We're only 6 weeks into the new year, but the wild stock and bond market swings have made it seem like much more time has passed. This of course is because 2021 was a relatively easy year where seemingly everything went up in value. In our 4th Quarter Newsletter, I called 2021 "The year everything went right." I outlined how all the "easy" catalysts for the rally will not exist in 2022 and many negative catalysts could cause problems for buy & hold investors.

Weekly Talking Points

- Stock and bond investors alike are "fighting the Fed", something they really haven't had to do for the better part of 25 years. This means different data points are met with different reactions than most people are accustomed to.

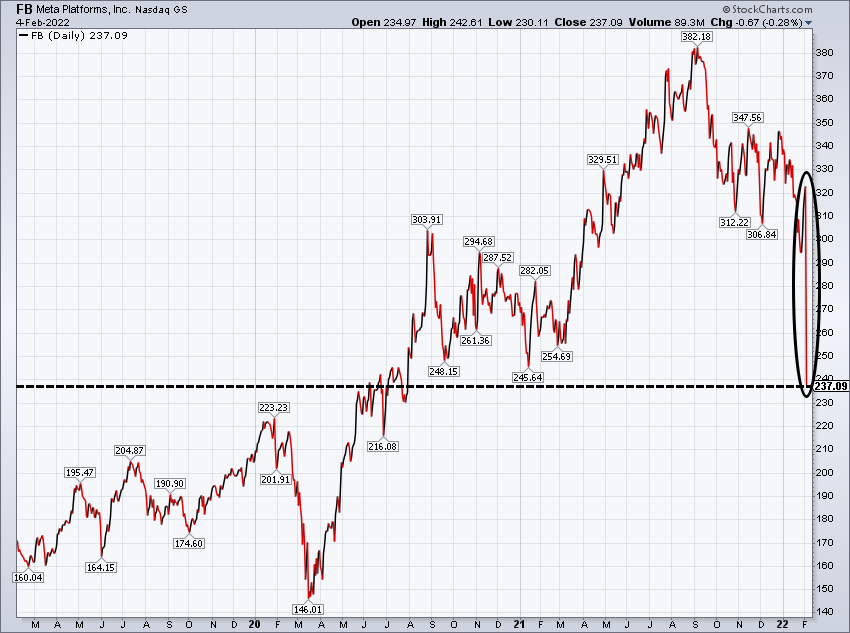

- High P/E ratios (valuations) mean there is little room for error. High priced stocks who do not promise continued earnings growth can be punished very quickly (such as Meta aka Facebook). This is an environment most people are not accustomed to.

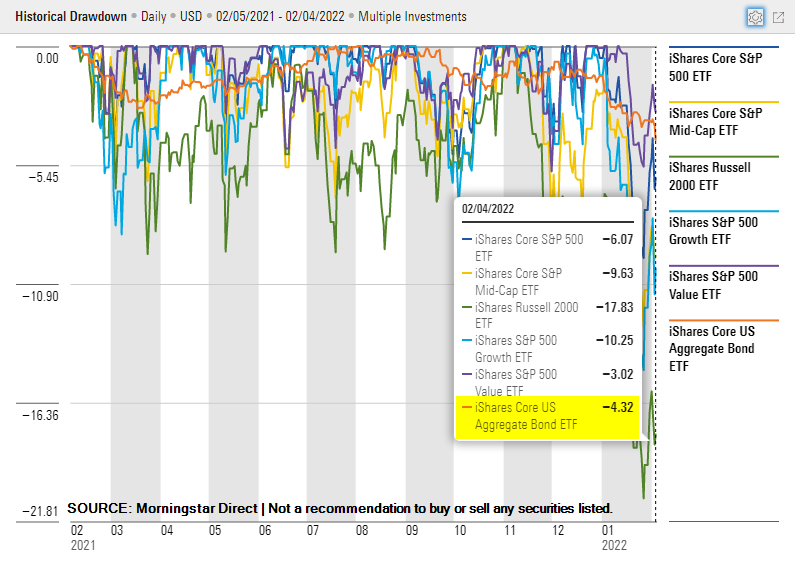

- Bonds are not providing the protection they typically have over the past 30 years. The aggregate bond index has become overweight Treasury Bonds, which means as government bond yields increase bond index funds go down in value. This is an environment most people are not accustomed to.

