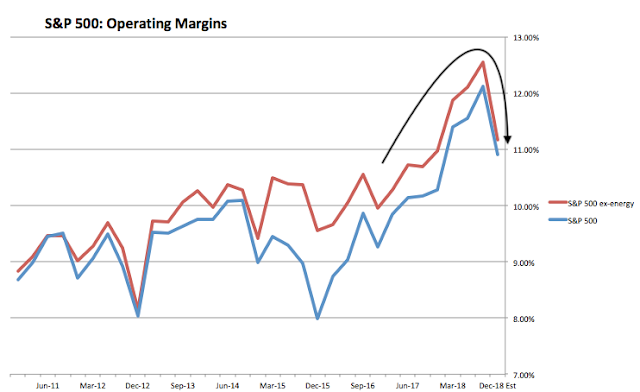

Stock market cheerleaders often point to the high earnings growth rate projections when recommending investors “buy any dip” in the stock market. Last week we highlighted both the very high expectations for earnings growth along with a big increase in the “multiple” (Price/Earnings ratio). Essentially,

Tag: Corporate Profits

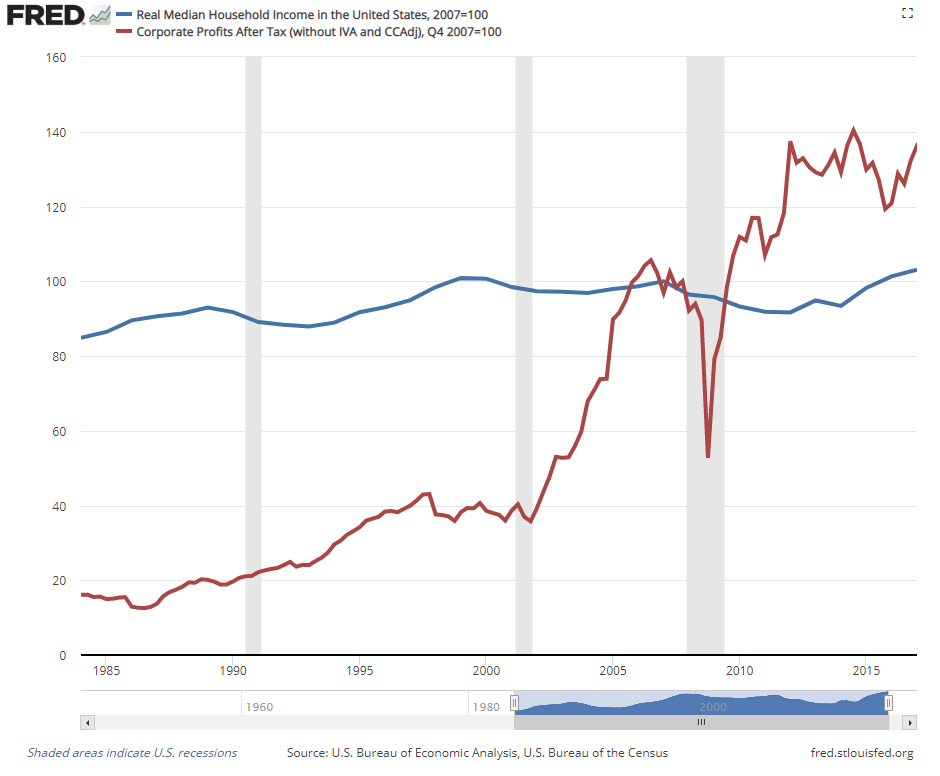

Last week we reported the shift to “slowing growth” in our economic model. This resulted in a significant decrease in risky assets in our Dynamic models. A few advisors have commented on how the economy doesn’t matter for stock prices. On the surface (and a great

This week we learned the Median Household Income of Americans finally surpassed the 2007 peak. Inside the report released by the Census Bureau was a long discussion of the “lost decade” for most Americans. Masked by the overall income level is the fact average earnings are down, but

Despite the rebound in job creation in April, the big picture has not changed. Throughout this century we’ve seen corporations taking a bigger piece of GDP at the expense of the labor force. Please do not take this statement as an endorsement of socialism. Instead it is a