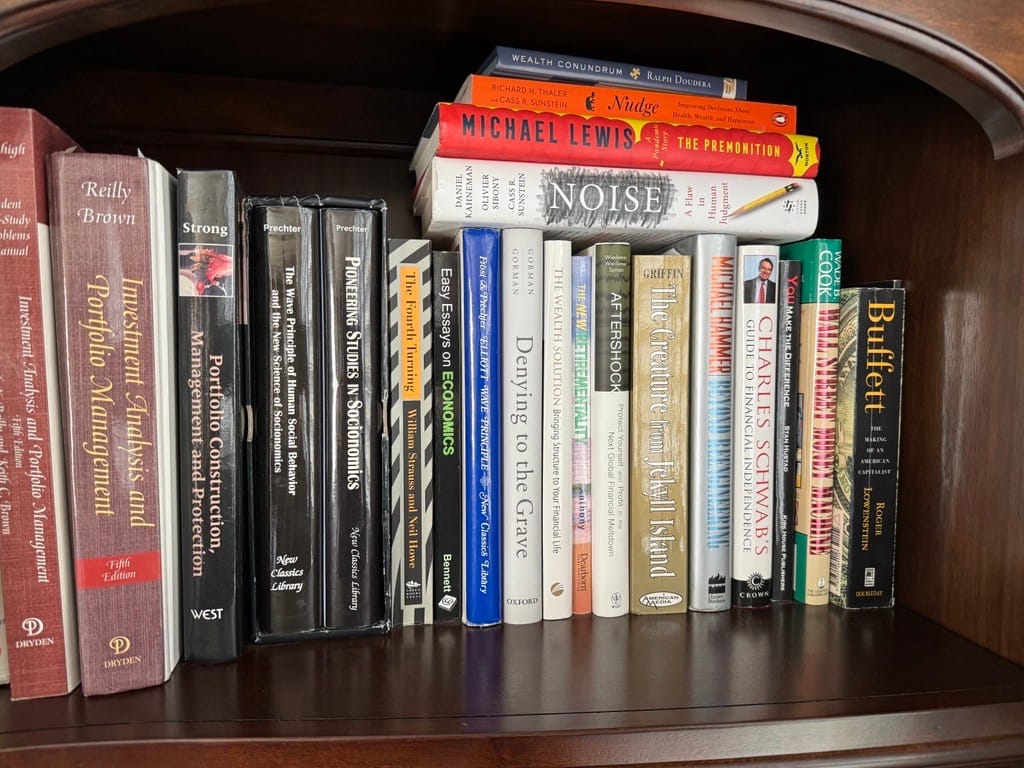

I have always said you can tell a lot about a person from what they choose to read (or in today's world if they still read). I didn't always enjoy reading, but my 11th grade American Literature teacher helped me find books that I enjoyed which fostered a love of reading that helped make me who I am today. Early in my adult life we would go to the library sometimes a couple of times a week. For vacations I'd check out as many books as they would allow. Because of this I purchased one of the first Kindles made. I currently have 607 books in my Kindle library. Most of those books are fiction, which I enjoy reading in the evenings to help shut my brain down.

I love the convenience of the Kindle for vacations, reading at night, and always having a wide range of books with you at all times, but there are certain books where I prefer the physical copy. Those books are ones where I expect to have the pages dog-eared and highlighted to reference at a later time. These books sometimes get split between my SEM office and my home office based on what is on my mind at the time. Here is a shot of one of the shelves next to my desk in our home office.

This week as I watched the stock and bond markets throw a mini-tantrum over a 0.1% "miss" on the CPI report, I found myself grabbing "The Creature from Jekyll Island". This book walks through the history behind the creation of the Federal Reserve and then proceeds to detail all of the times they have failed and the issues they have created. The latest (2nd) edition was published in 2010. I would think a 3rd edition should be due at some point in the next decade.

The irony of where the secret meeting of the big banks took place in order to form the beginnings of the Federal Reserve should not be lost. Jekyll Island is a gorgeous retreat, but I cannot help but think of "Dr. Jekyll and Mr. Hyde" when it comes to the Federal Reserve.

A few of the quotes on the dog-eared pages were:

The creation of the Federal Reserve allowed a handful of men to control the nation's money supply and interest rates, giving them unprecedented power over the economy.

The Federal Reserve is not federal, and it has no reserves. It is a banking cartel that benefits its members at the expense of the American people.

The Federal Reserve's power comes from its control over the issuance of money. By manipulating the money supply, they can create booms and busts in the economy.

The purpose of the Federal Reserve is not to promote economic stability, but to generate profits for its member banks.

That last quote was the one I was looking for after watching the market sell-off last week. Last week I posted our latest economic update. The headline says it all.

The economy is doing quite well. A few weeks back I noted how the Fed lowering interest rates would actually hurt the 'lower half of the K' (the average American).

So why would the Federal Reserve still even be considering lowering interest rates with the economy so strong? Read that last quote again:

The purpose of the Federal Reserve is not to promote economic stability, but to generate profits for its member banks.

Inside the Federal Reserve system there are "Primary Dealers" who are the trading counter-parties with the Fed to help them institute their policies. Here is the current list of the Fed's partners:

1st quarter earnings reports just started coming out last week. Here was one headline to summarize the 3 reports that hit on Friday:

The big banks have been complaining about the impact of higher rates since the Fed started hiking rates in 2022. There is no reason for the Fed to cut rates based on the DATA, but that doesn't mean they won't do it anyway if the stock market sells off too much.

The problem is we've become too reliant on the Federal Reserve over the past 15+ years (or longer). We EXPECT them to cut rates and help 'stimulate' the 'economy' every time the market goes down. Recessions are supposed to be cleansing in that they wipe out inefficient uses of capital and allows better companies to emerge and grow. The Fed's focus on the stock market hurts the creation of businesses and leads to the largest companies controlling too much of the market.

