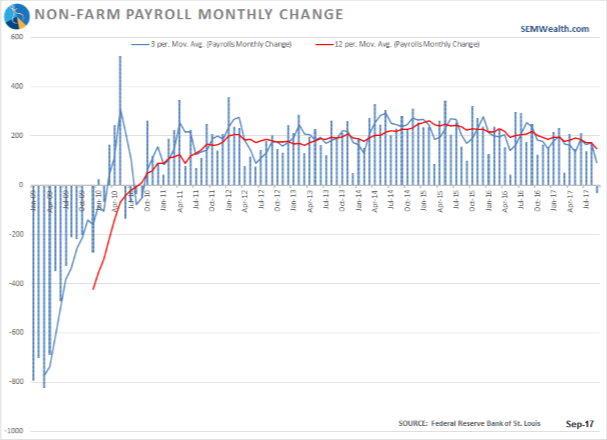

The September employment report marked the first decline in the number of jobs 84 months. The last time our economy lost jobs was back in September 2010. That decline was due to the loss of temporary census jobs. Back then market participants did not care because Ben Bernanke had recently announced his intentions to launch QE2. Back then the Fed balance sheet was a “mere” $2.4 Trillion. Today the balance sheet has ballooned to $4.5 Trillion.

Last week’s Chart of the Week discussed the “much ado about nothing” regarding the Fed’s decision to bleed off a bit of its balance sheet. It is a simple coincidence the end of the job creation streak came as the Fed finally begins to consider unwinding its unprecedented Quantitative Easing programs. This is likely a momentary short-term blip caused by the multiple hurricanes that hit the US the past two months.

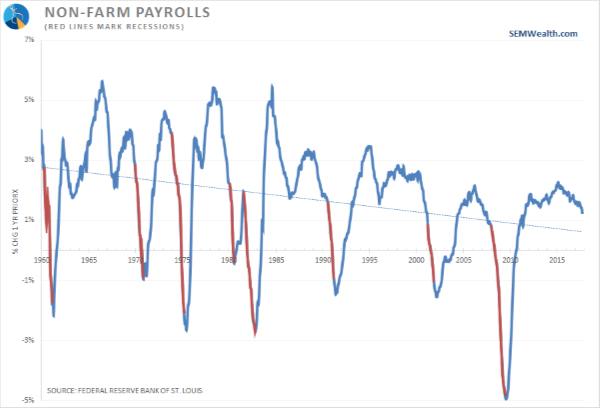

The bigger concern for long-term investors should continue to be the declining trend in the pace (and quality) of jobs being created. Our economy is going through a major demographic shift and we should not assume we will see the type of growth in the economy, corporate earnings, or investments we once enjoyed.

Being diligent and actively seeking opportunities while avoiding large losses is going to be the only way to overcome this decline in growth. A passive strategy that worked the past 30 years is likely going to do far more harm than good. Unfortunately at the same time we are seeing a mass exodus from active strategies into passive ones. While the drop in jobs in September is a short-term bump, the long-term trend remains down and should be something we are all concerned about.