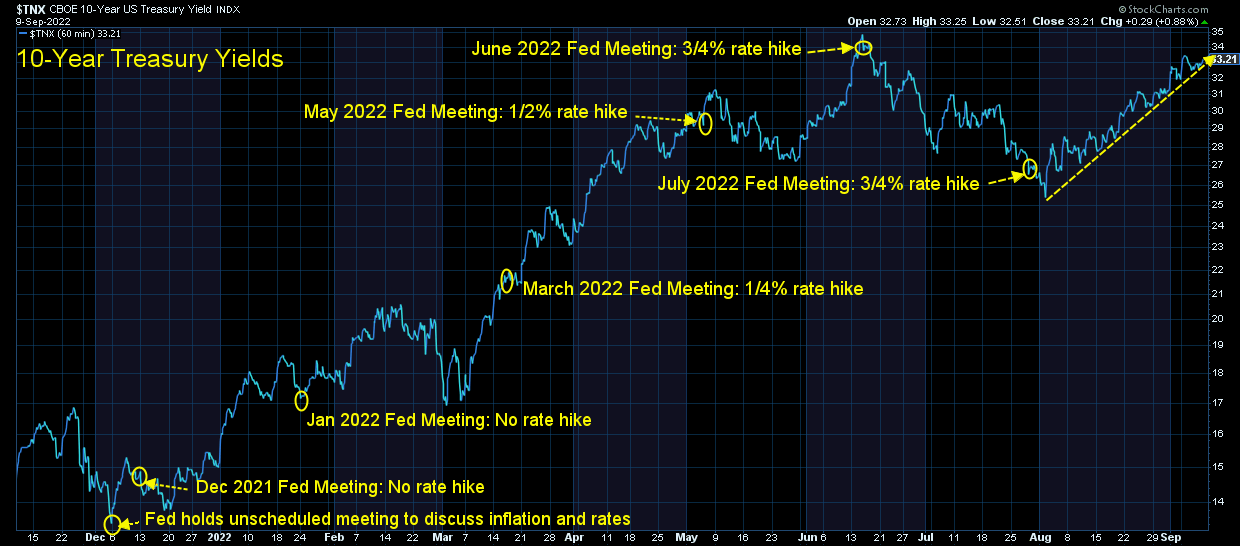

This chart tells the story of the year. The Fed was too late to hike rates and the market has continued to be disappointed by the on-going rate hikes.

Last week I zoomed into the March-April rally and overlaid an identically sized box on the current market movement. So far the greed, fear, greed cycle is playing out. If this continues, we should expect another leg down soon.

