Even with Friday's big drop, it was a positive week for stocks. The S&P 500 was able to break above its recent trading range.

This was important as going into the week, stocks had been putting in a series of lower highs and lower lows (which is bad).

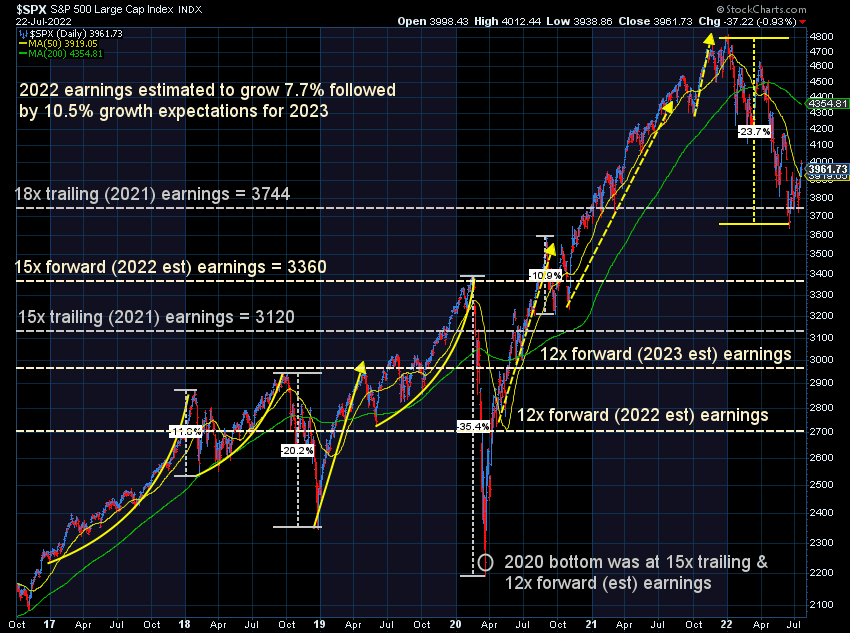

From a valuation stand-point, the S&P 500 is back in the "overvalued" category, trading at 20x trailing earnings & 17 times "forward" (2022) expected earnings. The long-term average is 18 and 15 respectively, so unless you firmly believe the economy is going to rocket back to "expansion" mode (above average growth), stocks are NOT attractive at these levels.

