The first week of October was exhausting. We saw so many market moving headlines crossing throughout the day it was hard to see a common theme. After having some quiet time to replay the past 7 days and look at some key data points and Wall Street research reports, we are seeing a very similar story developing in the market.

Despite data that does not always agree, many market analysts believe Republicans are good for the stock market and economy and Democrats are bad. The thought is Republicans are in favor of lower taxes and fewer regulations and Democrats are in favor of higher taxes, more regulation, and a wider distribution of income. Therefore, we typically see markets rally in anticipation of a Republican election win and sell-off ahead of a Democratic expected victory.

I won't go through the recap of 2016, but we saw the opposite happening. The thought throughout October was Hillary Clinton was "good" for the markets and economy and Donald Trump was "bad". Over the last week I see a similar playbook developing.

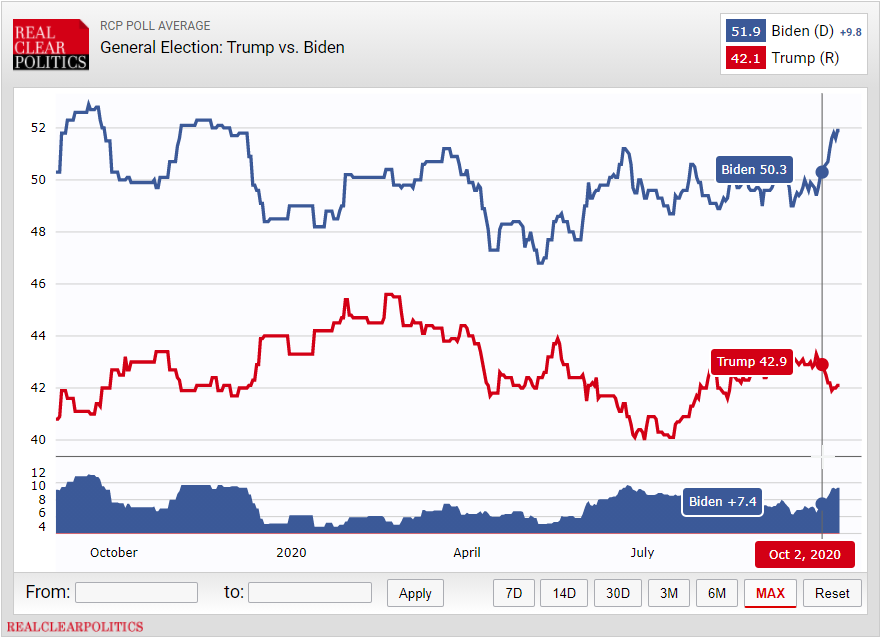

Biden's National Lead Widened

While many Donald Trump supporters viewed his "miraculous" recovery from COVID19 as a boost to his prospects, the national polls show the opposite is true.

While the polling data in 2016 clearly showed there were issues, the national polls correctly predicted Hillary Clinton would win the election. At this point Clinton had a 7 point national lead over Trump. Biden's lead is currently 9 points.

