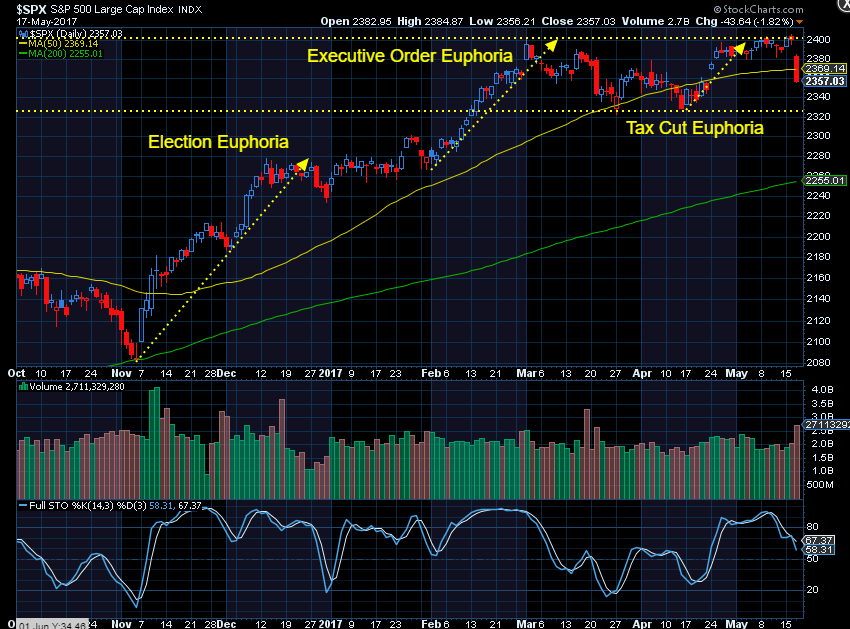

I can’t think of any other word to describe the stock market’s reaction to the election of Donald Trump than “euphoria”. Despite what the so-called experts predicted, the election of Donald Trump was not met with a market crash, but rather a massive inflow

Tag: Trump

The overwhelming enthusiasm towards the new president and his “pro-growth” ideas is being met with a dose of reality as investors are reminded how difficult it is to get anything accomplished in Washington.

Last week we saw how 26 members of the Freedom Caucus broke the market.

For the first time since the election, investors seem to be calling into question their expectations for the Trump Administration. Since the election I’ve warned about being overly confident in any predictions regarding the ability for the new president and Congress to implement any of their campaign ideas. The

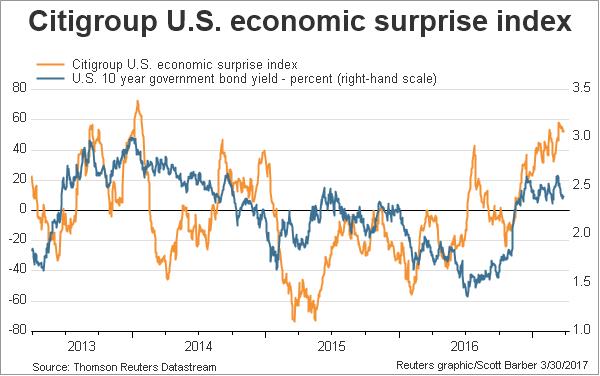

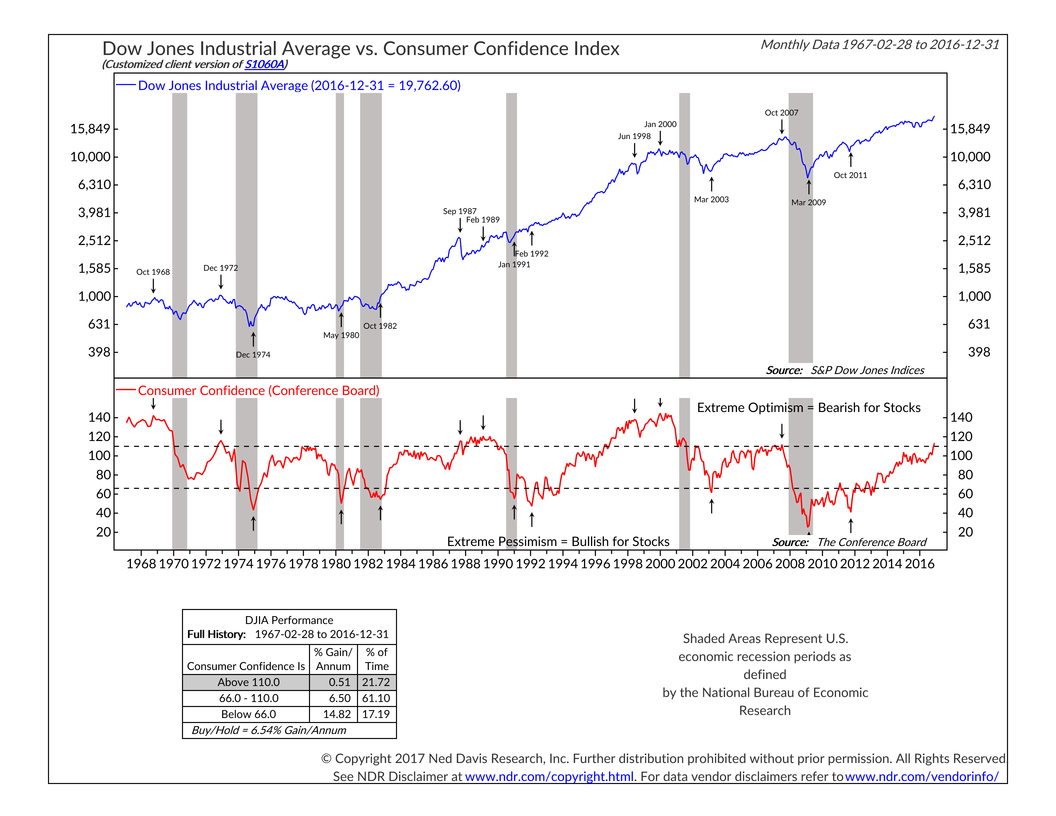

For the most part investors have been focusing on all of Donald Trump’s “good” policies since his election. Things such as mass tax cuts, infrastructure spending, and cuts in regulation in theory would provide a strong boost to the economy. (I say “in theory”

Today is the day half the country has looked forward to for 8 years, while the other half has been dreading for the past 2 1/2 months. We’ve all spent far too long guessing what the new President & Congress will mean for the economy & the