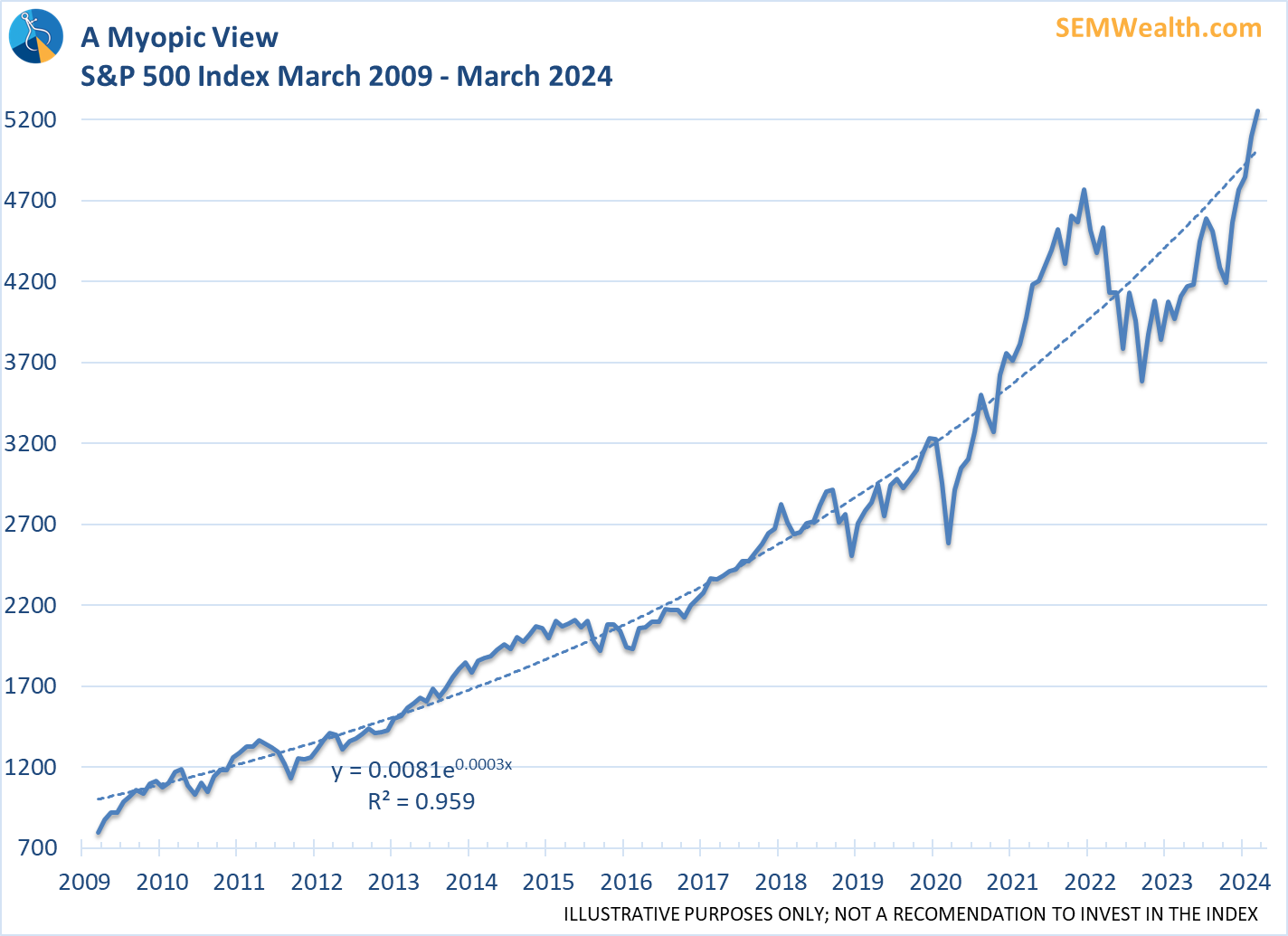

This is a chart of the stock market since March 2009. We've been conditioned to buy every dip because the market always comes back. What is missed is that every dip was fueled by a policy change by the Fed. The market bottomed most recently in late 2022 when the Fed hinted they were near the end of the rate hiking cycle. It's been off to the races every since.

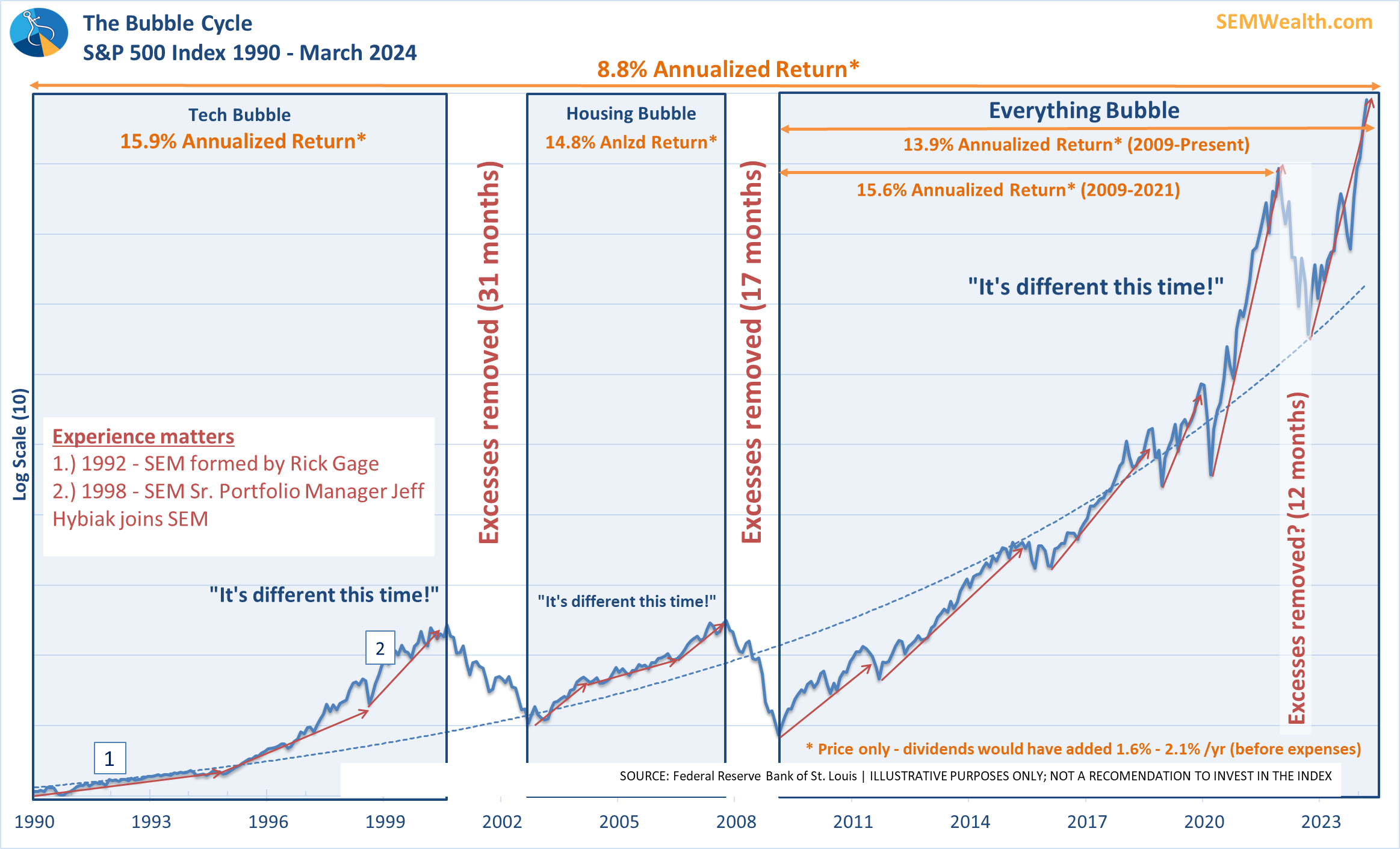

A reality check comes in when we zoom out to 1990 to see despite the Fed's best efforts (or because of their efforts) whenever we had long periods of time where the market enjoyed returns well above the long-term average, those excesses were painfully removed.

