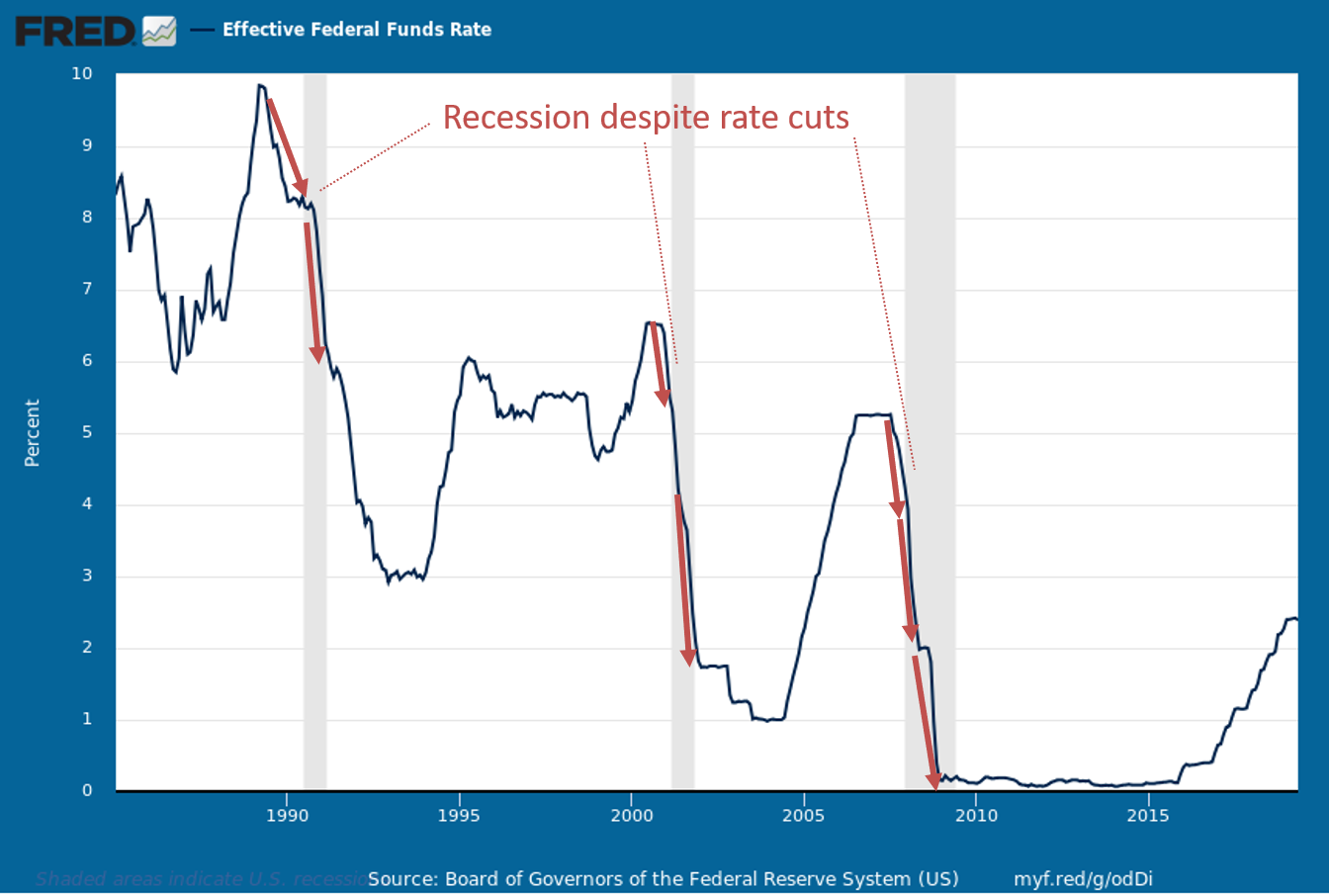

This week the Federal Reserve gave every indication they are ready to cut interest rates as soon as July to fight a slowdown in economic growth (or at least that’s how the stock market participants took it.) Despite the celebration there are really only two outcomes for the

