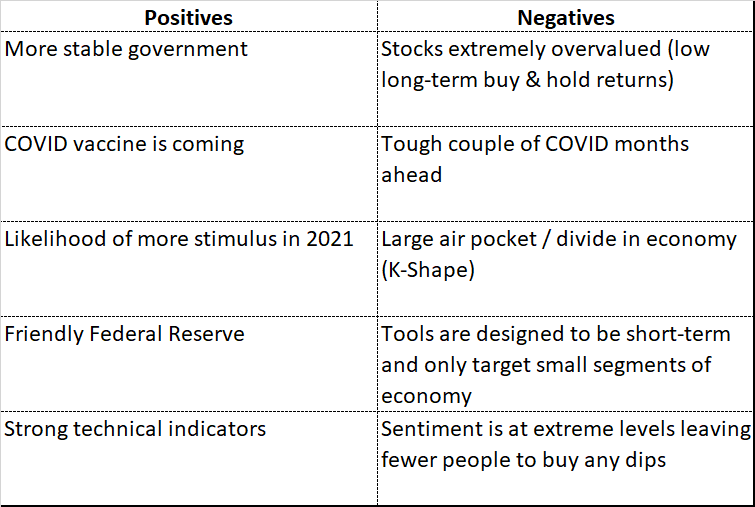

As we enter the final month of 2020 many investors will be making plans for 2021. I could write several thousand words listing all the things we should be considering. Instead, I thought we'd use my favorite tool – a 2-column list to look at the current market environment.

As I've shown throughout the years, I can pick either side of the argument. I prefer the markets go up because our clients make more money that way, but I also know the more markets go up, the more likely mistakes will be made. Risk appetite ratchets up along with expectations for double digit gains in our investment accounts, which leads to a big disappointment down the road when the inevitable happens. This "unexpected" drop in values often leads to an emotional response.

At SEM we're designed to let our models run as long as possible before taking money off the table. Each model serves a specific mandate in a portfolio and we usually advice utilizing 2-5 models in each account. This may not be as exciting as bragging about owning the latest craze stock which doubled in value in the past month, but it is a proven strategy that has helped clients ride the ups and downs of the market.

Here's what's important – when you work with SEM you're no longer just guessing about what you should do.

If you're a buy and hold investor or have been doing it yourself, you need to pick a side. I've done this for over 25 years and just as I said at the end of 2019, when Here are a few supporting charts and data points that may help:

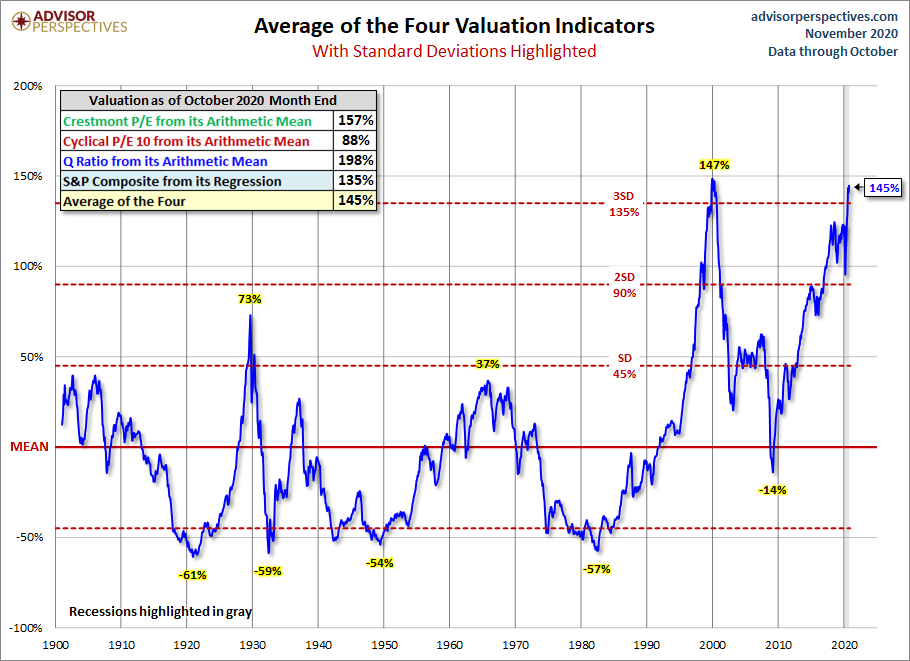

Stocks are extremely overvalued

We entered the election at high valuations. The celebration of a "more stable" government has driven stocks to borderline ridiculous valuations. It is going to be close to impossible for stocks to deliver the type of earnings necessary to justify current valuations. Here's a good chart from Advisor Perspectives.