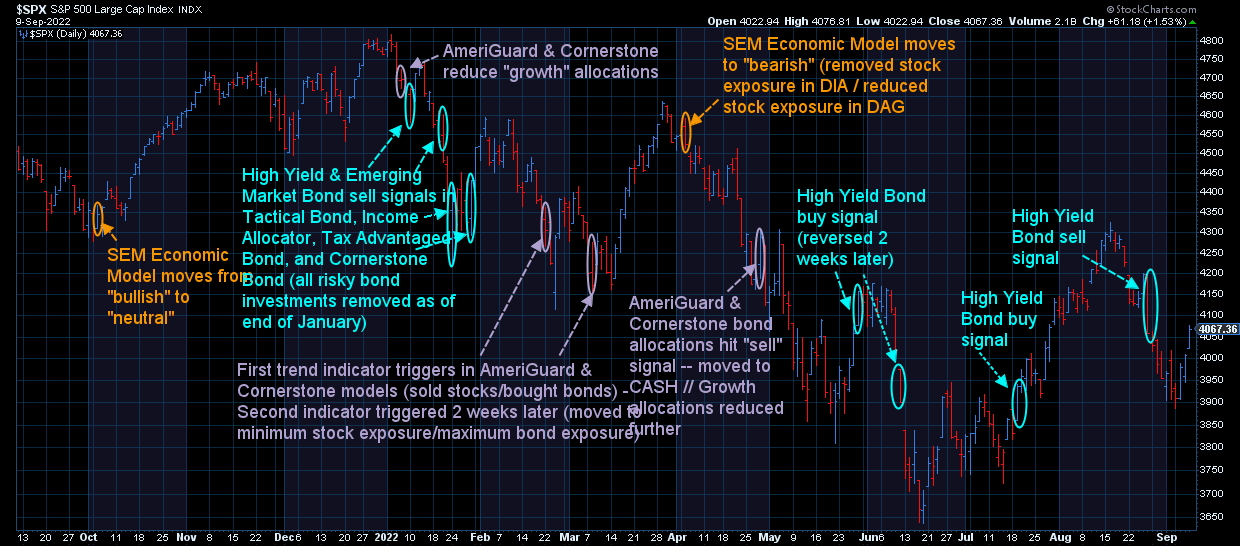

This chart looks at the moves of SEM's various trading systems inside our models. Remember, bear markets are a process, not an event. Our diversified approach is designed to not pull everything out at once (or pour everything back in). This allows a much smoother ride for our clients (and their advisors).

Again, the DATA says we are still in a bear market and our models are positioned accordingly.

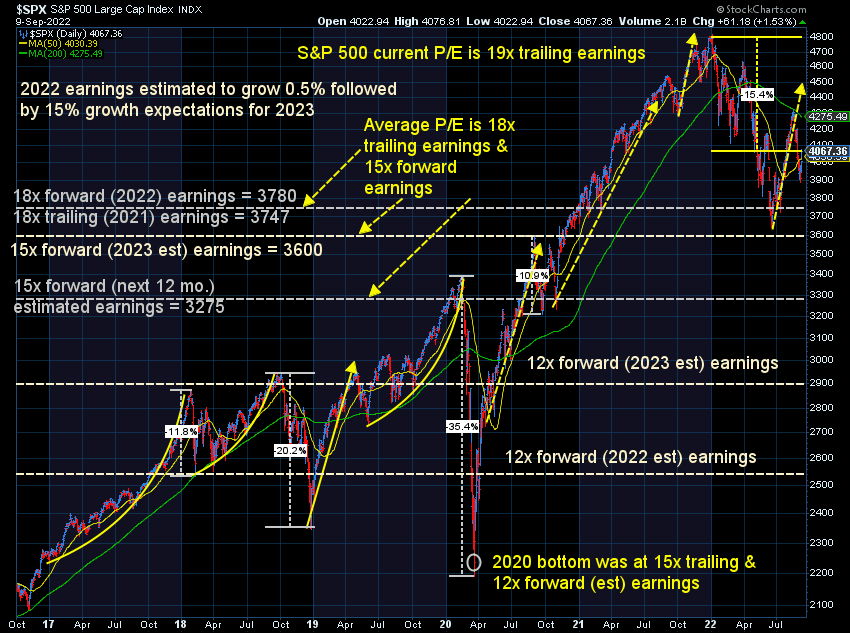

Stocks continue to be overvalued and pricing in no recession. If I were subjectively deciding when to jump back into the market I wouldn't begin to get excited until we saw the market drop to BELOW average valuations. As you can see on the chart below, we are well above levels most reasonable people would consider attractive.

The biggest issue for stocks is the bond market. Long-term yields (set by the free market, not the Fed) continue to march higher because the bond market believes the Fed has lost control of inflation. This move on the long end and supported by the Fed on the short end means higher costs for any business or consumer borrowing money. This means lower economic growth and thus lower earnings, yet the stock market believes earnings will grow by 15% in 2023.

Please be careful out there.

If the Fed told the truth

Trying to keep up with the times, we've been creating some short-form videos to continue our mission of providing common sense financial literacy. This week after watching Jerome Powell give a speech I thought, "what if he actually told the truth".

Here's how I think it would go. This may have to become an on-going series.....

@finance_nerd #federalreserve #inflation2022 #interestratesrising #interestrates2022 #pressconference #stopinflation #americanpeople #goingforward #neverhappened ♬ Crowd of People Talking Ambience (Mingling Chatter Chatting) [Background Ambient Noise Sound Effect] - Finnolia Sound Effects

If you have a shorter attention span or simply want some quick takes on a wide array of topics, make sure you are following our channels.

You can follow us here: Instagram | TikTok

Why did stops drop on Tuesday?

We're finding these short-form videos easier to get out there than a blog post. Check out our quick market recap following Tuesday's sell-off.

@finance_nerd Why did stocks drop on 9/13/22? #stockmarket #bearmarket #bearmarket2022 #investing #inflation2022 #greenscreen #Inverted ♬ Breaking News - Breaking News