Tag: Federal Reserve

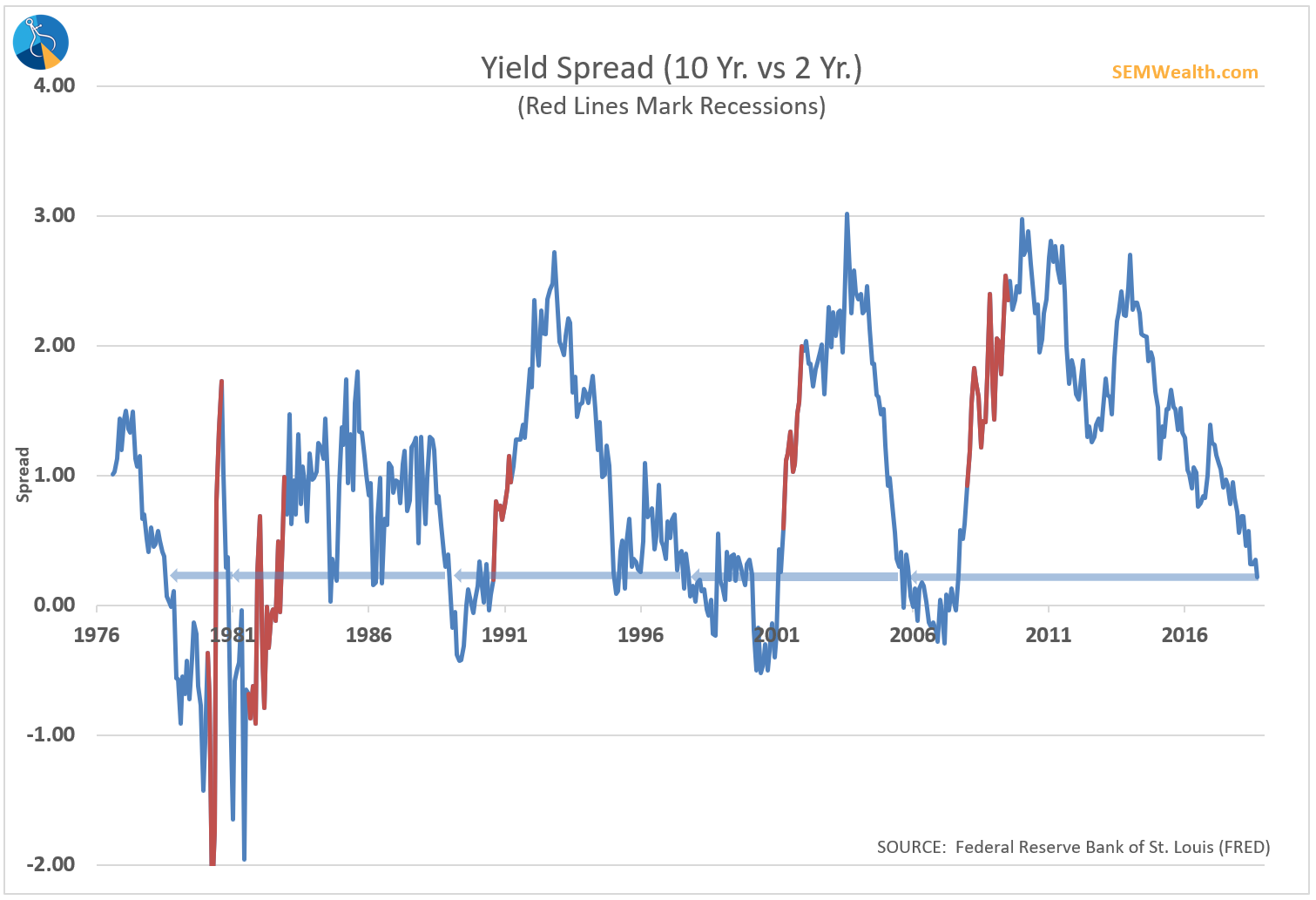

Back in 1997, while I was still in college I read a study from the Federal Reserve Bank of New York titled, “The Yield Curve as a Predictor of US Recessions.” This was in the early days of the development of my economic model, so I studied

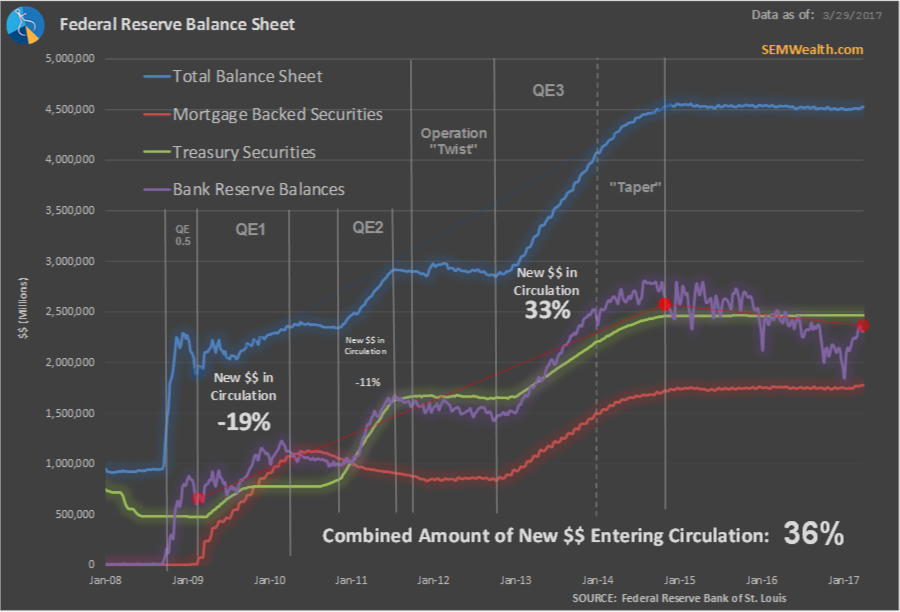

On Wednesday the stock market got spooked when the Fed minutes revealed a lengthy discussion about how & when the Fed will begin to unwind its balance sheet. Many people have forgotten that it is NOT NORMAL for a central bank to hold so many assets on their books. In