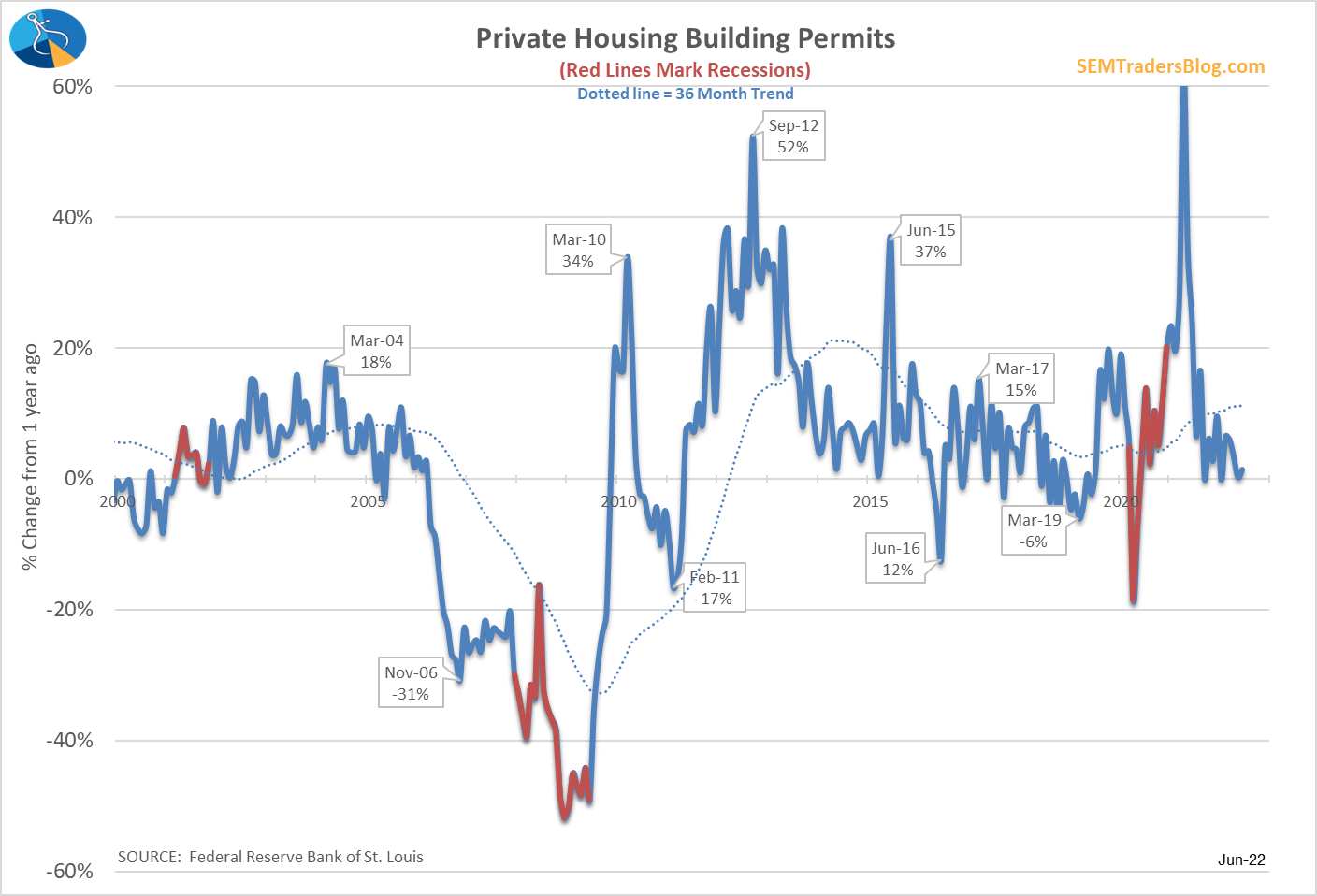

From an economic perspective two of my favorite leading indicators this week showed continued signs we are either already in a recession or very close. First was Building Permits, which have slowed significantly over the past 12 months.

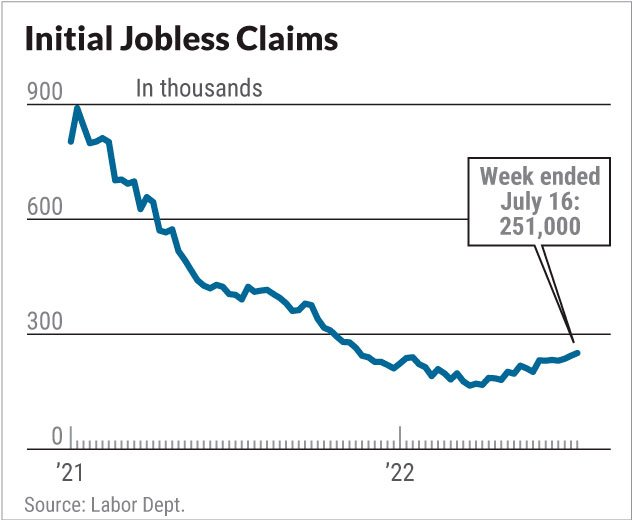

The next was Initial Jobless Claims, which are a "leading, leading" indicator (this ticks up well before we see any slowdown in the official jobs report.

