2020 just keeps on giving us more and more crazy news. With the President dealing with COVID19 along with a large number of people from his administration and members of Congress, the market and economy has yet another unknown to deal with. We don't like dealing with unknowns and will stick to the data.

This doesn't mean SEM isn't ready for some more problems to emerge. We discussed some of those things and how we are preparing in our Fall Newsletter, which posted last week.

As we go into the final quarter of 2020, the rebound in the economy seems to be weakening based on the month end updates to our economic model. Congress continues to play politics on any additional stimulus. The President and House seem to want to get something done. I don't think anybody knows where the Senate stands. With floor votes in the Senate postponed until at least October 19 due to a GOP COVID outbreak, the chances of something happening before the election are further diminished.

This morning, let's look deeper into our economic model to see what's working and what isn't.

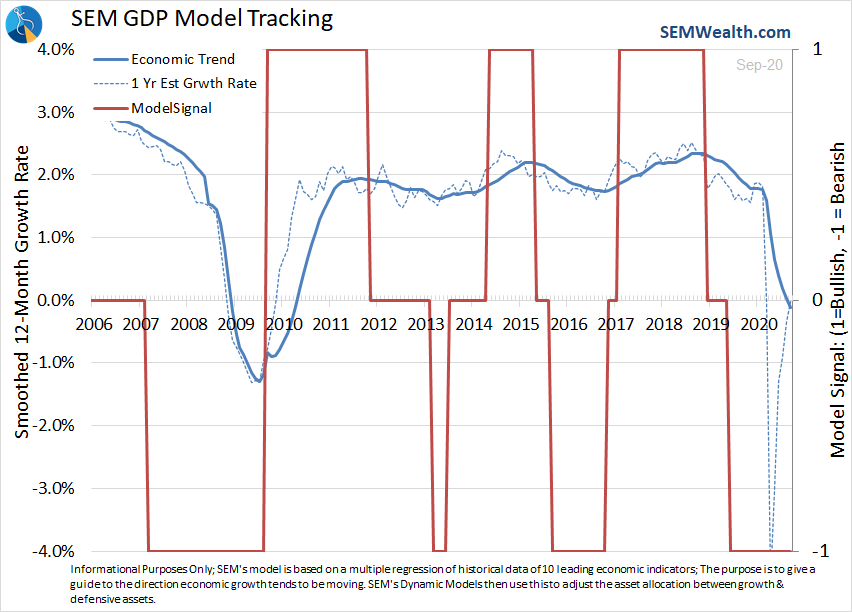

Still Bearish

While the model obviously didn't know COVID was coming when it went bearish early last year, it did see an economy that was weakening significantly. The impact of the tax cuts had already worn off and businesses were struggling to pay back the hefty amounts of money they borrowed during the expansion. When you have to take current earnings to pay back your debts it hurts your ability to grow.

The model measures the momentum in the solid line. The dashed line is the models' prediction for growth over the next 12 months based on our leading indicators. The red line is the allocation signal for our Dynamic models. "Bearish" means no exposure to risky assets (Dividend Growth stocks in Dynamic Income and Small Cap / Emerging Markets in Dynamic Aggressive Growth).

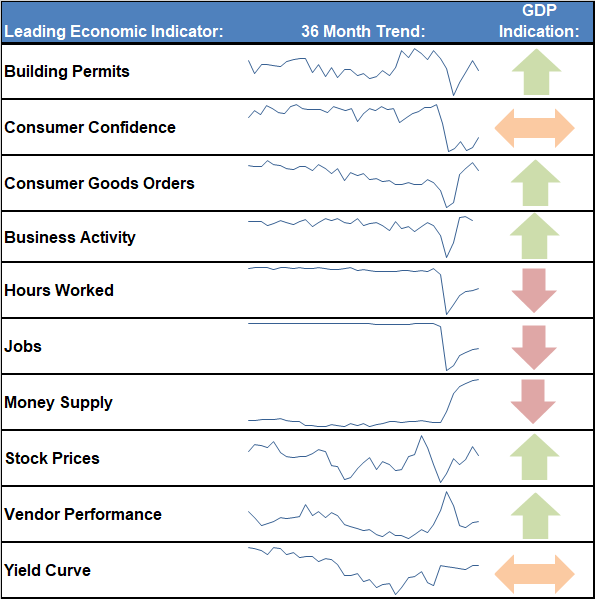

A mixed bag

I like looking at this dashboard to get a feel of areas of strength and possible weakness in the economy. The different indicators give different weightings in the model, but it is helpful to see the trends.