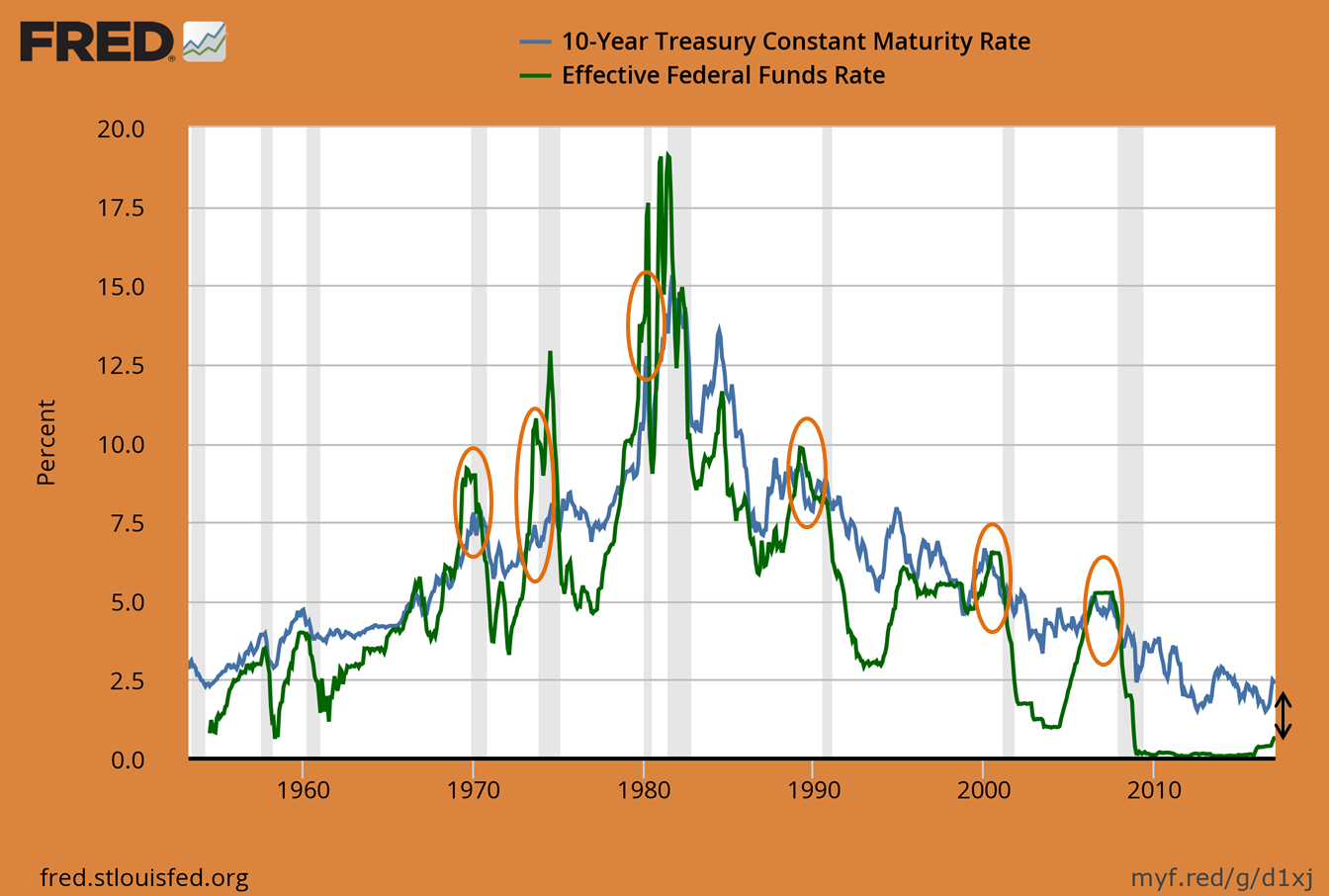

For 9 years I’ve been talking about the unintended consequences of the Fed’s policies. The growth rate of the economy during this bull market has been the worst on record, yet it is now the third highest gaining bull market in history. What happened? The Fed

The Fed raised interest rates at their meeting this week, just the 3rd time since the recession ended nearly 8 years ago. Over the past two weeks market participants have worried the Fed would push rates up too far and too fast. Stocks rallied during Fed Chair’s press