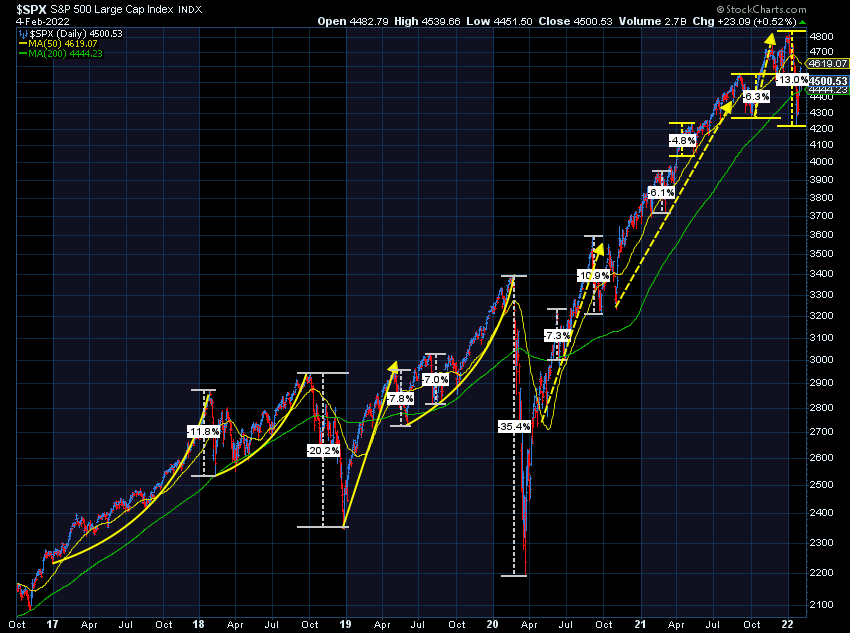

- Corrections are normal and the market was overdue for one. 5% corrections normally occur about 3 times a year and 10% corrections about once a year. 15-20% corrections occur about every 3 1/2 years. We're probably due for one of those as well. The only people who should be concerned are those who jumped into riskier asset allocations simply because they wanted to get higher returns.

- If you didn't jump into stocks just to get higher returns, you should only be looking to make changes if your FINANCIAL SITUATION has changed. Whether you're an SEM client or not, our Risk and Objective Questionnaire can be a good starting point to see if your portfolio needs adjustments.

