The Mega Cap Growth Market

If you’re an investor in an S&P 500 or related index fund, you’ve had a pretty good 18 months. Ignoring a couple of quick, scary drops, you’ve had a pretty good 15 years.

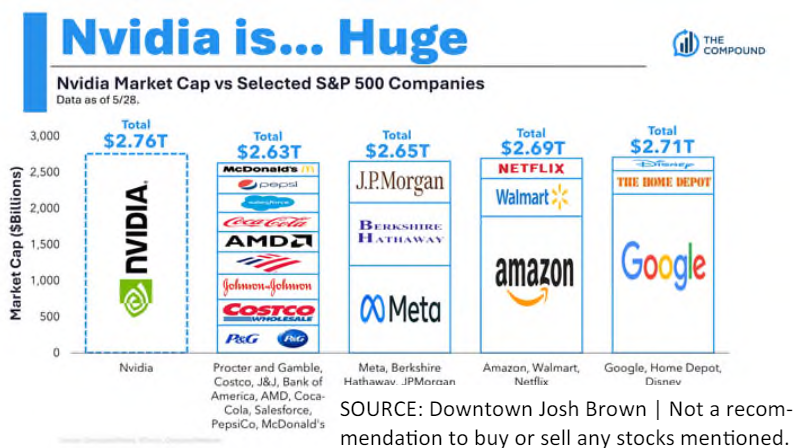

The largest companies have become behemoths who dwarf the rest of the market. While the returns have been spectacular, market history, economic fundamentals, and simple logic tells us this is not healthy for the long-term. The graphic to the right illustrates how big Nvidia has become relative to other mega-cap US companies. History will tell us whether or not this made sense, but looking back at the past, whenever just a handful of companies comprised such a large percentage of the S&P 500 it was followed by a reset of prices. These mega-cap companies have to continue to generate strong sales growth to justify their high stock prices. Those sales have to come from the rest of the economy. If the small and mid-size companies are struggling, sooner or later sales growth will slow.

When that happens is anybody’s guess. At SEM we are continuing to ride this trend higher and did throughout the first half of 2024. As a fiduciary and risk manager we simply cannot blindly invest all of that money in an S&P 500 index fund because the index has become too reliant on the top 10 stocks in the index. While this diversification may reduce returns somewhat compared to the S&P 500 market history tells us this is prudent.

This isn't normal

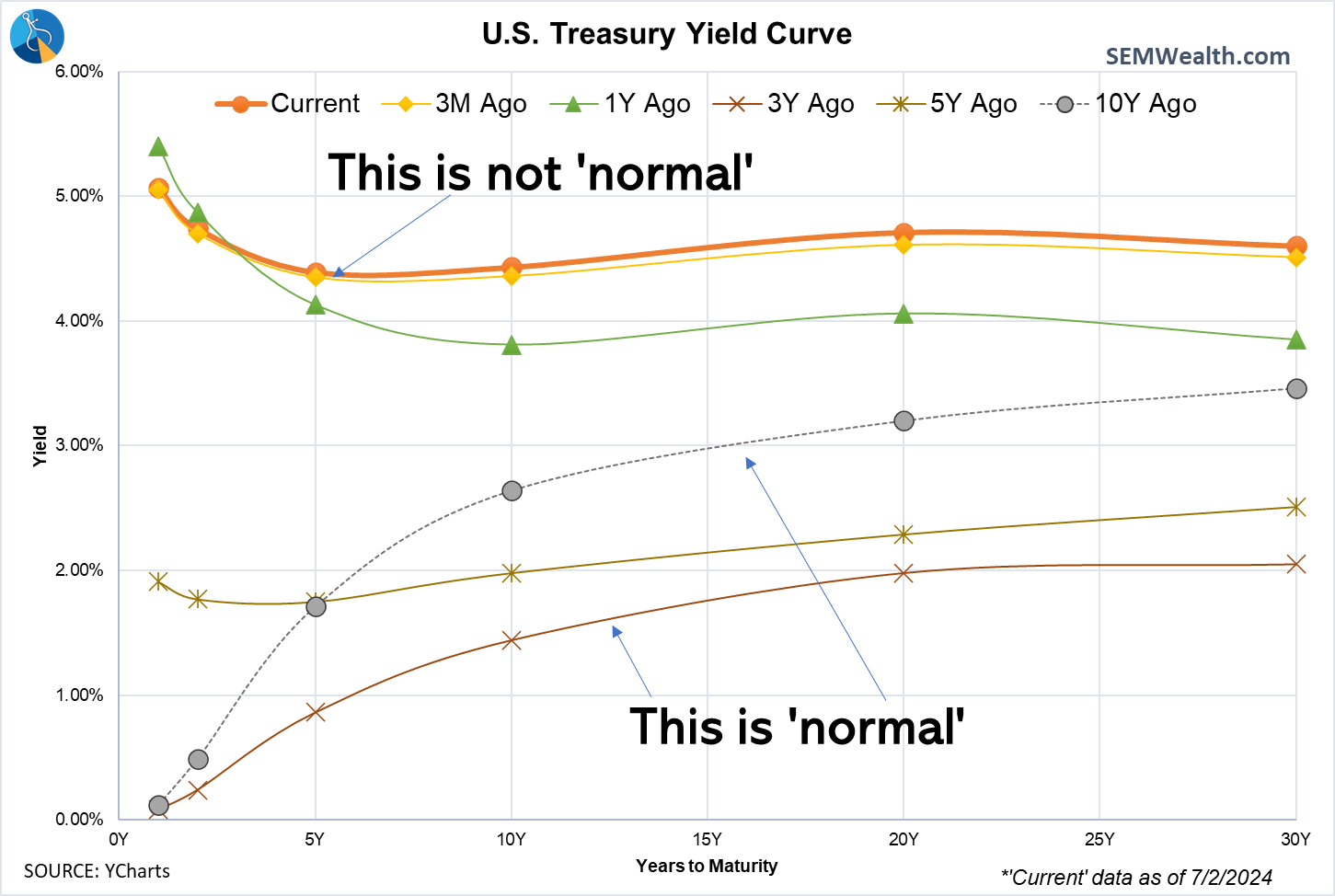

We’ve talked many times over the past 4+ years about the unprecedented actions taken before, during, and after the pandemic. This has led to many economic and financial indicators being skewed which leads to abnormal situations. One of those situations is for interest rates.

This chart illustrates the yield curve over various periods of time. Normally long-term interest rates are higher than short-term interest rates, but the unprecedented policies from the Fed and Congress has led to short-term interest rates to be higher than long-term rates for a long period of time. This means CDs and other “guaranteed” investments look very attractive. However, at some point those “guaranteed” products will mature and need to be reinvested. If interest rates have returned to normal, there is an opportunity cost.

SEM conducted a study of CD rates over the long-term compared to other investments. If you’d like a copy of the study, go to our website SEMWealth.com and fill out the contact section with your request.

"It's different this time"

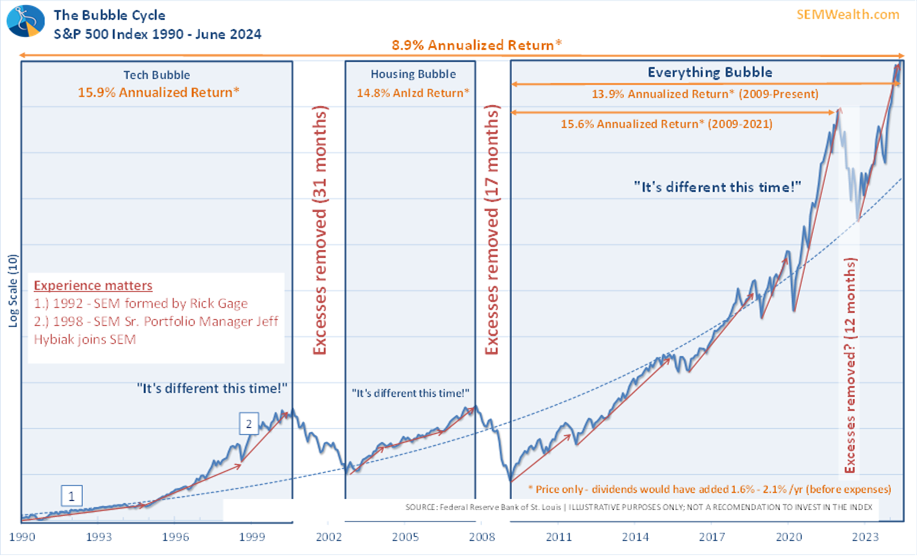

If you are in the market for a new car and it went up by 15% in 3 months you’d probably be less likely to buy it. Conversely if it was down 15% you’d probably rush to buy it. For some reason that is not the case with stocks. Following the big jump in stock prices (already above the long-term average return for a year) we are seeing investors rushing to buy stocks, especially the big-name Mega Cap Growth stocks.

