This week I was on an Investment Panel with three other portfolio managers and strategists. Two of the panel members were from large, well known firms. Several of the questions centered around ways to handle a recession or bear market. The ‘solutions’ proposed were to have “diversified portfolios” with the following examples of asset classes that would help mitigate the losses in a portfolio:

-

International Stocks

-

Emerging Market Stocks

-

Dividend Growth Stocks (instead of the “risky” bonds)

-

Emerging Market Bonds

-

Small Cap Value

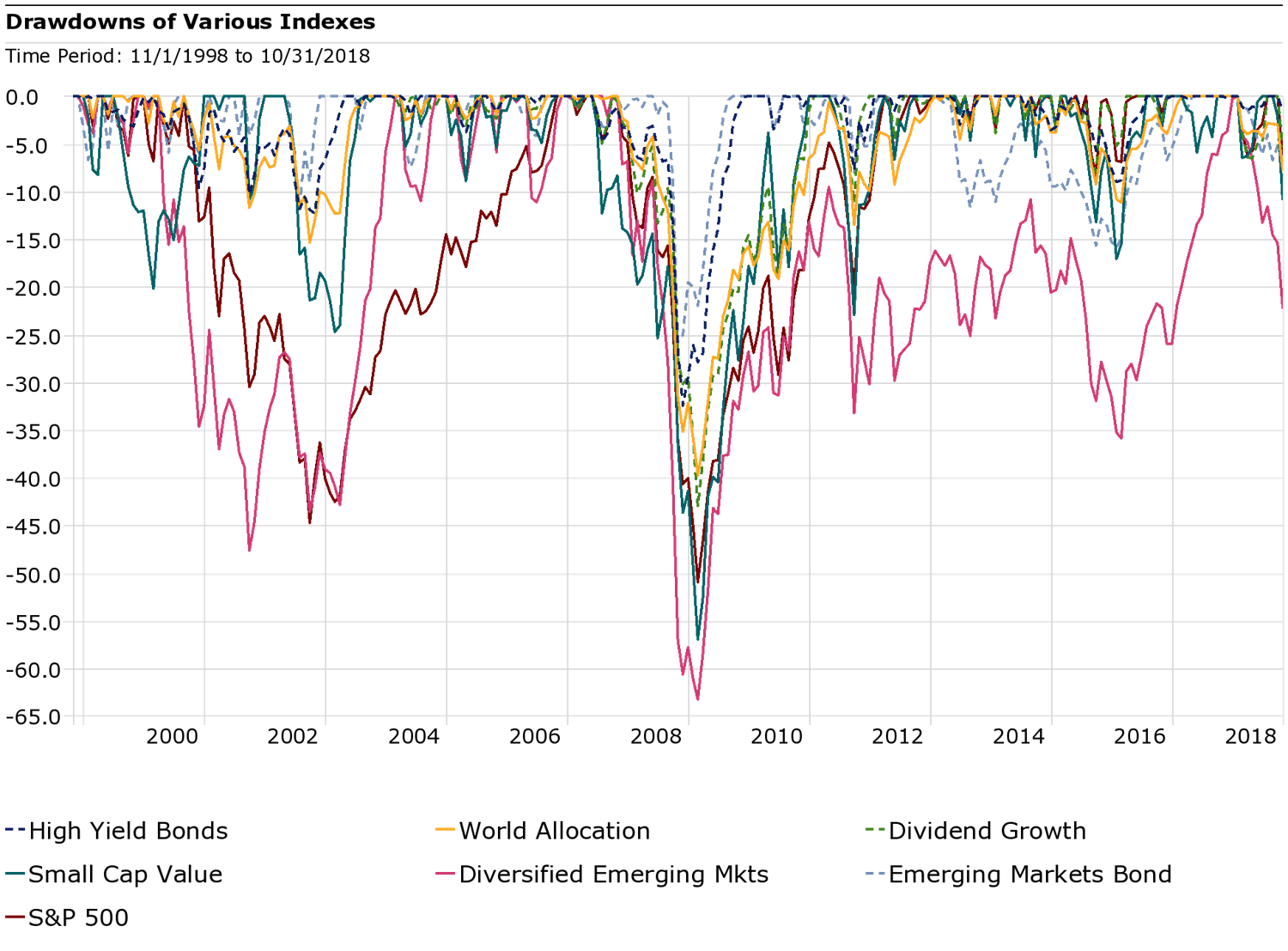

Using these asset classes to reduce risk in portfolios is based on academic research and something I see far too many asset managers and investors relying on. This week’s Chart of the Week plots the drawdowns (losses) of these “diversifiers”. Having managed money for 20 years, I’ve seen first-hand what happens if you lose too much money — investors who said they had a long time horizon and a high risk tolerance become emotional and end up abandoning their investments at the wrong time. Believing that these asset classes will help prevent this is naive.

At SEM we choose to AVOID asset classes such as these during the worst times in the market (typically in the midst of a recessionary bear market). Dividend Growth Stocks lost more than High Yield Bonds and Emerging Market Bonds, which lost 25% during the last bear market. Small Cap Value & Emerging Market Stocks lost more than the S&P 500 during the last bear market. During the 2000-2002 bear market, we saw a slight bit of non-correlation of these “diversifiers”, but during the 2008-2009 bear most risk assets became correlated. Since that time we’ve seen downside correlation among asset classes increase. We can see during the 2011 & 2015/16 market corrections how all of these diversifiers went down together, just as they did during 2008.

I don’t know when the next bear will begin, but please do not fall into the trap that these larger firms are setting — The panel members offered no proof or reasonable explanation as to why we would expect the spike in downside correlation we’ve seen the last 10 years would change. SEM’s data driven approach gives us an advantage over these academically driven approaches. Even our AmeriGuard models, which fall near the same category as these other panel members’ offerings provide an advantage because AmeriGuard will migrate out of riskier assets as necessary (for instance, we have had little to no international exposure this year). This does not mean we won’t own these asset classes, but why keep rebalancing all the way down hoping for a bottom when you can wait for those asset classes to show some signs of strength? It’s been an approach that has helped us for 26 years and one that our research shows will continue to provide stronger risk-adjusted returns into the future.