Hopefully everyone had a safe and enjoyable Thanksgiving week. The stock market continued its latest bear market rally albeit on very light trading activity. The markets move in cycles and as we said for the last few weeks, it is important to understand this. Markets do not go straight down nor do they go straight up. The underlying trend is what matters and until the DATA says otherwise we remain in a bear market.

I won't spend a lot of time today rehashing why we believe this is nothing more than a bear market rally. For a recap check out these more detailed posts.

We will receive a lot of economic data this week so make sure you check back next week for a full breakdown. We also have pretty much every Fed member giving speeches, so expect a lot of reading between the lines. It is important to not get sucked into the hype of this strong rally. The market usually is up in the 4th quarter and we've already had a huge jump in stock prices.

We will continue to focus on the DATA. One of our trend indicators turned bullish at the end of October, moving half of our cash position back into stocks inside AmeriGuard and Cornerstone. Two weeks ago, we also saw our first high yield signal turn back to a "buy". The spread between high yields and Treasury bonds is not very attractive nor is the underlying yield. We fully expect this to be a short-term signal, but will take any gains we can get this year.

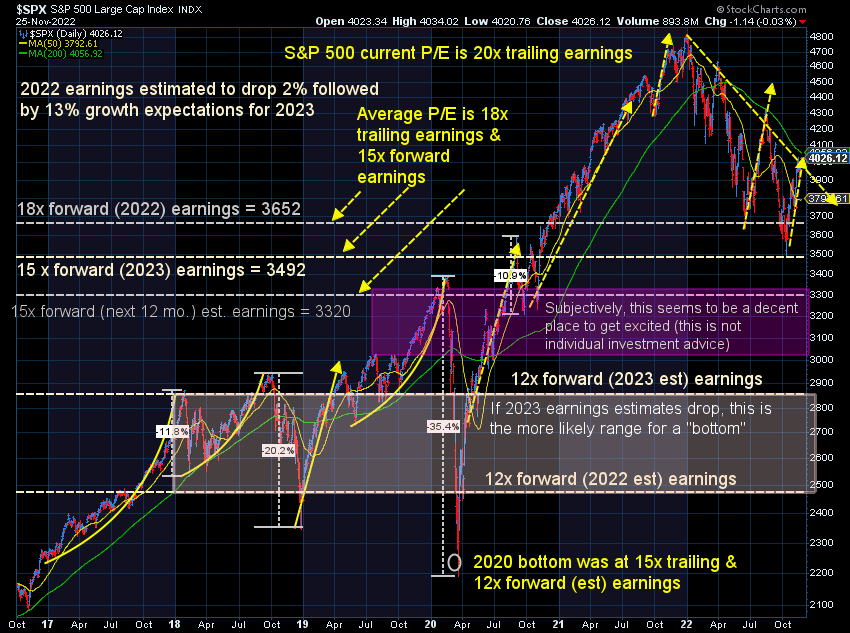

Remember, even if the Fed stopped cutting interest rates today, we'd still likely see the economy go into a recession. This means earnings estimates for next year are way too high, especially given the P/E ratio we are trading at. Investors are optimists at heart and are clearly optimistic we will not go into a recession. Of course, they were just as optimistic when the year started.

Turning to the charts, the S&P 500 needs to clear the 4025ish range to put the next target – 4105ish in play. From there we could see a push to 4160ish. I'd be surprised if we get much more than that, but we will see.

From a bigger picture perspective, stocks remain in a downtrend and EXTREMELY overvalued at 20x earnings. This is the same valuation levels as we started the year. The difference is earnings have dropped significantly from the beginning of the year estimates. Again, if you want a good entry point to stocks, you need to wait until stocks are BELOW average valuation levels, which is much lower from here. Right now you are buying high and hoping to sell higher.

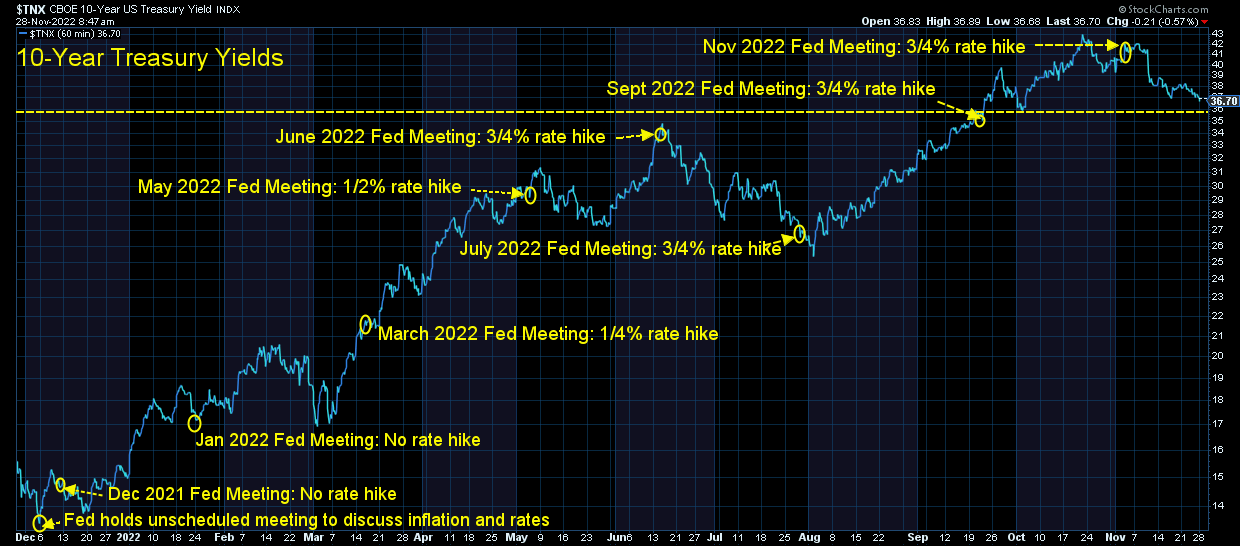

Looking at bond yields, the shorter-term trend remains down, with a target of at least 3.57% on the 10-year.

Remember, bond yields skyrocketed because the bond market feared the Fed had no control over inflation. As the economy cools, we could see yields continue to fall. A recession is the best antidote if you're hoping to cure inflation. However, if the market continues to heat up due to the Fed seemingly slowing down their inflation fight, we could see yields spike once again.

The most important thing to do right now is to stay focused on your plan. If you had too much risk in your account, this seems like a great time to de-risk. If for whatever reason you jumped out of the market sometime this year, now does not seem like a good time to get back in. We should see lower prices again to put cash to work.