The longer you’ve been around (SEM is in our 33rd year) the less surprised you are at these cycles. The chart below is a good reminder of how quickly the trend in the market can reverse. Over the long-term the stock market has generated annualized returns in the 8-10% range (depending on the starting date). There have been several times where returns for 7-15 year periods were well above that as illustrated below. However, each of those times were followed by a big drop to return the market back to the “mean”.

Given the big returns the first half of 2024, we thought we’d share some quotes from two successful investors who have been around longer than us:

“Quotations fluctuate constantly, reacting often illogically to all sorts of temporary and even trivial influences.” – Benjamin Graham

"When the price of a stock can be influenced by a "herd" on Wall Street with prices set at the margin by the most emotional person, or the greediest person, or the most depressed person, it is hard to argue that the market always prices rationally. In fact, market prices are frequently nonsensical." – Warren Buffett

If you would like a review of your investments, go to Risk.SEMWealth.com

Bonus Content: Video Call Quick Tips

Here are some tips from our Director of Technology, Dustin Briles for video calls:

- Test before you join and try to join a few minutes early. This gives you the chance to make sure you know which audio and video device(s) you want to use before joining. Don't rely on the application to "remember" which devices you used last time, or to honor the "default" device on your computer. It's much easier to figure out issues before you're under the stress of being late for a meeting.

- Consider using background blur rather than a virtual background. Virtual backgrounds can sometimes be more distracting than your messy office, especially if you move your head and hands a lot. The best-case scenario is that you have a natural background you don’t mind showing on camera.

- Use headphones, earbuds, or a headset for your output device. This will reduce echo, even if you still use the microphone built into your laptop or webcam as the input device. If you're worried about visual appearance, earbuds are a good option.

- If you want an even better audio quality, a dedicated microphone will work best. If there is a microphone built into your headset or earbuds, that is typically a good middle ground option.

Bonus Content: Economic Update & Preparing Your Portfolio for the Election Webinar

Every election year, there is much angst about the outcome and what it will mean for the economy and your investment portfolio – which is why we wanted to host a webinar several months before the election! This webinar focused on what the DATA says about the true key drivers of the economy, what the current economic environment is saying about those drivers, and what historically happens following the election. Along the way, key behavioral finance topics were covered to better understand what is likely to be a year filled with uncertainty.

Bonus Content: Bubble or Opportunity?

SEM has been around since 1992, so we've experienced quite a few different cycles. Thanks to our data-driven approach we have been able to navigate each of these "new eras". The current AI-mania is yet another cycle which is causing many people to make the same mistakes we've seen happen throughout the past 33 years. We discussed this in the post below, comparing the "new era" of 2000 to the current "new era", including taking a look at the tech leaders of the year 2000 and what happened the following 15 years.

Bonus Content: Politics

We do not enjoy talking about politics and in fact try our best to stay as neutral as possible. When we do discuss it, we keep it centered around the impact on the financial markets and economy.

During the 2008 election we coined a phrase: "Do not let your political OPINIONS influence your INVESTMENT decisions." Each election since that time has been more heated, filled with more opinions, and has been fueled by social media and other news algorithms which cause us to lose track of the bigger picture. Throughout the year we've been posting an occasional series surrounding politics. Here are the links to each post so far:

Download/Print version of the Newsletter

What is ENCORE?

ENCORE is a Quarterly Newsletter provided by SEM Wealth Management. ENCORE stands for: Engineered, Non-Correlated, Optimized & Risk Efficient. By utilizing these elements in our management style, SEM’s goal is to provide risk management and capital appreciation for our clients. Each issue of ENCORE will provide insight into investments and how we managed money.

The information provided is for informational purposes only and should not be considered investment advice. Information gathered from third party sources are believed to be reliable, but whose accuracy we do not guarantee. Past performance is no guarantee of future results. Please see the individual Model Factsheets for more information. There is potential for loss as well as gain in security investments of any type, including those managed by SEM. SEM’s firm brochure (ADV part 2) is available upon request and must be delivered prior to entering into an advisory agreement.