Throughout the last 37 weeks I've been providing musings each Monday summarizing what I'm seeing in the investment world. Some of them have been quite long and wide-ranging, others have been fairly brief. This week, there is A LOT of news we could talk about, but I kind of wonder what the point is because nobody seems to care.

When we started the year I warned about how giddy everyone on Wall Street was at the prospects for 2020. Now as we end the year I'm struggling to find anybody who sees any sort of risks in 2021 for stocks. Whether it's professional advisors or individual investors the consensus seems to be nothing can stop stocks.

This is of course hyperbole – plenty of advisors we work with see risks ahead and are legitimately concerned, however they have voiced their frustration that too many individuals believe the market won't go down again.

There is one group of investors who do see some big risks ahead – some of Donald Trump's most loyal supporters. I understand this is an emotional time for everyone, but I will again urge everyone to follow my number one rule of election year investing – 'Do not let your political opinions influence your investment decisions.'

We discussed what we should expect from the political environment and how SEM is set-up to handle what is likely to not be as smooth sailing as everyone currently believes. The prepared presentation was 30 minutes, but the Q&A lasted another 20. There were some great questions that I believe summarized some of the things many of us are thinking. Check out the replay here:

Rather than getting into all the news floating around out there, let's take a look at why I'm growing increasingly concerned about the prospects of stocks at current levels. It's all about sentiment. Stocks go up when more people buy than sell and they go down when more people sell than buy. When too many people are optimistic, you run out of new buyers and then people start cashing out their gains. Suddenly sellers outnumber buyers and you get some rapid losses.

