Earnings are again in focus as companies report their latest quarterly results. Long-time readers know that I come from an accounting background & have been a critic of the reporting methods used by these companies. Even more aggravating is the fact Wall Street is not only allowing it, but utilizing non-GAAP compliant earnings in their own valuation models. This does not mean earnings do not matter, but it is more difficult to determine how healthy a company or the overall market really is. Thankfully, there are a few numbers that are still useful as they are difficult to manipulate. One of those numbers is Revenue or Sales.

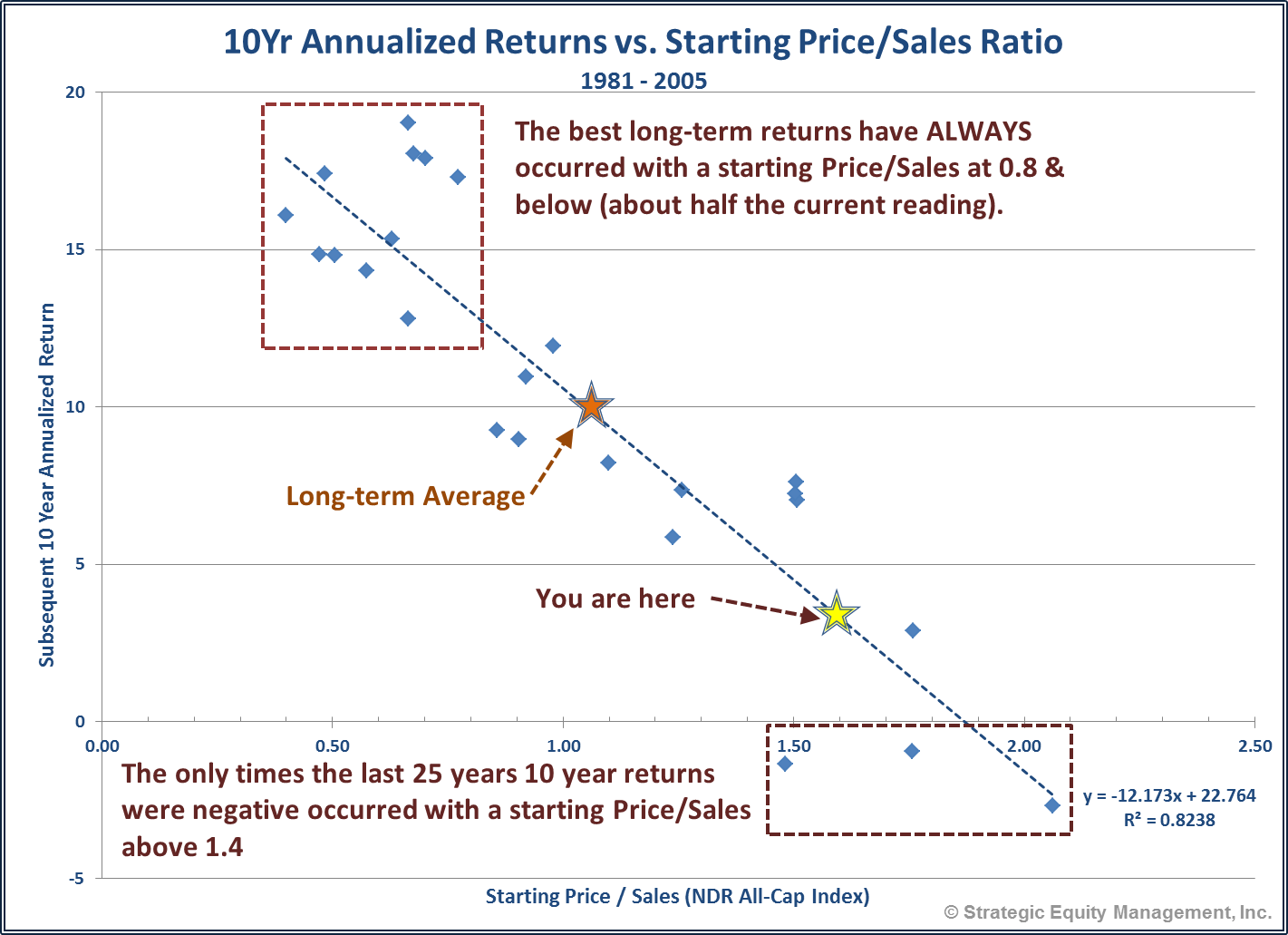

Unfortunately for investors, the Revenue of the S&P 500 companies has not kept pace with the growth of the market, causing the Price / Sales ratio to reach extreme levels. Even more unfortunate, the starting Price / Sales ratio is one of the best determinants of long-term (10 year) returns for investors – far better than the P/E ratio is in predicting returns.

What does the current Price / Sales ratio tell us we should expect? Look at the chart above & come up with your own conclusion.