I'm not sure if keeping track of how many weeks helps, but we're entering the 5th week since the country began shutting down. I was in Tucson for my quarterly trip to our office there when the panic really began. That was the week the NBA and then all other sports shutdown. I was happy to be able to get home. 2020 has been quite a year. Seems forever ago, but Cody wrote an insightful piece at the beginning of February talking about the "irrational election process." He and Courtney created a picture of a reverse PB&J. Courtney shared this meme with us in our family chat over the weekend. I think it accurately portrays the year thus far (as well as the election process Cody wrote about).

We're all being inundated with information. As the Outsourced Chief Investment Officer (OCIO) for so many financial advisors across the country, I'm forced to read and digest all the information. You don't have to. I couldn't possibly write a blog on each topic, so here's my weekly "brain dump" of everything that came to my mind over the weekend:

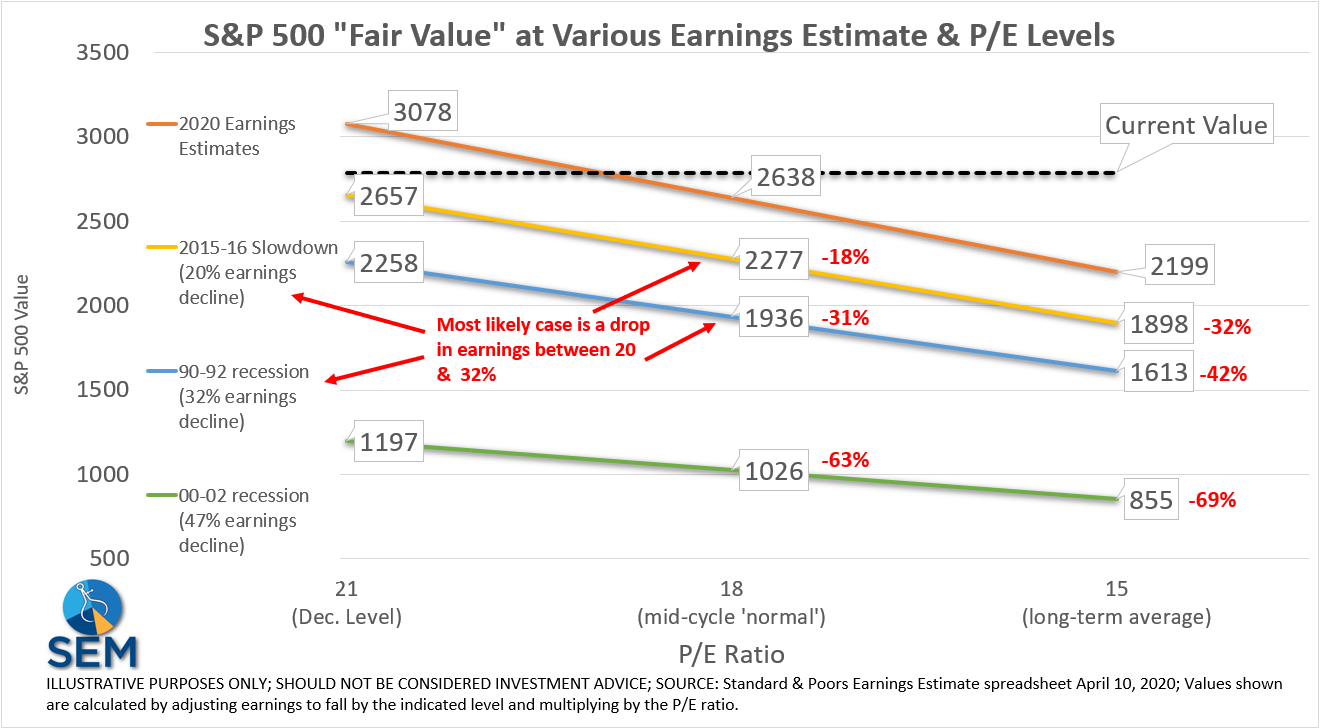

-The market is coming off one of the best week's in the history of the market (and we only had 4-days.) Anybody arguing stocks are still a good value are living in fantasyland. They never really got to an attractive place and now anybody buying is risking SERIOUS declines in their portfolio unless we return to the economic / earnings growth rates we saw at the beginning of the year very quickly. Analysts are now expecting just a 7% drop in earnings in 2020, but then expect 2021 earnings to rocket all the way back to where they were in 2019. [For more see the second half of our "Valuations" article]

