These headlines are shocking and certainly something I don't want to make light of. While it is indeed the worst number since the Great Depression, the way GDP is calculated does not fairly represent what is actually happening. The government takes the estimated economic output for the last three months, adds or subtracts using a "seasonal adjustment" model, divides it by the prior quarter number and then essentially multiplies it by 4. We can't take your investment performance the last 3 months and then assume it happens 4 more times to quote a number, but for some reason the government does it when it comes to the economy.

Surprisingly a few news sites picked up on this and reported the number I've always used when measuring the economy – the % change from a year ago.

A 9.5% drop for the past 12 months is big and the worst since the Great Depression, but it isn't catastrophic when you consider the massive forced shutdowns our economy has endured. To put it another way, the economy is currently at 89% of where it was at in December. We have a long way to go, but it's not as bad as everyone believed.

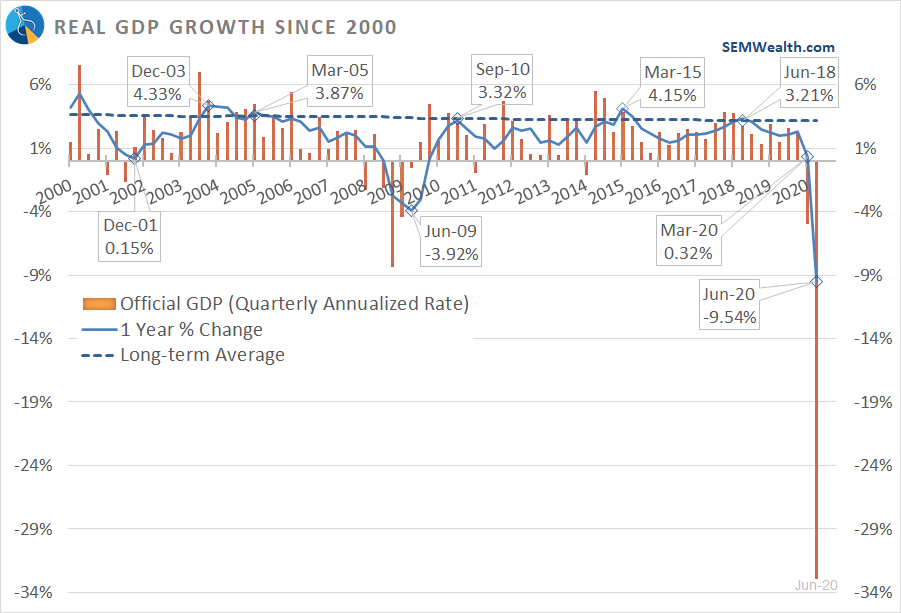

Here's how the "official" (orange bars) compares to the year-over-year % changes. Notice how much more volatile the "official" number has been.

I highlighted the past peaks and troughs in the economy. What is critical to understand as we emerge from this recession is how weak the economy was before we had even heard of the Coronavirus. We only saw one period since President Trump took office where the economy grew faster than the long-term average. This was after the massive tax cuts in 2017. We can see from the chart the impact of those tax cuts was short and the growth rate was rapidly shrinking throughout 2019.