This quote comes to mind:

The Federal Reserve's power comes from its control over the issuance of money. By manipulating the money supply, they can create booms and busts in the economy.

Now, it could be argued that the 2022 drop in the market was enough to spark a 'new' bull market run. Stocks fell back to the long-term trend line before they started the stampede we are enjoying today.

My opinion is the market is due for a much bigger correction, but we do not invest based on our opinions. The 'Market Charts' and 'SEM Model Positioning' sections below have additional details on what we are watching and how we are positioned.

Market Charts

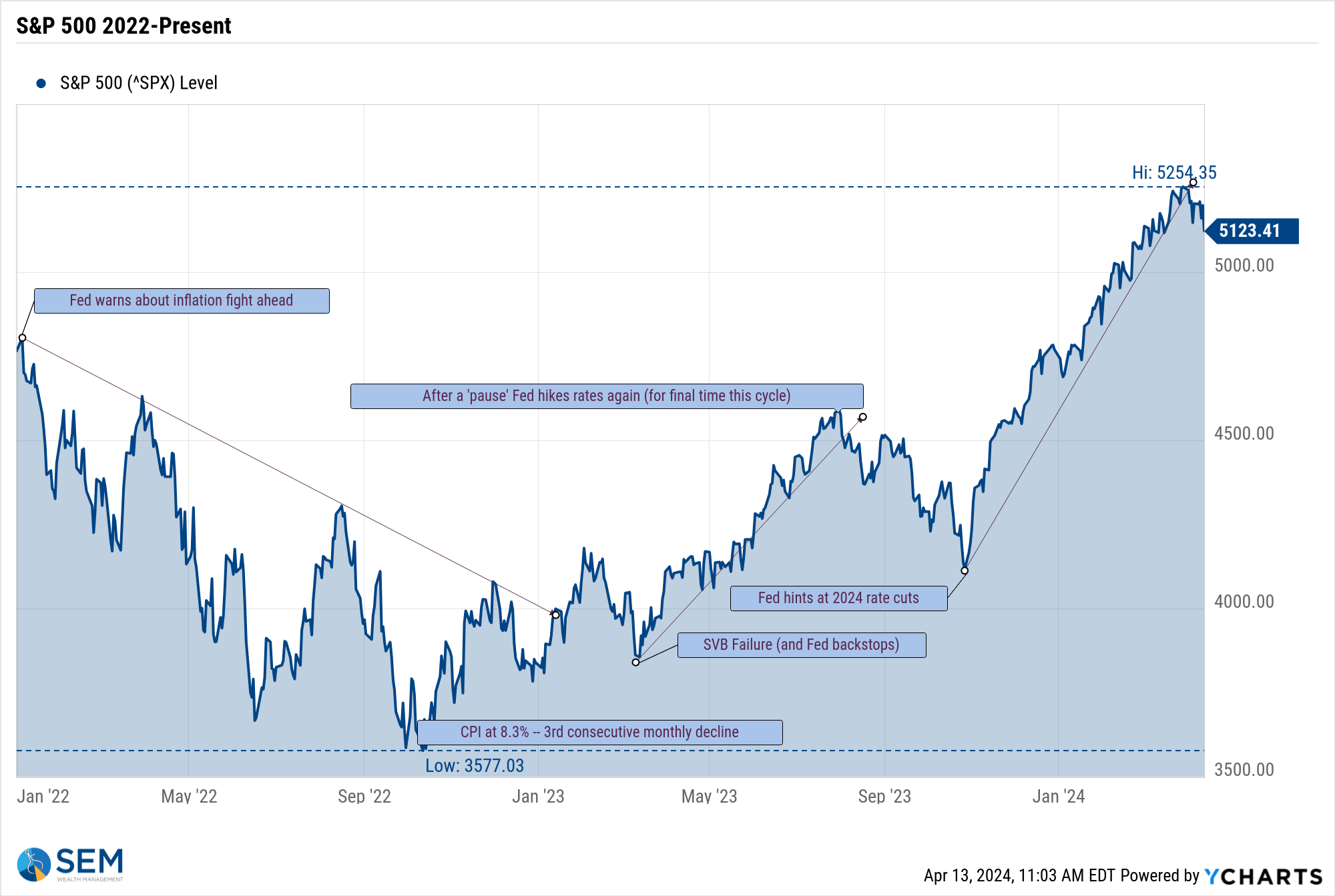

Here is a very simple chart illustrating the impact the Fed has had on the markets.

