Last week I wrote how investors were in "Fantasyland" as earnings expectations not only do not reflect any sort of economic slowdown in 2023, but are pricing in an ABOVE AVERAGE growth rate. Two weeks ago we illustrated how our economic model is at best predicting a BELOW AVERAGE growth rate for the economy. The only way this will happen is if the Fed achieves a "soft landing".

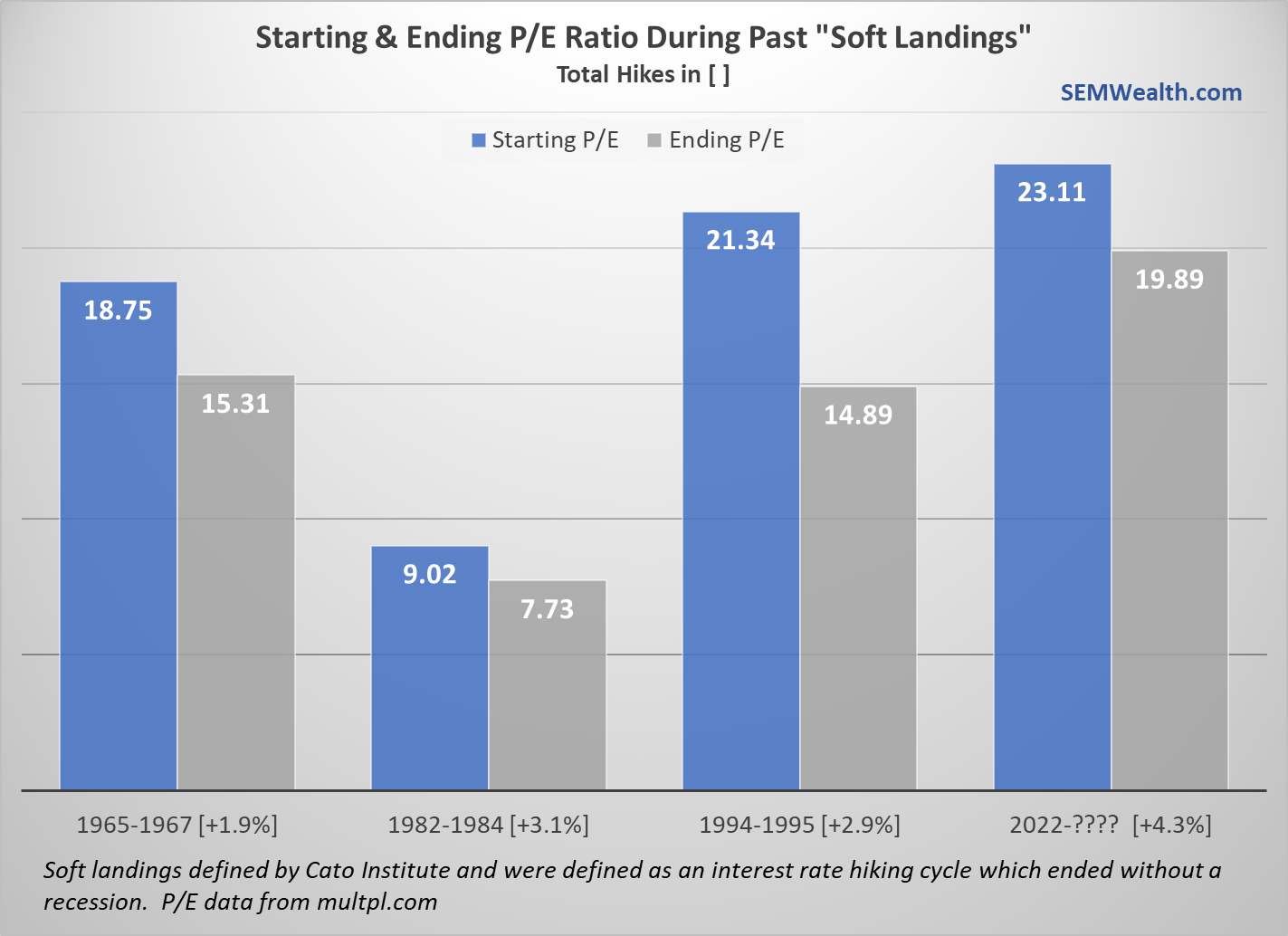

This is yet another term Wall Street likes to throw around to paint the picture of the current environment. A "soft landing" is an interest rate tightening cycle which does not end with a recession. According to the Cato Institute, we are in the midst of the 13th tightening cycles since 1954. The Fed has not triggered a recession just 3 times. Put another way, 75% of the time when the Fed completes a rate hiking cycle the economy is thrown into a recession.

