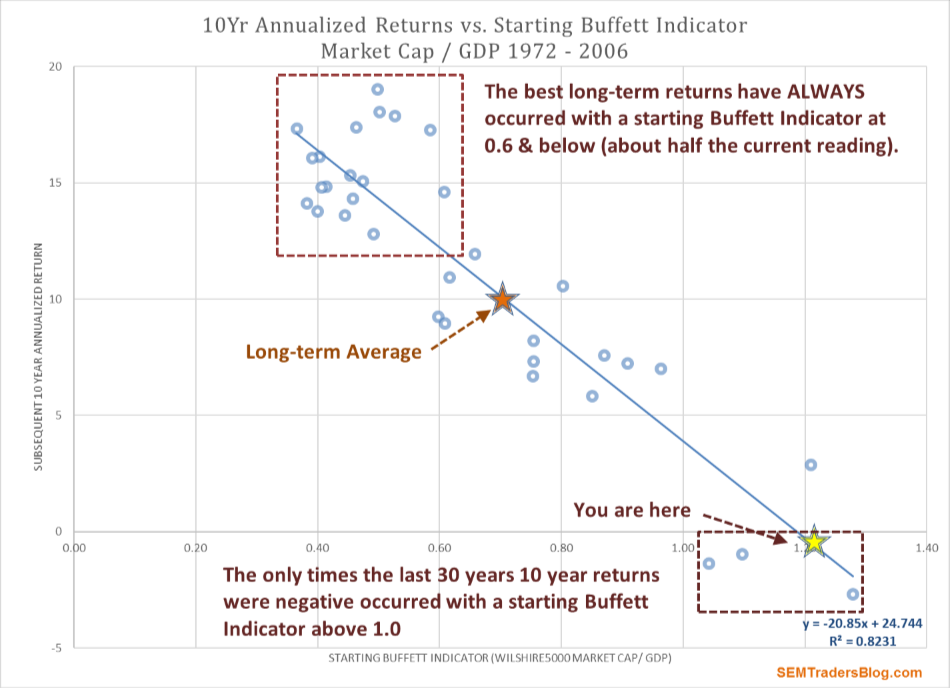

This week the stock market continued its impressive bull market run with the S&P 500 crossing a milestone level — a market capitalization of $20 Trillion. While most of the market participants took this as a positive sign, it reminded me of one of the most reliable predictors

