Availability Bias: an information-processing bias in which people take a heuristic (mental shortcut or rule-of-thumb) approach to estimating the probability of an outcome based on how easily the outcome comes to mind. Easily recalled outcomes are often perceived as being more likely than those that are harder to recall or

Tag: Behavioral Finance

Almost 2 years ago I took the final portion of the CFA Exam. The materials for that section have completely changed the way I look at everything. Level I was focused on market fundamentals, Level II focused more on how to analyze the various asset classes available, while Level

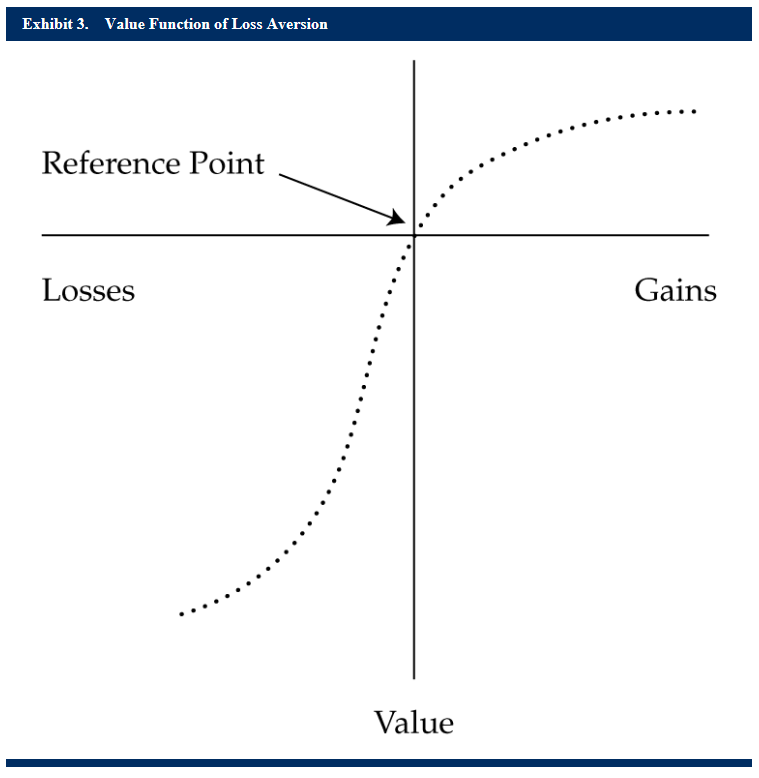

SEM applies a Behavioral Approach to Investing. Our total portfolio approach is designed to overcome the most common behavioral biases. To understand the importance of this we need to first understand the biases. About two years ago I posted a video clip from one of our client seminars where I

After 20 years with SEM I should not be surprised to see how many people get sucked into the late stages of a bull market. We all have heard the key to investing – “buy low, sell high.” Unfortunately, our brains typically trick us into forgetting this wisdom.

Conservatism Bias: A belief preservation bias in which people maintain their prior views or forecasts by inadequately incorporating new information. Conservatism causes individuals to overweight initial beliefs about probabilities and outcomes and under-react to new-information; they fail to modify their beliefs and actions to the extent rationally justified by the