On Friday Jeff wrote a very well thought out and sophisticated article going over the reasoning and data behind Facebook’s valuation after it fell 25 percent (located here). I saw that same drop and clicked buy (for my non-SEM account that is completely discretionary and has nothing to

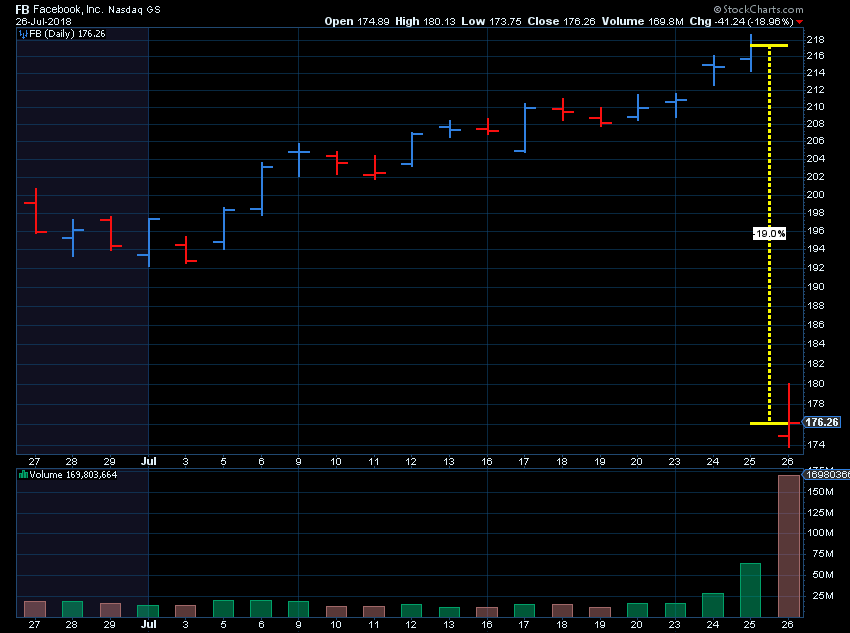

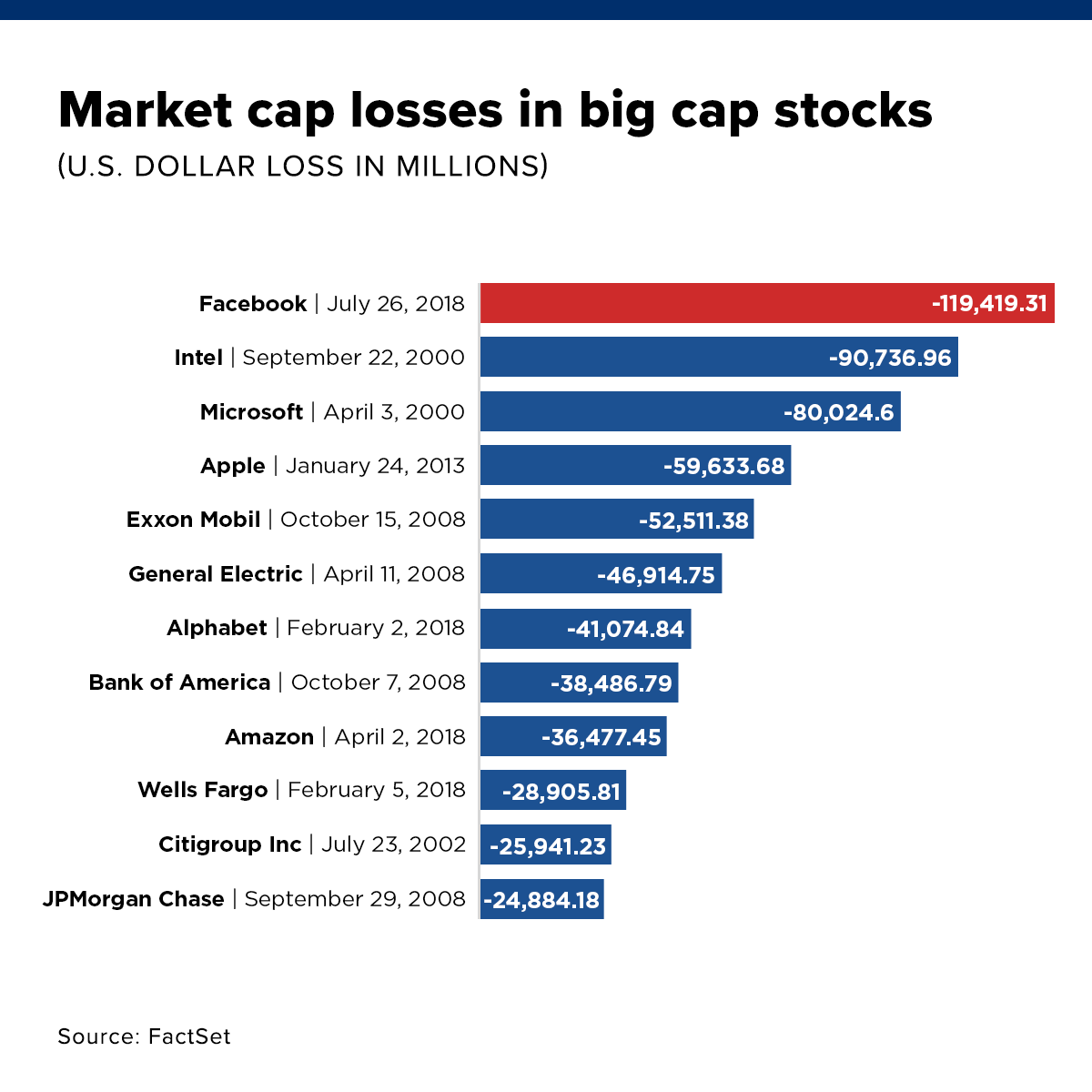

On Thursday Facebook stock suffered the largest single day loss of market value in history. At one point the stock was down 24%. It recovered to close down 19%. $119 Billion of market capitalization was lost. The reason behind the drop was a combination of the company reporting quarterly earnings

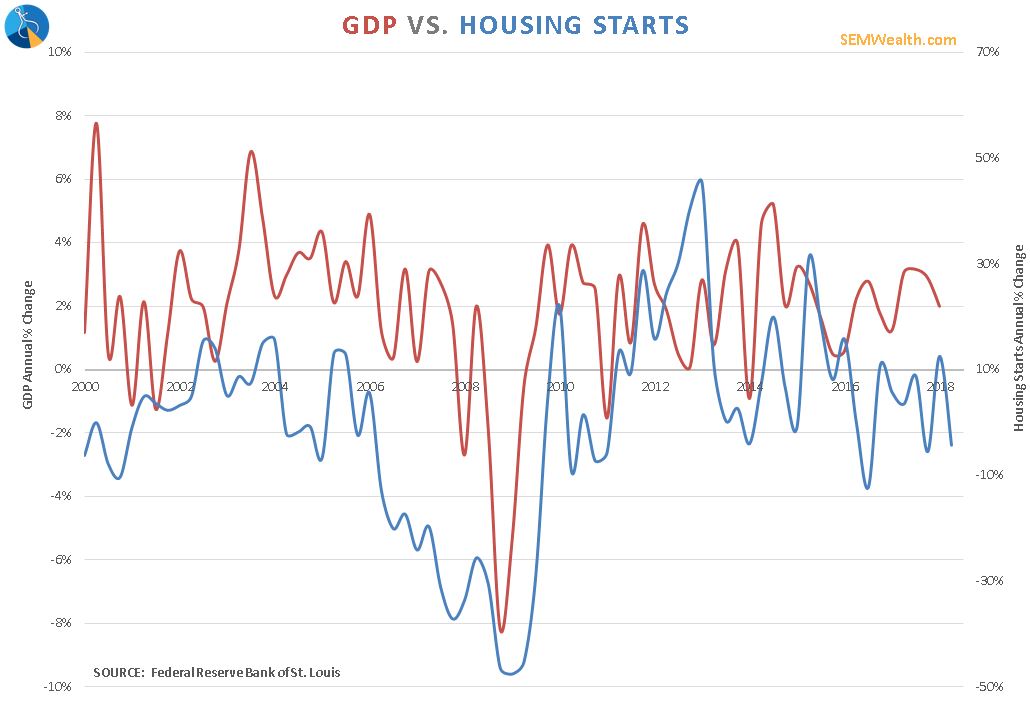

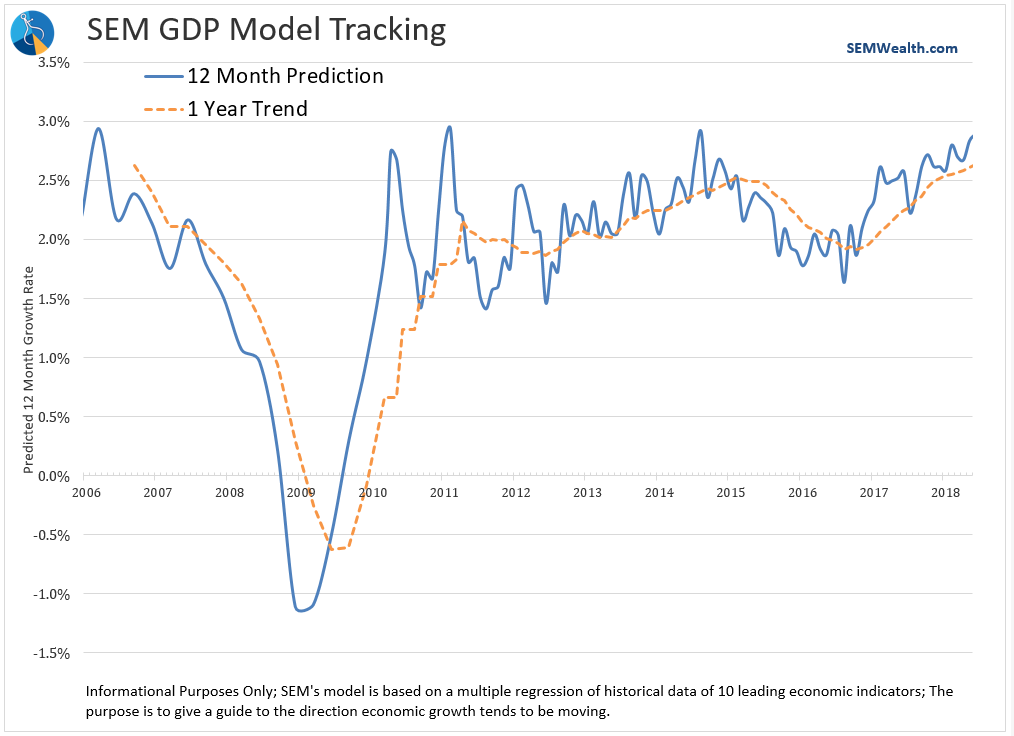

This week my second favorite leading economic indicator was released and it immediately threw cold water on my optimistic outlook. Two weeks ago, I posted our economic model showing a continued bullish uptrend for the next several months. Building Permits and Housing Starts tend to be a very early leading

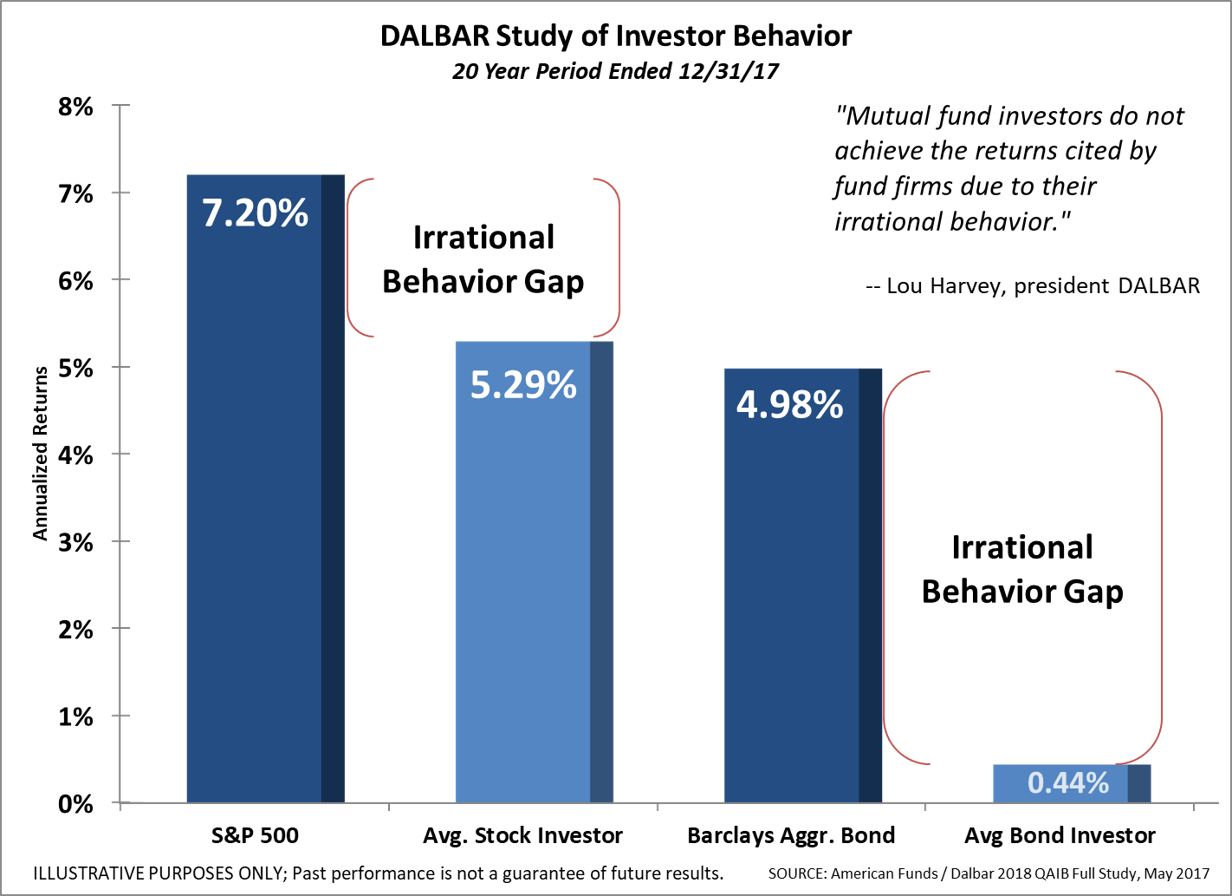

Being human means we are not always completely rational. There is nothing wrong with that. This is what makes life interesting and makes each person unique. If everyone behaved rationally we would have a world full of robots. When it comes to investing, however, our natural human traits can cause

It seems the only thing the market focused on in June was the impact the heated trade talks was having on the economy. Each day seemed to have a fresh warning about the damage the Trump Administration’s trade policies would do to our economy. While it will take