Fear and greed are both strong emotions which cause us to often make irrational decisions. During bull markets FOMO "fear of missing out" leads to seemingly unstoppable rallies despite little fundamental logic for the rally. Sure, we convince ourselves there is a good reason for a specific stock or the entire market to continue to move higher, but we are lying to ourselves.

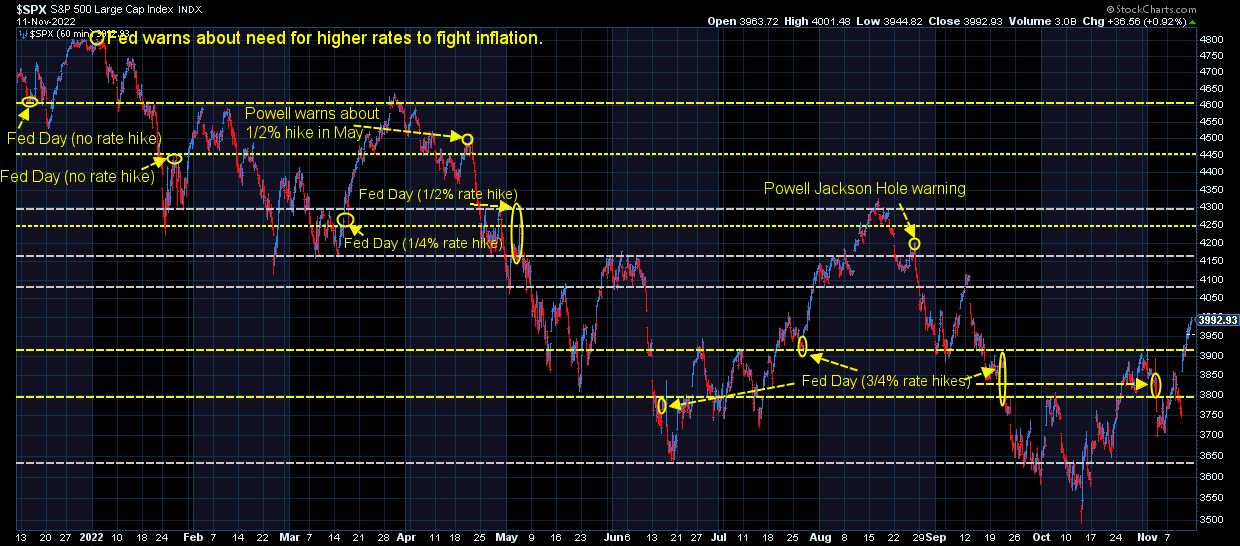

When reality inevitably sets in and prices start to fall, the momentum to the downside accelerates. Legitimate fear sets in when our expectations for continued gains is squashed with the normal economic cycle. All along the way we see investors trying to find the "bottom". They believe the market is going to come roaring back and want to buy in before the train gets started. This quest for catching the bottom leads to huge rallies inside the bear market.

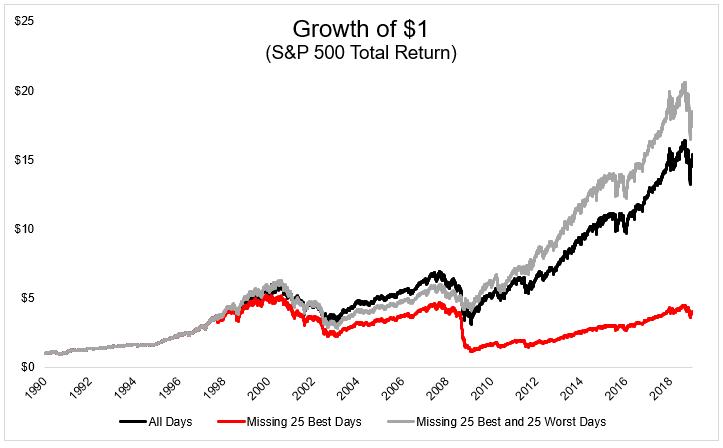

I'm sure you have heard the warning about what happens if you miss the 10 "best" days in the stock market and how bad your returns would be. What they don't tell you is 47 of the top 50 days in the market the past 25 years have occurred when the S&P 500 was BELOW the 200-day moving average. The 200-day moving average is a decent indicator of bull and bear markets as it encompasses nearly a year of data. If the market is below that average, it's been a bad 9 or 10 months for stocks.

