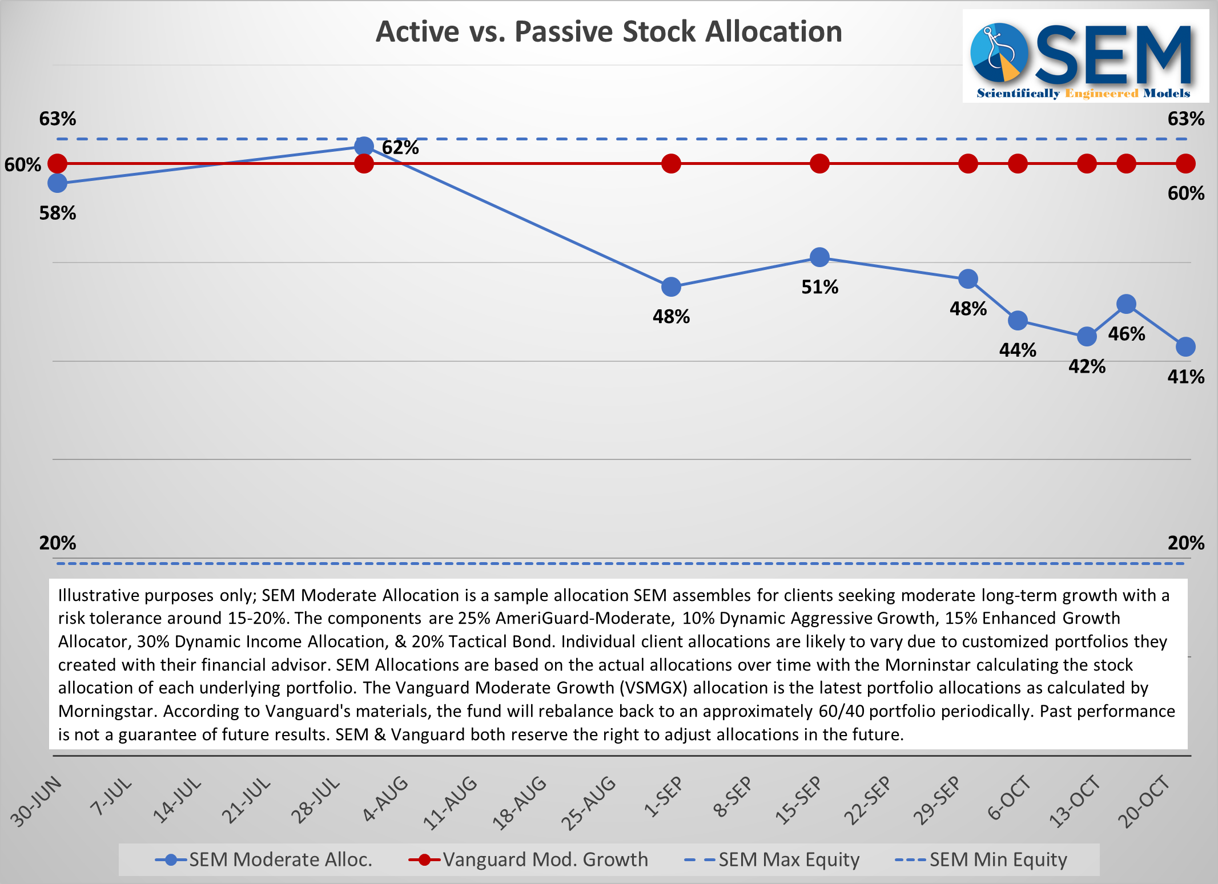

After traveling for 7 weeks to conferences, advisor meetings, and client events it is good to be back in the office for a full week. The major theme across the board was confidence. Clients, advisors, and portfolio managers are overwhelmingly confident there are no risks ahead. The Fed is easing,

