During a bear market each countermove is closely examined. Our sensitivity is heightened because psychologically losses cause twice the emotional response as gains. Throughout the year we've warned about not being sucked into the inevitable bear market rallies. The 3rd quarter started with a huge rally in October with November adding a couple more percent to the current bear market rally.

Nothing changed fundamentally to spark the rally. In fact, the data argues the underlying economic foundation is weaker now than it was in October. Given the large jump in stock prices this means the chances of another large sell-off are significantly higher. Investing during all cycles requires discipline and a big-picture approach. This is especially true during bear markets. I'm a big fan of lists to help maintain a disciplined focus. Here is the list I created this weekend as we go into the last 3 weeks of the year:

1.) We are likely going into a recession (or at best very slow economic growth)

2.) The Fed will remain restrictive

3.) Inflation has peaked, but will likely remain above the Fed's 2% target

4.) Corporate Earnings are likely to slow

5.) Stocks are already overvalued even before the market reflects the economic slowdown

In summary, the economy is slowing, the Fed will continue to fight any strong recovery, and inflation will continue to be a problem. Just as we saw a year ago, analysts' earnings expectations are too high, which means stocks need to be repriced.

Last week's blog is one I would keep bookmarked. We dove into all of the above with lots of charts to tell the story.

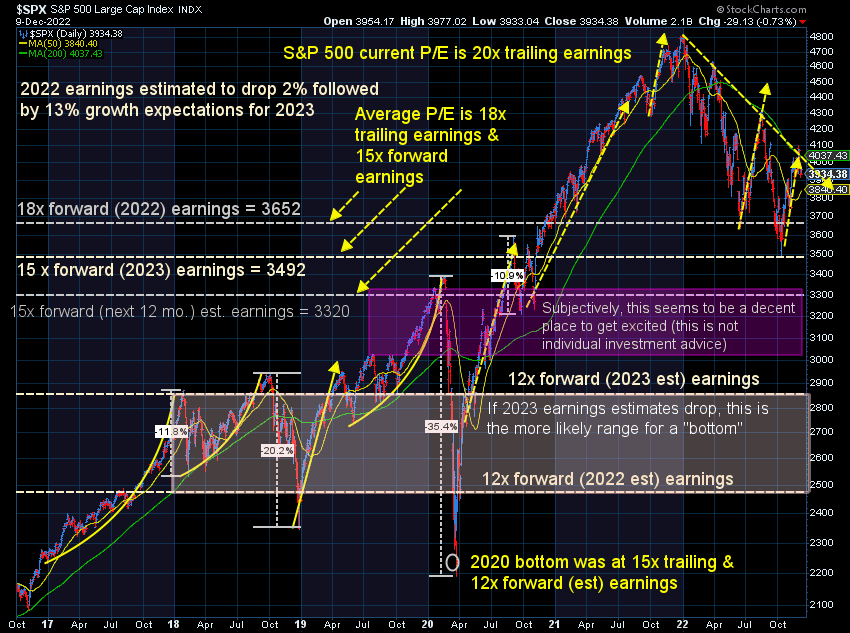

Turning to the markets, here are the charts I look at every day. First, the hourly chart of the S&P 500 really shows the emotional swings. Look closely at the peaks – we continue to see lower highs and lower lows. Each time the market makes a big push we see a drop, an attempt to rally, and then an eventual fall to new lows. The economic data says we likely haven't hit the ultimate low for stocks.

This longer-term chart highlights the real issue – stocks have not fallen anywhere near enough to be considered "undervalued". If you are overexposed to stocks every rally should be used to reduce your exposure. I wouldn't get excited for the long-term prospects for stocks until we see the P/E drop to the 12-15 range. A fall to 3300 (15x 2023 earnings estimates) would mean a 15% drop from here.

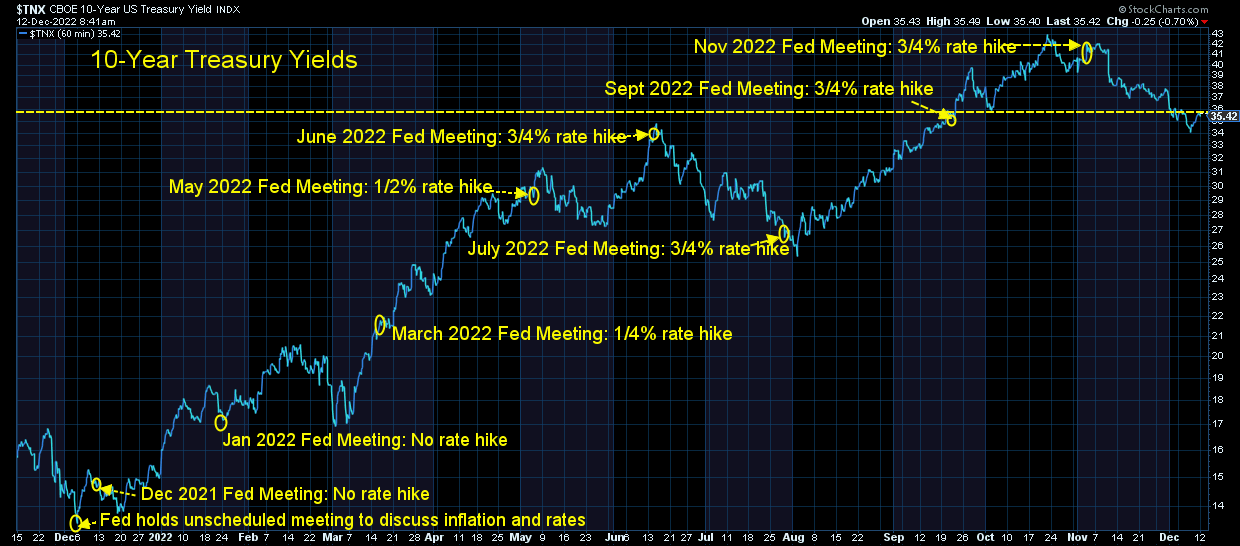

Turning to bonds, we may be seeing a shift from an inflation focus to a recession focus. 10-year Treasury bonds broke below the key 3.5% level briefly last week. The Producer Price Index (PPI) caused a panic when it was 0.2% above expectations. 0.2% is a rounding error, so this shows how sensitive market participants are right now.

This week will be a big week in setting the direction for the rest of the year. The Consumer Price Index (CPI) will be released on Tuesday and the Fed will announce their final policy change for the year on Wednesday. If the Fed indicates a slightly lower "terminal" rate (the level they expect to end their rate hikes) we could see a nice rally. If they instead keep that guestimate the same (or worse increase it), we could see a huge drop in stock prices (and a jump in bond yields).

I know this matters to the short-term direction of the market, but I will remind people a year ago the Fed held an unscheduled meeting to finally begin discussing fighting inflation. They didn't get around to raising rates until March. At that time the "terminal" rate was 3.5%. After the last meeting the terminal rate was up to 5%. In other words, the Fed has no idea where rates will end up.

What should you do right now? That depends on your financial plan. Each of our clients are placed in customized investment allocations designed to fit with their financial plan, cash flow strategy, investment objectives, and investment personality. Overall, our quantitative approach has reduced the volatility in every portfolio, leaving plenty of money on the sidelines ready to take advantage of what we expect will be significantly lower prices.