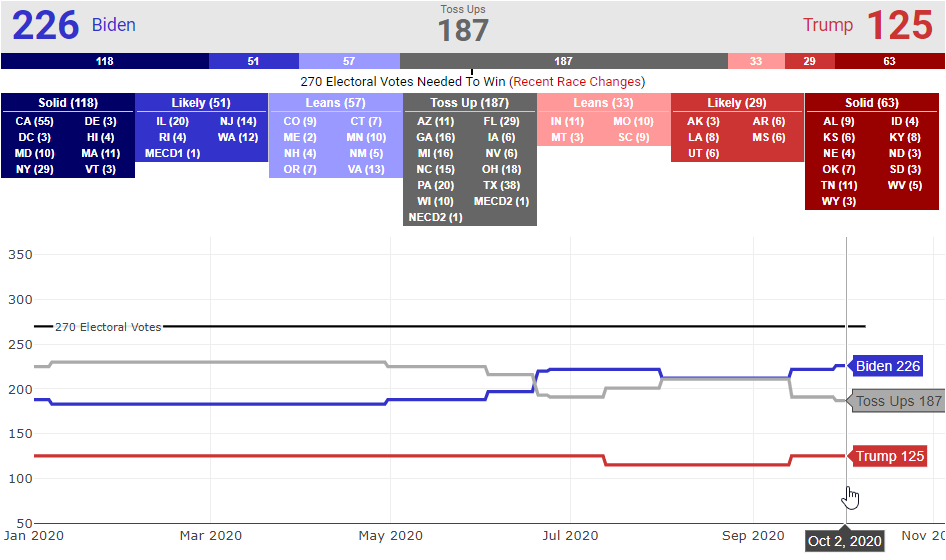

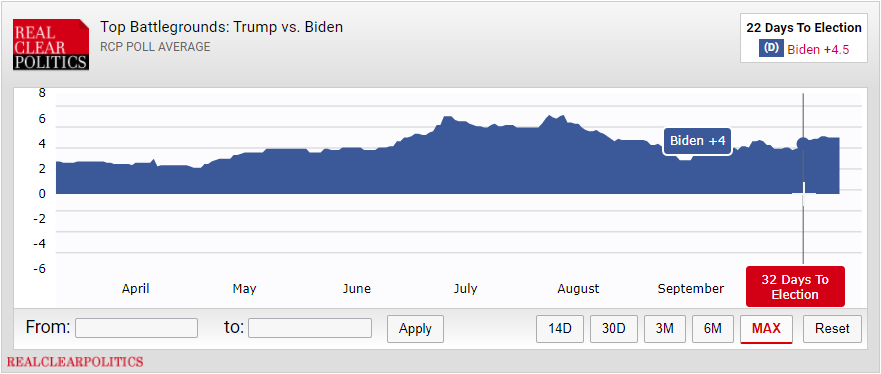

Only a Small Change in Battleground States

As we learned in 2016, candidates cannot ignore the middle part of the country. State polls were unreliable in 2016. Experts believe they have improved, but there are plenty of states too close to call that could swing the election either way.

In the top battleground states (Pennsylvania, Michigan, Wisconsin, Florida, North Carolina, and Arizona), the President is slightly ahead in those states compared to the same time in 2016. That said, he's still trailing in those states and the gap grew slightly over the past week.

Is Biden Better for the Market?

Before we go any further, I need to caution anybody from reading what has happened in the past or what we saw developing last week and making portfolio decisions. My number one rule of investing is "Don't let your political opinions influence your investment decisions." I heard somebody else say, "don't let election chaos create portfolio chaos."

Two weeks ago we hosted a special SEM University on the election. You can view the replay here:

We are also hosting a second part of this the week before the election. Here is the sign-up link:

I'll let our data-driven process decide on what allocation adjustments we should be making. Our emotions are all high after 31 weeks of the pandemic and those emotions could cloud our judgement. Focus on what you can control – your financial plan and SEM will take care of navigating the markets.