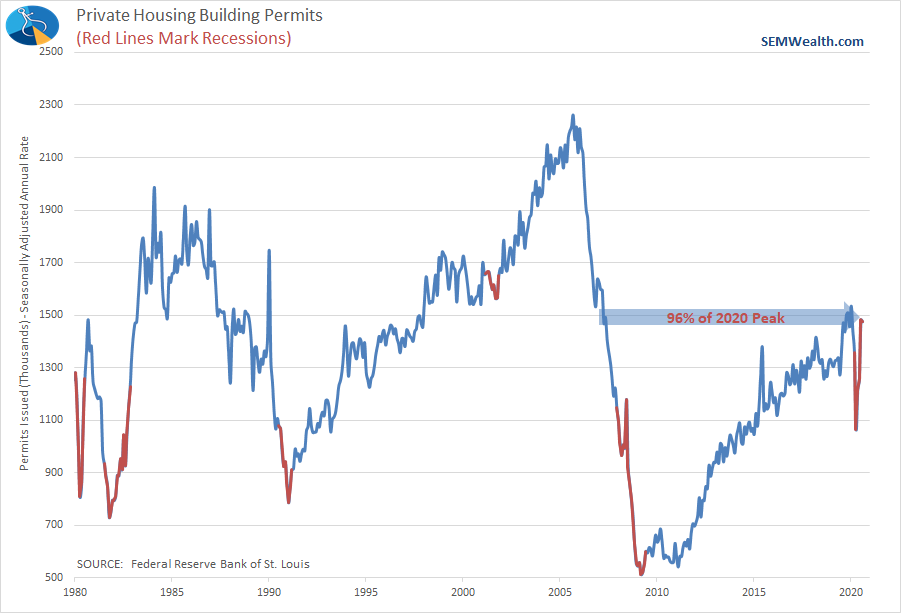

Housing has been a star. The combination of more Americans realizing they can work from home and moving out of the cities and ultra-low interest rates has led to a boom in many areas of the country. Permits did slow a bit in August and are still below the peak earlier this year.