Tag: Volatility

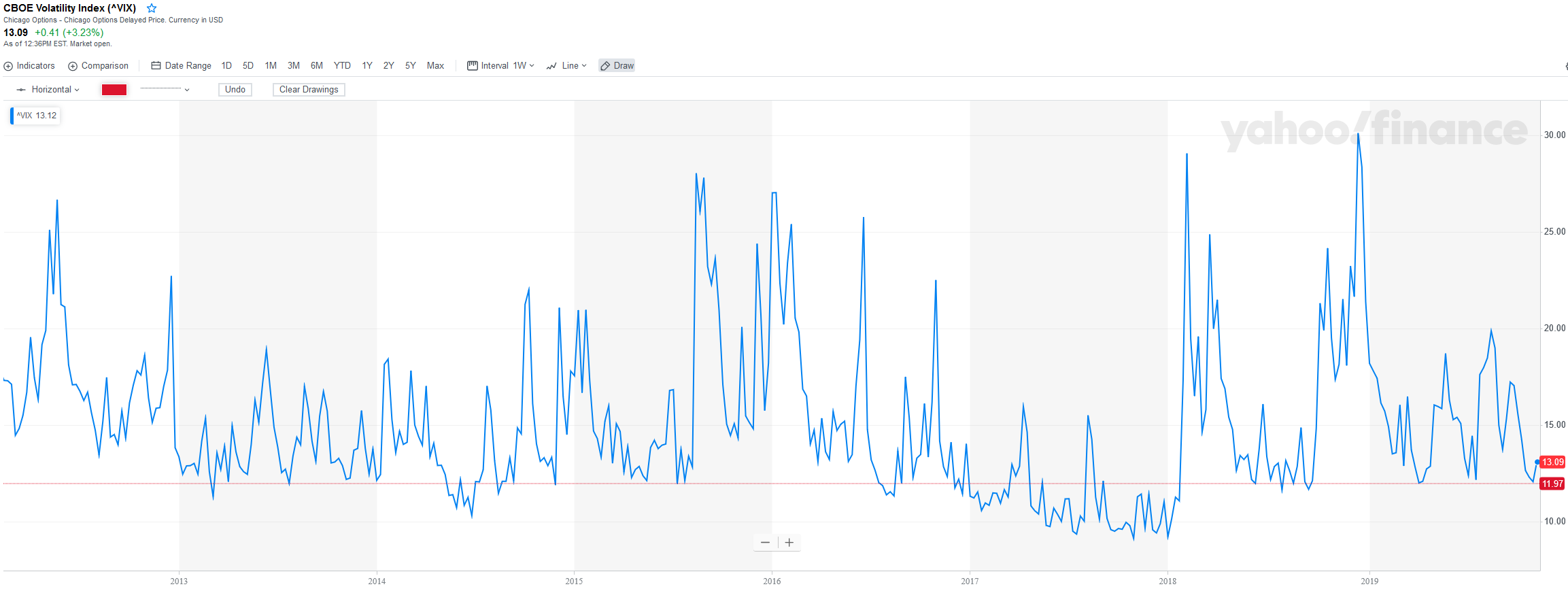

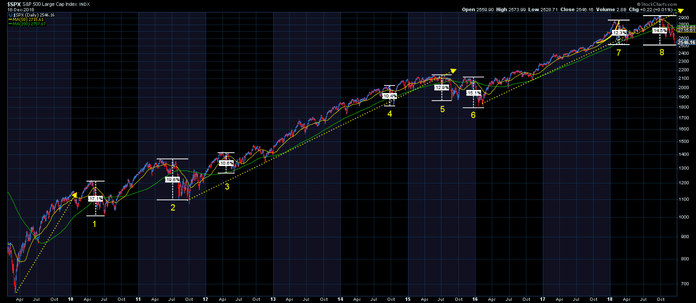

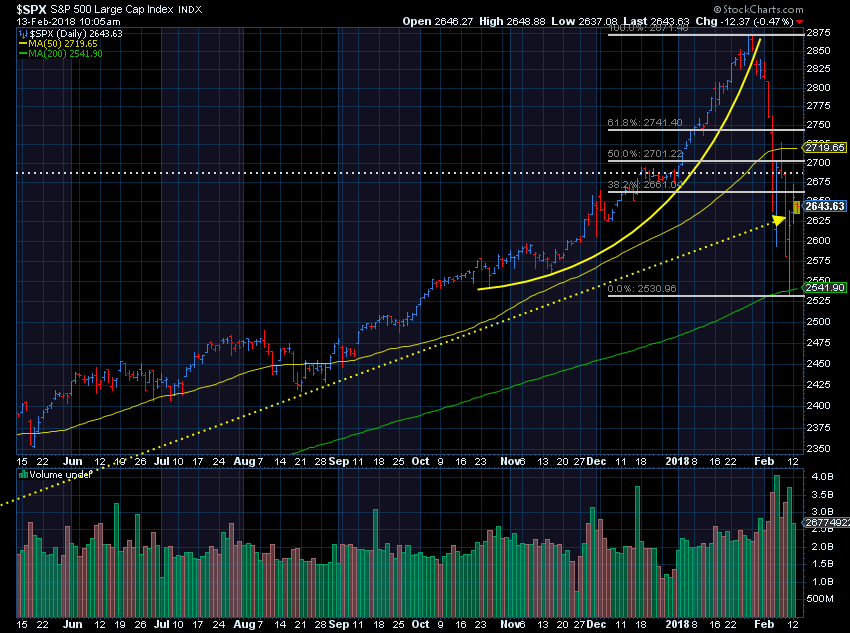

Volatility has become the norm it seems. After a nice steady first year under President Trump, since the beginning of 2018 we have seen the market swing wildly. The key drivers have been interest rates and trade policies. Both have put a sharp focus on the chances of entering a

2017 was the least volatile year on record. While 2018 is not going to break records for volatility, after being lulled into a sense of complacency the past several years, 2018 has reminded us why having a well thought-out plan is important for long-term financial success. The stock market has

Listening & reading to the “experts” over the weekend further cements my belief SEM’s Behavioral Approach to Investing using Scientifically Engineered Models is the best way to manage money. The wide-range of opinions following some scary drops in the market along with some tremendous rallies feeds