Last week Airbnb stock opened 115% above it's initial public offering (IPO) price. It closed up 113% on the day. When discussing it with Cody, our Client Portfolio Manager who holds an Accounting degree, he said, "That's just crazy. How does anybody justify that price?" When I mentioned it to Dustin, our Director of Technology he explained, "Wow! Good for them."

Some of the data points Cody and I discussed:

- Airbnb is worth more than every single publicly traded hotel chain. They are worth more than double Marriott International.

- Airbnb has no tangible assets – only a network and idea ("goodwill")

- If they were in the S&P 500, Airbnb would be the 70th largest company, just below AMD, IBM, Raytheon, Blackrock and above American Express, 3M, Charles Schwab, Intuit, CVS, Caterpillar, and General Electric

- In 2019 (pre-COVID19), Airbnb lost $674M.

- They are worth 22 times 2019 revenue (more on that below). Even if you annualize their large Q3 2020 revenue bounce, they are still trading at 21 times revenue.

- There appears to be some accounting shenanigans going on around their capitalization and how they are accounting for certain costs.

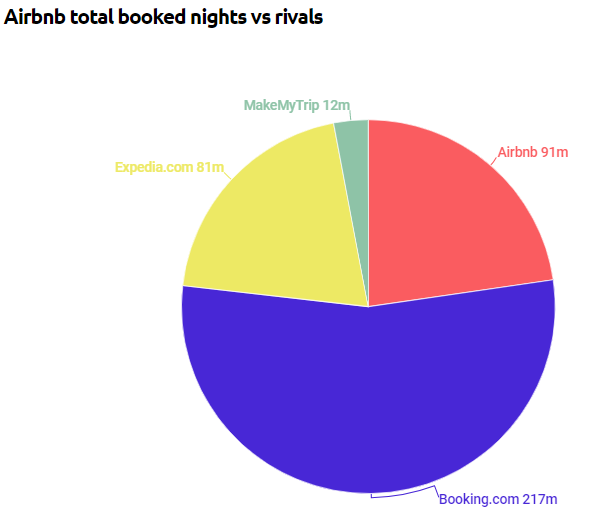

When I brought the above up to Dustin, he said, (paraphrasing), "that stuff doesn't seem to matter any more." I'm not insulting Dustin. He's one of the smartest and most logical people I've ever met. His way of thinking on this and other stock moves is "new is replacing old". I've never stayed at an Airbnb, but absolutely love VRBO (which is owned by Expedia). I obviously like the concept of not staying at a hotel. Booking.com (owner of Priceline and other entities) and Expedia dominate the online short-term rental market.

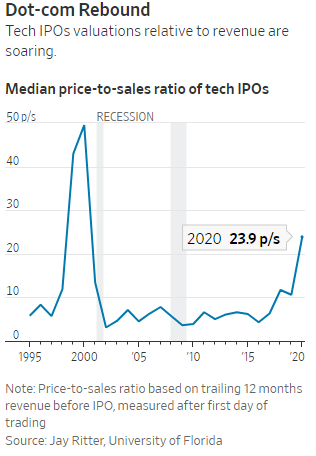

Airbnb's performance overshadowed some spectacular performance earlier in the week by Doordash, which was up 'only' 86% in its debut. While not as insane as the 1999 tech stock IPO bubble, the price-sales ratio of tech IPO's is clearly showing the most frothy market this century.

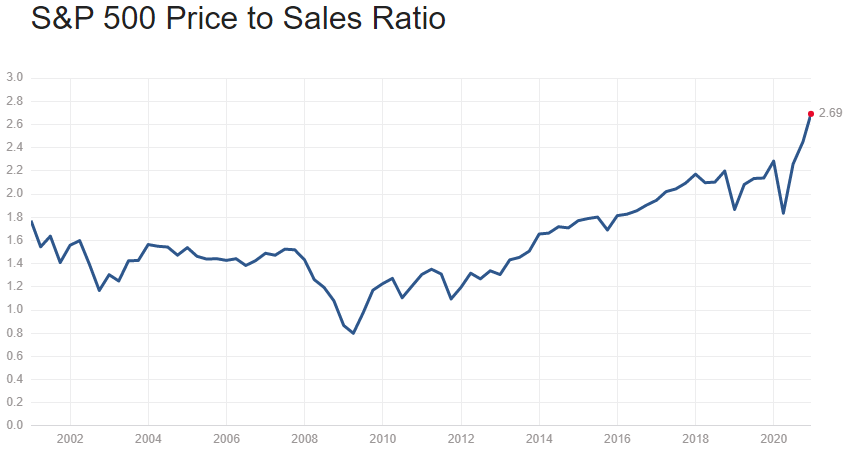

For 19 years, the average price-sales ratio has been just above 5 (compared to the S&P 500's 2.69 (which is also the highest we've seen this century).

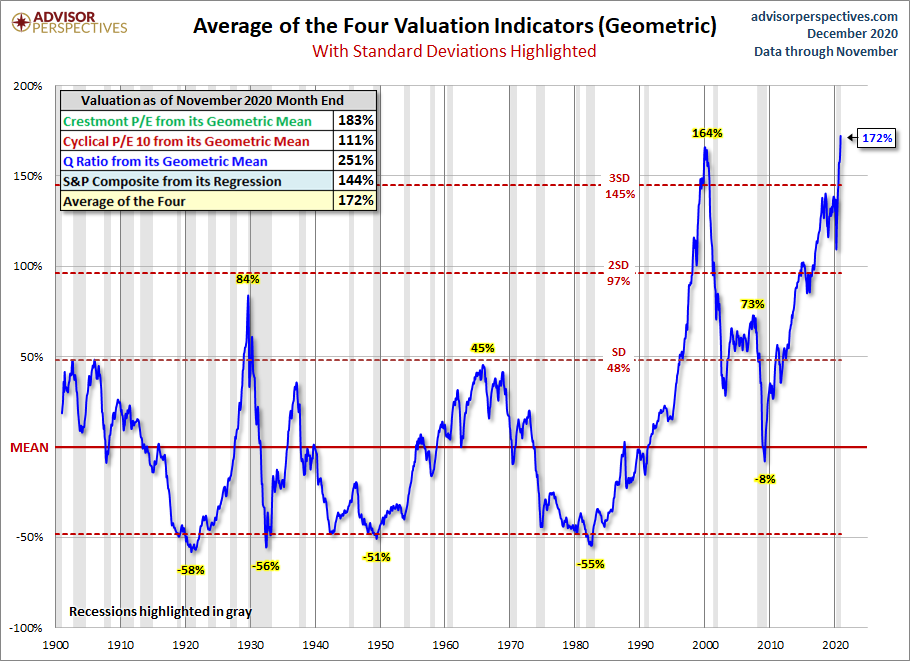

Earnings can be manipulated, but it is much harder to manipulate revenue (although we do see companies trying). My accounting brain along with my experience knows when people start buying "concepts" without any regard for the underlying financial picture I know we're in a bubble. The problem is bubble's can and will continue to go on far longer than most of us "rational" thinking people believe is possible. To me, valuations help set expectations for long-term returns as well as potential sharp drops.

It's not just IPOs. Tesla is set to be added to the S&P 500 in a week. The only companies that will be worth more than Tesla in the S&P are Apple, Microsoft, Amazon, Google, & Facebook. They will be worth more than Berkshire Hathaway, Visa, Wal-Mart, Johnson and Johnson, Disney, and every other company that has been around for decades (or more than a century). In a week, all the people following a passive index strategy will suddenly own a large percentage of Tesla in their portfolios along with the aforementioned technology companies.

As it is, it's hard to argue stocks are attractive at these levels unless you believe "it's different" this time.

It's not just stocks. High yield bonds are also getting to unreasonable levels. Unlike "safer" bonds, which are sensitive to interest rate changes, high yield bonds are sensitive to "credit" risk. The best way to measure valuations in high yields is the spread between them and 10-year Treasury bonds. Spreads are now back down to where the same point they were in January 2020. (Note: It's easy to forget, but risky assets had a very sharp rally in February 2020, despite the growing news out of Asia about the "Wuhan" virus.)

I've written about the risks facing our economy (and thus high yield bonds) as well as what the high valuations mean for stocks the last several weeks:

Tech stocks have clearly supported the market both in terms of price gains as well as earnings. This reminds me a lot of the pre-Y2K bubble. Businesses and consumers alike ramped up their technology spending to make sure they are covered. Once Y2K hit everybody had already (over)spent on technology and the momentum in both earnings and prices suddenly stopped. At the same time, you had the government and Federal Reserve propping up the economy and markets to help with Y2K readiness. When they pulled back the reigns a bit there was a giant air pocket that quickly turned into a bear market.

Think of the current environment. We've all probably spent quite a bit of extra money on technology, both hardware and software/services. Those stocks have received a huge boost in both earnings and prices. The market is pricing in further momentum in 2021, but it's hard to fathom we all will be spending just as much on technology next year as we have this year.

Maybe Cody and I are wrong and Dustin is right. The best part of the way we invest is we are having some VERY nice gains this year and continue to fully participate (especially in our AmeriGuard & Cornerstone Growth & Max models). On the lower-risk side our Tactical & Cornerstone Bond models are up in the high single digits with Dynamic & Cornerstone Income not too far behind. When you consider how little they lost during the COVID19 panic, those returns are even more impressive.

For more on Cornerstone, check out our most recent Cornerstone update:

I didn't think it was possible for professional and amateur investors alike to be as giddy as they were in February of this year, but I was clearly wrong. The overwhelming belief is stocks won't go down. We'll continue to ride this insanity until the trends change. We've been here before and will be here again. If you're retired, or retiring in the next 10 years, you may not get the opportunity to recover the losses that will occur when the bubble bursts.

If you're an advisor and do not have a plan to handle what could be a very difficult decade, we should talk. If you're an investor and do not have an advisor prepared to handle the next decade, let me know and I can put you in contact with somebody in your area.