At the end of April the S&P 500 (barely) reached a new all-time high. The next day, Federal Reserve Chairman Jerome Powell mentioned the slowdown in the economy is likely “transitory”, which is Fed-speak for temporary. This seemed to remove the prospects from traders’ minds about a rate cut this year and slightly elevated the chances of a rate hike at some point.

The employment report on May 3 removed the fears of a rate hike with job growth coming in strong while wage increases were tepid. This “Goldilocks” economy was just what the speculators buying stocks wanted. It seems things were going too well for the market for the President, so he shocked the markets on the evening of Sunday May 5 by threatening to impose a 25% tariff on an additional $325 billion of Chinese goods. This just ahead of the week where most people had priced in a solution to the trade dispute that has gone on for over a year. The Chinese have since announced their intentions to retaliate with tariff hikes on US products. He can’t blame the Fed for this sell-off!

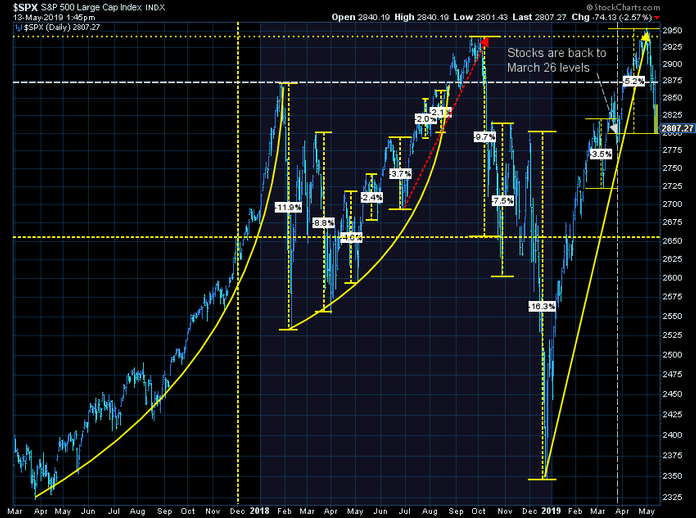

It is important to keep in mind a few things — first 2019 has started as one of the best year’s in any of our lifetimes. The move has come in the face of decreasing earnings growth rates, falling profit margins, and a slowing economy. This means all of the growth in the market this year has been due to expanding P/E multiples, which is always a risky proposition, especially at this point in the market cycle. Second, this sell-off so far has been minor, but it doesn’t mean it cannot cascade rapidly. This chart illustrates the parabolic rises and rapid drops the market has gone through since late 2017. I’ve added a line noting the 5/13/19 position of the market — the 5% drop has only taken us back to the March 26 levels. In other words, most portfolios are sitting approximately where they were when the last quarterly statements were posted.

ILLUSTRATIVE PURPOSES ONLY — PLEASE SEE DISCLAIMER AT BOTTOM OF PAGE

At SEM, the value of our diversified approach has been clear the last 15 months. Our “tactical” models are the most bullish of our three disciplines. They are still invested, but if markets do not stabilize in a few days will likely begin exiting. Typically there will be a snap-back rally. The tactical trading systems are designed to watch the health of that snap-back to gauge whether they should sell into the rally or if the uptrend has truly resumed.

Our “dynamic” models, which follow our economic model have been defensive since last November. Our “strategic” or AmeriGuard models are right in the middle of the two. The nice part about this position is if the sell-off continues, our tactical models are the ones designed to start putting on defensive positions the quickest. It will just depend on how the market participants view the latest jabs in the on-going trade war. (For more on the Trade War see our 2nd Quarter, 2018 client newsletter titled ‘A Necessary War?‘) [Update: Our tactical high yield systems inside Tactical Bond & Income Allocator exited from high yields on 5/13.]