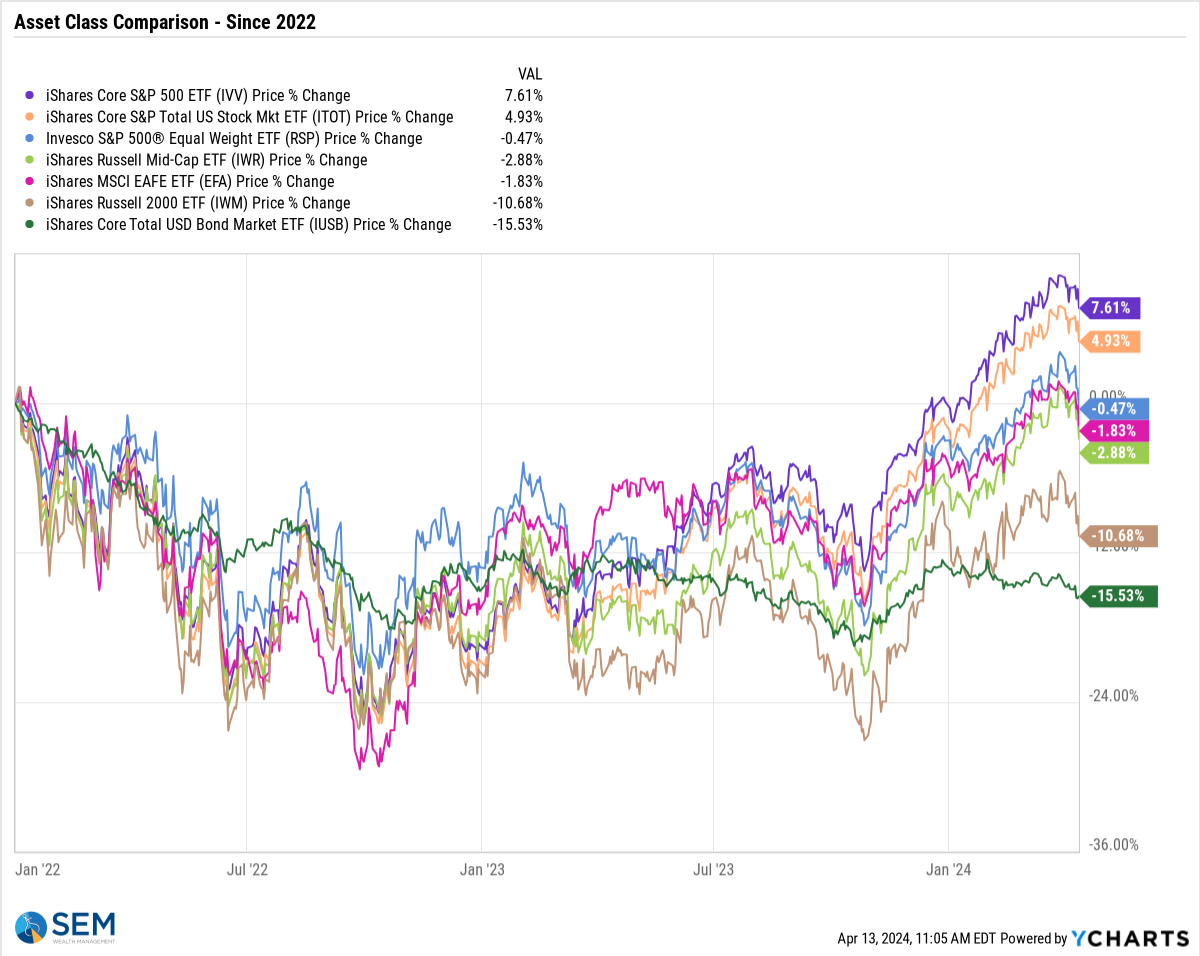

The performance since the inflation fight began has been quite mixed. The largest companies have pulled the "index" higher, but smaller companies continue to struggle.

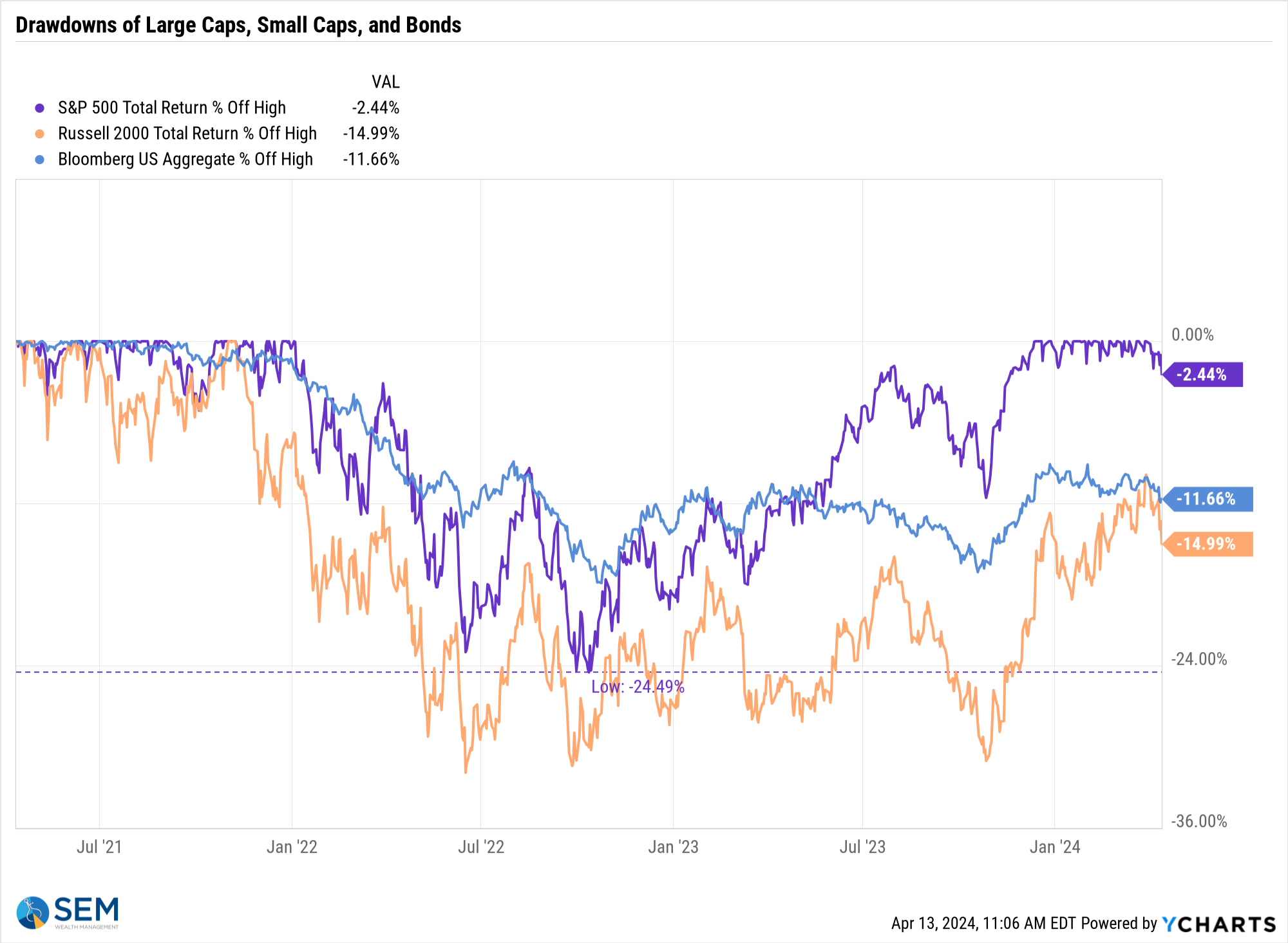

Despite the sell-off last week, the S&P 500 is only 2.4% from its all-time high. Small cap stocks are 15% off their 2021 highs and bonds are still 12% from their all-time high.