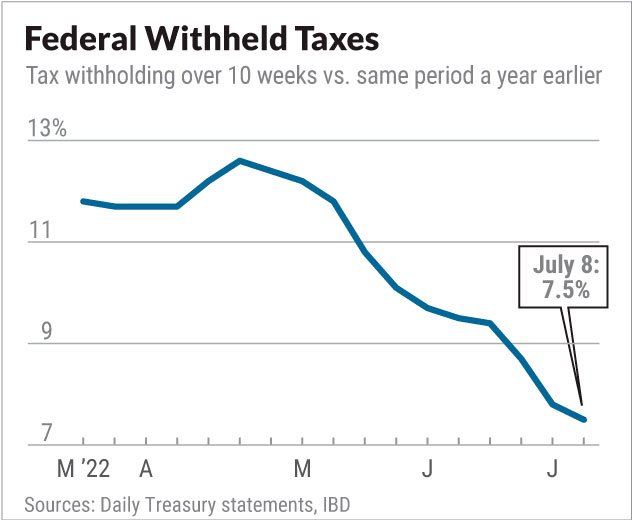

Digging even deeper, Federal Income Tax Withholdings show a much weaker jobs market than the Payrolls report indicated a few weeks ago.

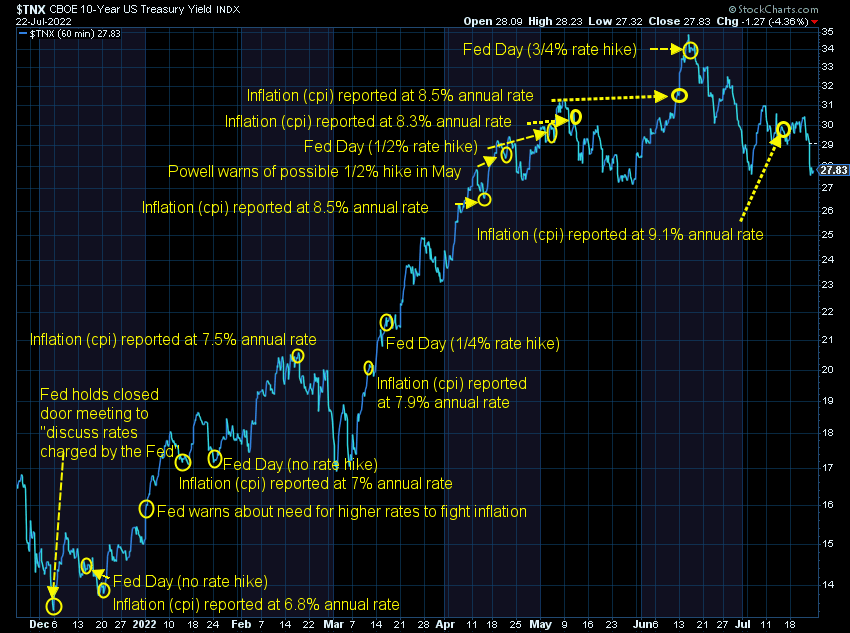

Stocks rallied under the hope the weaker economic data would mean the Fed is less likely to continue raising rates aggressively due to the slowdown in the economy. I believe that is a false hope as inflation remains stubbornly high even with a slowdown in commodity prices over the past month.

The bond market is either saying inflation is not going to be a problem or the economy is going to slow rapidly (or both). After inverting last week (short-term rates higher than long-term rates) yields across all bonds dropped significantly over the past week. We are nearly back to the same yields we saw at the beginning of June.