As a side note, you are actually much better off if you somehow miss the 25 'best' days AND the 25 'worst days'. It turns out the worst days AND the best days almost always occur in a bear market.

The reason for this is simple – everyone is searching for the bottom during a bear market and one piece of seemingly positive news can drive a flood of money into the markets. That excitement is typically squashed as the reality of the economic cycle sets in.

This is exactly what the DATA is telling us about last week's rally. It is most likely another sucker's rally. We've seen this story 4 times already this year. Each began with the hope the Fed was nearly done raising rates. Each ended with either higher than expected inflation or the Fed reminding us they are more worried about inflation than hurting the economy.

Here's the quick note I sent out to our team Friday morning to share with advisors:

Yes this rally is exciting and we are happy to see the nice pop in our performance, but we need to consider:

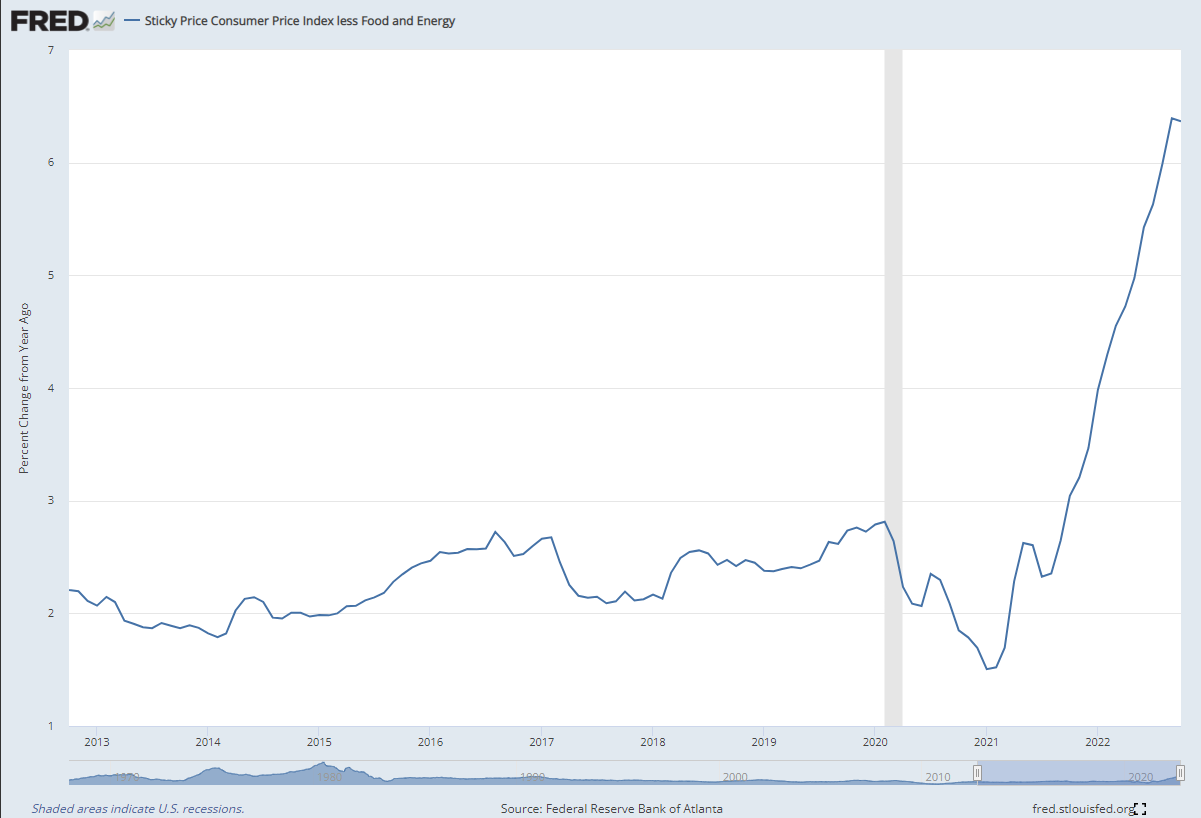

-Inflation is still high – how does 0.2% below expectations change “fair value” of the stock market by this much? Yes, inflation is probably coming down, but how fast and with how much more damage? Excluding food & energy inflation is still quite high.

