I think most people enjoy fall. The transition from the hot summer weather to something a bit more comfortable is a relief. In many parts of the country the changing of the leaves comes at the same time the insect population begins to diminish. For others pulling out hoodies, fall decorations, and anything with a pumpkin spice flavor brings a sense of excitement.

For the stock market and economy, fall is often a time of transition at key points of the cycle. Often with hindsight we see market tops and bottoms were put in place in the fall. The transition from the free spending summer economy to the fall/winter economy will often highlight any strains that may have been hidden during the summer.

This fall we are facing a very obviously tenuous transition. While our economy is still dealing with the drag of COVID, it is also going to be forced to stand (somewhat) on its own. The staggering $5.3 Trillion of COVID related stimulus has been mostly spent. The Federal Reserve is preparing to "taper" their asset purchases and hinted last week inflation has remained stubbornly high, which could force them to raise interest rates much sooner than everyone anticipated.

Additional stimulus via the Biden 'infrastructure' and 'social' spending bills is still in question in terms of both size and how it will be paid for. Even if Democrats get their full $4.5 Trillion of spending, unlike the COVID spending bills, these bills are designed to be used over 10 years. Somewhat linked to these new spending bills is yet another debt ceiling debate.

[Side note: I've gone through 7 or 8 of these in my career. Based on this experience I'm betting America will not "default" so all the fear surrounding this is way overblown. Democrats and Republicans will posture and try to use it as a bargaining chip. If the deadline to raise the debt ceiling is October 18, the odds say they will wait until that week to finally pass something. Based on how long they extend it, you can bet the positions will change next time around if a different party is in the White House.]

The transition to fall comes with a lot of questions. We tackled some of those in our just released quarterly newsletter.

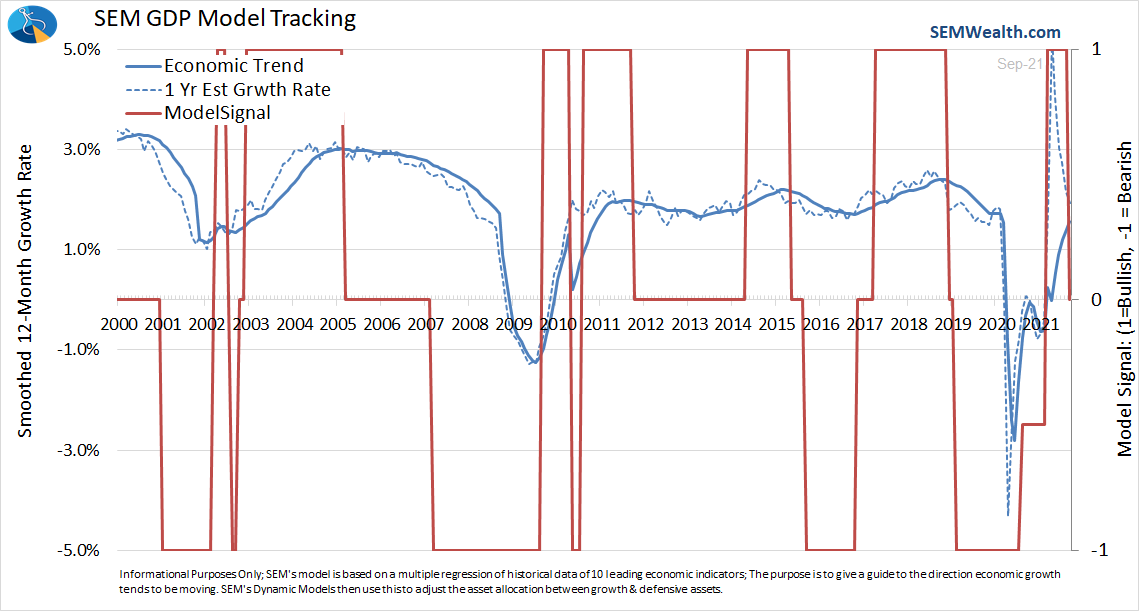

Turning back to the economy, as expected, SEM's quantitative economic model has moved from "bullish" to "transition" based on the most recent monthly economic data. This doesn't mean we will head towards a recession, but instead that the pace of expected economic growth has slowed enough it could lead to problems for the stock market. You can see how rapidly our model's expected growth rate has slowed the past few months. It is now running at a 1.85% annual pace, which is far below the 3% "normal" rate. It is also nearly back to the level it was BEFORE COVID, which wasn't that great.

Areas that have led to the change in the model include, personal income, hours worked, and manufacturing new orders, which all have slowed significantly in the past few months. There are few indicators showing increasing growth, which should be expected following $5 Trillion of stimulus, which is 25% of our total economic output. The key will be whether or not we can get some stability in the economy and start moving higher again.

The change in our economic model does mean some adjustments were made at the close on Friday in our Dynamic models. In Dynamic Income, this means selling half of our 40% position in dividend growth stocks and increasing our allocation to tactical fixed income. In Dynamic Aggressive we sold half of our 40% allocation to small cap stocks and added some "hedged equity" positions as well as some tactical fixed income. (Dynamic Balanced Allocation is a 50/50 mix of Dynamic Income and Dynamic Aggressive.) Transition signals are the trickiest times as it typically leads to volatility as institutional managers attempt to decipher whether this is a speed bump or a shift to a slowing economy.

What about the other models?

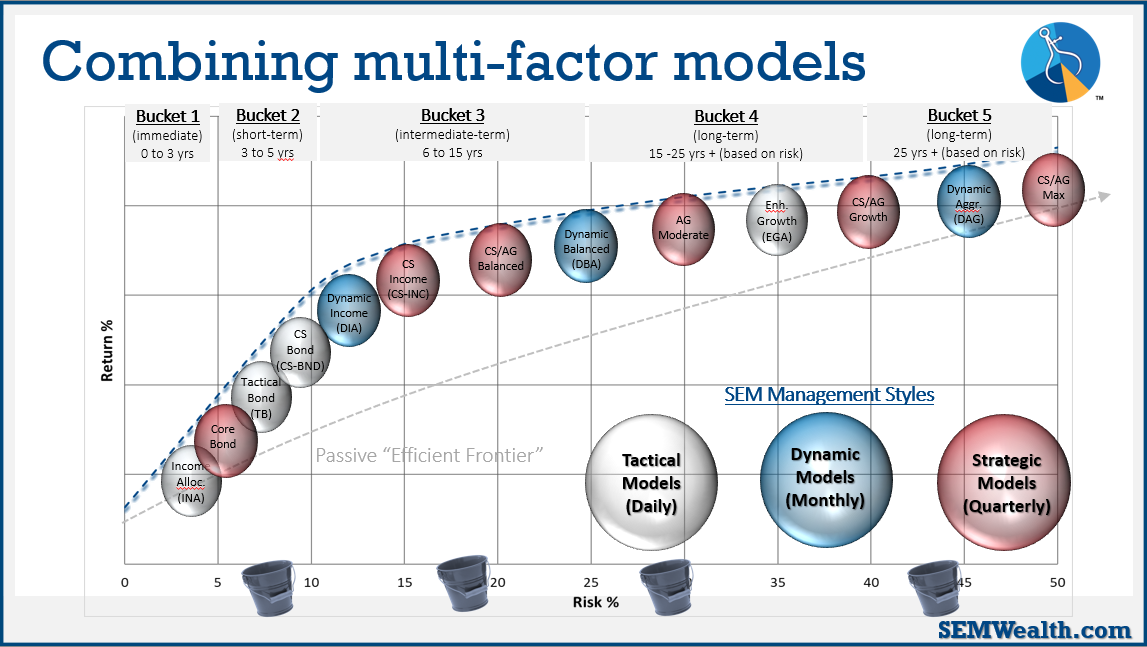

It should be noted this only impacts one of our three management styles. Part of our behavioral approach is providing completely independent ways to analyze the markets and allocate to the various asset classes. On the tactical side, while high yield bonds have weakened recently they HAVE NOT confirmed the negative economic signal. High yields have actually held up better than other bonds, which is typically a sign the fundamentals beneath the economy have not broken down just yet. If they do, this could be a sign the economic weakness indicated in our model is accelerating.

On the "strategic" side, both of our trend following indicators in AmeriGuard remain on buy signals. They are at their weakest points since late 2020, but have a ways to go before they would show signs of concern. Put another way, the intermediate term trend remains higher despite the weakness in September. The "core" inside of AmeriGuard is confirming what we are seeing in our economic model. Small cap strength has diminished and large cap growth is again in favor. We are likely to see AmeriGuard sell most or all of our small cap exposure and again be overweight large cap stocks. Those stocks typically hold up better during an economic slowdown.

As you can see, this three-pronged approach typically helps us avoid "whipsaws" where we pull all the money out of the market and/or slam it back in all at the same time. Instead we use the three independent management styles to ease in and out of the market. For those who have been hanging on to risky investments outside of SEM, it could serve as a warning it may be time to cash in the nice gains and move to something which has an objective plan to pull out if necessary.

Expectations

With our downgrade in economic growth potential and several clients "frustrated" at low returns in their ultra-conservative investment accounts, I was reminded of the fundamental growth equation for stocks. Long-term return expectations, based on when you start eventually revert to this equation: GDP Growth + Inflation + Dividend Yield.

GDP Growth was running at 1.8% going into COVID and as we noted is right back to that number. Inflation was also running at 1.8% for the 10 years before COVID. As I mentioned, the dividend yield was also 1.8% to start the year. Even if we assume inflation will be higher (let's say 3%) as things settle back to 'normal', the EXPECTED return for stocks is 6.6% (1.8% GDP Growth + 1.8% dividend yield + 3% inflation). Bump GDP to 3% and you still only get 7.8% returns for stocks. Either way, this is BELOW the 'normal' long-term returns and certainly below the 15% annualized returns we've enjoyed since 2010.

The longer stocks are running above this fundamental equation, the more likely a sharp correction will occur.

Bond yields are low. Dividend yields are low. Potential economic growth is low. We should expect lower returns until we get a correction which increases yields once again. At that point we will expect significantly higher returns. The key will be to remain patient and have the capital ready to deploy to take advantage of the opportunities.

We are quite pleased with our returns in 2021 thus far. The aggregate bond index is down nearly 2%. The fact our conservative clients are up 2% is a win, in our opinion. Our models are designed to wait patiently for better opportunities, especially for our most conservative clients. When we have low yields in both stocks and bonds, this becomes an especially dangerous situation for conservative investors. We discussed this in our 2nd quarter newsletter.

As always, if you are "frustrated" or even concerned about how you are currently invested, the best place to start is by taking the short survey at Risk.SEMWealth.com.