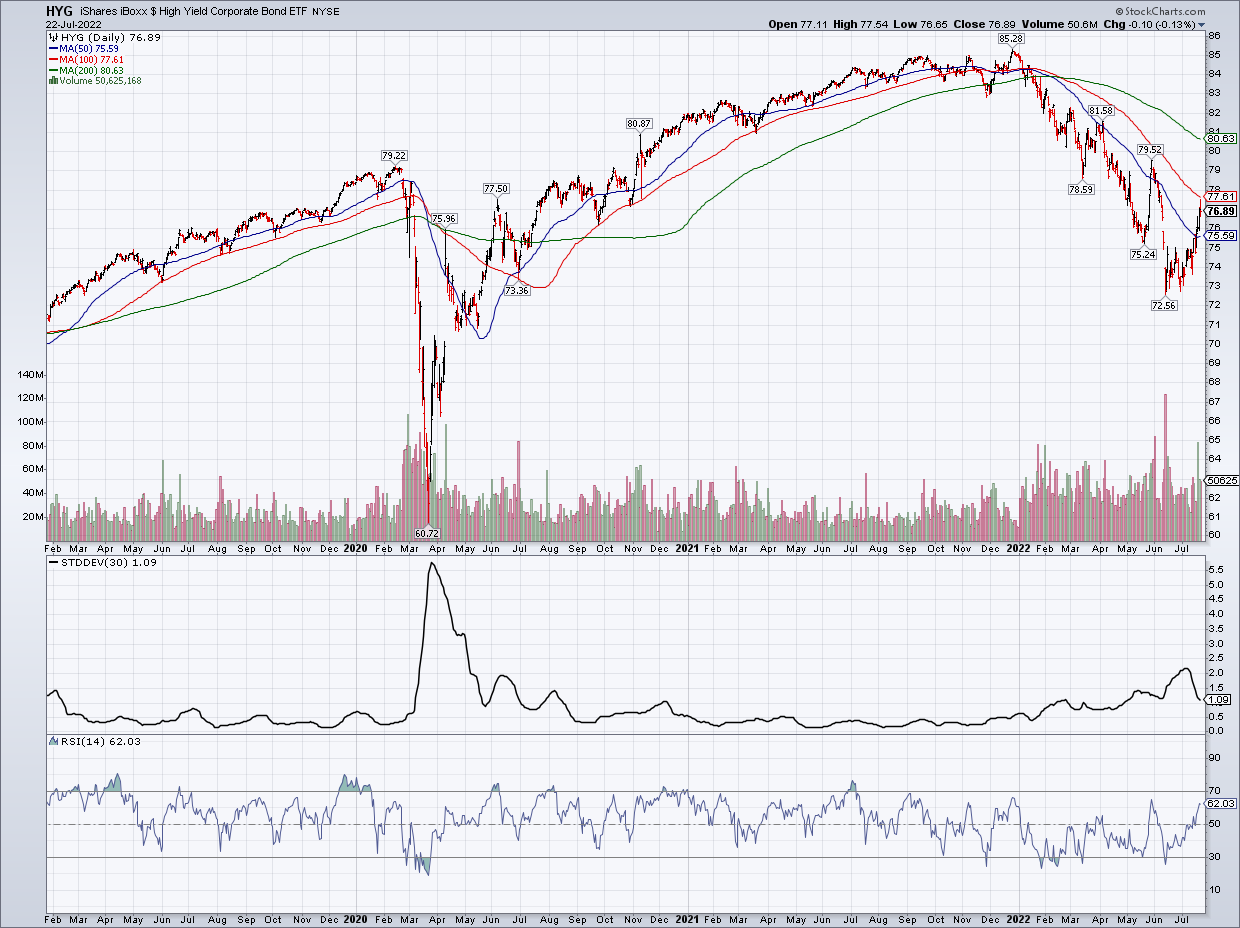

Even high yield bonds have staged an impressive rally (which generated a couple of buy signals for our high yield model inside INA, TB, and Cornerstone-Bond).

Time will tell if this was simply another asset allocator putting money to work because they were tired of having so much cash on the sidelines or an actual end of the very short "bear" market. If I were to guess, it is the former, not the latter, but the nice part of using SEM is we don't rely on my opinions (guesses). Instead we focus on the data.

The focus this week will once again turn to the Fed and parsing every word as well as the tone from the Fed Chair during his post-meeting press conference.