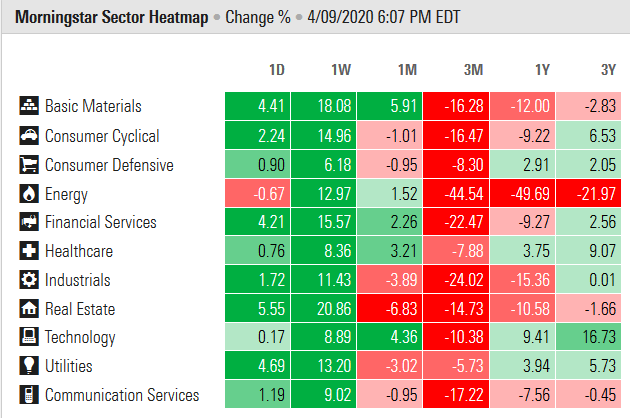

-Watching the markets the past few days it looks more like some large rebalances rather than true volume coming into play. We saw one day at the end of March which saw $160 billion to buy on close. It moved the market 3% in 30 minutes. SEI and Blackrock had announced they would delay their quarterly rebalancing to April. I'm not sure if/when they implemented these, but think about how a "strategic" portfolio works. You have your set allocation to a broad range of asset classes. Periodically you have to buy those things that went down the most and sell those that went up the most. Generally this quarter we'd see those portfolios buying stocks and selling bonds. As you look at sectors and style boxes, you see the worst of them having the best returns last week.

-Normally I'd be encouraged by small caps doing so well, but with so much money moving to passive allocations we have lost a lot of the "price discovery" that was so valuable. The next few weeks will tell us whether true investors are buying into small caps and value stocks or if this was a false flag.

-We've been fortunate enough to still be able to go to our office (5-minutes from our house) during this "stay-at-home" order. All the remaining employees in our Virginia office are our family members. Today we are having to use our "disaster recovery" site (our house) as we deal with severe thunderstorm warnings, power outages, and tornado warnings. Our house has a basement and an always-on-generator. Down to just one screen today, but it's nice we have this option.

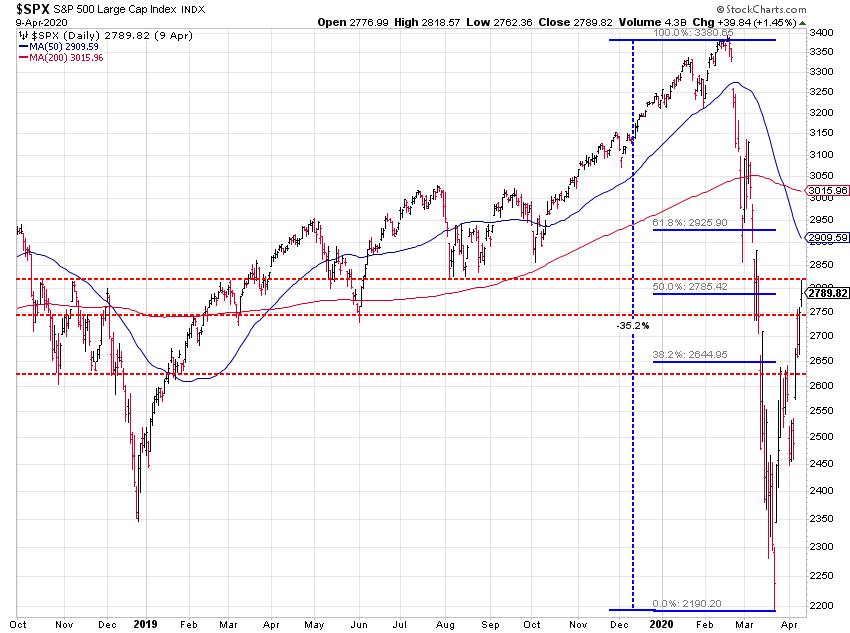

-Way back at the depths of the sell-off in March I highlighted a few areas where the market was likely to bounce. The first wave would take us to ~2650 on the S&P, the second wave to ~2825. Here is the updated chart with the original lines. We hit 2825 intra-day, which takes us back to where the market was at in August & September of 2019 (among many other points the last 18 months).