The last "soft landing" occurred in 1994. I've seen many experts perform some pretty impressive logical contortions to justify the market prices by comparing today's environment to 1994. About the only thing I've seen them mention where I can see strong growth for the economy going forward is the demographic shift from the retiring Babyboomer generation and the much larger Millennial generation now entering their "peak" earning years. While I believe this will be a huge driver the last half of this decade, long-time readers know we have some STRUCTURAL issues to work through before we get there.

Ignoring everything else, there is one primary difference between now and 1994 – back the Fed actually knocked the P/E ratio down to a reasonable level (before it went absolutely ballistic in the last half of the 90s.)

To me this environment continues to look much more like 2000-2002. Many people forget the pre-Y2K spending boom in technology in the last few years of the 20th Century. Computer systems needed upgraded at every business. We saw a decade worth of capital expenditures pulled forward into 18 months. Making things worse, the Federal Reserve, fearing disruptions in the financial system flooded the economy with excess liquidity. When Y2K came and went with barely a hiccup, the Fed was forced to pull back that liquidity. The problem going forward was companies had no reason to spend money on technology. The growth in the last few years of the 90s was artificial and we needed a reset.

Remember, despite the 50% drop in stock prices from 2000-2002, the economy wasn't that bad. The recession was mild and only lasted from July 2001-November 2001. We were in an economic expansion in 2002, but that was the worst year of the bear market.

Consider today's environment. Unlike Y2K, the economy was broken by the pandemic. Businesses and individuals alike had to suddenly spend money on everything from laptops to software to webcams to desks and chairs. This time Congress and the Fed dumped 50% of GDP into the economy to help. This led to a spectacular boom in the stock market. Now as things attempt to "normalize" you have to wonder how many businesses or individuals need to spend money on technology or other upgrades. Based on the layoffs in the technology sector, the slowdown in spending could be expanding.

Our economic model is not predicting a collapse, but it is pointing to what could be a very slow and inconsistent economy ahead. It certainly isn't signaling an "all clear" for earnings growth like the market is pricing in.

Our granddaughter spent the night with us last weekend. Saturday morning she asked if we could go to the donut store (of course papa said 'yes'). During our drive she said, "Papa, I just really want to see a unicorn. I've waited my whole life to see one and I still haven't seen one yet." (she's 5) This reminded me of 5-year old Cody telling us, "I can't believe I'm 5 and haven't even seen the ocean yet." (We lived in Arizona back then.)

To me, the stock market behaves like a 5-year old. They don't know how to define the long-term. Not having seen something in 5 years makes it seem like it will never happen. Unlike with Cody, I've yet to figure out a way to find a unicorn for Aurora. She will be disappointed at some point, but this papa couldn't crush the imagination of a 5-year old just yet (and he'll probably leave it up to mommy & daddy to do so.)

However, any reader of this blog is not a cute, sweet, innocent 5-year 0ld, so I hate to break it to you – based on the data, my experience, and a study of history, the chances of you seeing a "soft landing" and justifying today's stock prices is slightly better than you seeing a unicorn.

