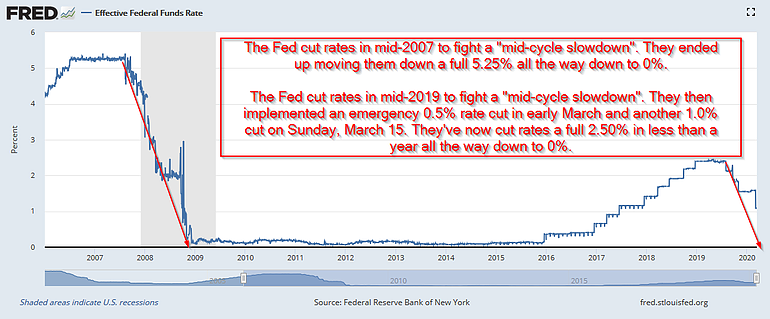

For the second time in a few weeks, the Federal Reserve took "emergency actions" to help offset the impact of the COVID-19 panic. This time they resorted to slashing interest rates 1% -- all the way down to 0% as well as launching another round of Quantitative Easing (QE4) totaling $700 Billion over the next few months. This follows an expansion late last week of their "not QE" repo expansion to $1.5 Trillion. They also essentially eliminated reserve requirements at banks, cut the overnight lending spread, and expanded the swap maturity window for foreign banks from 1 week to 84 days.

This is all right out of the 2008 playbook. As I said on March 4, when "your only tool is a hammer, everything looks like a nail." I went into great detail in this article "You need the right tools" about why this problem won't be solved by monetary policies. We need FISCAL policies (White House and Congress) and thus far the ideas being proposed will do little to stop the economic damage.

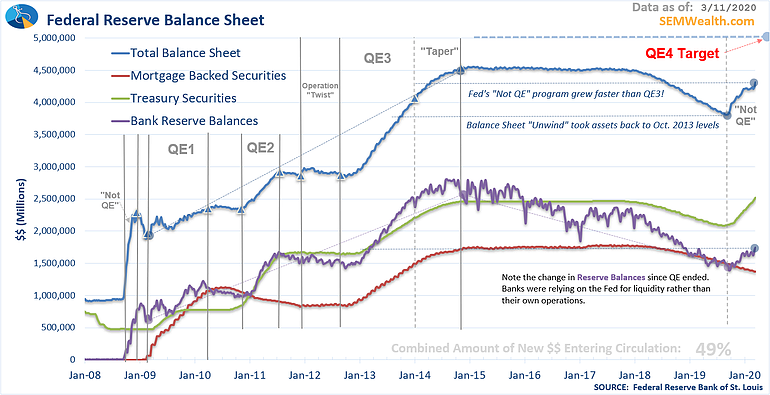

While these policies will not help the economy, they may temporarily prop up the banks. The problem is, the banks were struggling last fall. I wrote several articles back then when few people were paying attention to the liquidity problems at the banks. [See "Cracks in the Financial System," "Perpetual Bailouts," and "The Banking System is Broken."] Banks were struggling during an economic expansion because interest rates were TOO LOW and the government was BORROWING TOO MUCH. The government was scheduled to borrow over $1 Trillion in 2020 when everyone assumed a growing economy. Now tax revenues will be cut significantly and the government will be spending possibly trillions of dollars. Because the Fed has been the only game in town, they will be the only ones able to absorb all of the excess borrowing from the government.

In other words, they'll be creating money to buy government debt.......again. The $700 Billion they announced on Sunday will not be enough. Shortly after the market opened on Monday they already announced a $500 Billion extension to their "repo" program that broke down last fall.

Don't get me wrong. I was seeing MAJOR liquidity issues in the bond market last week. We saw "safe harbor" investments such as short-duration government bonds, agency debt, and municipal bonds going down on days the stock market was down. Clearly institutions wanting/needing to raise money were "selling what you can", which meant the most liquid investments. It was far worse for fixed income ETFs. They were down double or triple the indexes they were supposed to track. (This is another reason SEM chooses to use mutual funds rather than ETFs for our fixed income investments.) QE should help those "safe harbor" investments hold up better in the down markets.

NOTE: SEM sold nearly all of our short-duration bonds last week and moved to government money market funds. While the Fed has now pushed the yield on money markets back to 0% with their actions on Sunday, we're in an environment that is about return OF capital, not return ON capital.