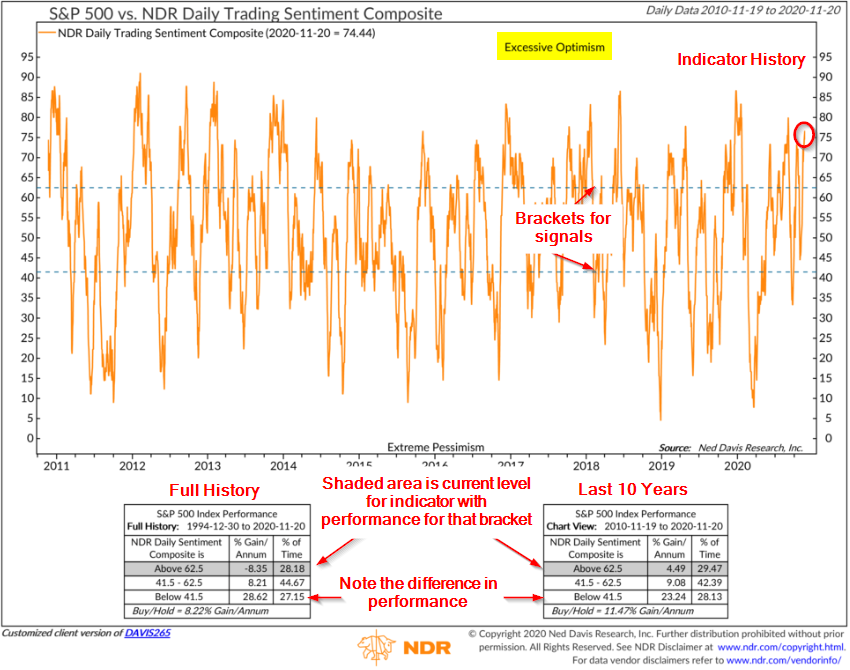

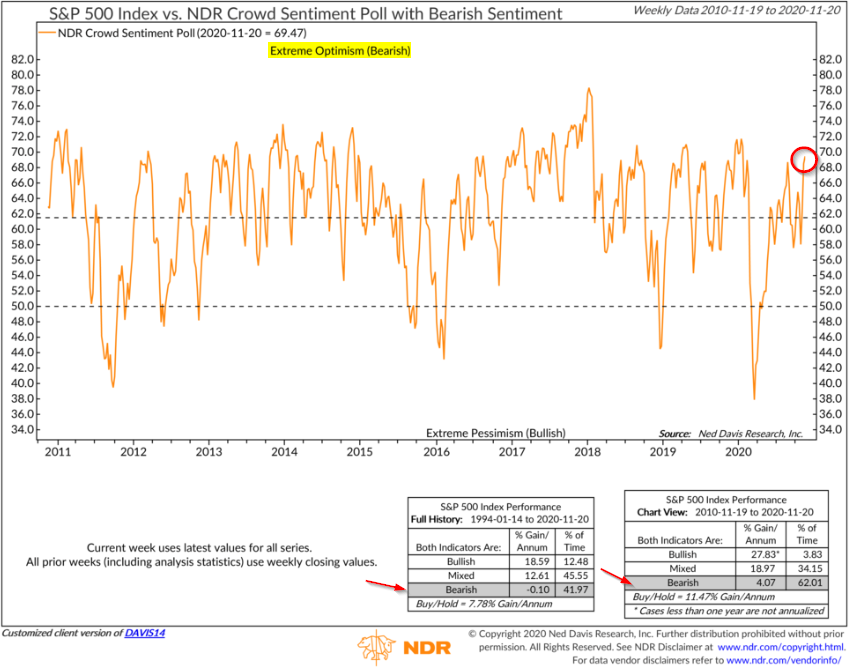

Ned Davis is a tremendous data resource for us. Their charts can sometimes be confusing to people unfamiliar with them. I tried to simplify them by highlighting the current level and marking the return expectations. The tables show the performance of the market based on the indicator's value. The table on the left goes back to the history of the indicator while the one on the right is for the last 10 years. Across the board, when sentiment is this high, we are looking at returns far below average.

I personally like the NDR Daily Trading Sentiment Composite as it is a combination of over 18 different sentiment indicators, including many that are derived from market data (not just surveys of investors).

The NDR Crowd Sentiment is focused more on investor sentiment surveys.

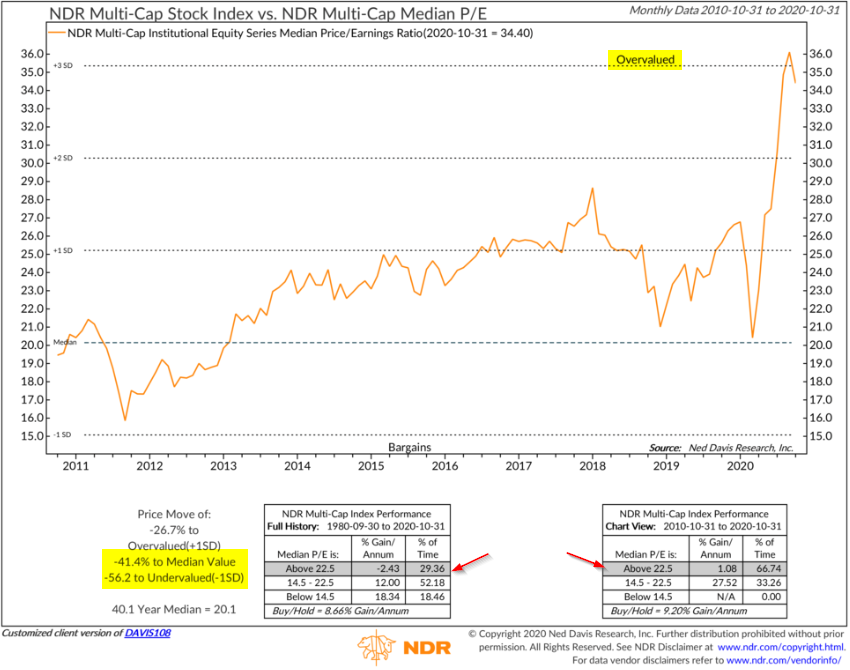

The data is clear – optimism is at the extreme. When it has been at these levels historically returns have been significantly below average (or negative). This matches the message from last week – lower your expectations for stocks or risk being severely disappointed (and possibly blowing up your financial plan). One of the key points I used last week was the starting valuation. Valuations are also a good sentiment measurement. If you feel good about stocks, you don't mind paying higher prices. That sentiment can quickly reverse, which is what happens in a bear market. No matter which way you look at it, stocks are in the upper quintile of valuations, which means you should expect below average or (negative) returns.

Here's another chart from Ned Davis looking at valuations. Once again, you should expect below average (or negative) returns.

As a reminder – at SEM we do not use ANY of the indicators in today's blog. Sentiment and Valuation indicators are very good at helping set expectations, but HORRIBLE timing mechanisms. Stocks can remain overvalued and investors delusional for far longer than most people can remain in business. We follow the trends and the data. We remain very heavily invested, but are closely watching every indicator in our trading systems for signs of trouble. As we proved in the spring as well as during past bear markets, our systems are designed to take risk off the table fairly quickly.

If you're in a buy and hold portfolio and have been feeling especially optimistic towards your investments, that probably a sign it's time to take some money off the table and move towards something that is designed to manage the allocations more scientifically.

If you're in a buy and hold portfolio and believe investing is easy, it's probably time to take some money off the table and move towards something that is designed to manage the allocations more scientifically.

Finally, if you're retired or retiring in the next 10 years, it's probably time to take some money off the table and move towards something that is designed to manage your retirement more scientifically.

We're here to help. We're designed to remove emotions from the equation, which helps remove emotions from your investment decisions.