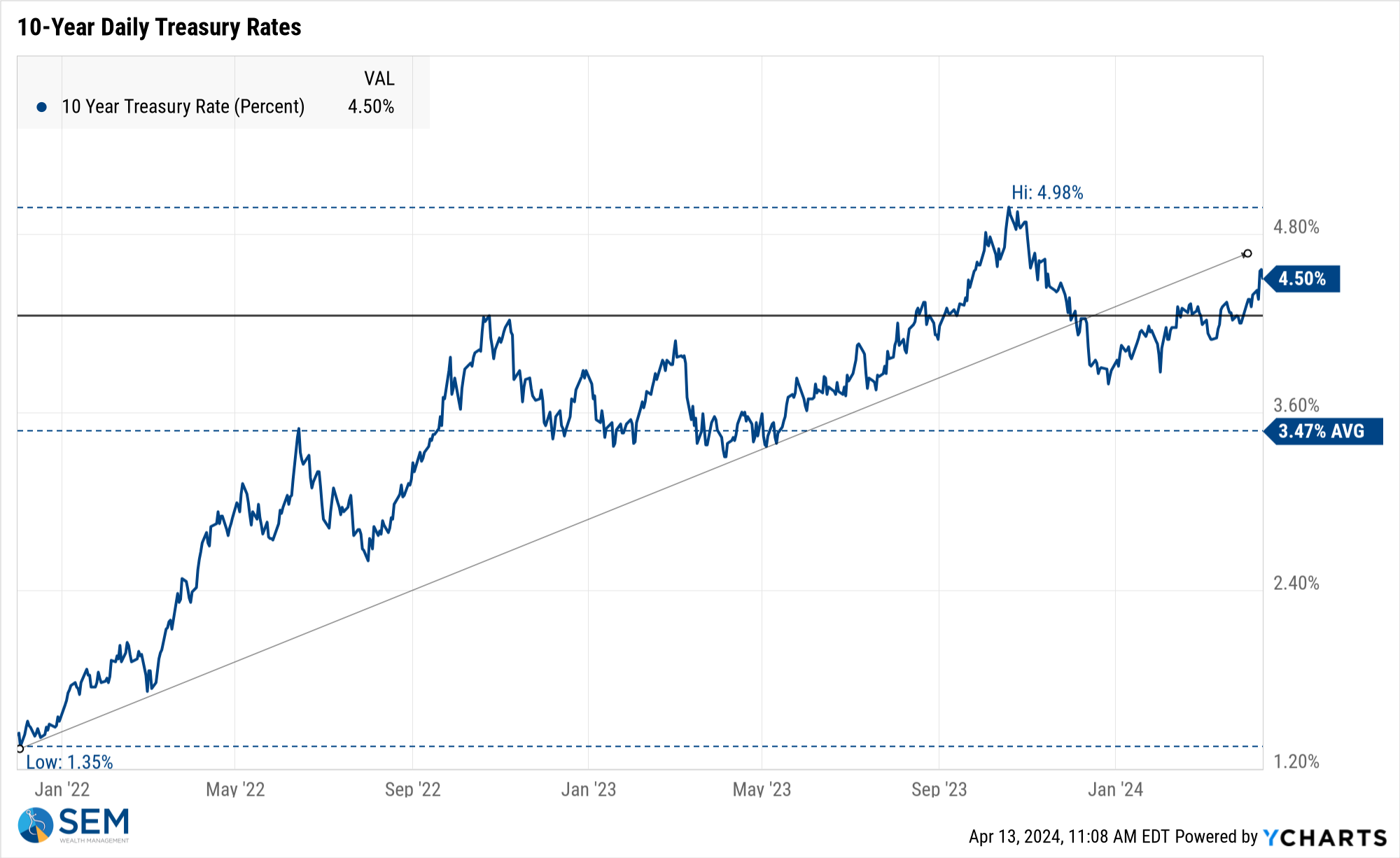

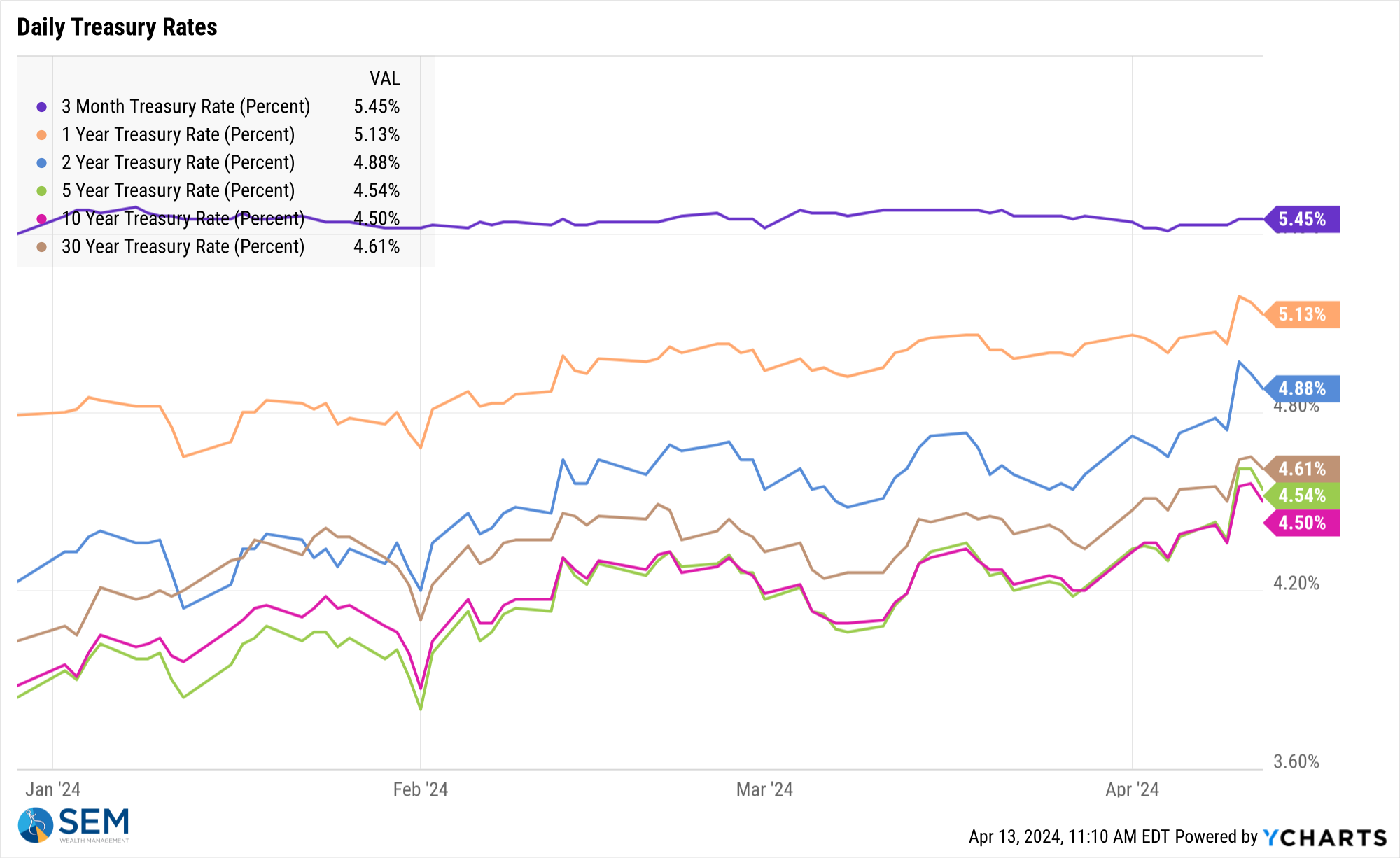

Speaking of bonds, the bond market has not bought into the Fed's assertion that rates should be cut. Inflation erodes the value of interest payments. The bond market is saying rates should be HIGHER, not lower based on the current (strong) economic environment.

10-year yields started the year at 3.9% and are now above 4.5%.