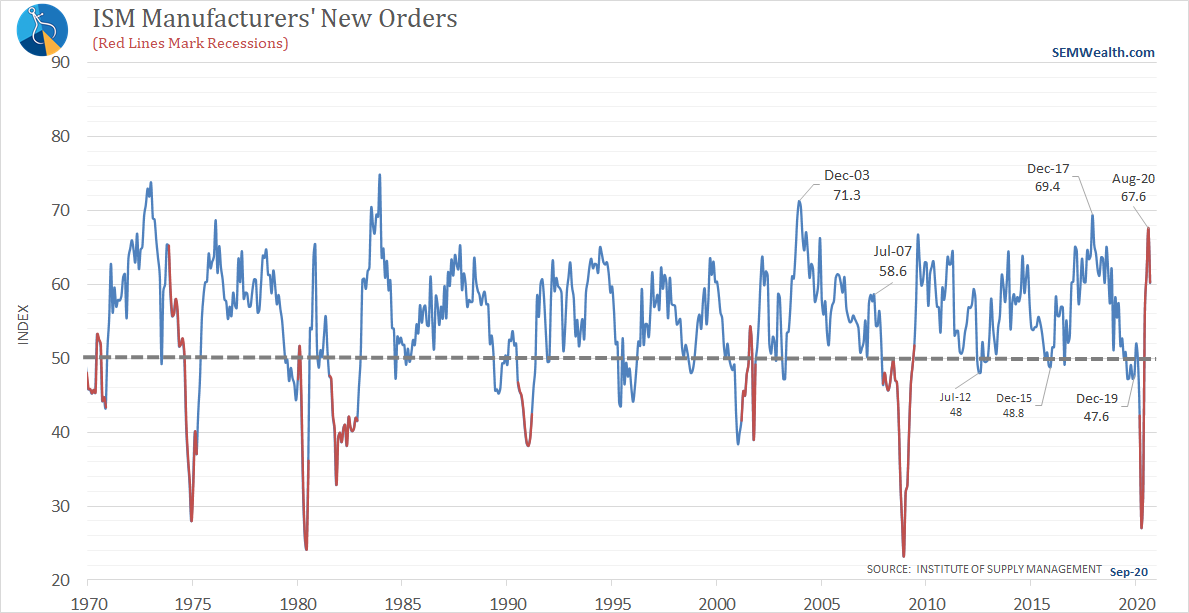

Manufacturing is still providing upward momentum, but it did weaken in August.

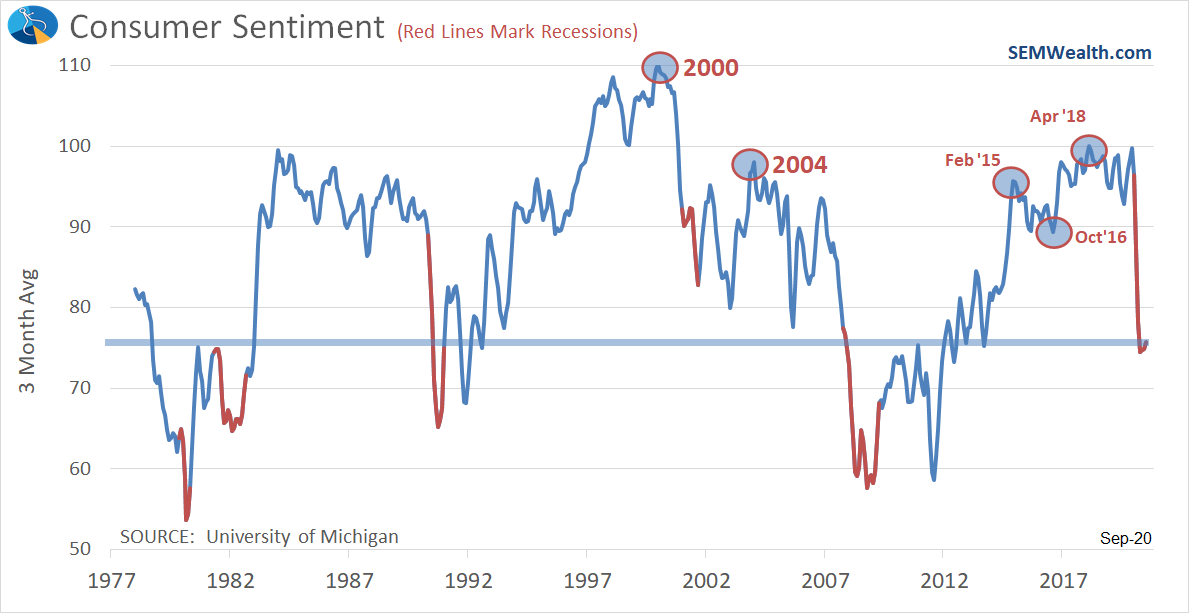

Consumer Sentiment improved in September, but is still hovering around 2013 levels.

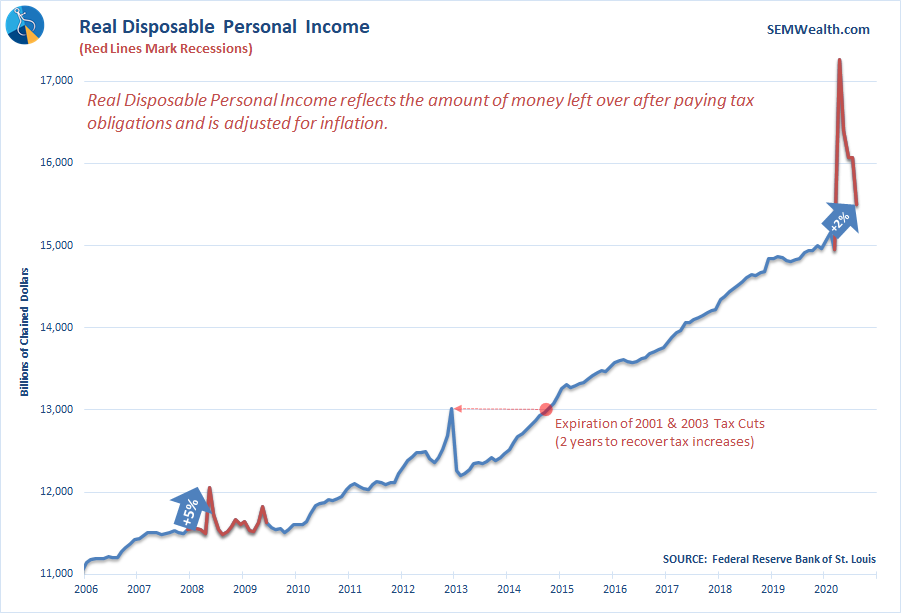

Stimulus wearing off

While Congress continues to disagree about how much and what types of stimulus are needed, the temporary boost in income and thus spending has nearly evaporated.

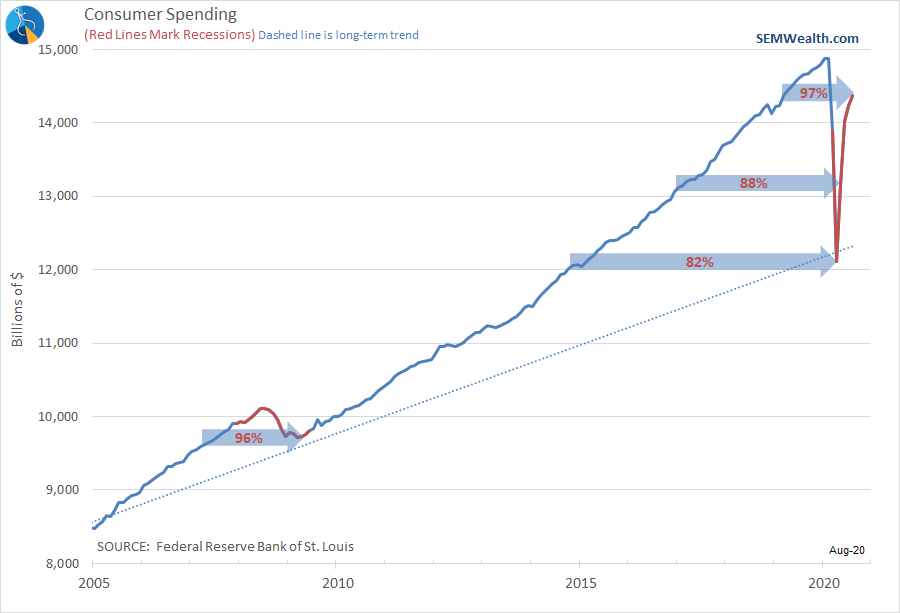

Consumer spending is a function of confidence and income along with the ability/need to spend money. The rate of growth in August slowed significantly in August. This was the first month the federal unemployment benefits expired.

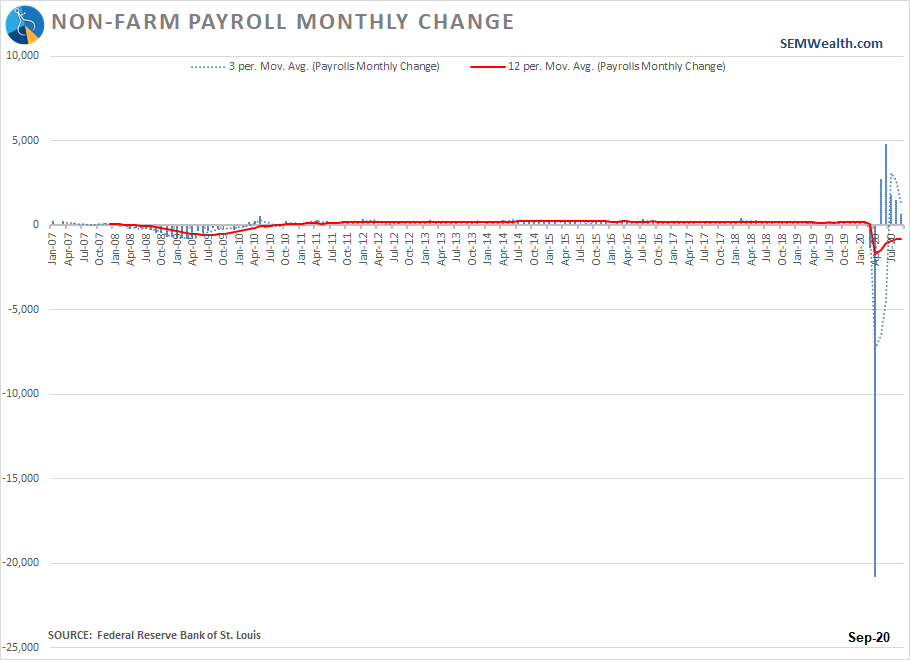

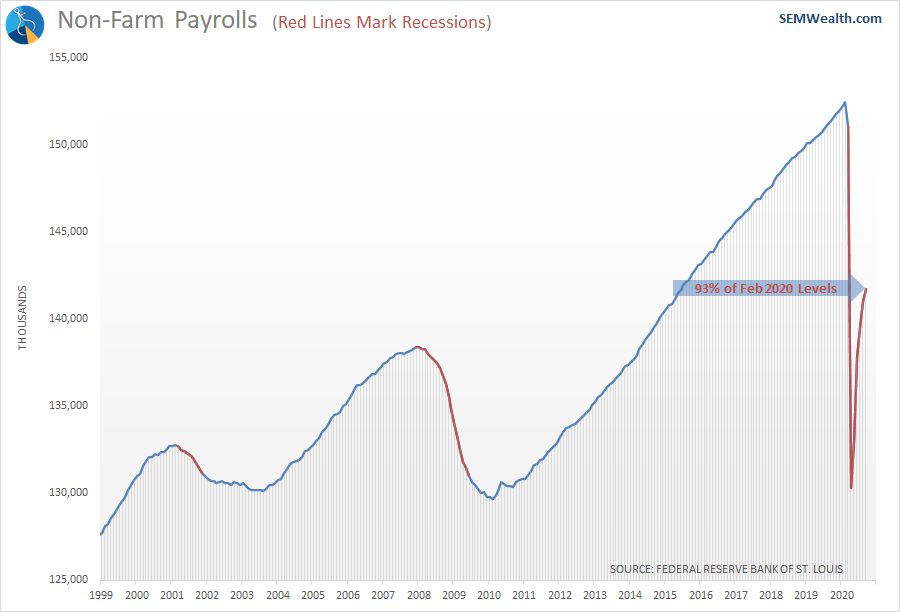

Not a good jobs number

I never thought I'd write that 600,000 "new" (returning) jobs was bad news, but compared to the gains we saw over the summer, it is disappointing and concerning.

We are nowhere near getting back the jobs we had pre-COVID. This isn't a function of people not wanting to work, but the fact there just isn't enough economic activity to put people back to work. I've argued from the outset most Americans have learned there are probably things we were wasting too much money on that we really didn't miss during quarantine.

This is a good example of the "paradox of thrift" – it is good for an individual to spend less and save more, but if too many people are spending less it hurts the economy.

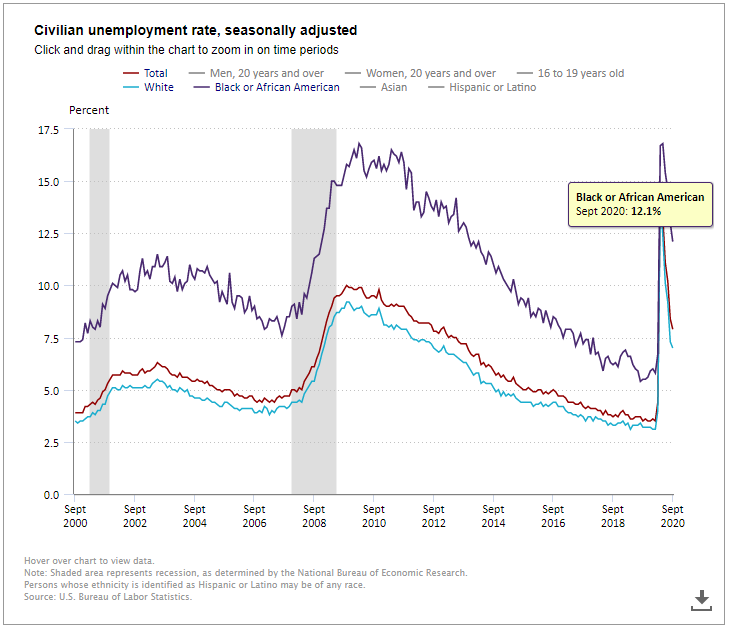

The unemployment rate declined slightly, but the gap between White and Black unemployment remains high.

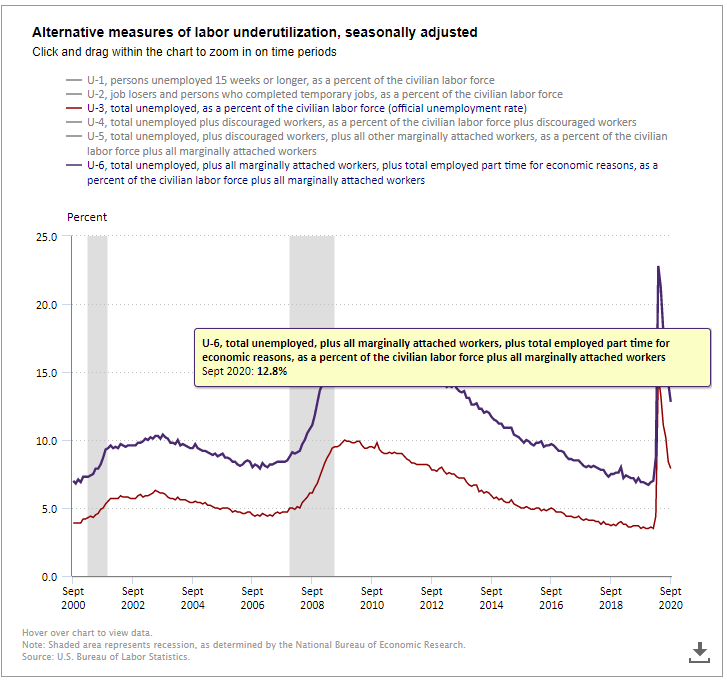

"U-6", a measure of unemployed and underemployed also remains high.

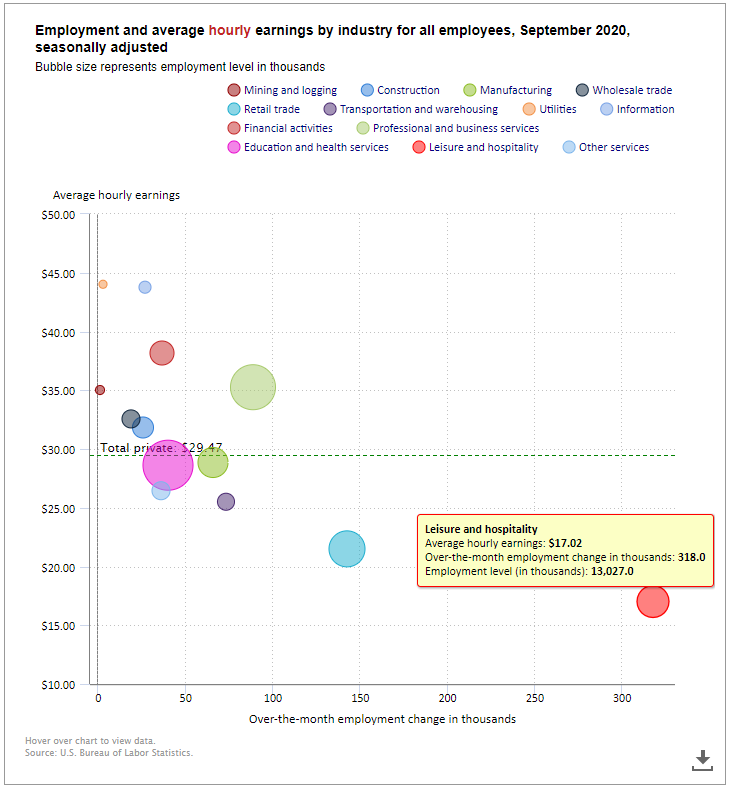

And an even bigger issue is the QUALITY of jobs coming back. Once again, the lowest paid industry, leisure & hospitality, accounted for most of the job gains.

And we still have the virus

Obviously with the news of the President contracting COVID19 the virus has again popped to the top of everyone's mind. Time will tell if whatever wave we are currently in turns out less deadly or if we are in for a painful fall. The news over the weekend is encouraging and something we've been talking about for a while – doctors have discovered new ways to treat the virus, making it less deadly. Of course not all of us will have access to the world's best doctors and an immediate treatment cocktail if we catch the virus.

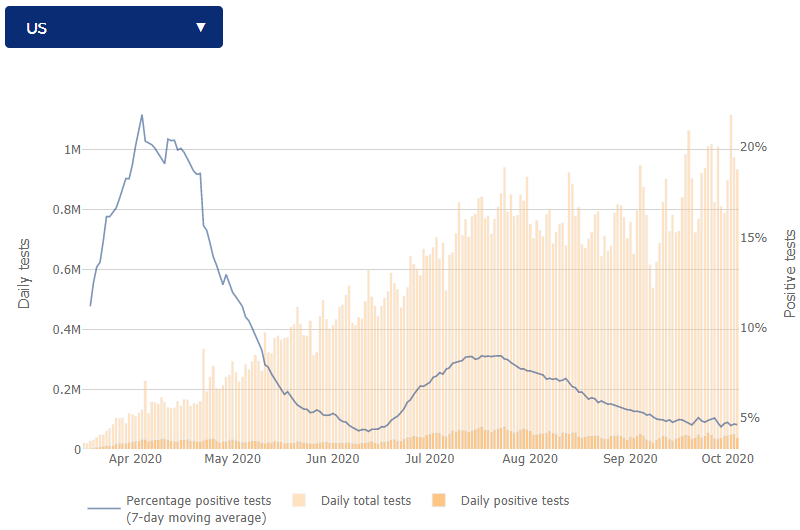

Despite more school and economic re-openings, we have yet to see a spike in the overall percent positive test results.

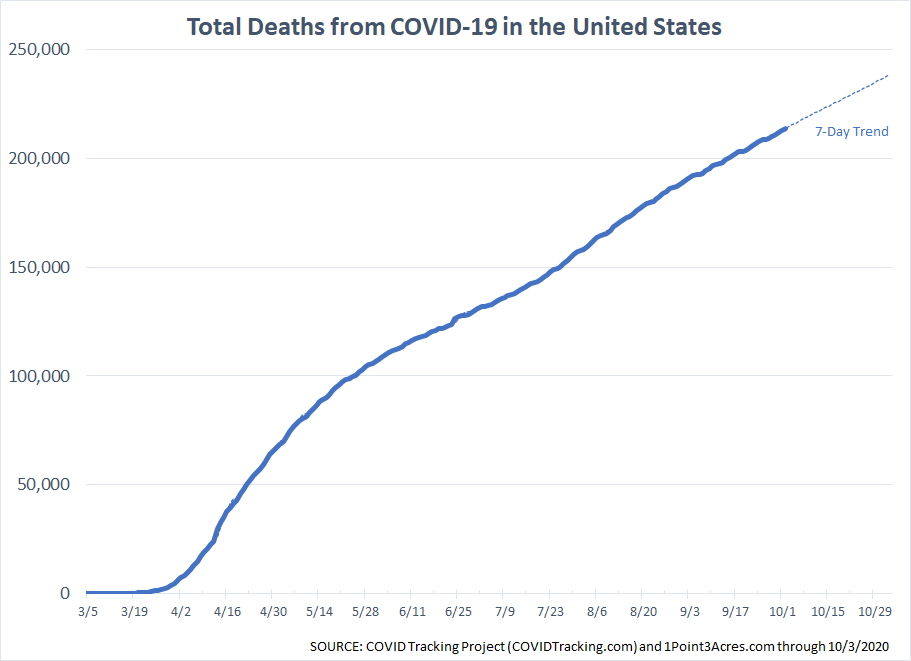

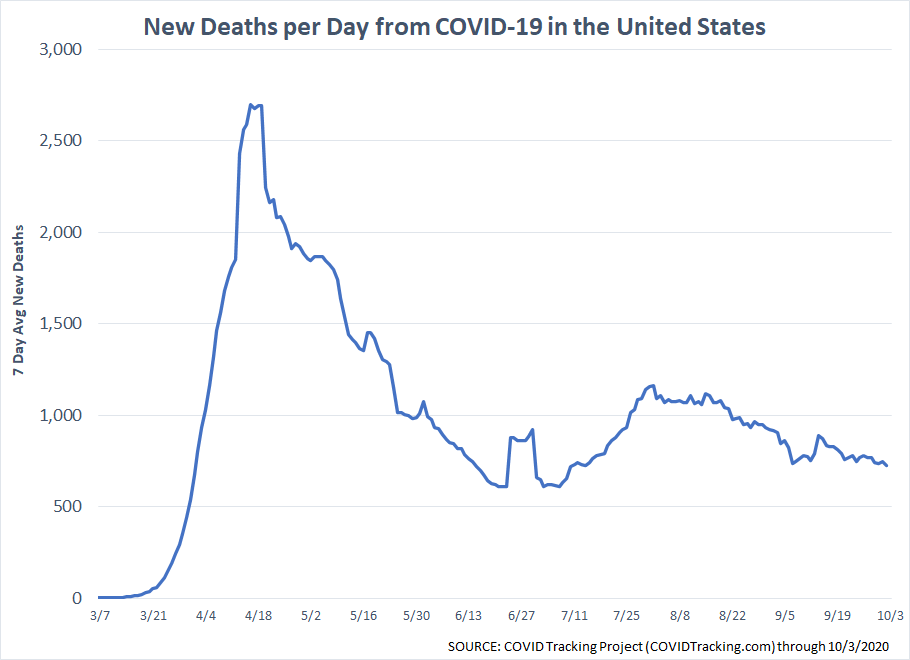

Deaths are high, but remain above 700 per day.

Time will also tell if we see more people taking precautions to prevent the spread of COVID, which could lead to more people feeling confident in the economy. Based on the pictures of rallies over the weekend, I don't think anything has changed just because the President and over a dozen people at the Rose Garden ceremony over the weekend caught COVID. It seems if you didn't wear a mask or avoid large shoulder-to-shoulder gatherings on Thursday, you aren't likely to do so today.

Whatever your politics, to truly get the economy going again the majority of Americans need to feel comfortable in their financial future, kids need to be back in school, and we need more widespread (reliable) testing and treatments. Either presidential candidate has their work cut out for them in 2021.

SEM Stands Ready

Whether it is a weak economy, the virus, or the election I hope you've appreciated how unique and valuable SEM's data-driven Behavioral Approach can be. 2020 has certainly been a year of "unprecedented" events (I haven't even mentioned the western wildfires, which also could cause a major drag on the economy long-term).

If you missed our SEM University last week on the election, I'd encourage you to check it out. It was by far our most widely attended SEMU so far.

We've already had several requests to host a similar event for advisor clients. If you'd like to schedule yours, let us know. We also had requests to hold another event a little closer to the election. You can sign-up below: