This is my 4th year in Virginia. After 20 years in Arizona where you have a very short spring before moving into the 90-110 degree temperatures, there is just something about seeing the landscape come to life. After the year we just went through, it seems like there is even more excitement this spring.

Maybe it's because I played baseball or softball for 27 straight years, but to me the year starts with spring. With that in mind I spent most of Monday Morning Musings (MMM) in March helping you work on a game plan for the "new year". I'd encourage you to check them out if you haven't already:

- 5 Questions to ask as you formulate your plan

- 3 Things investors may not be considering

- Our long-term deficit problem

- March economic update

Here's a short summary that's on my mind as we start the week:

The Pillars of the Rally

We posted our Spring Newsletter at the start of April. I'd encourage you to check it out here.

The lead article for our clients and advisors helps identify what has caused the sharp rise in the market:

Any cracks in the pillars above and the market will likely run into problems. All of these are priced in. The market doesn't like being disappointed, especially when we've seen this sharp of a move.

Lower your expectations

If all of the above pillars are already priced into the market, if you are aggressively buying stocks right now, you must believe things will get BETTER than expected in the year ahead. Based on client and advisor conversations, many people believe the rally is just now getting started.

I outlined last week what our economic model is saying. There are certainly some indicators that have taken off much faster than expected. There are also others still struggling.

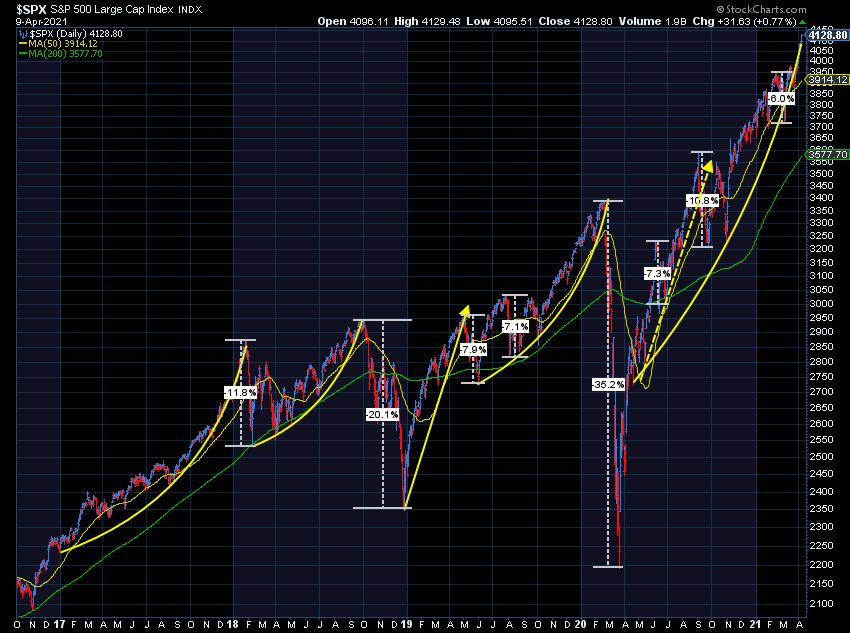

Throughout the past 5 years we've seen some big "parabolic" moves in the S&P 500. These moves have led to some sharp losses on seemingly minor "disappointments".

The 12% drop in early 2018 and the 20% drop in late 2018 was the result of economic and earnings numbers that failed to meet expectations. This was after the temporary boost of the Trump tax cuts wore off. Obviously we know COVID caused the 35% drop, but we also had two 7% declines in 2019 as the economic data was again showing signs of a possible recession.

In hindsight it is easy to see – stocks were trading at high valuations expecting a continuation of the strong economic and earnings growth. When those growth numbers were reduced, stocks took a major hit.

Be careful putting too much in stocks at this point unless you have a well tested, non-emotional plan to get out.

In the same way, bonds are at extremely high valuations. For corporate bonds, including high yield ("junk") bonds, the best valuation metric is the difference in yields between those bonds and Treasury Bonds. This is because Treasury Bonds are deemed to not have any credit risk. The lower the spread, the more optimistic the bond market is. Right now, bond investors have pushed spreads to the lowest level since before the financial crisis.

