Given all the uncertainty we are facing in 2020 and beyond, the value of SEM's Behavioral Approach has become apparent. This short webinar discussed how investor emotions determine stock prices, behavioral biases we face as humans, and how our approach has us prepared for the unknowns ahead.

Tag: Presentation

Being a data driven, scientifically-minded investment manager, we've always been uncomfortable making decisions that did not have a solid basis. Our study of behavioral finance and market history, as well as nearly three decades of experience managing money tells us our brains often can play tricks on us. This realization

SEM Director of Technology, Dustin Briles and Marketing Manager, Courtney Hybiak worked to revamp SEM's Trader's Blog. In this short webinar, Dustin walks through the layout of the new blog. Jeff also answered some questions about the changes.

With the stock market calming down somewhat and the country looking at the next phase of the crisis, I wanted to take some time to walk through what we are seeing in the economy, the stock market, and SEM's investment models. I know many advisors and investors alike have questioned

Here are 3 positive things we see within the investment markets and our portfolios.

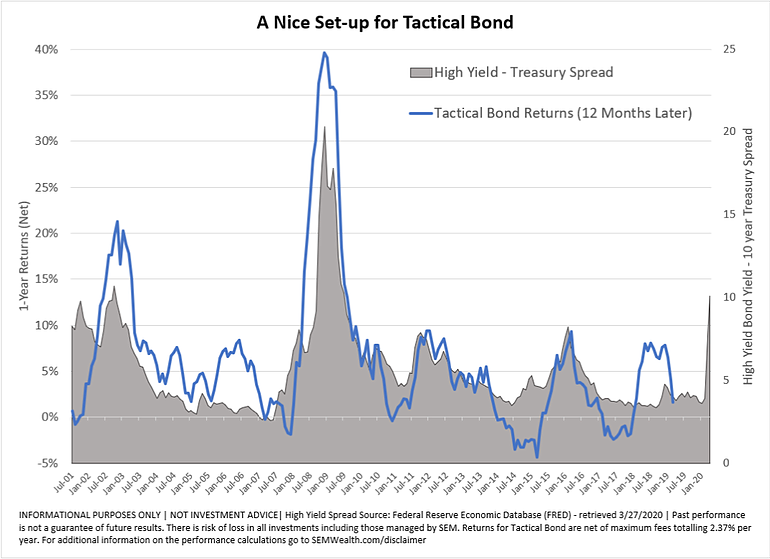

1.) Valuations have gotten very attractive thanks to the sell-off.......in high yield bonds. For a deeper look about what this means and actions you should be taking right now, click here.

2.) AmeriGuard allocations can