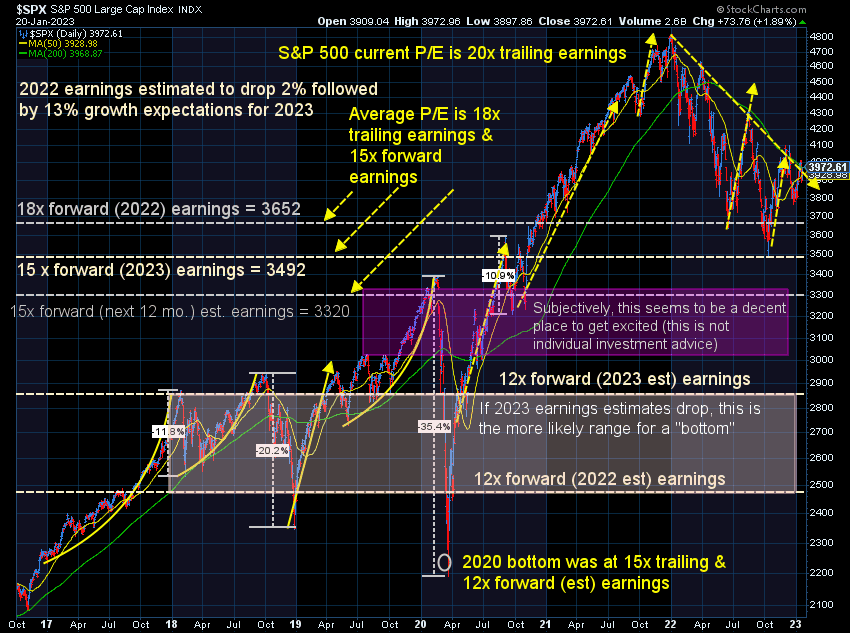

Turning to the market charts, technical/options traders seem to be uncertain about which way stocks should move next. When we see the market gyrating between round numbers it is usually because of derivative activities (which have triggers around various round numbers). Last week we saw both 3900 & 4000 levels on the S&P 500 providing support and resistance. The market could move up to 4100 and down to 3800 and still not provide much direction. Be careful.

We are still technically in a downtrend and as this chart shows, stocks are still technically overvalued. It's really tough to be excited by stocks at this point.

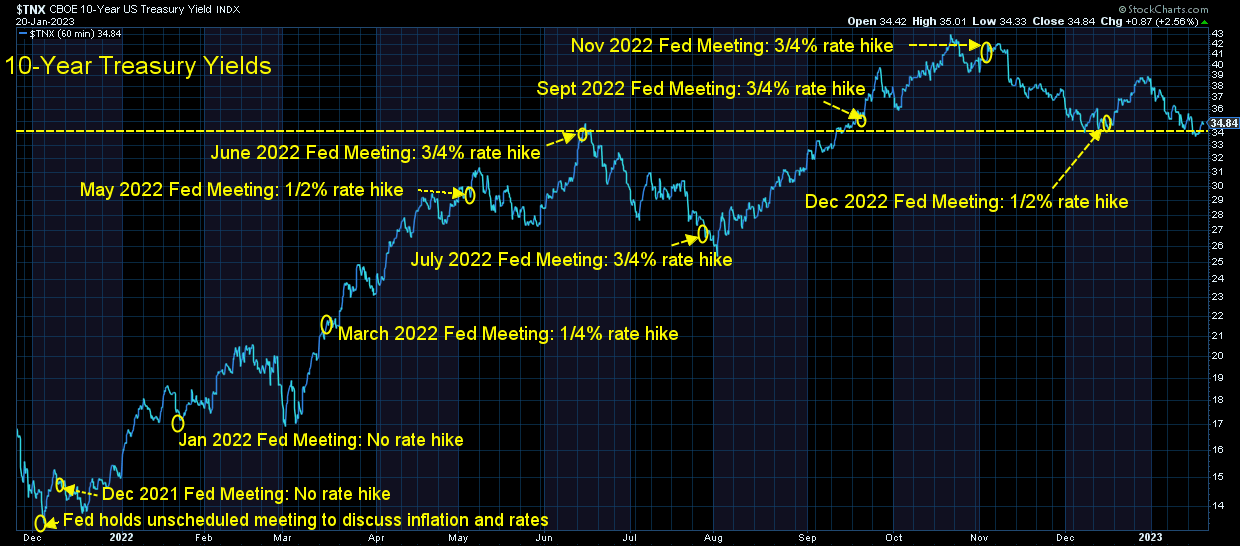

Turning to bonds, the 10-year fell to it's "pivot" of 3.4% and actually closed below it for one day. Same advice I gave on stocks – be careful. Rates (and prices) can move quickly. Volatility in bonds has cooled some, but they still are not a "safe haven" or diversifier inside portfolios.

Our systems remain cautious despite the strong first 2 weeks of the year. There will certainly be easy times to invest. Now is not one of them.