We are currently at max investment in high yield bonds in Tactical Bond, Income Allocator, and Dynamic Income Allocation. There is still room to make some money here, but the easier money has already been made. This doesn't mean you should try to take higher risks by moving to alternative sources of income, but instead be patient. We've been trading high yield bonds since the 1990s. There is a time to be aggressive and a time to be patient. Right now is the time to be patient.

What is 'infrastructure'?

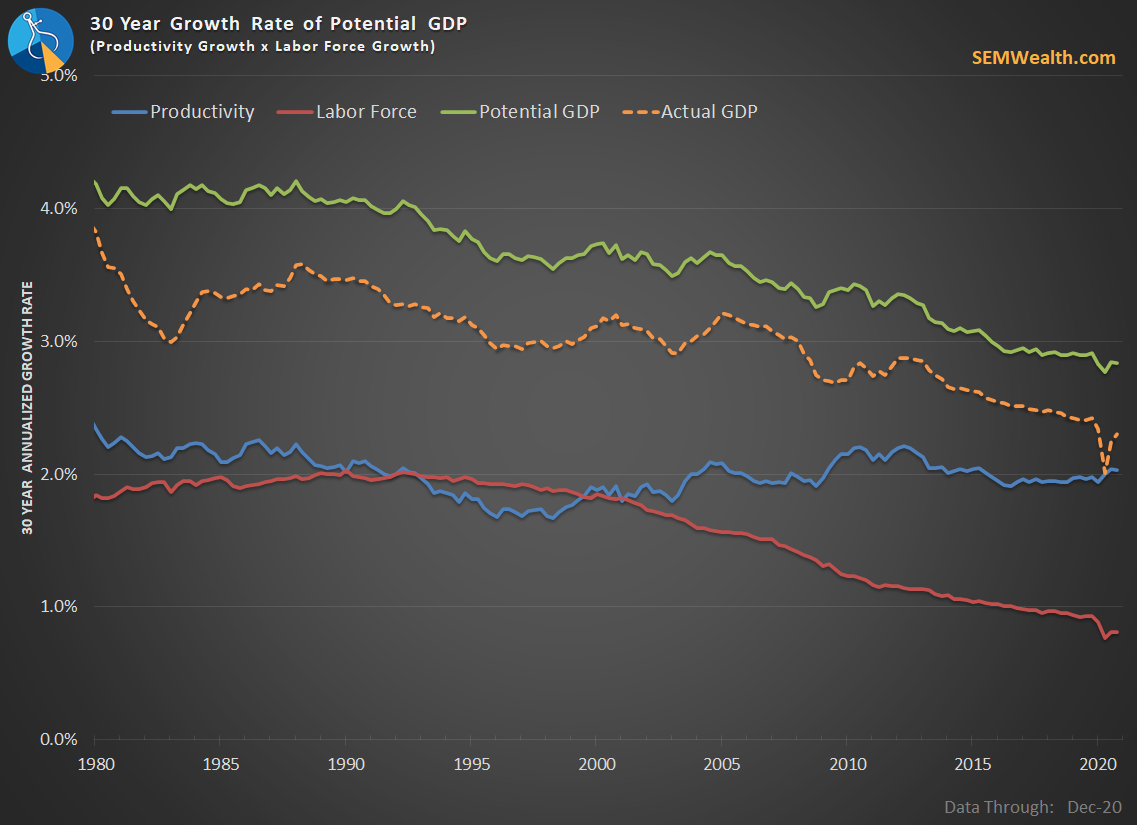

The focus in Washington has turned to President Biden's infrastructure bill. Since this is one of the 'pillars' to the rally, we need to pay attention. The President has used a liberal definition for infrastructure. For over a decade I've outlined both what infrastructure is and our dire need to address it. It boils down to being the only two things that can grow our economy over the long-term:

- Increase the size of the labor force (how many people are working?)

- Increase productivity growth (how much are the workers producing?)

Anything else is a waste of money because it will not increase our long-term economic growth rate. Worse, it is money that will have to be paid back from future growth. Our actual growth rate has lagged the "potential" growth rate because we have spent too much on wasteful spending and because we run such a large trade deficit.