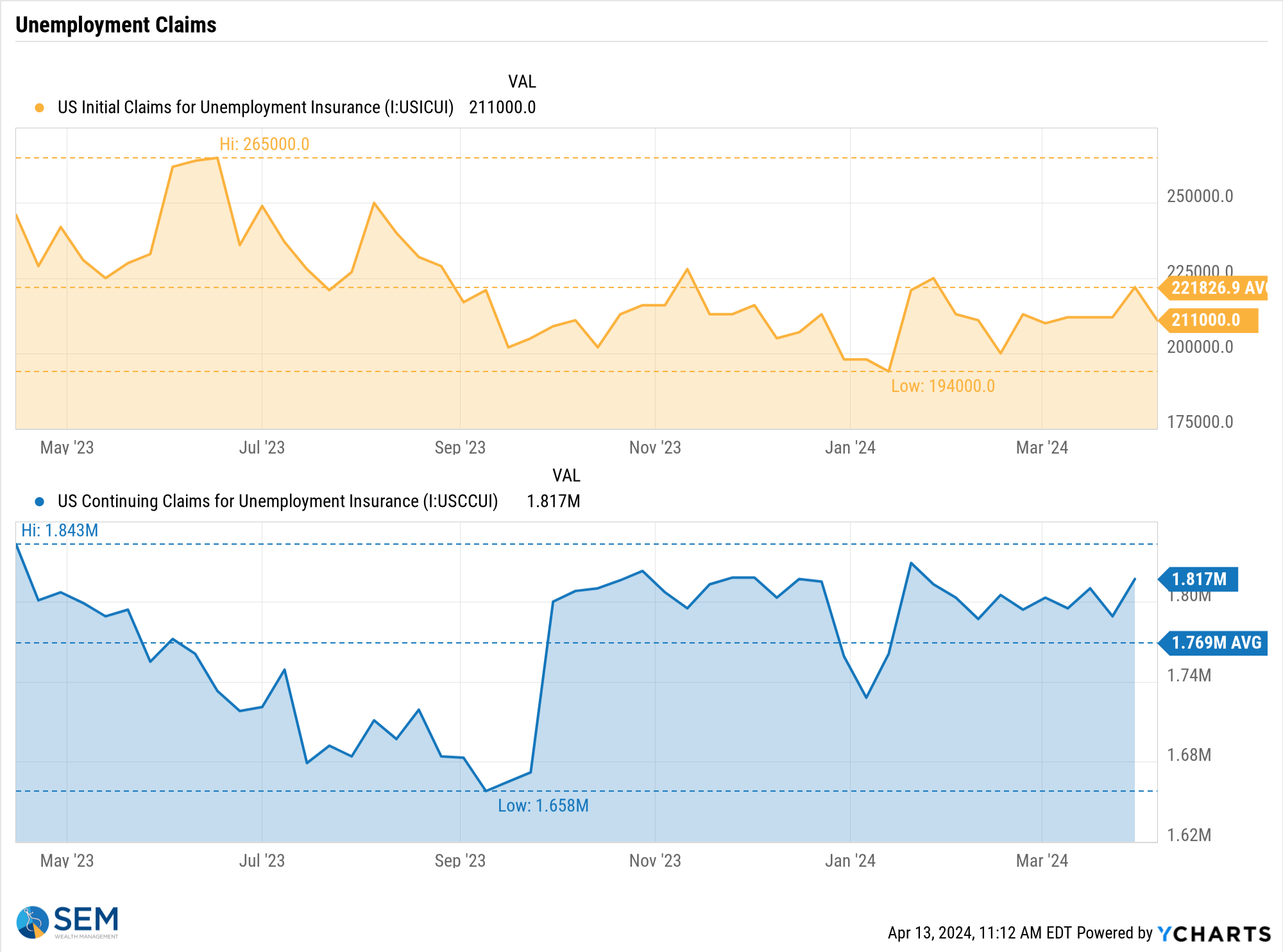

Speaking of the economy, the one key metric we are watching is Jobless Claims. Initial Claims appear to be coming back down, but the move higher in Continuing Claims could be a warning that the labor market is weaker beneath the surface than the data currently shows (and something the Fed uses as an excuse to cut interest rates).