Whenever valuations are high, expected long-term returns are low.

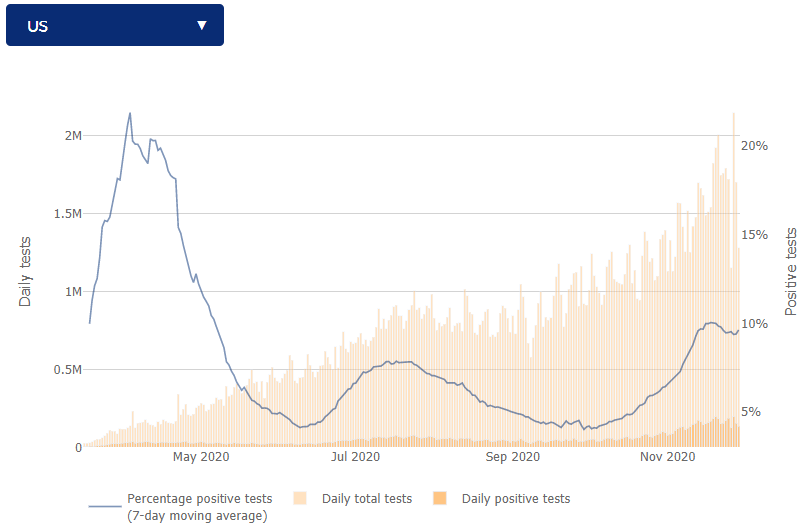

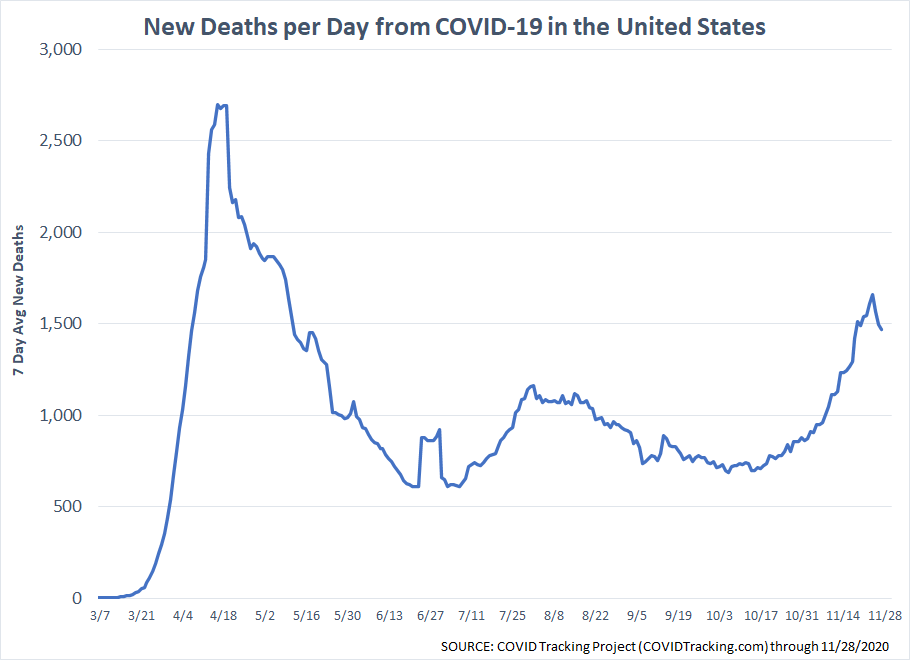

Tough couple of COVID months ahead

I'm as excited as anybody about all the great vaccine news. I said from the beginning we just need to give American scientists time and patience to solve this thing. I think we are on our way. That said, Americans are Americans and we are tired of staying home, tired of being told what to do, and tired of taking care of ourselves (speaking in terms of the 'average' American). I get it. I'm tired of it all too and have been less cautious the last few weeks than I was in March. It's such a random virus, but from talking to others who it hit hard, it's not something any of us really should challenge.