There is also debate about how this bill will be paid for. The President's team has used shady math that has never been done before. The 7 year cost of the bill will be "paid for" over 15 years of corporate tax increases. Revenue time horizons are supposed to match spending time horizons. If it doesn't, the bill will increase the deficit, which of course will not be popular with moderate Democrats.

There is also a novel concept being floated by Treasury Secretary Janet Yellen. Essentially she suggests corporations pay taxes on their stated profits, not what they tell the IRS is taxable income. For decades corporations have used accounting tricks to post increasing earnings while not paying taxes on those earnings. Small businesses do not have that luxury. If we make money and take it out of the company it will be taxed. This logical change in taxation of corporate profits will not be popular and would hammer earnings and dividend payments short-term, but it is a way to at least make the tax code for large corporations align with small businesses.

Theoretically, if the infrastructure bill truly focused on the real definition of infrastructure, businesses would be better off even after paying more in taxes. Higher long-term economic growth is good for everybody.

For more, see the bottom half of my '40 Years Later' article.

Return to normal?

I received my second dose of the Pfizer COVID vaccine on Thursday. Like the first dose, the only side effect (thankfully) was a very sore arm. Over the weekend I posted this on Facebook:

Unpopular opinion in today’s world: I’m thankful for the leadership of President Trump in pushing so hard for a vaccine. I’m thankful for the leadership of President Biden to offer more federal support to get the vaccine distributed more quickly.

Could either of them done a better job? Probably, but hindsight is perfect. As a country we can keep dwelling on the mistakes of others or we can choose to move forward. We can let the decisions made the past year tear us apart or make us stronger as a country. Which will YOU choose?

A month ago we had no idea when anybody in our family would get a vaccine. As of Monday everyone will have received at least their first dose. Things are looking up for our country and politics aside we have both President Trump and President Biden to thank.

I said from the outset, if there was ever a president to cut through the red-tape to get a vaccine done, it is Donald Trump. I also said throughout, America has the best scientists in the world and we just have to give them time to find the solution. It doesn't need to be political. We shouldn't be identified as "Democrat" or "Republican" or in the case of me and 35%+ of Americans "Independent". We are all Americans and should be proud of where we are versus the rest of the developed world in terms of vaccinations.

I know our family is looking forward to getting out in public more come May. That said, I know we aren't going to go back to our old ways. During COVID we discovered a lot of ways to entertain ourselves and have enjoyed the simplicity of that. From making more meals at home to watching movies in our new home theater (or from our back porch), I just don't see us wanting to go back to our old ways.

We also did something apparently many Americans did over the past year – we bought an RV. Anybody who knows us would know we aren't "campers". Our new endeavor is best called "glamping", but we absolutely love the simplicity of staying in our camper. Kayaking, biking, and hiking allows us to re-charge our brains and unwind from the stress we deal with on a day-to-day basis. Even if it is just 20 minutes away from home at the lake, we all enjoy just being outside in nature far more than spending 2 hours in a movie theater. I have no desire to get on an airplane or stay in a hotel again (even though I know business will require it at times going forward).

So many of us have discovered a different way to go throughout life and I suspect we will not see our economy go back to "normal" because we learned what is important in life.

Cold brew season is here!

I came to love coffee much later in life. When we lived in Arizona, we would spend at least one week a summer at Mission Beach in San Diego. We had a favorite coffee spot that turned me into a coffee snob. During our last summer on the west coast, while waiting in line one cool summer evening, I listened to a barista explain the difference between iced coffee and cold brew. I didn't believe there was a difference.

When we moved to Virginia in August of 2017, Brandi bought me a cold brew system. Since then, the weekend I make my first batch of cold brew coffee is an exciting time for me. It means a transition to GOOD coffee to start each morning. Add that to all the green in our landscape, the extra hour of daylight, and the completion of our tax filings and it seems like all is right in the world.

Despite my outlook, I know a lot of things can go wrong in the economy and the market. That is key to working with SEM. Our "mood" has nothing to do with our outlook or our investment allocations. We'll do what we always do – watch the dozens of trading systems which comprise our wide ranging models for adjustments that need to be made. No opinions, just data.

The nice part about this for clients and advisors who use SEM is you can enjoy this fantastic time of year. You don't need to worry about all the things that could go wrong, but can instead focus on what brings you joy knowing SEM is watching the markets for you.

Have a great week!