-I see some people citing China as their justification behind the "rocket ship" recovery. I think that is wrong. First of all, we were slower to react than China in shutting the country down. (We were slow, apparently, because China flat out lied (again) about how quickly it was spreading. Their first case was in mid-November and doctors in December were getting the disease after treating the patients.) Secondly, China is a communist country with communist controls. Some of the ideas being floated by economists to quickly open the country would mean our citizens giving up many civil liberties to allow our movements and ability to transact to be severely restricted. Finally, we are a service economy and don't manufacture much of anything. China is back to work trying to again produce all the things that have been disrupted.

-Our over-optimized supply chain (and profit margins) have been exposed during this panic. Hopefully it is a wake-up call to business and government leaders that we can't rely on one communist country to provide all of our goods.

-One thing being lost in the "rocket-ship" assessment is the fact like the Coronavirus, it is attacking the weak. The Federal Reserve is trying to prop-up every single sector that is weak, but that will create more issues down the road (more on that later). Corryn sent us this picture during her weekly shopping outing. The lady then took the same wipe and cleaned the counter and keypad before putting it back against her mouth.

-I find it interesting how so many people are suddenly medical experts and are (selectively) listening to the recommendations of doctors. I thought this meme was fitting.

-I understand businesses shouldn't have to suffer when it was the government shutting the economy down. However, that doesn't mean those who take huge risks and made billions of dollars by taking those risks should be bailed out. Unfortunately that is what we are seeing. Bloomberg posted this article about all the big bets Wall Street was making that have been exposed. As I said in the aftermath of the financial crisis, if you don't punish those who took on too much risk and needed bailed out, they will be incentivized to do it again. Guess who's on the hook? Taxpayers.

-In case you missed it on Thursday, the Federal Reserve is now buying both individual junk bonds as well as junk bond ETFs. Now they aren't allowed to do this, so they are merely serving as the banker for the US Treasury department. In the 800+ page "CARES" Act, there was language that authorized the Treasury Department to create Special Purpose Vehicles (SPVs) to be funded by money from the Act. These vehicles are directed by the Treasury Department to purchase and hold assets it deems necessary. A few weeks ago those vehicles included the ETF LQD (Investment Grade Bonds). On Thursday they added HYG & JNK to the list. The Treasury Secretary (former Goldman Sachs banker Steven Mnuchin) serves at the pleasure of the President. Remember all those times Donald Trump lamented the lack of actions by the Federal Reserve? Guess who essentially controls the actions of the Federal Reserve now? I guess the old adage, "never let a crisis go to waste" certainly applies here.

-I cannot begin to describe the anger I have towards the lack of responsibility in these actions. Two of the primary ETFs being bought by the Fed are iShares. iShares is owned by Blackrock. Blackrock became the largest investment manager in the world as so many people moved to passive management. They willingly took in all those assets and all the fees related to them. ETFs are great vehicles when you can match buyers with sellers (or as we saw so many times the last 10 years more buyers than sellers). When you have too many sellers, the ETF issuer is on the hook to purchase the assets inside the ETF. Rather than have Blackrock have to take the losses the Fed/Treasury has made sure the US taxpayer will endure the losses. Even better, guess who the Fed hired to make these trades on their behalf? You guessed it, Blackrock.

- I really wish I was kidding. I didn't think we'd have the political will to again bailout Wall Street, but Americans simply don't care. As I posted on Facebook, Republicans love socialism. It's not the same socialism that the liberals are endorsing. Instead Republicans love to use taxpayer money to bailout the mega corporations. Little guys like us don't stand a chance.