When Growth is Bad for Markets

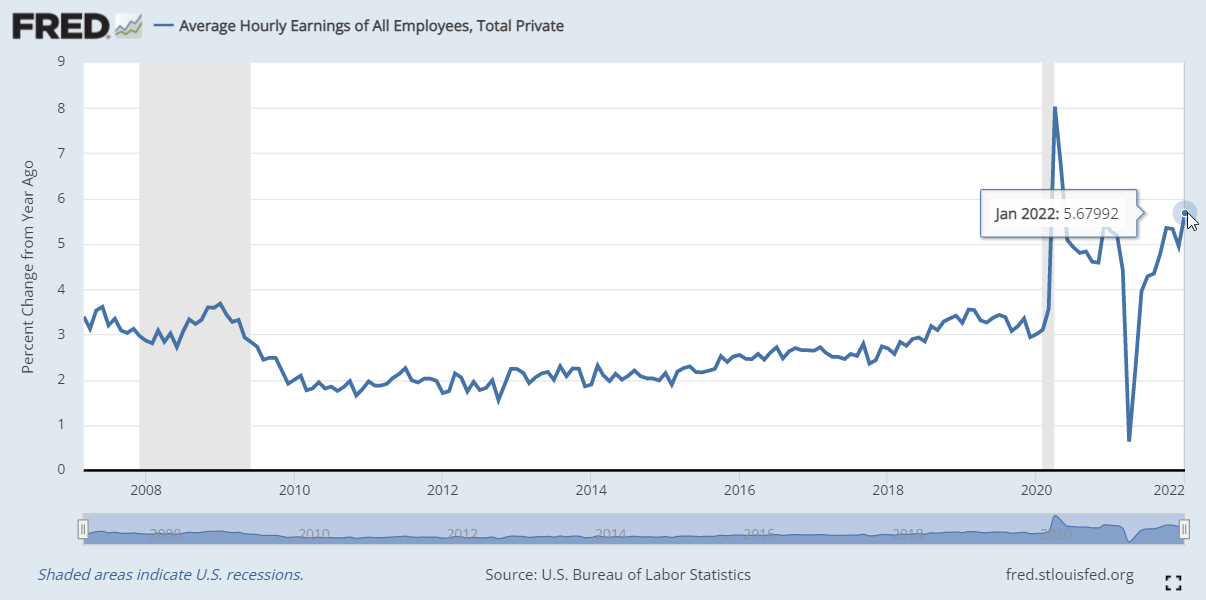

Economists had projected a terrible employment report for January. Instead on Friday we learned over 400,000 "jobs" were added. Normally that's a positive, but instead the stock market reaction was tepid. The reason came over concern about the jump in average hourly earnings.

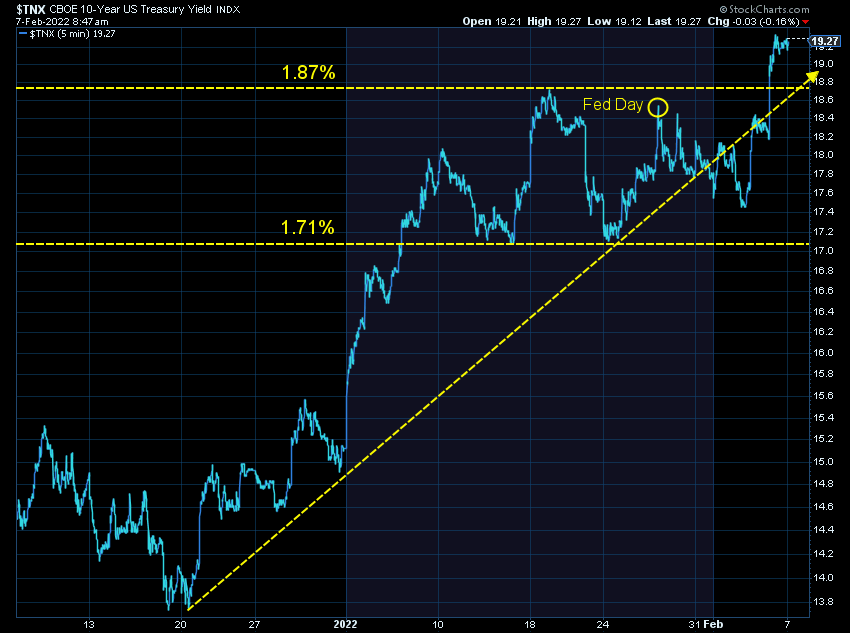

The bond market had the largest reaction, with yields on 10-year Treasury Bonds jumping to nearly 2%. Considering in mid-December those yields were at 1.5%, this is a big problem for stocks. Higher earnings, means more spending, which could accelerate inflation. This means stock and bond investors will be "fighting the Fed". This can depress valuations and growth rates alike.