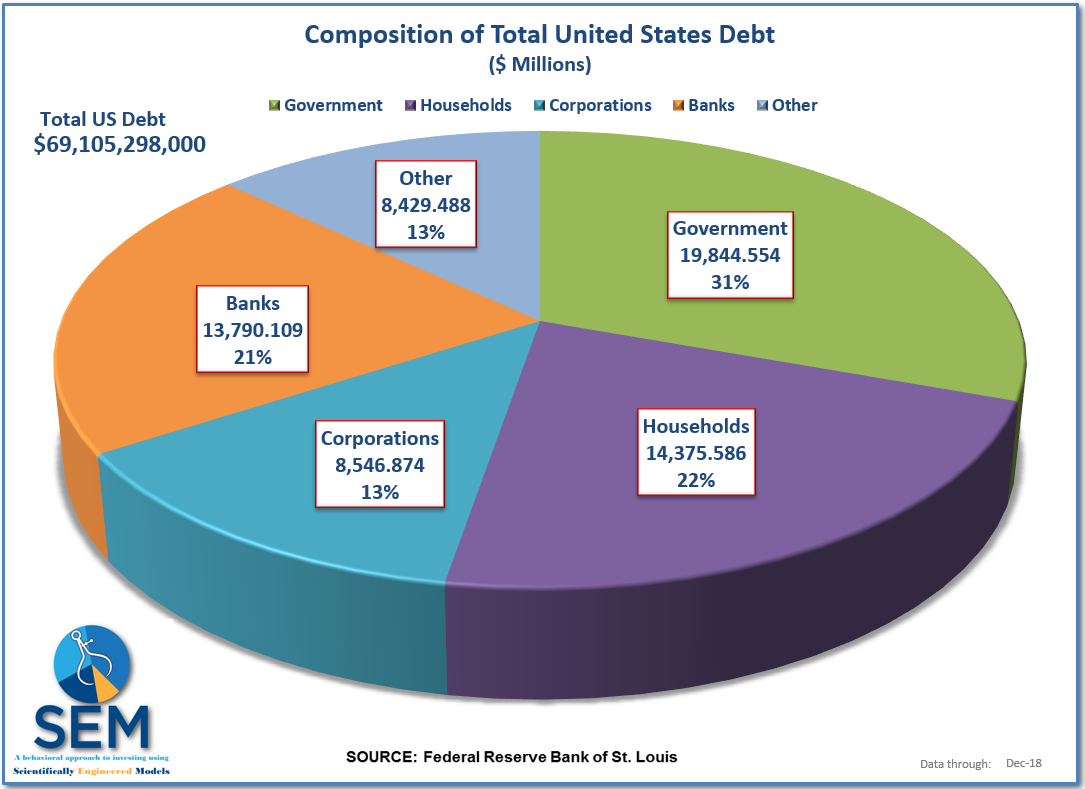

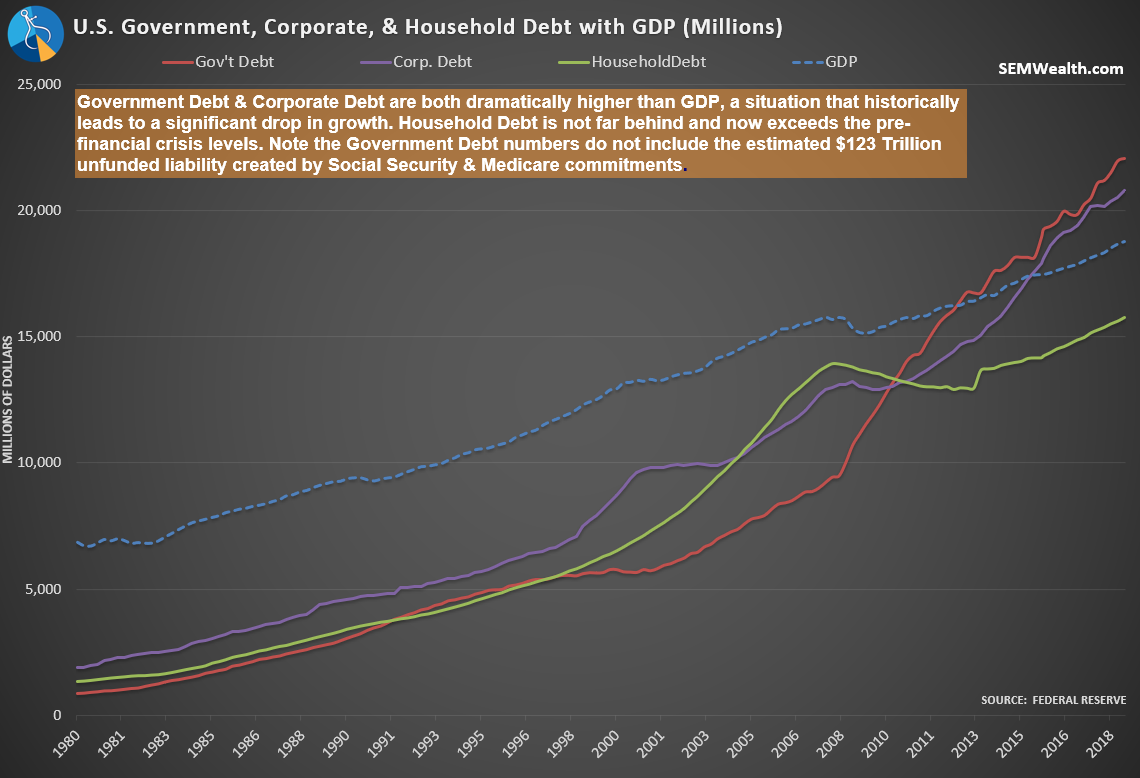

This is important as Congress argues over yet another round of stimulus measures. Any money will give the economy a short-term boost, but it will come at a tremendous cost in the future. We're still paying for the stimulus used to fight the 2000-2002 and 2008-2009 recessions (as well as for all the deficit spending during the "boom" times.) This means any economic growth will be slower due to the tremendous debt burden we are facing.

That's an issue for another day and many more blogs. Here are a few of the more recent ones where I touched on this issue.