Positivity data along with cases across the country continue to climb. It may be less lethal as it ran through the most at-risk populations earlier in the year and doctors have figured out better ways to treat it, but hospitalizations and deaths continue to climb.

We've already seen some cities, counties, and states impose more economic restrictions, which is something that will hurt some parts of the economy already struggling (especially if Congress continues to drag their feet on targeted stimulus).

Large economic air pocket / a divided economy

In our post-election game plan webinar I talked a lot about the economy and the difficult task our government leaders will have. In case you missed it, here is the replay.

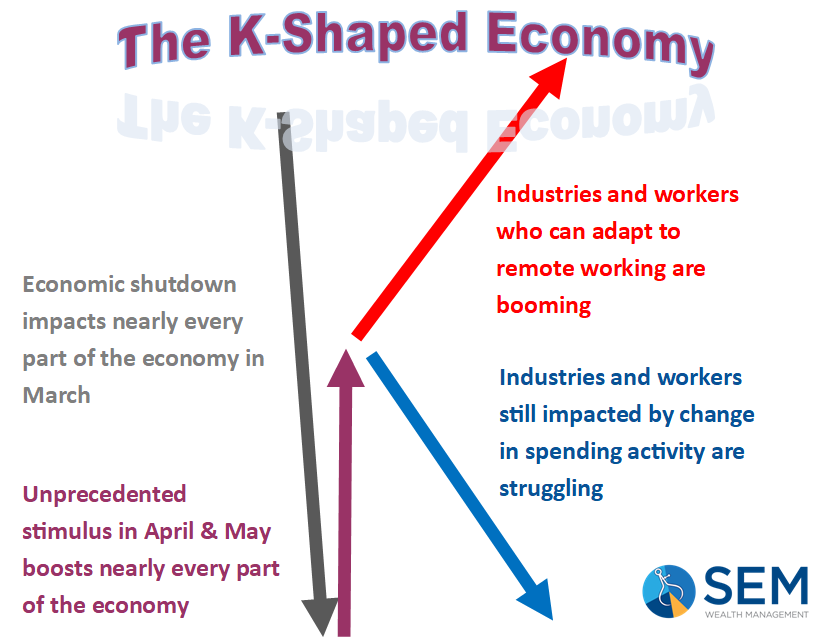

As part of that I focused on the K-shaped economy. The COVID outbreaks we are seeing is only going to make it worse.

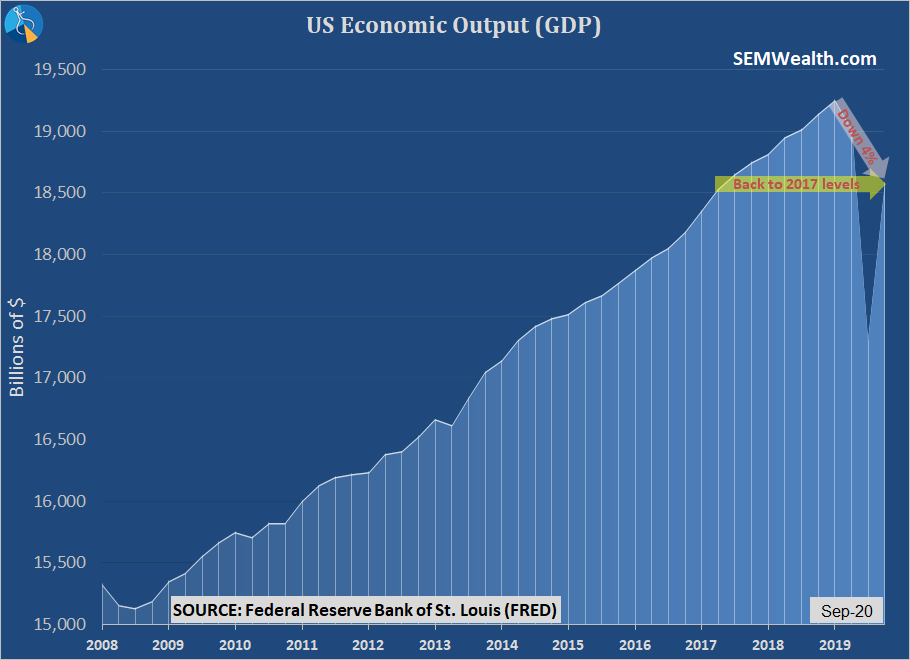

There has been some significant damage done. Many companies and Americans are at "all-time high" earnings levels, including many reading this blog. If you look at the entirety of the economy that means many companies and Americans are much worse off than just down 4%.