-The Fed is very likely to raise by 50bp in December – The second leg of the rally on Thursday was due to "dovish" comments from two Fed members. The two Fed members saying the Fed would “slow down” are a.) not saying anything new (Powell said the same thing at his press conference), b.) are non-voting members of the Fed, and c.) are two of the more liberal members (they always believe we need more “stimulus.”

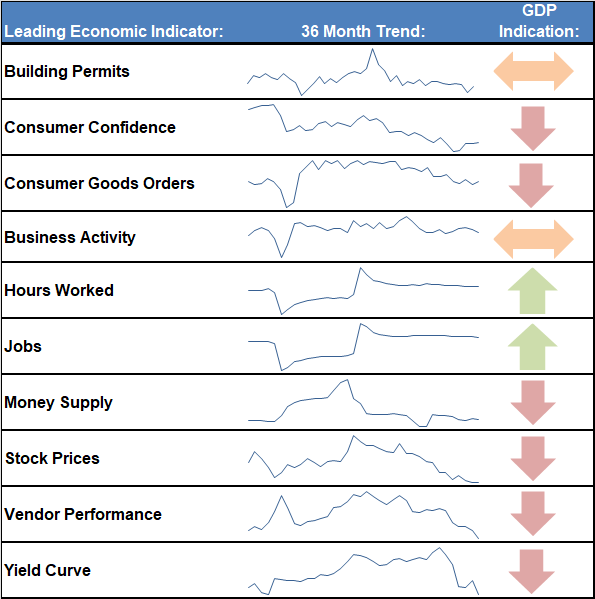

-The economy is still likely to head into a recession (based on our model). The data continues to weaken. Even if the Fed stopped raising rates today (which they won't) the path to recession seems to be in place. Even if the Fed CUT rates today (which they obviously won't do) the path to recession seems to be in place. For a full look at our economic model and the latest data, check out last week's blog:

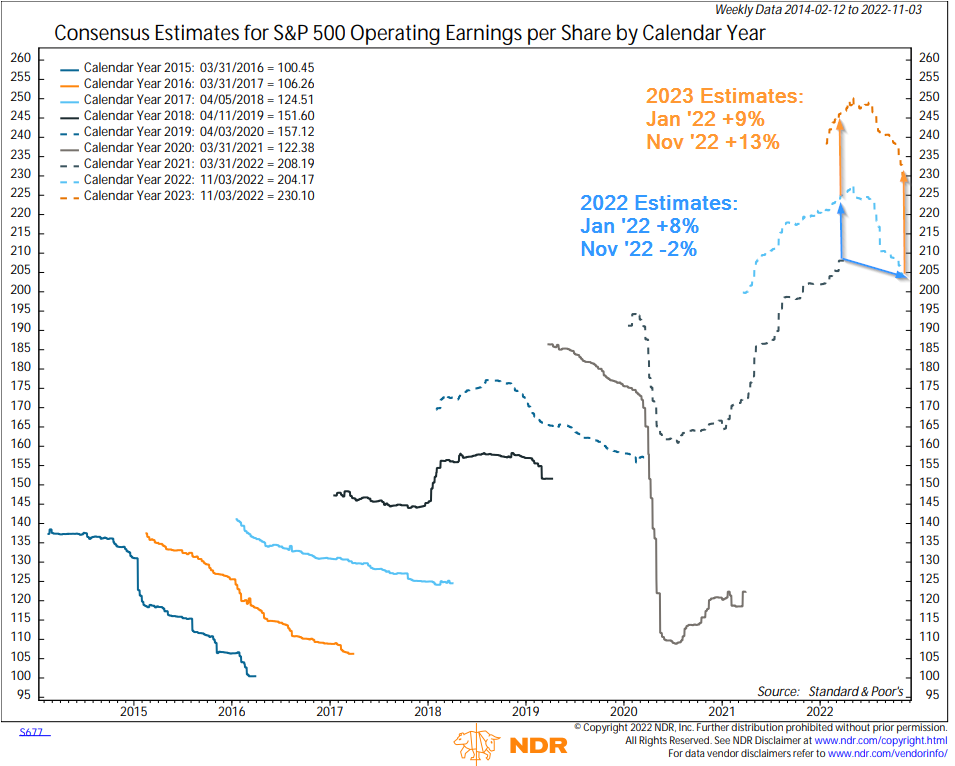

-Earnings are likely to be negative in 2022 and more importantly not grow at the currently expected 13% in 2023. Recessions always bring DECLINES in corporate earnings. This is absolutely not priced into the market. This is one of my favorite charts as it shows the trend in earnings estimates. Most of the time Wall Street has it completely wrong. What absolutely blows me away is the unwavering expectation that 2023 is going to be a great year for corporate earnings.

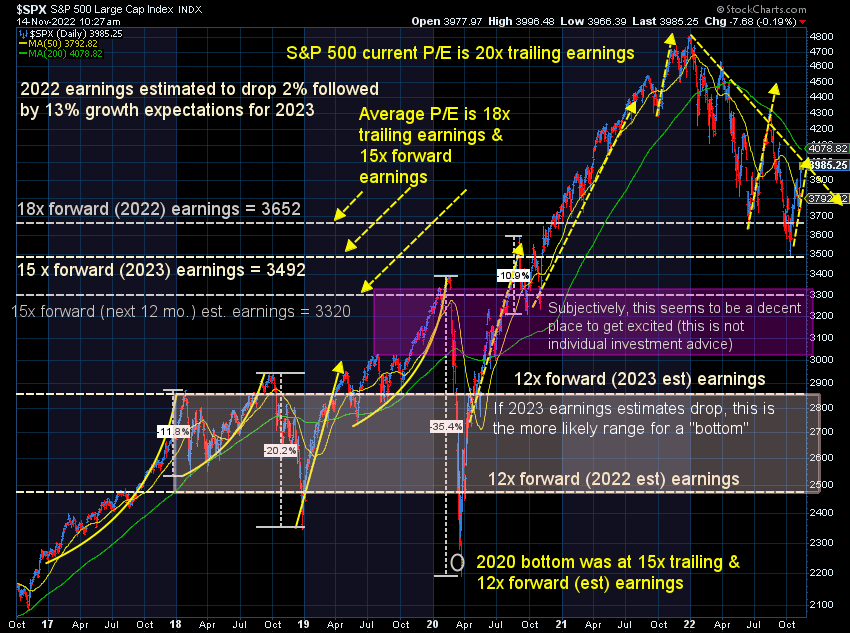

-Stocks are still overvalued. The median P/E the last 30 years is 18 (this is with interest rates trending down). We were at 18 to start the week. The P/E is now up to 20 (we started the year at 21 – the difference is earnings expectations for 2022 were $224 to start the year and now are down to $204.

If you trust the Wall Street estimates (which I think will be much lower in reality), you cannot argue stocks are attractive from a valuation standpoint. Maybe around 3500-3600 you could make that case, but certainly not now. Based on market history, I wouldn't even start getting excited until around 3000-3300. I'd actually prefer to see stocks down to 2500-2800 before I could declare stocks "undervalued".

While this is most likely a "suckers" rally, it could run awhile. We've passed the seasonally "bearish" period and stocks tend to rally after the mid-term elections. The percentage of bearish advisors and investors hit an all-time high in October. There is enough pent-up bottom seeking assets this could go on for a while.

As a reminder, one of our trend indicators inside AmeriGuard and Cornerstone triggered a buy on the last day of October. This means half of the money we took off the table in February and March has been put back to work. In addition, half of our high yield models bought back in last week. Remember, at SEM we let the DATA, not our opinions drive the investment decisions. While I believe the market will ultimately end up lower than it is today, I could be wrong, which is why we trust our systems.

Follow us on Social Media

While the blog will continue to be the source for deeper dives into everything that is happening, we post a lot more short-form content to our social media channels. Some are funny, some are quick takes on that day's news, and some are answers to questions we've received. Regardless, if you're looking for some different financial content, make sure you are following us.

Last week I talked a lot about inflation, the Federal Reserve, and the economy. I also discussed the election:

@finance_nerd What does the data say stocks will do after the election? #electionday2022 #stockmarket #investments #republicans #democrats #congress #financialliteracy ♬ original sound - Finance Nerd