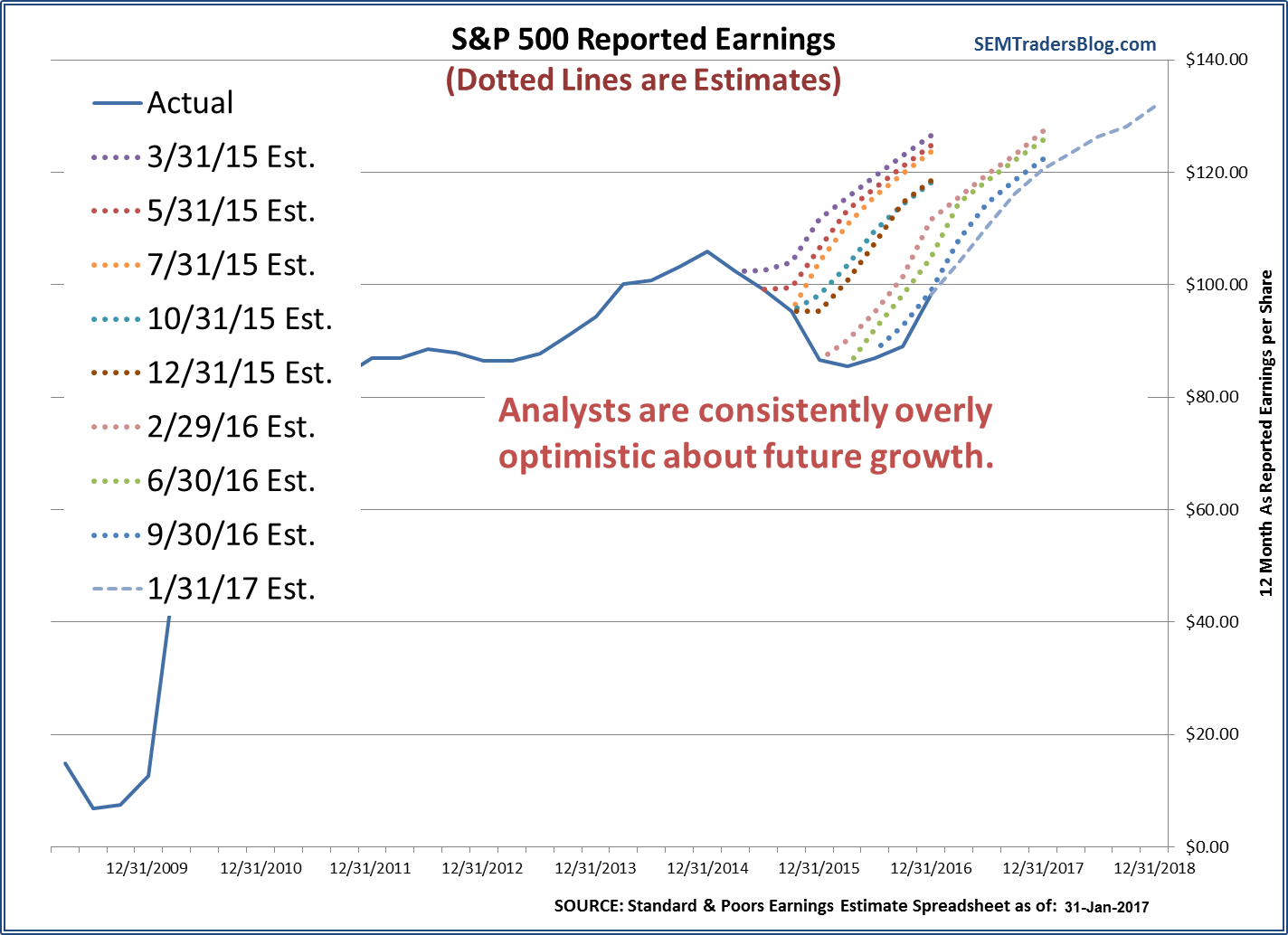

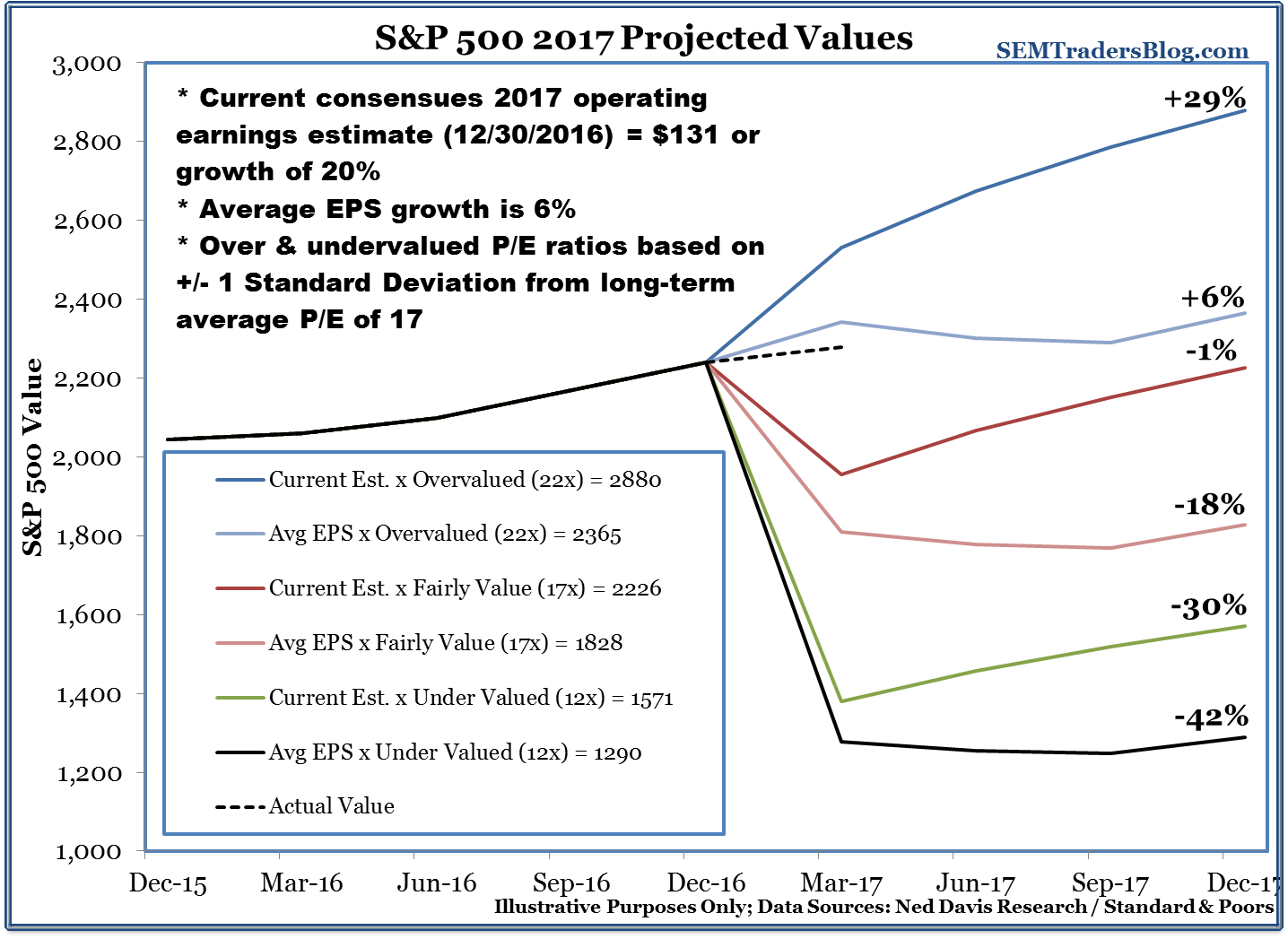

Last week I used the historic Super Bowl comeback by the Patriots as an example of why it is so difficult to make predictions with much confidence. I ended the week discussing the target price for the S&P 500 based on earnings estimates & the expected Price/Earnings

