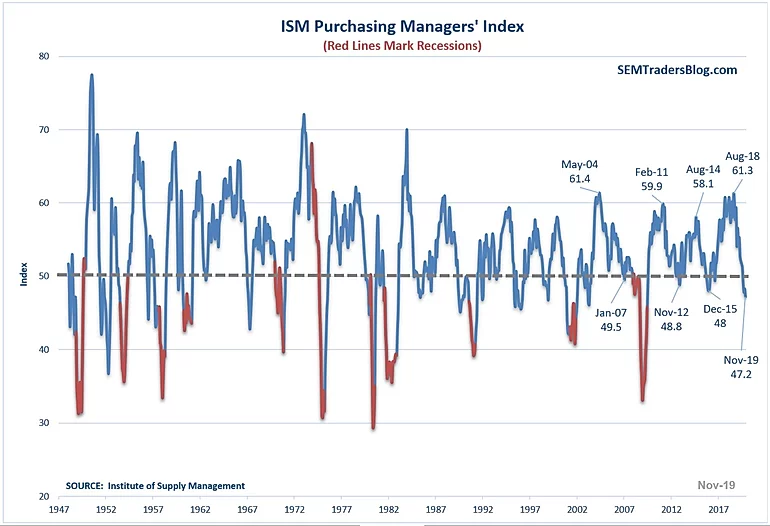

At the beginning of October, I pointed out the sensationalism of the financial media when they pointed out how the ISM Manufacturing Index posted the worst number in 10 years. It was only 0.2 lower than the previous 10 year low. After a rebound in October, the ISM Manufacturing Index took a decidedly negative turn in November. Worse, the internal components all weakened in November, with both New Orders and the Order Backlog falling to new lows for this expansion.

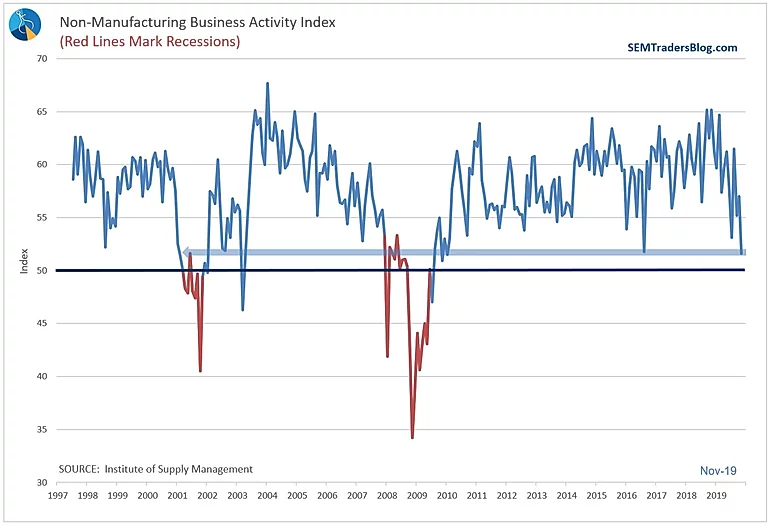

"But we're a service economy" many people argue. First, the reason the ISM Manufacturing Index is such a key leading indicator is its ability to show the true underlying strength of our economy. If things are going great, we're going to see orders for big ticket items increase which is not only good for economic growth, but also a sign of continued confidence in the expansion. When the opposite occurs it is a concern. Second, another key leading indicator, the Non-Manufacturing Business Activity Index also posted its lowest reading of the expansion (albeit just by a few tenths of a percent).

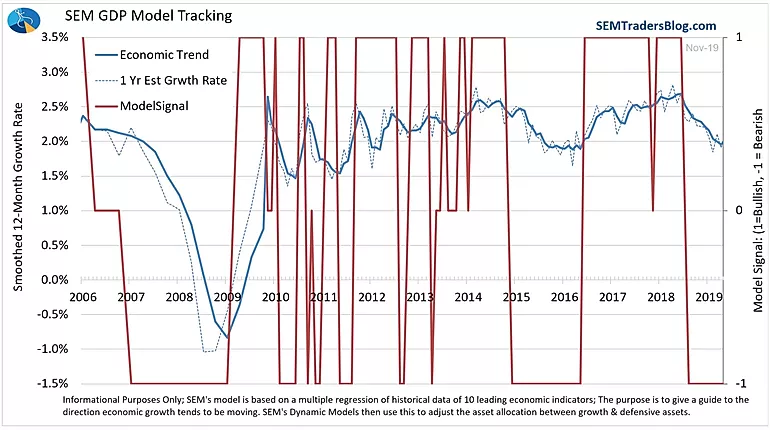

Combined, these two things along with increases in interest rates, stress at the banks that was so bad it led to the Fed launching a QE program that they are not calling QE, continued weakness in employment growth, and a valuation of the stock market that will make it tough to generate any sort of decent returns, we are not as optimistic as the "experts" seem to be as they dust off their crystal balls.

Our economic model remains as it has all year --- bearish. This doesn't mean a recession is imminent, but it does mean the environment for risky assets is likely only going to get more difficult.

As I said back in early October, I can't help but notice the dates of the previous lows in both the Manufacturing and Non-Manufacturing indexes corresponding with the "bottom" in the economic slowdown. Rather than guessing about whether or not this is the bottom we'll do what we always do -- let the models dictate our investment allocations using the data, not the opinions of any member of the SEM investment team (or financial 'experts').