One thing that is critically not in their toolbox -- the ability to buy anything other than government related issues (Treasury bonds and agency debt). This literally takes an act of Congress. While other Central Banks around the world have been able to buy corporate debt and even stocks (hello China, Japan, and Switzerland), the US has not gone down that rabbit hole yet. (In case you haven't noticed those markets have been hit SIGNIFICANTLY harder than the US markets even with their central banks able to buy everything.)

Remember our warning about Investment Grade Bonds?

By far the most controversial article I wrote in the past 10 years was last year's "Investment Grade Junk". The emotional response from those institutions, managers, and advisors relying on the investment grade bond market told me it is a market to be wary of. Here is a small excerpt from the article:

I don't know how bad things will get or when they will start. I do know each bear market starts with a different catalyst. My job is to look at all potential issues, inform our advisors and clients about the risks, and then stress test each of our investment models to make sure they are set-up to do their job. I hope I'm wrong, but a simple study of market and economic history should tell you nothing can be done to avoid a bear market or recession. Both are designed to wash out the excesses created during the past up cycle. Anything that is weak will be wiped out, but the aftermath should allow for strong, healthy growth.

Our current situation is analogous to the Pending Forest Fire I used to describe what happened in the tech crash and then to predict what would happen in the looming housing crash. I was early then and probably early now (although I've been sitting on the idea for this article for at least 9 months because I didn't see any signs of looming stress.) The signs are starting to increase and while we never invest money based on my "gut", it is telling me the odds are increasing rapidly of some sort of credit event in the next 12 to 18 months bringing in unknown collateral damage to the markets.

I hope I'm wrong, but hope is not a strategy. As the Outsourced Chief Investment Officer (OCIO) of a group of advisors we call the SEM Platinum Advisor Group I take my job seriously. They have hired SEM to perform all due diligence on potential investment managers and to create custom portfolios based on the clients' financial plan, cash flow strategy, and true risk tolerance. They also ask for assistance in crafting their message to current and potential clients. My message to them is simple -- the stimulus used to fight the financial crisis went on for too long. It has created massive excesses in the fixed income market that has created a situation that is dangerous for anyone depending on their investments over the next 10 years. (If you'd like to discuss how you become part of this elite group of SEM Advisors, send me a quick note.)

I'd encourage you to take some time to read the entire article. At SEM our income investments are all in money market funds or Treasury bonds. High yield spreads are getting attractive, although not at levels where I'm jumping up and down. We are teetering to the point of mass defaults if we don't see the economic slowdown end soon. Very good bonds will go down along with the very bad bonds. Remember, it will be "sell what you can, not what you have to." I don't enjoy seeing companies default and investors in those bonds lose money, but I do enjoy seeing capitalism work. Those companies that shouldn't have been allowed to borrow money at those rates and those people who willingly lent them the money deserve to pay the price while those who are prudent deserve to be rewarded. That's the premise our economy was built on.

What is fair value?

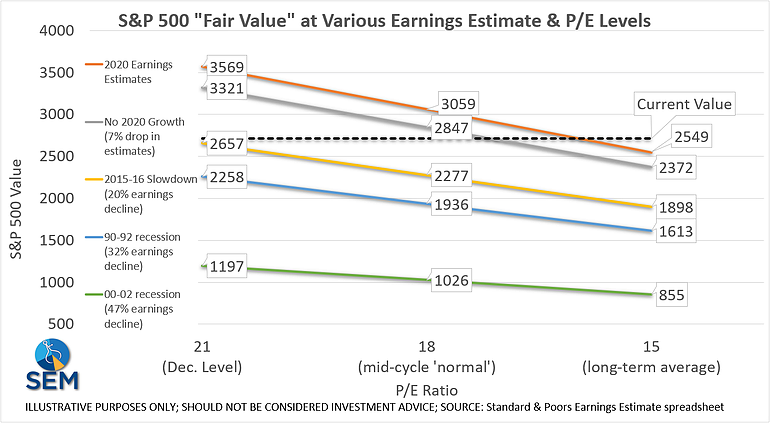

I don't know how anybody can confidently determine what the economy or corporate earnings will look like. As I last detailed in "Mapping the Next Move", not only do you have to guess what earnings will be this year and in the future when you're buying stocks, you have to determine what those earnings are worth (what is a 'fair' P/E). As stock prices go down, the P/E looks more attractive, but if we don't know what the "E" will be, who is to say these are a good value?

Goldman Sachs on Sunday downgraded their GDP forecast for Q1 to 0%. They are expecting a 5% drop in GDP in Q2, followed by 3% growth in Q3, and 4% growth in Q4. Overall they expect the economy to grow 0.4% in 2020. They originally forecast 2% growth to start the year and 1.2% growth a week ago.

If we extrapolate that to corporate earnings and assume rather than the 7% current projected growth we instead see no growth, we'd be working off the grey line. The question then turns into what P/E do you want to pay?

Seeing what I'm seeing in corporate America, there is a big chance earnings will be down 20-30% before this is over. Remember, the government is able to create money to boost economic growth. Corporations cannot. The yellow, blue, and green lines show the impact on corporate earnings and stock prices if we see slowdowns similar to the 2015-16 slowdown, the 90-92 recession, and the 00-02 recession. I purposely left off the 2008 financial crisis when earnings were negative for the first time in the modern era.

I personally believe it is far too early to guesstimate what the impact will be. For long-term investors and especially those with 10+ years until retirement, now may be the time to begin shifting to stocks and continue adding as they go down. Remember, what I'm most worried about is a RECESSIONARY bear market. Those can last 18-24 months, knock off 50% or more from stock values and take 5-10 years to recover the losses. This means we still can lose 33% or more from today's prices over the next 18-24 months.

If this ends up not turning into a recession, then those bear markets tend to be over in 3-6 months, lose around 25%, and recovery within 9-12 months. At SEM this is why we constantly advocate for our three-pronged approach --- Our "tactical" are watching the market everyday and are ready to deploy are low risk investments into higher risk investments when the time is right. Our "dynamic" models have been "bearish" for over a year. They saw an economic slowdown coming way before COVID-19 was discovered. They too are ready to deploy to riskier investments when the time is right. Our "strategic" models (AmeriGuard and Cornerstone) are designed for long-term investments. They are thus far staying the course, but also have reduced risk by only being invested in large cap stocks, which are holding up much better than small cap and international stocks.

In other words, no need to guess, our models will make adjustments accordingly. If you want a quick check of your portfolio, whether with SEM or not, check out our Risk Questionnaire.

Technical Analysis 101

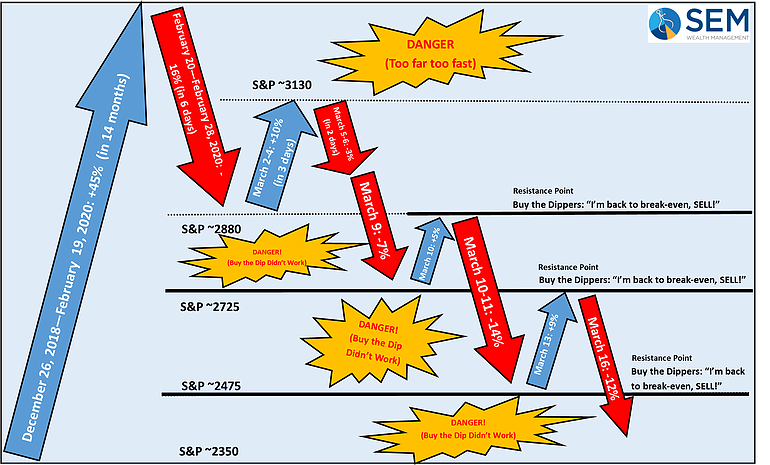

Our models don't follow traditional technical analysis. They are much more sophisticated, but they have all been built on the fundamentals of how the markets function. If more people buy than sell the market goes up. If more people sell than buy it goes down. There are certain psychological numbers where large groups of investors bought or sold. Those numbers become points where you'll see emotions run high -- "I'm back to break-even" or "stocks are back to where I wish I'd bought them" are two of the things we see occur throughout market history.

Remember, despite technological improvements, humans still make the ultimate decisions. Here is my updated diagram of the market the past several weeks.

We really need to see the market oscillate between two of the solid lines. Rick calls it "damped oscillation" and is a function of an out of control process finally stabilizing. Friday's furious rally only took it up to the lows of March 9. The key level to watch is now around 2350. This was the Christmas Eve low from 2018. It's crazy how quickly the market erased all of 2019's gains.

I think everyone would welcome some days where the markets move less than 1% (or even 3%).

As I've said quite often -- SEM is literally built for this. Whether it is our Scientifically Engineered Models or our operational set-up, we have everything under control. Stay safe, do what you have to, and try to keep your emotions in check. If you want to talk, we're here. Just send me a message or call our office.