This is not a short-term problem. I shared a personal story about our K-shaped economy here:

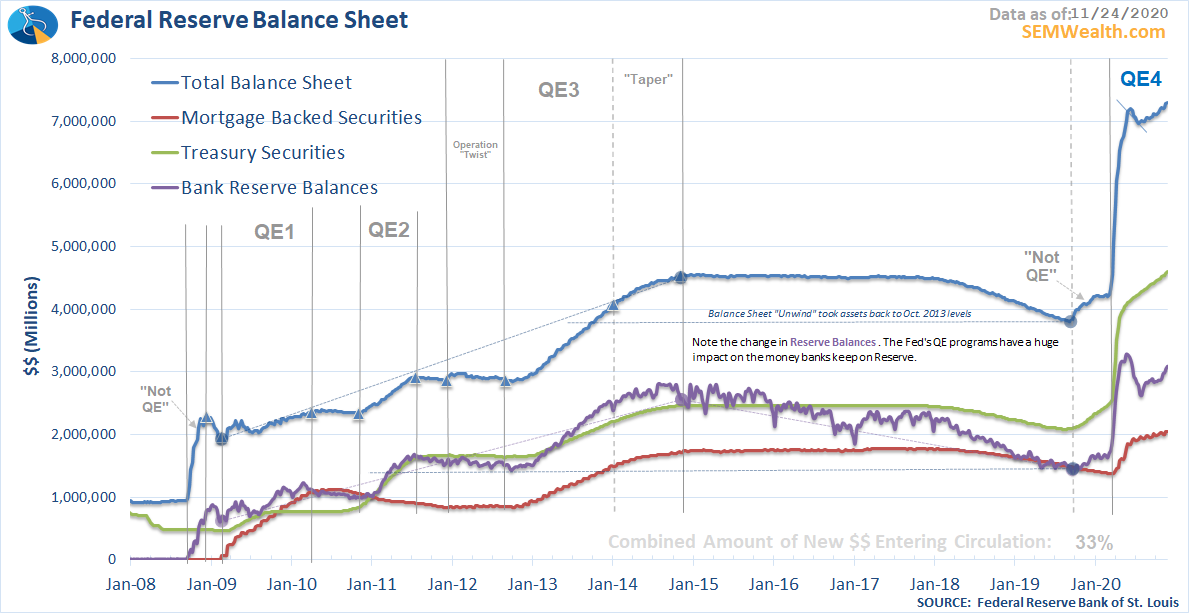

Fed tools are only designed for the short-term

Many people have clung to the fact the Federal Reserve will stop all economic damage. They have over and over again attempted to avoid recessions, yet we still have them and I've argued they make them worse by preventing damaged companies from going out of business sooner. This is an inefficient use of capital and is one reason economic growth has been so lackluster the last 20 years.

Here's my snapshot of the Fed's Balance Sheet. Notice on the far left-hand side of the chart they tried to reduce the stimulus in June, but since late July have had to again create more and more short-term stimulus to keep things afloat. There is no such thing as a risk-free bailout. Unwinding their interventions will cause unforeseen consequences to the markets and economy.

Sentiment is at extremes

Finally, last week I walked through some sentiment measures. I've done this long enough to know when these measures are at these levels there is a big drop coming that will surprise far too many people.

Investing is not easy. If you think it is, you're probably taking on too much risk. There's nothing wrong to our "boring", mechanical approach. It is designed to navigate all kinds of markets and has proven time and time again the value in our ability to side-step the worst losses, especially in our lower risk income models. The "positives" may indeed lead to a fun 2021, but the negatives will still be lurking. The more the market goes up, the more likely that big drop will be larger and faster than most people are comfortable with.