SEM Model Positioning

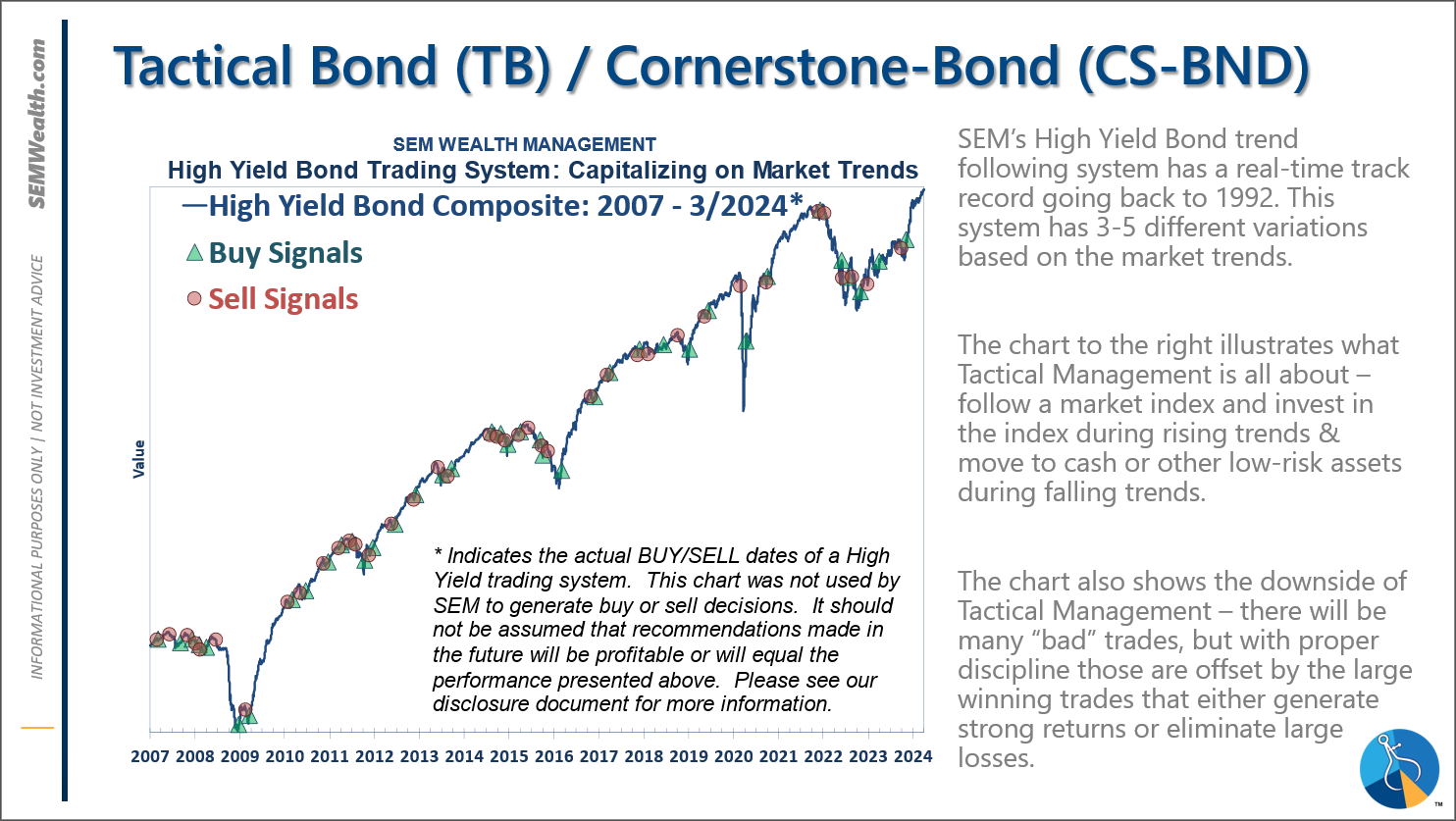

-Tactical High Yield went on a buy 11/3/2023

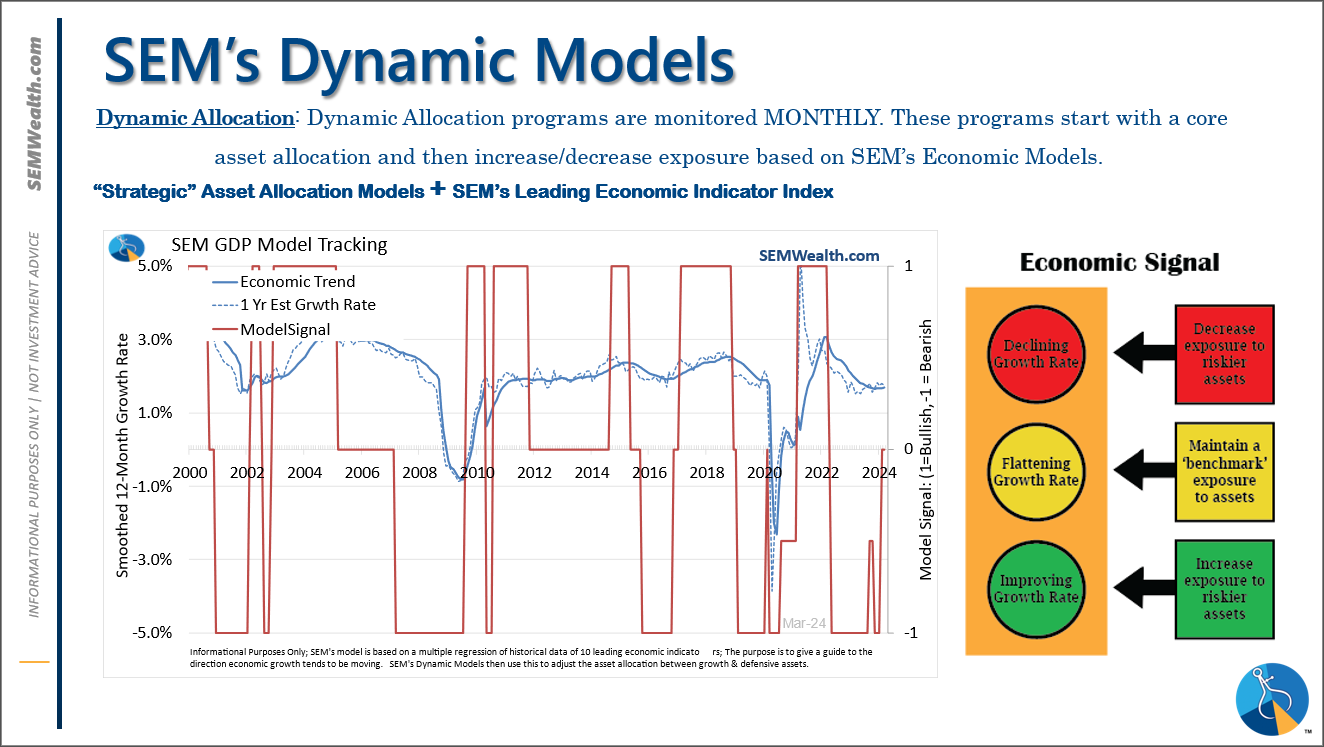

-Dynamic Models went to 'neutral' 2/5/2024

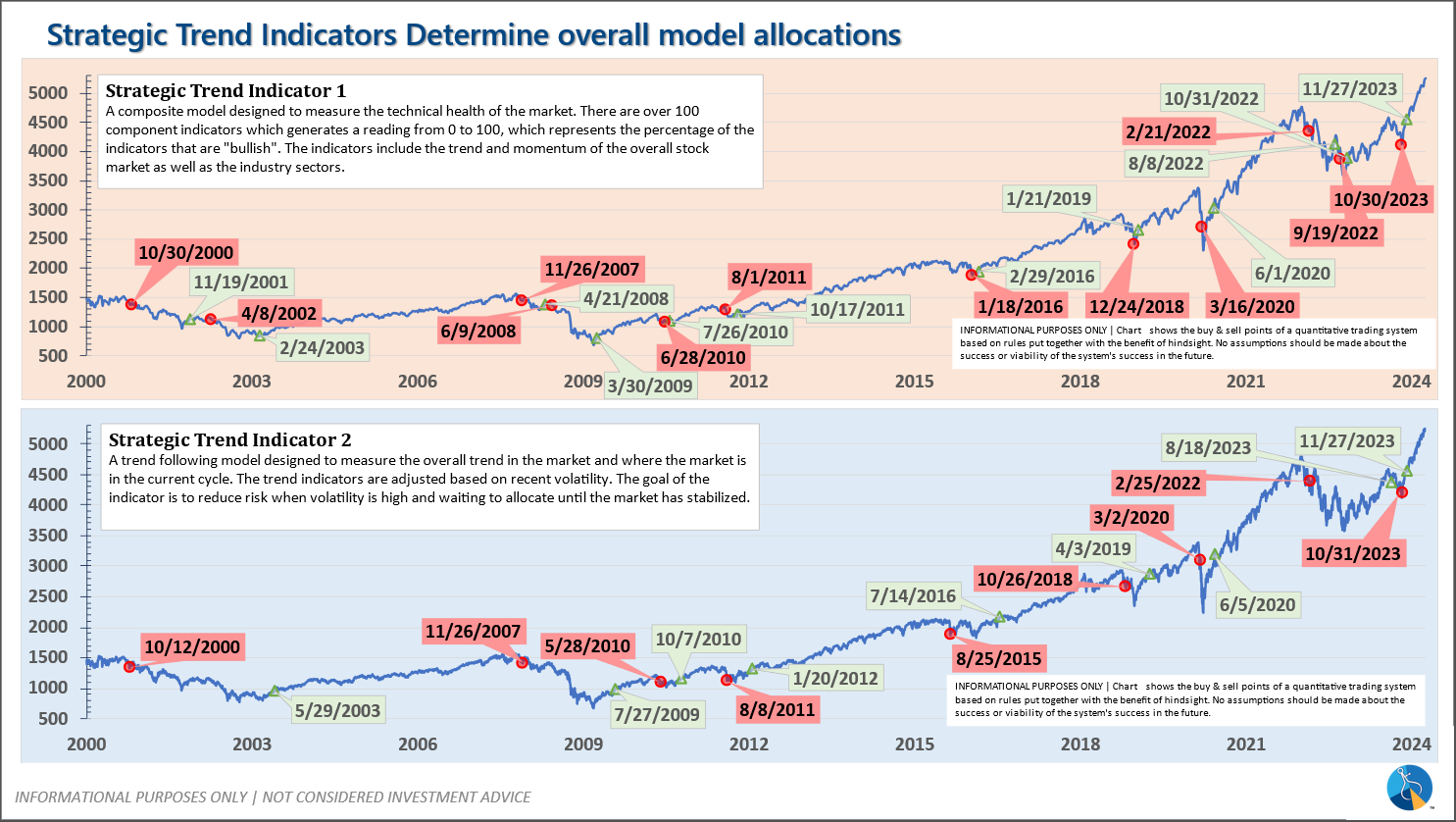

-Strategic Trend Models went on a buy 11/27/2023

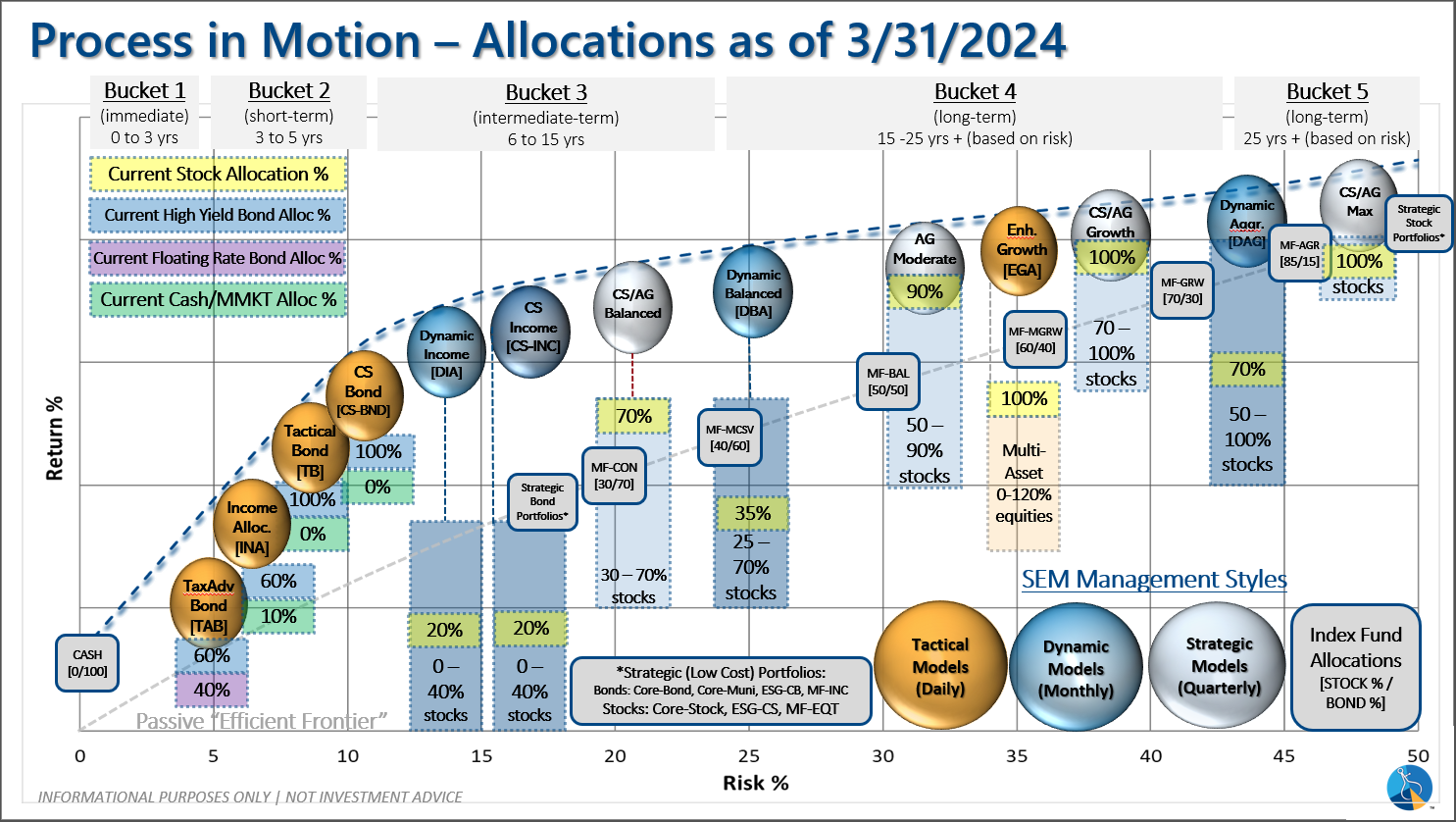

SEM deploys 3 distinct approaches – Tactical, Dynamic, and Strategic. These systems have been described as 'daily, monthly, quarterly' given how often they may make adjustments. Here is where they each stand.

Tactical (daily): The High Yield Bond system bought the beginning of April and issued all 3 sell signals 9/28/2023. All 3 systems were back on buy signals by the close on 11/3/2023. The bond funds we are invested in are a bit more 'conservative' than the overall index, but still yielding between 7.5 -8.5% annually.

Dynamic (monthly): At the beginning of December the economic model reverted back to "bearish". This was reversed at the beginning of February. This means benchmark positions – 20% dividend stocks in Dynamic Income and 20% small cap stocks in Dynamic Aggressive Growth.

Strategic (quarterly)*:

BOTH Trend Systems reversed back to a buy on 11/27/2023

The core rotation is adjusted quarterly. On August 17 it rotated out of mid-cap growth and into small cap value. It also sold some large cap value to buy some large cap blend and growth. The large cap purchases were in actively managed funds with more diversification than the S&P 500 (banking on the market broadening out beyond the top 5-10 stocks.) On January 8 it rotated completely out of small cap value and mid-cap growth to purchase another broad (more diversified) large cap blend fund along with a Dividend Growth fund.

The * in quarterly is for the trend models. These models are watched daily but they trade infrequently based on readings of where each believe we are in the cycle. The trend systems can be susceptible to "whipsaws" as we saw with the recent sell and buy signals at the end of October and November. The goal of the systems is to miss major downturns in the market. Risks are high when the market has been stampeding higher as it has for most of 2023. This means sometimes selling too soon. As we saw with the recent trade, the systems can quickly reverse if they are wrong.

Overall, this is how our various models stack up based on the last allocation change: