I've spent my entire career criticizing the Fed. A group of academics sitting around trying to control the economy with interest rates and the various other vehicles always ends up causing additional problems elsewhere. I've argued for the past 10 years the Fed would again create bigger problems due to their manipulation of the markets. They waited too long to pull back stimulus measures and when the stock market went down, they reversed course and added even more stimulus. This created a huge bubble in 2019.

That said, I am thankful they are acting so aggressively. We've seen the Fed pull out nearly all of their Financial Crisis tools in the last two weeks. They've cut rates twice, increased their repo funding window (both length of loans and amount), re-instated Quantitative Easing, opened a Commercial Paper lending facility, guaranteed foreign currency swap contracts to help foreign banks, and put a backstop on money market mutual funds.

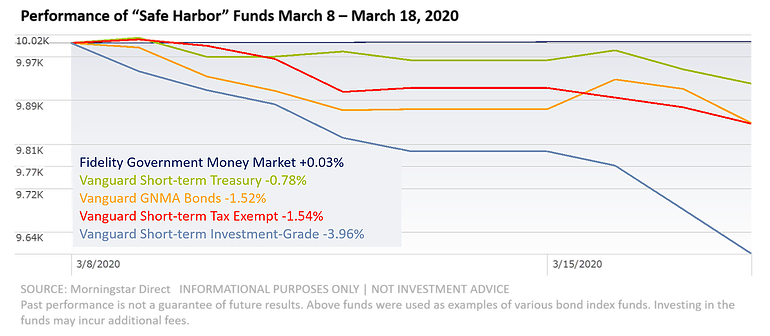

I'm glad they did all of the above. They had to. Early last week at SEM we started noticing strange behavior in the funds we call "safe harbor" funds. As our long-time readers and advisors know, when we exit risky assets (as we did in bulk the last week of February and first week of March), we move the money into lower risk assets. The first stopping point is short-duration bonds (maturity within the next 3 months). This provides some interest payments while we wait for a more stable environment. During a crisis, these funds typically go up in value as the market participants move to "high quality" investments.

Not only did they stop going up a week ago. These funds started declining -- quickly. This is a sign of a wide-spread liquidity crunch. This week's Chart of the Week shows the performance of some common index funds on our "safe harbor" list. Over the last 5 days nearly all of our "safe-harbor" funds have hit our sell thresholds and we now sit in Money Market accounts in Tactical Bond, Tax Advantaged Bond, and nearly all of Income Allocator.

We are also seeing longer-term Treasury bonds getting hammered the past several days. The selling started when President Trump first floated the idea of a (beautiful) Trillion Dollar Stimulus package. Remember, going into the year we were on pace to already have a Trillion Dollar deficit. That was with expectations of 2% GDP growth. Now with tax revenues evaporating and spending ready to hit exponential levels, the question becomes 'who will buy all the debt needed to finance this'?

Earlier in the week, I detailed some of the problems we are seeing in the financial system. I'd encourage you to take some time this weekend to read through it and some of the other linked articles. One of the key points -- last fall banks were having a hard time absorbing all of the debt issued by the Treasury department. There is zero chance the $500 Billion promised to buy Treasury bonds in QE4 will be enough.

The losses in the "safe harbor" funds along with the sell-off in Treasuries led to some mid-month sell signals in Dynamic Income (DIA) as stop-loss levels were hit on several of our holdings. Like Income Allocator, Tactical Bond, and Tax Advantaged Bond, DIA is in "return of capital" mode instead of "return on capital". All 4 are now sitting in a very nice position. The more carnage we see in the bond market, the more opportunities they will have to make significant gains on the other side.

The Fed is going to have to increase their bond buying significantly to absorb the debt. They also are going to need to buy municipal bonds (have you seen how quickly even highly rated muni-bonds are going down?), corporate bonds, and possibly find a way to bailout the pension plans (and possibly insurance companies) who have relied on the Fed's liquidity bubble the past 12 years to make promises that now will come into question. All of that will literally take an act of Congress. This is the situation I worried about when I wrote the much criticized "Investment Grade Junk" white paper last year.

I don't want to be a pessimist. This is not a problem that suddenly appeared in February. It is the result of 12 years of bailouts and never letting the free markets function. Now we are seeing the result of the other side. When you give a patient pain meds for a decade, it's going to take an increasing amount of more powerful meds to achieve the same level of pain management.

I'm optimistic our country will figure it out. We've never been so divided ideologically and socially, but that doesn't mean we can't come together and fix this. However, why in the world would you listen to the "experts" who 2 months ago were telling you to sell bonds and buy dividend paying stocks (which are now down 35%) now tell you how this is a buying opportunity? It eventually will be, but we've gone through this before. The real buying opportunity will be so scary and seem so crazy very few people will be able to pull the trigger.

I'm not seeing the "fear" yet. Too many people are giddy at the "bargains" they are seeing in the market. Maybe they are right, but I'm so thankful at SEM we don't have to guess when the time to buy will be. Our models have all done their job to avoid the larger losses where they were supposed to and still give us the opportunities to participate when the market rallies.

I've also heard too many people say, "it's too late to sell." What if it isn't? There are so many variables in answering the question "when is it too late" I can't answer it here, but if you find yourself saying that with your clients or your investments, let's talk.

We'll get through this. The key is to have money ready when everyone else is too scared to invest.