As we start the 20th week of the Coronavirus panic in the U.S. in many ways it feels like we haven't made much progress. Cases are spiking in two heavily populated states, schools are trying to determine what they should do with their students, Congress is arguing over what

It seems like since the Coronavirus shutdown began in March, the rest of the year has been filled with unrest. This world is corrupt, and we know this isn’t what God wanted for the world He created. As Christians, we should be striving to make an impact for God’

EDIT 2020-08-03: It looks like the Bitcoin scam was conducted by three younger people (one is a minor) after a long period of reconnaissance and successful social engineering attacks against internal Twitter employees.

Sources:

- https://arstechnica.com/tech-policy/2020/07/florida-teen-arrested-charged-with-being-mastermind-of-twitter-hack/

- https://krebsonsecurity.com/2020/07/three-charged-in-july-15-twitter-compromise/

Honestly, in terms

Like a prisoner, marking the days is a way to keep track of the passage of time. Days can blur together and it is easy to lose touch with the outside world. For the past 19 weeks I've been marking the weeks with the hope we'll be able to resume

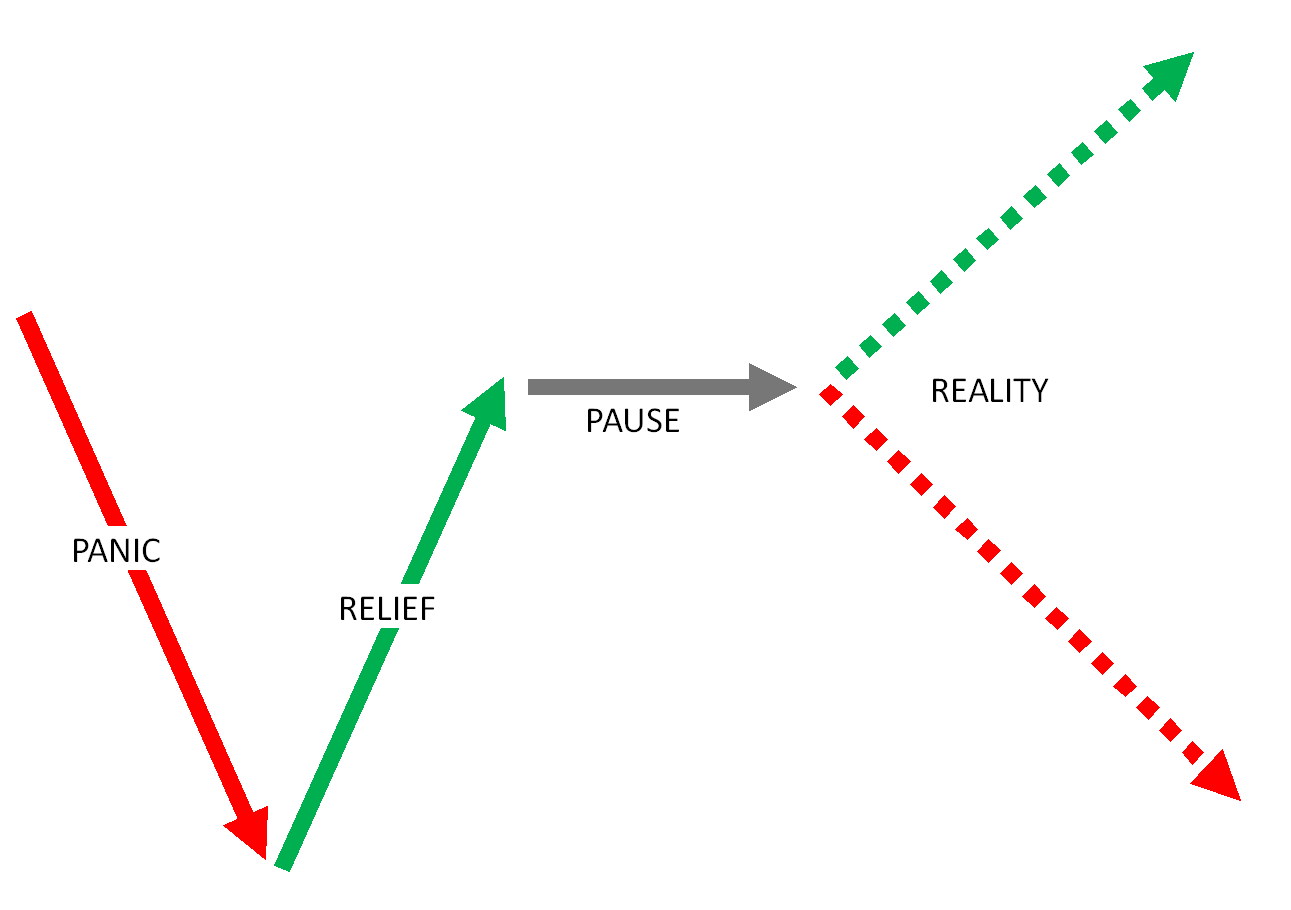

When we are facing unknown situations our brains will try to find similar situations and then use it to make decisions. This is called representativeness bias. It can be especially dangerous because we may miss some critically different situations that render the past situation useless for decision making. This applies