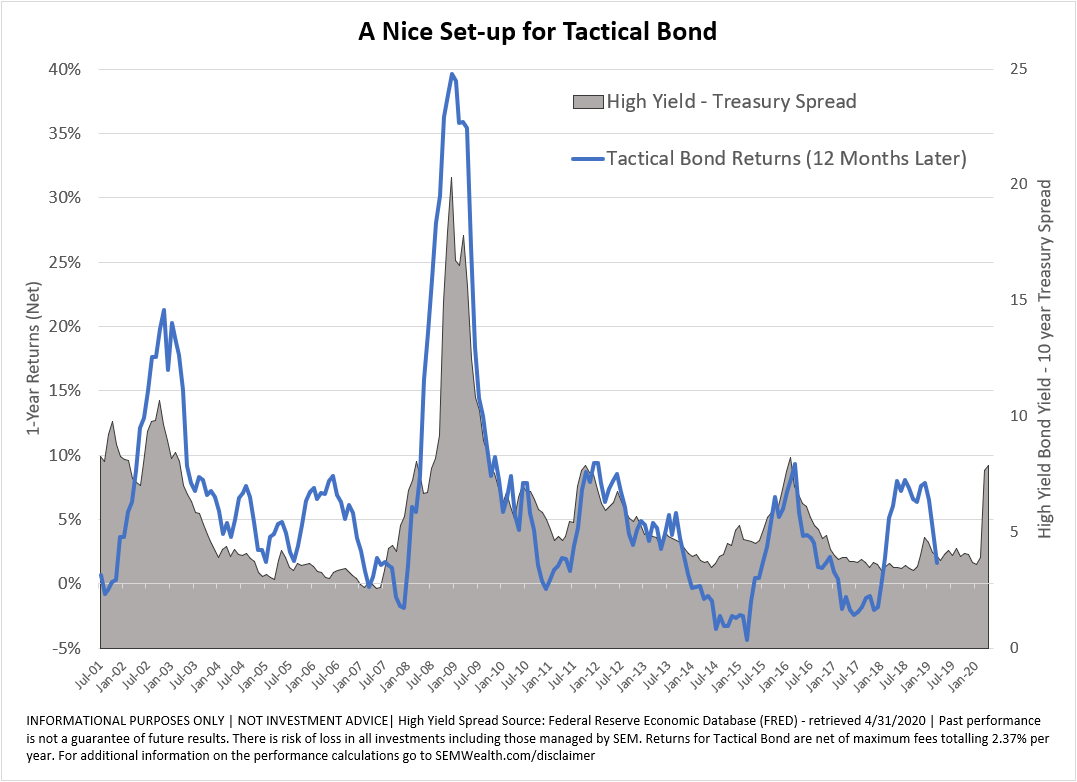

-I've been asked a few times since the Fed's latest announcement if this takes away our opportunities. My answer was, "no, it just makes them look different." We will both see some benefits earlier – Tactical Bond made around 0.85% on Thursday with a tiny 12% allocation to high yield bonds and Dynamic Income made around 1.1% with only a 20% allocation to high yields. We also have to keep in mind the Fed/Treasury cannot buy everything. The real purpose of their purchases (not counting the JNK/HYG purchases) is to protect companies who were reated at least BBB- before the shutdown and are still rated above BB. In other words, the "fallen angels" would be protected, but the junkiest of the junk is still at risk of default. I still wouldn't want to be in any other fixed income investments outside of Tactical Bond and Dynamic Income Allocation. The Fed's actions always have unintended consequences.

-I couldn't help but think of this again on Thursday.

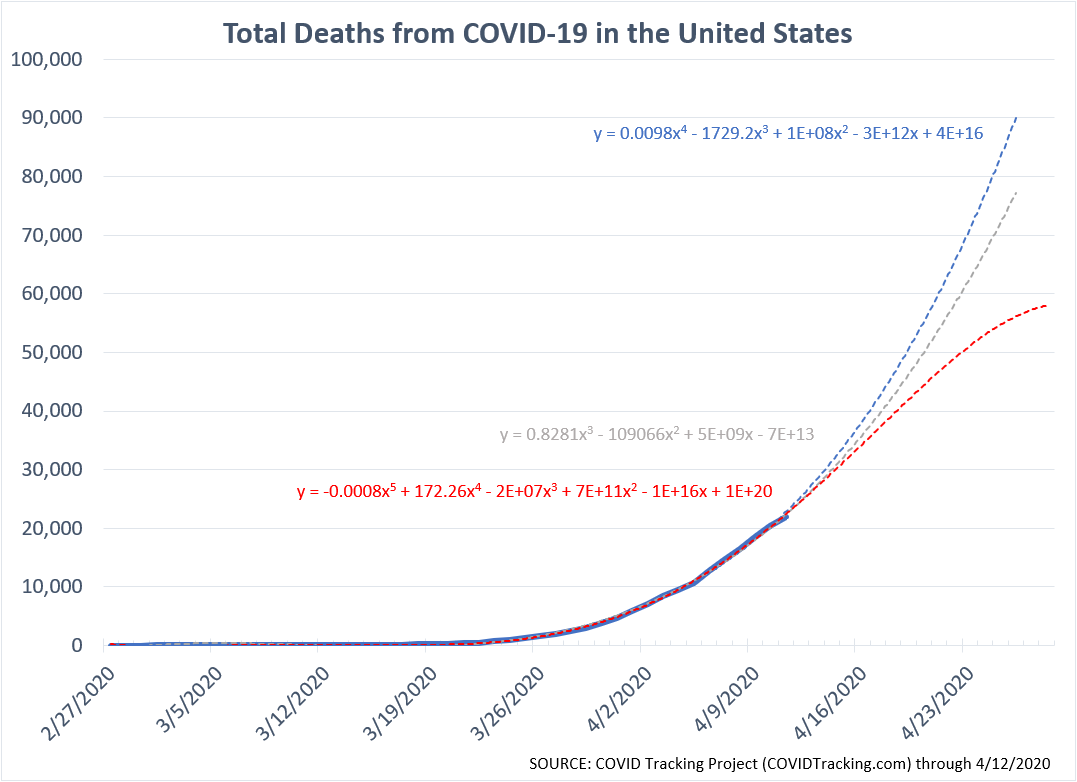

-We are certainly flattening the curve. Here's the updated chart from my "Worse Before it Gets Better" blog. I'll continue to update those charts several times throughout the week.

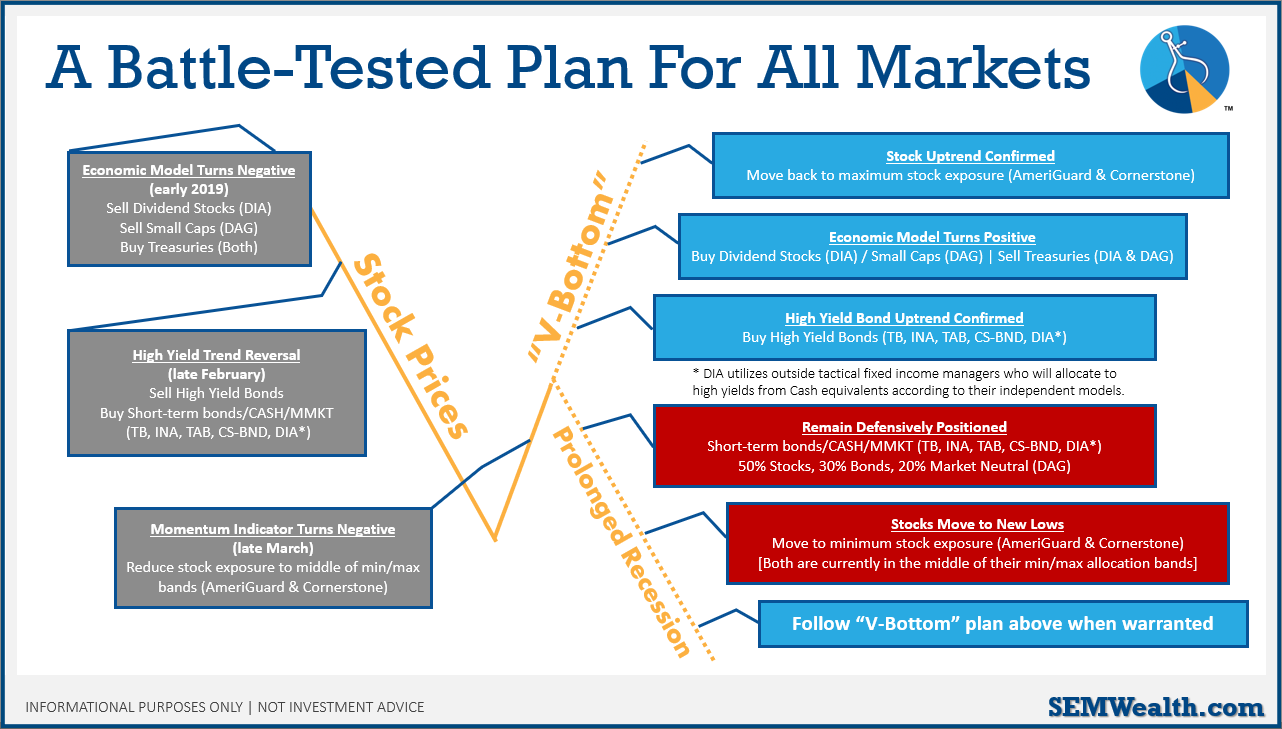

-Regardless of what happens, know WE HAVE A PLAN. We laid it out last week in this blog post. Based on the Fed's unprecedented actions we may have both a "V-Bottom" initially and then the Prolonged Recession. Just because the Fed is buying some high yield bonds, does not mean they will prevent a large round of defaults.

-Don't give the big firms a break. They didn't see any risks at all in the economy. We did. In fact we specifically warned about the "complacency" in the market as 2019 ended and said our biggest concern was the "unexpected". Big firms never see risks and always want you to stay invested.

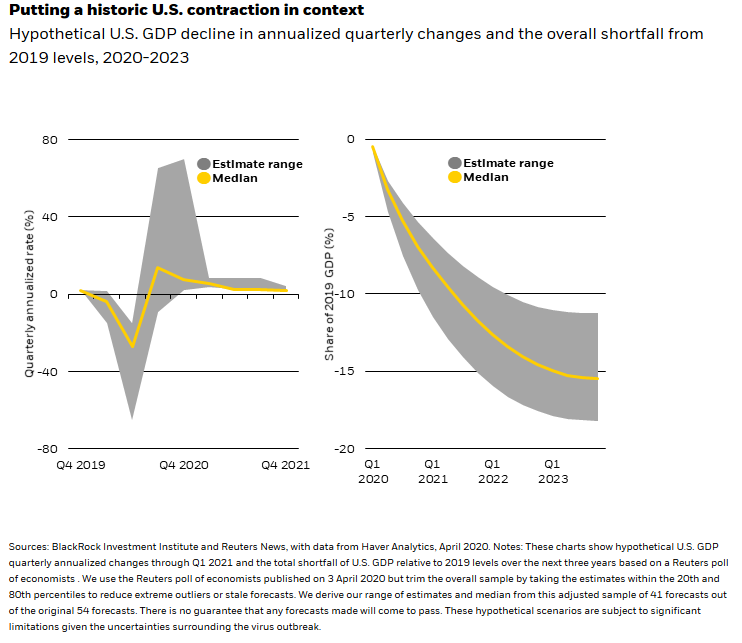

-Speaking of big firms, I was surprised to see Blackrock the only one actually mentioning the prospects of a prolonged slowdown in the economy. (The cynic in me says it's because they are now able to sell their ETFs to the Fed and get paid to sell them even though I know these are completely different divisions.) They are cautious on the outlook and illustrated the hit to GDP in their report.

-There are on-going debates about "opening the economy". I hope it can open quickly, but also I don't want us to go too fast and end up with another rapid shutdown. This is how I feel about the daily press conferences and the indications they give us about when we can get back to "normal":

-If you've found the blog content useful the past several weeks, make sure you share it with your friends, family, and colleagues. Special hat-tip to Dustin and Courtney for moving the blog to a new server and a new format. It took quite some time, but it was well worth the wait.

I think it's time to hit the publish button. We've already had one tornado warning today. It's going to be an interesting week. Stay tuned to the blog for all the latest updates.