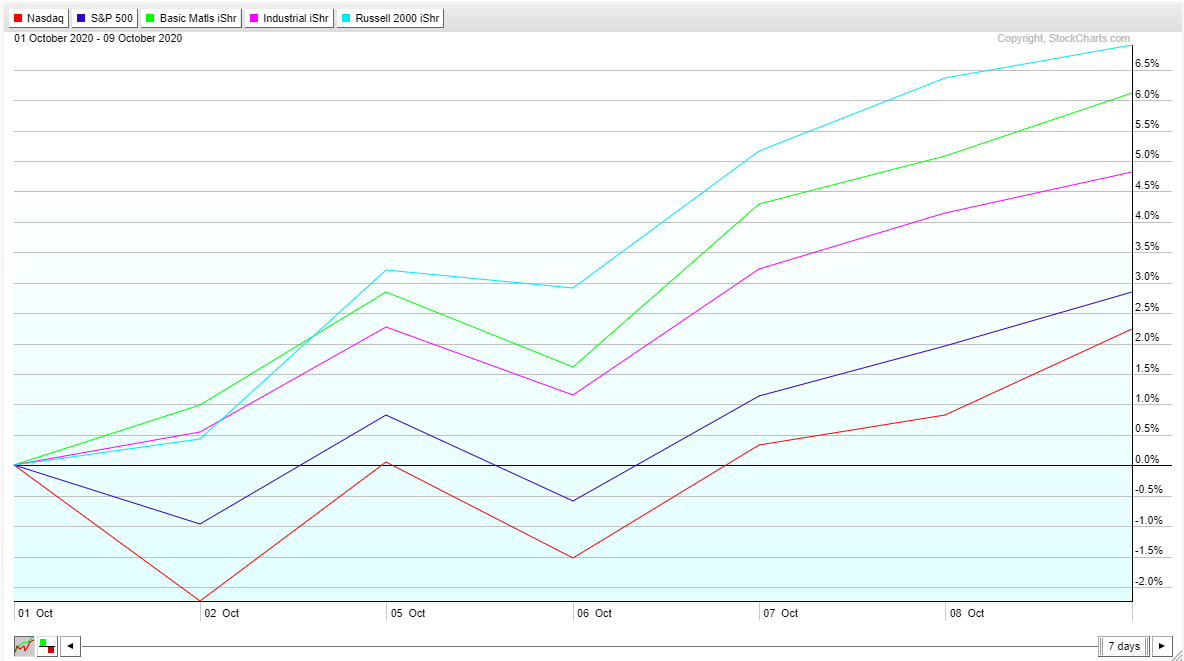

A Bet on Stimulus

Even though the chances seem slim to get any sort of stimulus done before the election (and even after), the market seems to be betting a Biden victory and possible Democratic sweep will lead to a stimulus package that will save the economy. At the same time Biden's poll numbers grew, stocks posted their best week since July. A stimulus package is thought to bailout the small companies who are still struggling. The talks from the Democrats on a wide-scale infrastructure spending plan (something Trump also campaigned on in 2016) led to an out-sized rally in the Basic Materials and Industrial sectors. The tech-heavy NASDAQ trailed the overall market over the past 7 trading days.

We welcome the broadening of the rally. Our AmeriGuard & Cornerstone models reduced our large cap growth exposure and added small and mid-cap positions when we ran our quarterly core model rebalance.

High yields also rallied with the hopes of more stimulus if the Democrats win in November. This led our high yield trend following systems inside Tactical Bond, Income Allocator, and Cornerstone Bond to jump back into high yields.

Again, please don't jump to conclusions based on a single week or what the "story" is behind the market move. That can change very quickly.

The K-Shaped Economy

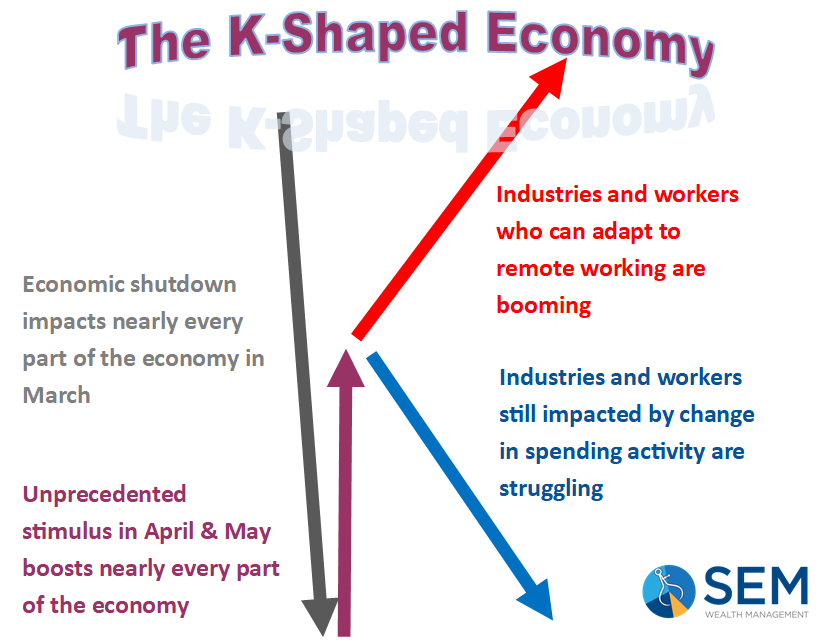

During the presidential debate debacle, Joe Biden discussed the "K-shaped" economy we are facing. While the President talked over him about the V-shaped "spectacular" recovery, Biden did not get a chance to explain what he meant. I've described it as the "95% economy", where we simply do not return to the prior levels overall for quite some time. The more I thought of it, the K-shape is a good description of what we are facing.

I created this graphic to illustrate.

We most certainly have seen some parts of the economy (including most of our readers) go through a "V-shaped" recovery. Many of our clients and advisors are better off now than they were in February thanks to stimulus payments, various bailout programs, low interest rates, and the ability to generate new business from their homes.

However, there is a large part of our country going through a depression. Whether it is fear of the virus, forced shutdowns, or simply a realization that we don't NEED all the things we used to spend money on, I firmly believe we have had a STRUCTURAL shift that will lead to a different economy for many people.

The trick for whatever our government looks like in January will be helping those in the bottom half of the K without doing too much damage to the upper part of the K. I don't have all the answers and am glad I'm not the one having to make these decisions.

Remember, you don't HAVE to participate in every single market rally. You don't HAVE to be in the market at the start of a rally. The key is to make sure your investments align with your financial plan, cash flow strategy, and overall investment personality. We'll see better times ahead and we'll see worse times ahead. Having a plan for both will be critical.