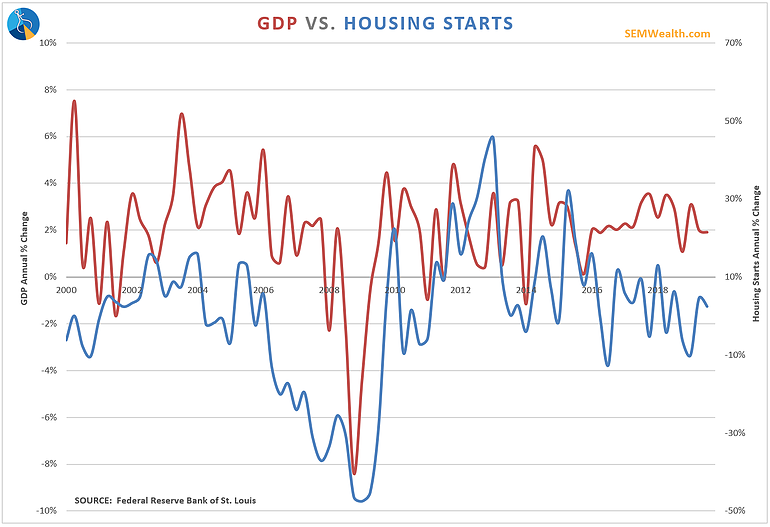

I've often said if I had to pick just one Leading Economic Indicator it would be Building Permits. If you've ever bought a house you know first-hand how much you personally stimulate your local economy. If it was a new home you've already provided jobs to the contractors and the

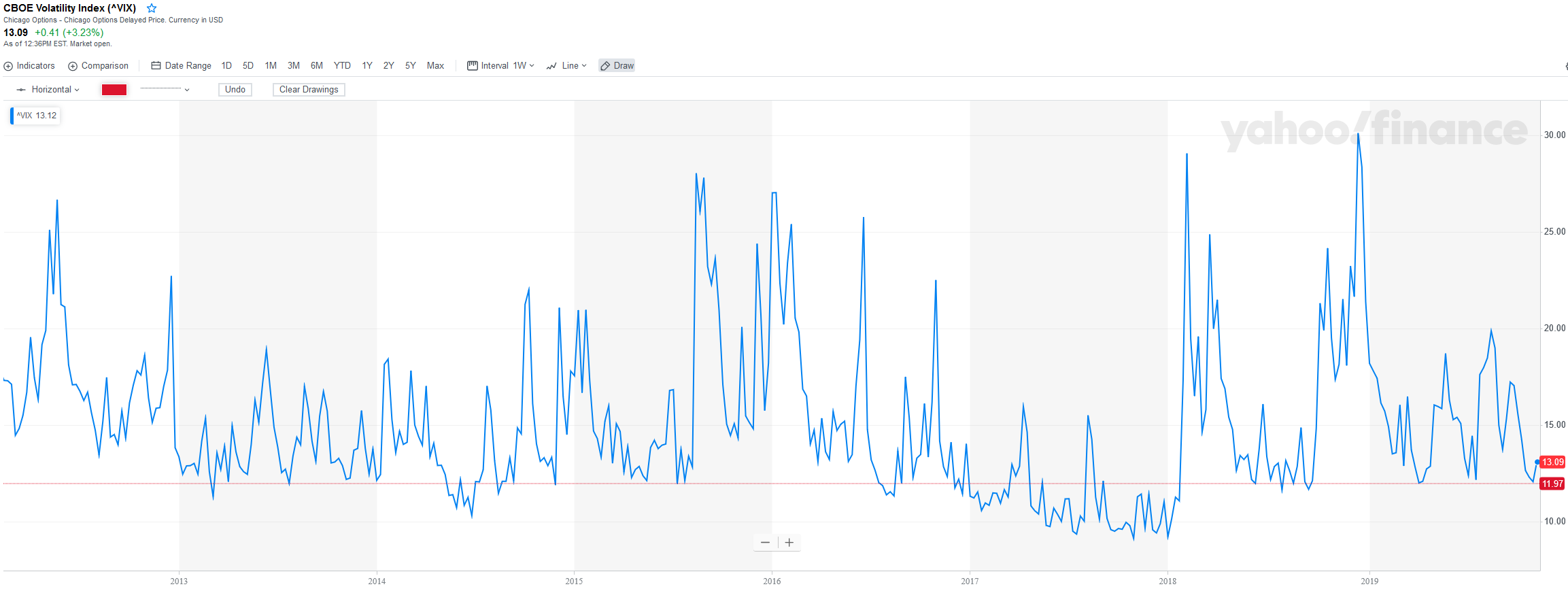

After traveling for 7 weeks to conferences, advisor meetings, and client events it is good to be back in the office for a full week. The major theme across the board was confidence. Clients, advisors, and portfolio managers are overwhelmingly confident there are no risks ahead. The Fed is easing,

