If the stock market was a living creature, I picture it as a diabolical schemer who enjoys seeing as many people suffer as possible. One way he or she would do that would be to act like your friend, to give you gifts, and make your life seem easy. Then,

Tag: economic growth

Unprecedented actions lead to unprecedented consequences. Back in April 2007, I wrote one of our most popular articles, "The Pending Forest Fire". At the time people thought we were crazy. Everything was booming. Real estate, stocks, the job market. We were in a new era where the Federal Reserve was

The market doesn't seem to be doing too bad.

Versions of this comment have been used at least a dozen times in the past month in meetings with clients and advisors. The fact stocks have remained near all-time highs despite some major economic headwinds can indeed be viewed as good

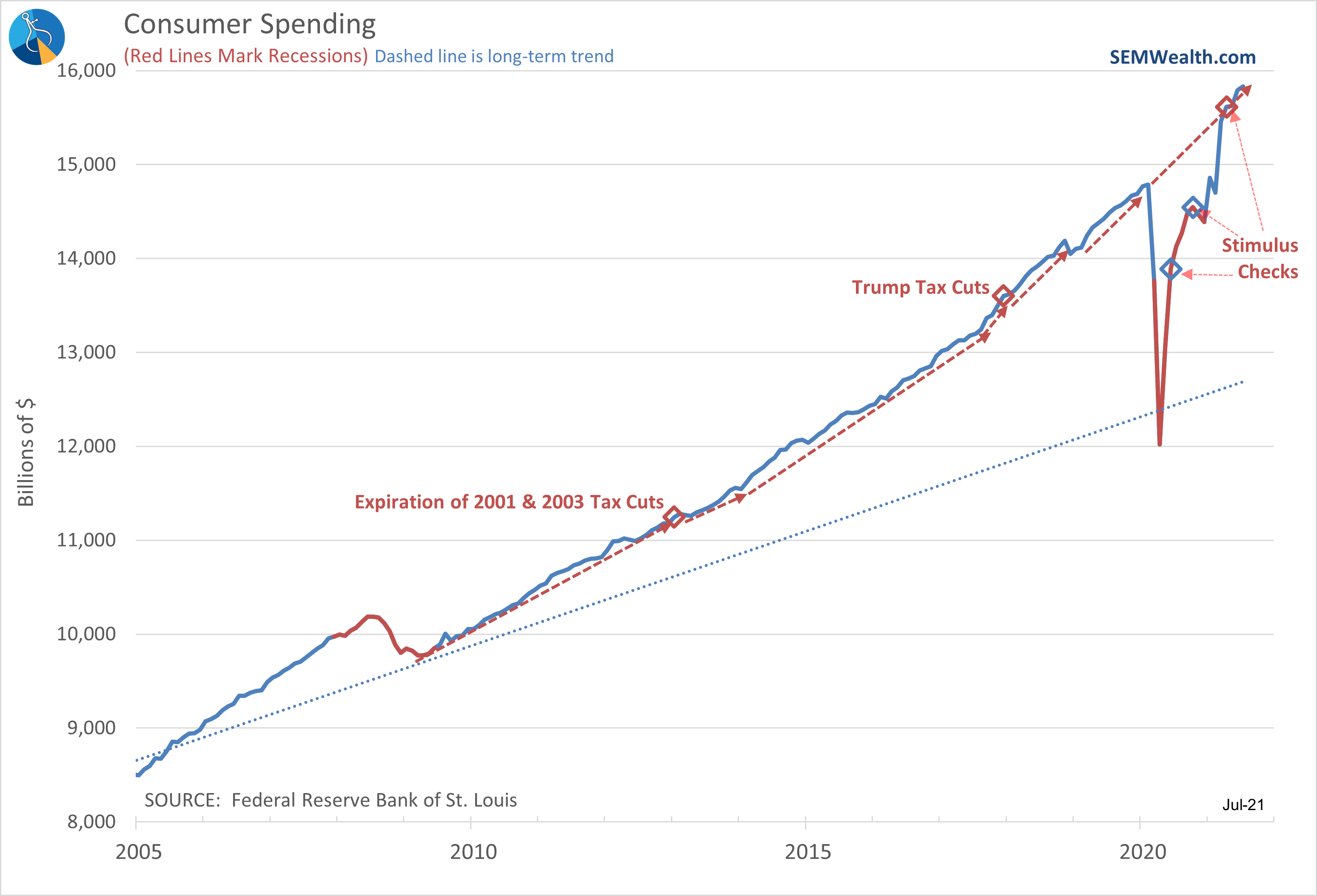

This week President Biden made a hard push for his $3.5 Trillion "infrastructure" bill. This came shortly after the House Ways and Means Committee released their proposed tax changes to help pay for the massive spending bill. I've received a lot of calls and emails from our advisors with

Stocks are back to all-time highs despite a brief "inflation" scare a couple of weeks back that knocked 10% off the NASDAQ and significantly more than that off the more popular momentum stocks. Most Americans will be once again receiving some nice payments from the Federal Government and the expectation