Early in my career I was a “fundamental” analyst. This meant pouring through financial statements, digging into what made an industry work, making economic predictions, and then applying that to the earnings of a specific company. I quickly learned how hard it was to consistently be right (or

Super Bowl 51 was arguably the best Super Bowl of all-time. It gave us the biggest comeback ever along with the first Super Bowl to go to overtime. At the same time we saw Tom Brady move into sole possession of several individual Super Bowl records (despite a very bad

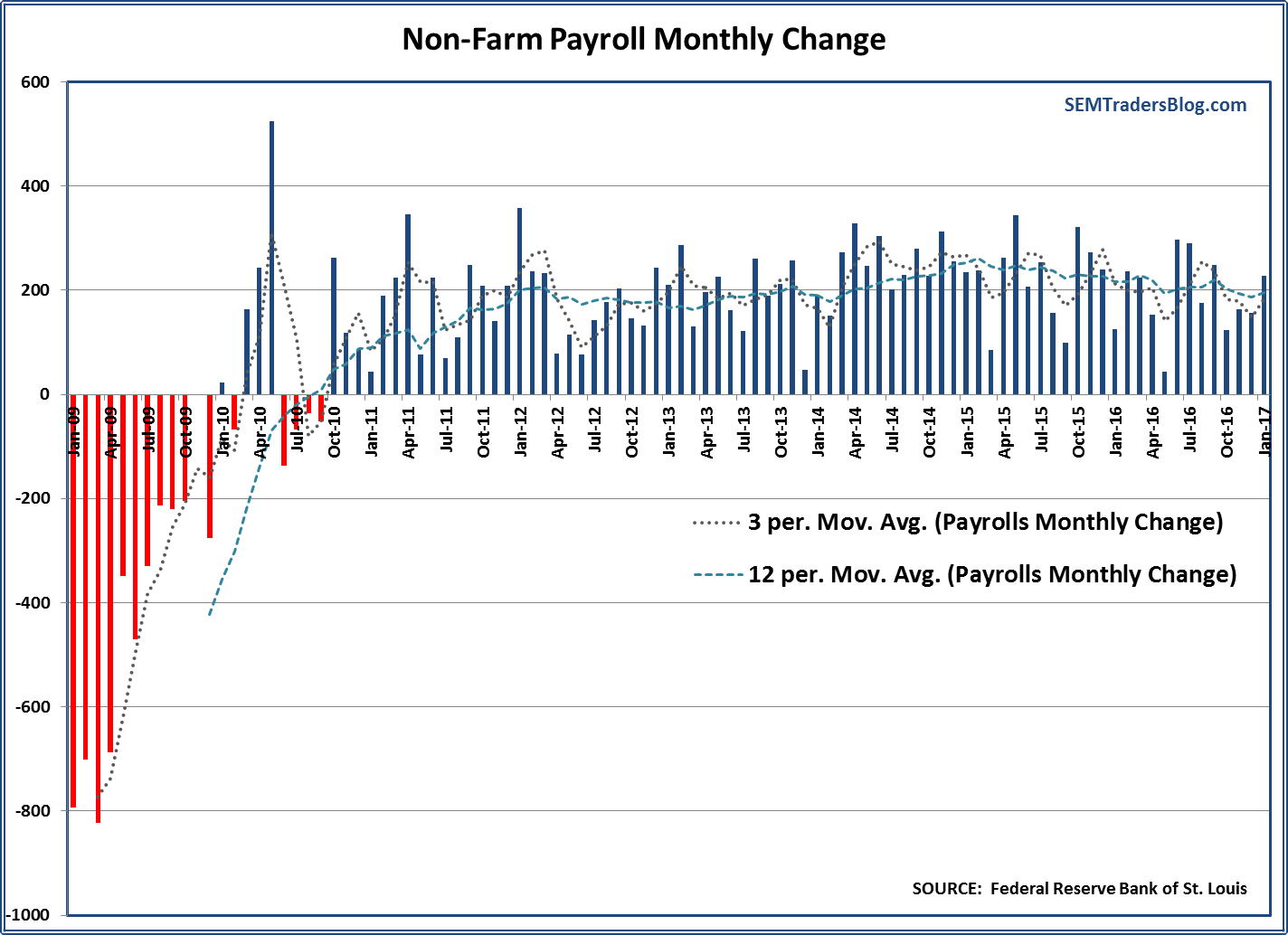

We learned this morning the US added an estimated 227,000 jobs in the month of January. Of course we have both sides taking credit for this impressive number. The Democrats say it is the result of President Obama’s policies and cite the “record setting” job