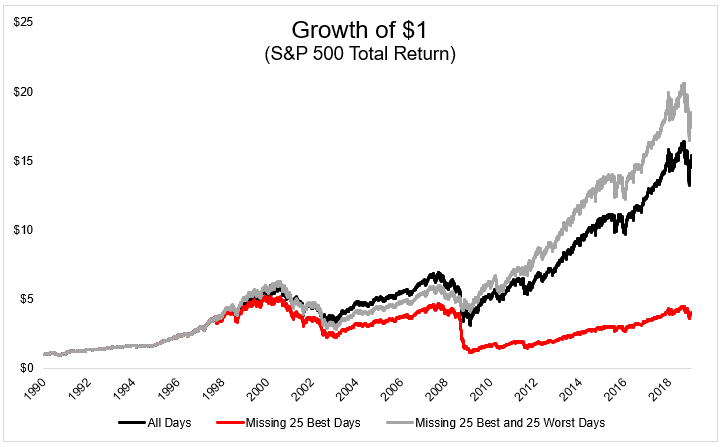

The bulls seem to be emboldened once again. They seemed to have a meeting to push out the most misleading chart for investors — the consequences of missing the best days in the stock market. Many are doing this in the name of “behavioral finance”, believing if you

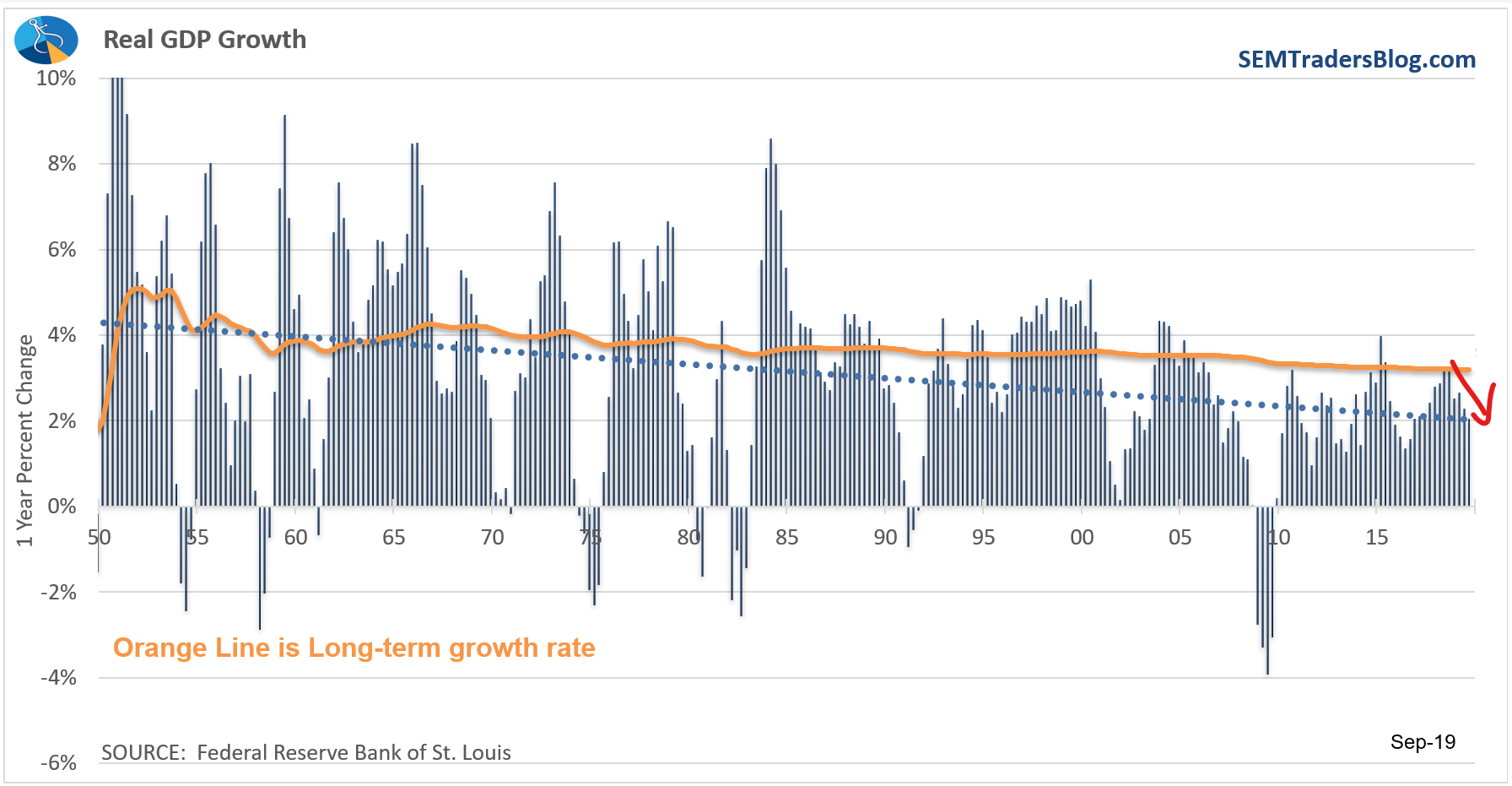

Earlier this week we learned the US Government ran a nearly $1 Trillion deficit this fiscal year. Despite promising 4%+ GDP growth to pay for the tax cuts, the temporary boost has already reversed and the trend is now clearly to the downside. As I’ve said since the

The stock market is attempting to stabilize, but the economic indicators continue to point to a slowdown. In this brief economic update I highlight what the DATA is saying along with ideas on what you should be doing to prepare for what could be a big move up or down.