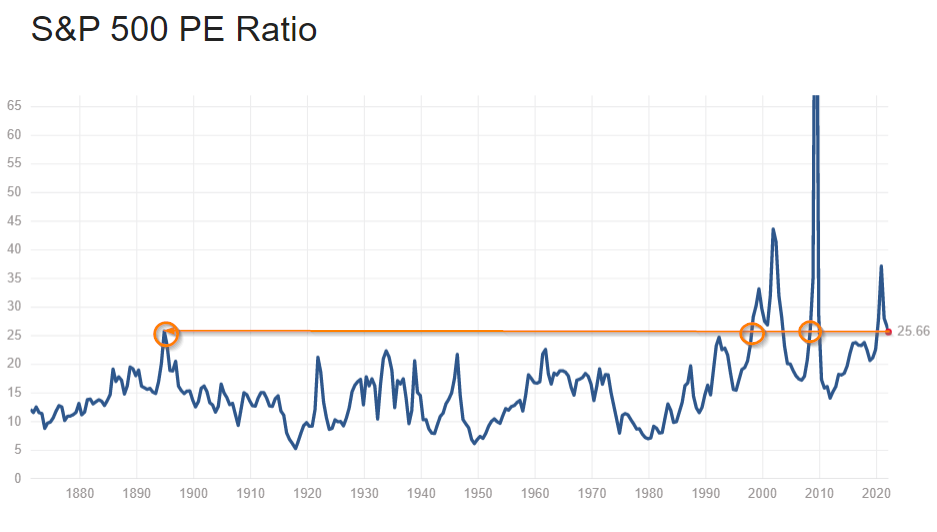

Value has not been created

We've been programmed the last 12 years to believe every time the market drops that it is a "buying" opportunity. I've heard at least a dozen "experts" on CNBC and Bloomberg talk about the "values" being created by this sell-off. I'm not sure what they are using to determine this. It reminds me of the furniture stores who list a "regular" price that is 100% higher than their "sale" price.

The way I look at this chart, stocks are just as attractive as they were in 2007, 1999, and 1899. Unless earnings growth ACCELERATES there is no justification for P/E ratios this high. We also know if growth accelerates too much the Fed will be even more aggressive in raising rates. Higher rates also mean LOWER P/E ratios.

Facebook (Meta Platforms) is a perfect example of what happens to a stock which had a higher-than-average P/E ratio. At the start of the year FB's P/E was 24. When it reported earnings below expectations and warned about slowing growth, it lost over 1/4 of its value in a single day. It now has a P/E ratio of 17.

Is it attractively valued? Nobody knows. All I know is that everyone who bought Facebook since May 2020 is now underwater on their investment. (This is most certainly not a recommendation to buy or sell FB or any individual stock.)

Bonds aren't helping

I've talked about this for the better part of 20 years, but I'll say it again – buying and holding bonds is not very efficient from a risk-reward standpoint. The returns are too low to compensate for what can be large losses at times. Investors have tolerated this because for three decades when bonds lost money it was at a time stocks were making big returns (for the most part). Conversely, when stocks lost money, bonds were making money (for the most part).

Now with the Fed concerned about too much inflation, bonds are not providing the same level of protection. After a bit of stabilization, the prior two weeks, bonds again resumed their losses on Friday. The aggregate bond index is still down less than most stock indexes, but most investors have not experienced an environment where bonds and stocks go down together.

By the way, our Tactical Bond, Cornerstone Bond, and Income Allocator are mostly invested in very low risk bonds and/or cash. They started selling on January 10, well before anybody was concerned about the market selling off. By design, they will sit in those lower risk instruments waiting for more attractive opportunities.

An important week

From a technical perspective, this could be an important week. Looking at the bond market, a move above 2% could both be a psychologically damaging move, but also a sign we are more likely to see yields around 3% in the coming months.

Turning to stocks, the S&P 500 made a valiant attempt to recover all of the losses during the correction, but ran into several technical roadblocks. The last two days we saw late day selling once again. The intra-day chart below shows some levels the market will need to work through/hold. How it handles that will either give investors confidence the correction is nearing an end or cause further angst/selling.

From a longer-term perspective, the S&P is again approaching the 200-day moving average, something many investors use as a long-term trend indicator. It briefly breached it two weeks ago, but quickly recovered. Typically a second breach of a key indicator squashes confidence from those who bought the last time it was down there.

We don't use the 200-day, but our own intermediate/long-term indicators are very close to sell signals, which would take money off the table in both AmeriGuard and Cornerstone. For now, they are telling us this is a "normal" correction, and we should remain patient. If that changes, they will react accordingly on behalf of all of our clients and advisors.