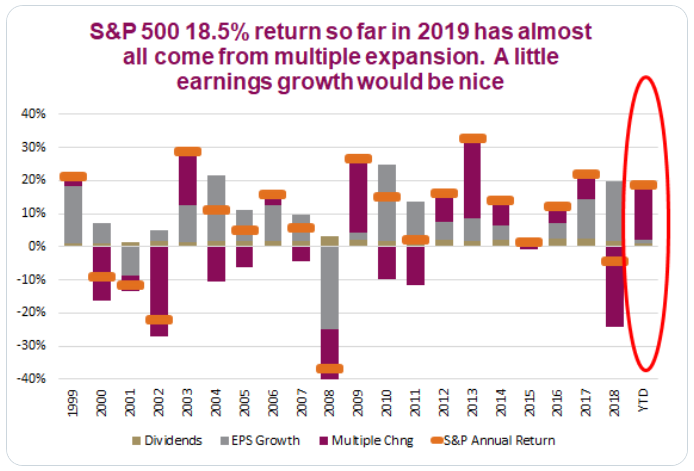

The stock market is supposed to be “efficient”, which means it is pricing in the current value of all future earnings for the component companies. Of course, nobody knows what those future earnings will be, so we often see wide swings between investors who are overly optimistic and

Tag: Valuations

Volatility has returned to the markets with full force this year. The financial media continues to point to various culprits every time the stock market makes a major move up or down. This has left investors wondering how one small piece of information can cause the stock market to fall

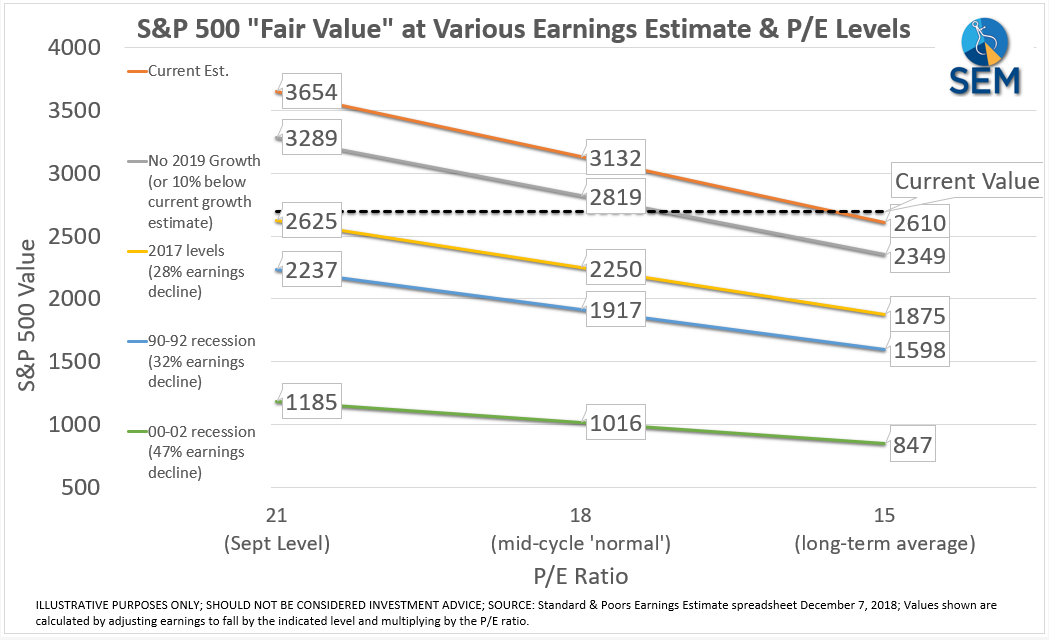

The US economy is growing at a “great” (but not historic) rate. This has pushed the S&P 500 all the way back towards the record high it hit in January of this year. My greatest fear is if the market surpasses the highs of January

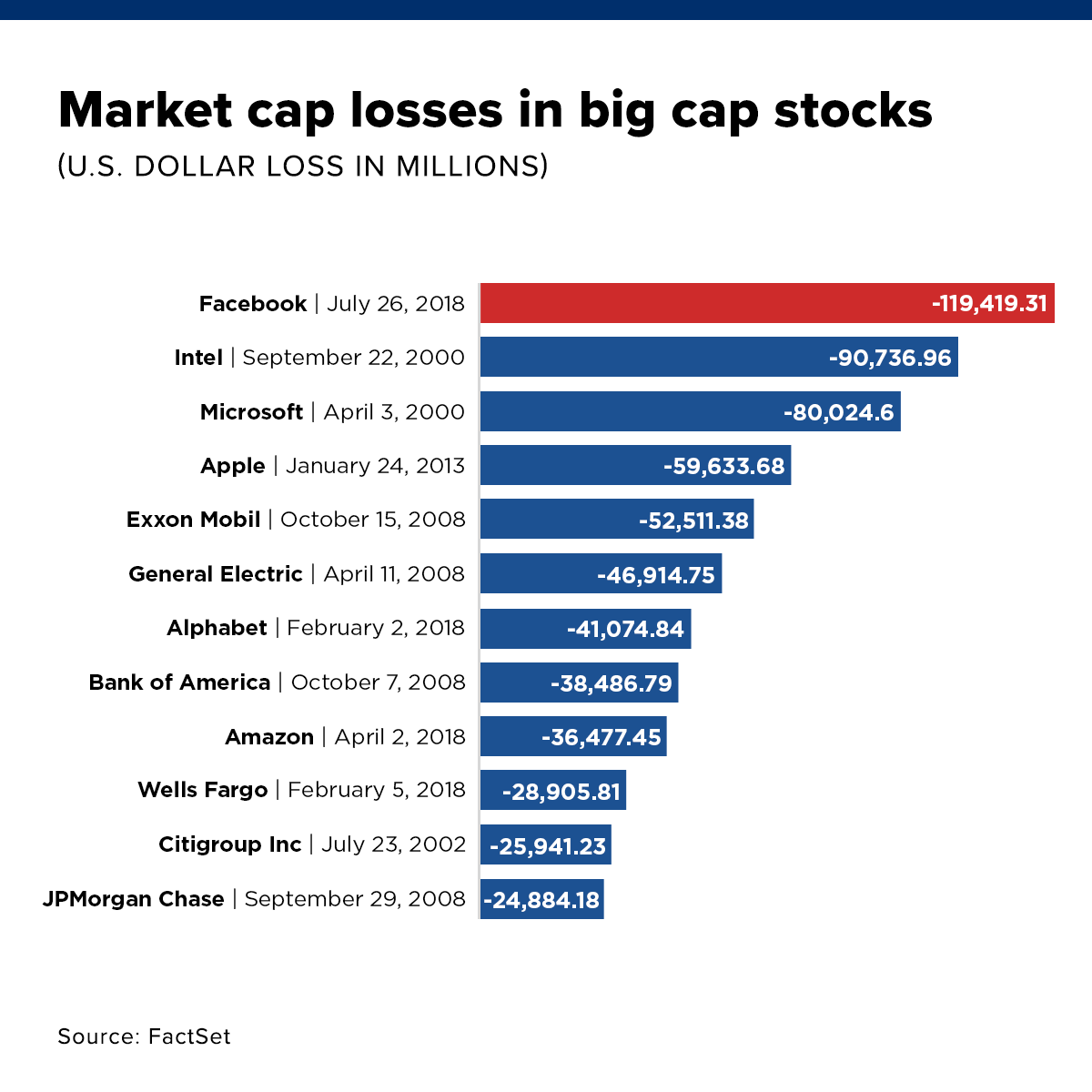

On Thursday Facebook stock suffered the largest single day loss of market value in history. At one point the stock was down 24%. It recovered to close down 19%. $119 Billion of market capitalization was lost. The reason behind the drop was a combination of the company reporting quarterly earnings

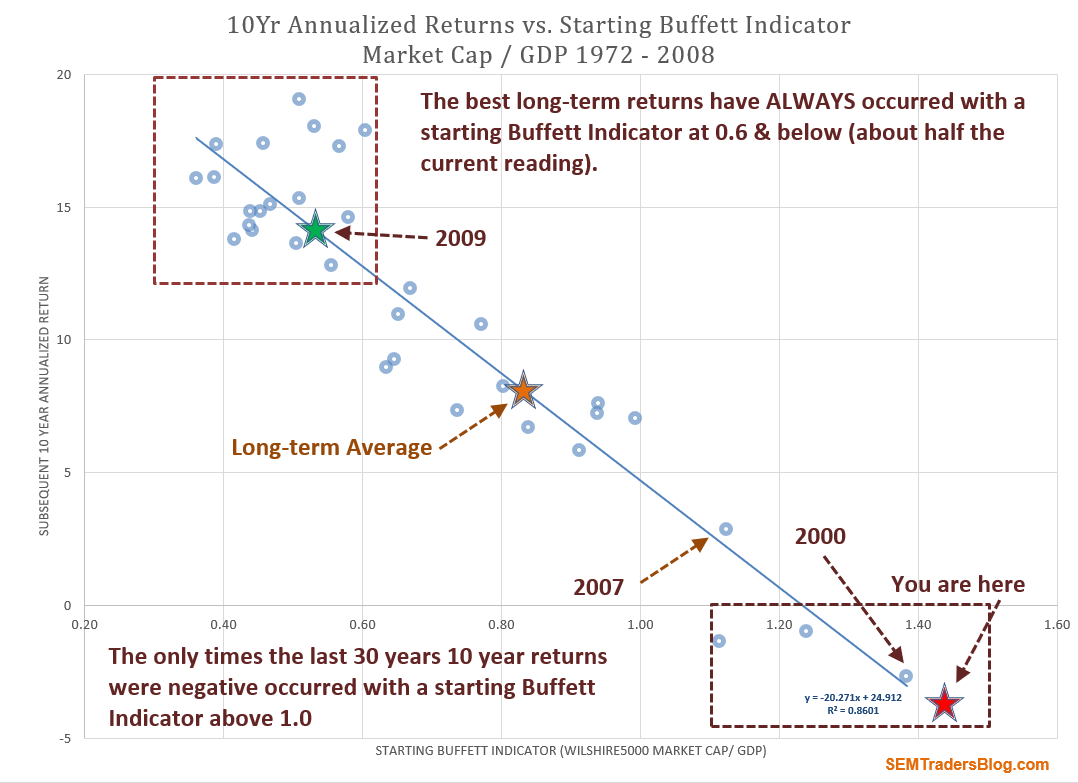

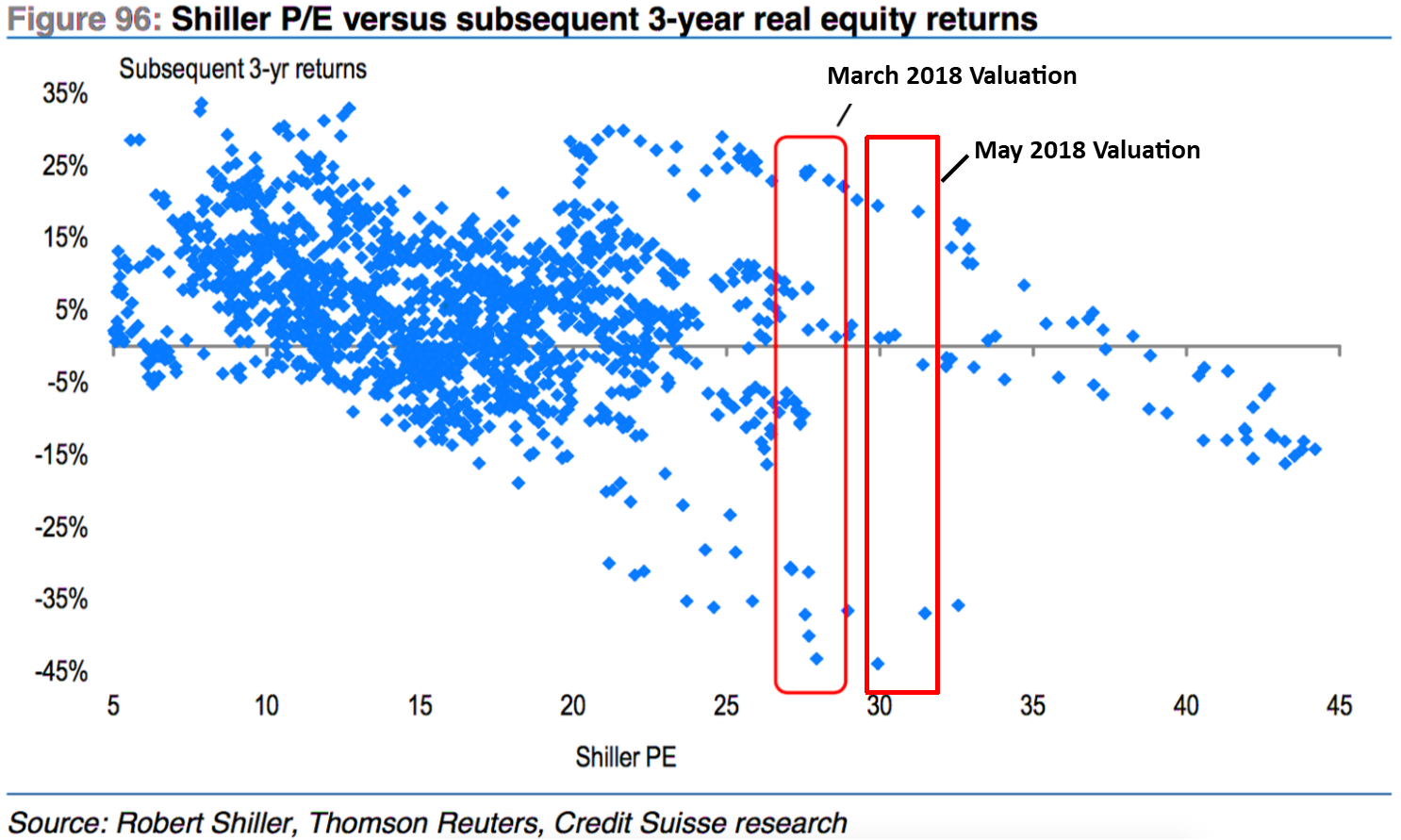

After 20 years with SEM I should not be surprised to see how many people get sucked into the late stages of a bull market. We all have heard the key to investing – “buy low, sell high.” Unfortunately, our brains typically trick us into forgetting this wisdom.