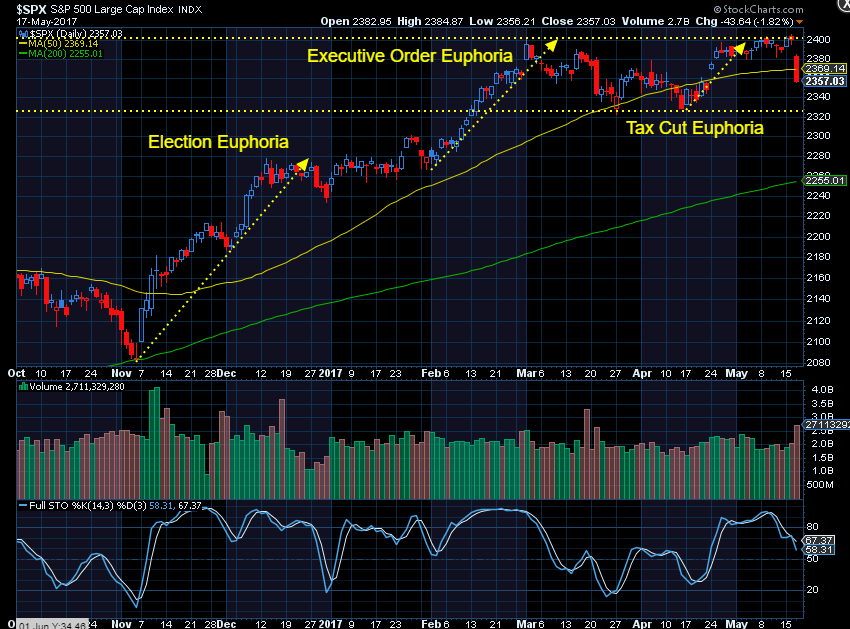

Maybe it was a coincidence, but before President Trump’s first international trip as president, the markets were in a panic as controversy swirled around his administration. Many were calling into question not only whether or not any of his “good” policies would ever become law, but

Last week the market was in a panic as it appeared President Trump not only would not be able to implement any of his “good” ideas, but also increasingly likely he wouldn’t still be president at the end of his first term. Then he left the

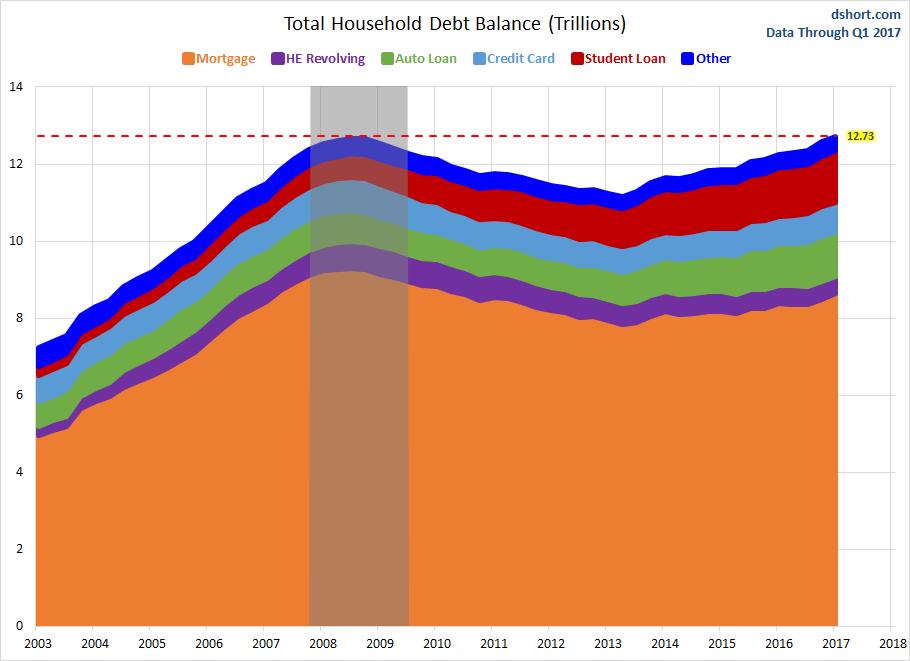

During the Presidential campaign last year we heard a lot about the economic recovery. One side said it was the best recovery of all time, the other said it was the worst. (For more see my 1st Quarter Economic Update) Thee is one data point I don’t think

I can’t think of any other word to describe the stock market’s reaction to the election of Donald Trump than “euphoria”. Despite what the so-called experts predicted, the election of Donald Trump was not met with a market crash, but rather a massive inflow

Don’t get me wrong. I love my job. One of the primary reasons I chose this field is to help people. However, every once in a while we run into somebody that is beyond help. After dealing with somebody last week who fell into that category this video